- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Flooring Market Size, Industry Report, 2030GVR Report cover

![Automotive Flooring Market Size, Share & Trends Report]()

Automotive Flooring Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Polyurethane, Polypropylene, Nylon, Rubber, Others), By Product (Carpets, Mats), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-961-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Flooring Market Size & Trends

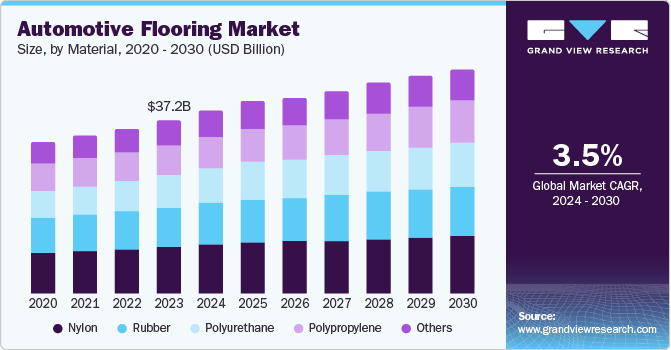

The global automotive flooring market size was valued at USD 37.18 billion in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030. A significant rise in demand for vehicles from consumers globally due to improving lifestyle and income levels, growing focus on automotive interior and aesthetics, advancements in flooring materials, and increased emphasis on vehicle safety have contributed to market growth. The increasing global population and fast pace of urbanization are driving a surge in demand for automobiles. For instance, the International Organization of Motor Vehicle Manufacturers (OICA) estimates that more than 92.7 million vehicles were sold worldwide in 2023, which was an increase of 11.9% over the preceding year. This sharp rise in demand for passenger cars as well as commercial vehicles is driving the market for automotive flooring components.

The increasing demand for vehicle customization and personalization is fueling the adoption of premium flooring solutions, such as carpets and 3D & 7D floor mats. Apart from being aesthetically appealing, these products are also used to prevent metal floor rusting and provide better cushioning. Additionally, the incorporation of a good flooring material reduces road noise and chassis vibrations and enables sound dampening.The increasing emphasis on safety standards and regulations is driving demand for flooring materials that meet stringent safety requirements. For instance, in the United States, the Federal Motor Vehicle Safety Standard (FMVSS) No. 302 serves to specify the requirements for burn resistance of materials that are used in a vehicle’s occupant compartment. Additionally, the government has implemented the process of self-certification that requires each manufacturer selling automotive components to adhere to certain safety standards.

The rising popularity of electric and hybrid vehicles is creating new opportunities for innovative flooring solutions that address the unique requirements of these vehicles. For instance, they have a battery installed at the bottom, which needs to be properly insulated and protected to avoid any potential hazards to the occupants. Furthermore, untapped vehicle segments such as Light Commercial Vehicles (LCVs) have fueled a substantial demand for customized and durable floor mats, leading to market growth.

Technological advancements, such as the integration of innovative features, including ambient lighting, heating, and cooling systems into flooring, are creating new opportunities for this industry’s expansion. The automotive aftermarket, which includes the sale and installation of replacement parts and accessories, is experiencing steady growth. The demand for automotive flooring replacement products is a major driver for this market. Moreover, the economic progress of emerging nations, particularly in the Asia Pacific region, is driving the expansion of the automotive industry and associated markets, such as automotive flooring.

Material Insights

In terms of flooring material, nylon led the market with a revenue share of 27.5% in 2023. Nylon's exceptional properties are responsible for its extensive use in automotive flooring applications. The material can resist abrasion and chemicals and possesses a high strength-to-weight ratio and excellent durability, making it well-suited to endure the challenging conditions of the automotive sector. Moreover, nylon's flexibility enables it to be molded and formed easily to meet the design needs of contemporary vehicle interiors. Additionally, its recyclability and reusability support the growing emphasis on sustainability in the automotive sector. The cost-efficiency and easy production of nylon makes it a favored option for manufacturers, leading to its widespread use in automotive flooring.

Polyurethane is expected to register the fastest CAGR over the forecast period. This is attributed to the unique combination of properties offered by this material, which makes it an appealing choice for automotive flooring applications. PU's superior flexibility, acoustic insulation, and vibration-damping capabilities enable it to provide enhanced comfort and noise reduction in vehicles. Additionally, its lightweight and durable nature aligns with the industry's focus on weight reduction and sustainability. The growing adoption of PU in automotive flooring is also driven by its versatility, allowing it to be formulated to meet specific performance requirements. These factors have collectively contributed to this material’s strong demand among manufacturers.

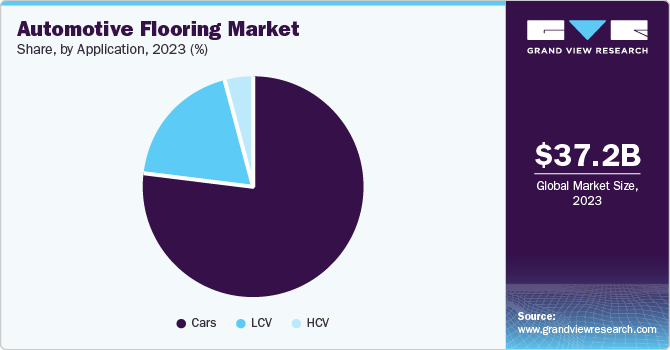

Application Insights

Cars accounted for the largest market revenue share in 2023. According to the OICA, around 65.3 million passenger cars were sold in 2023, which translates to around 70.4% of the total vehicles sold. This high proportion of sales has naturally driven a strong demand for vehicle flooring components such as carpets and mats. The cars segment encompasses a wide range of vehicles, such as sedans, hatchbacks, and SUVs, which represent a substantial market for automotive flooring. Additionally, the increasing focus on interior comfort, aesthetics, and noise reduction in passenger cars has led to a higher adoption rate of advanced flooring materials and technologies. This segment also benefits from the high replacement rate of flooring components due to wear and tear, which generates significant aftermarket demand.

The LCV segment is expected to register the fastest CAGR from 2024 to 2030. This is owing to the increasing demand for LCVs, driven by the rapid expansion of e-commerce, logistics, and delivery sectors. As a result, there is a growing need for durable and practical flooring solutions that can withstand heavy usage and cargo handling. The LCVs segment, which includes vans, minivans, and pickup trucks, is benefiting from this trend, with manufacturers and fleet operators seeking high-quality flooring materials that can enhance vehicle durability and reduce maintenance costs. Additionally, the rising popularity of customized LCVs has driven the demand for specialized flooring solutions that cater to specific customer requirements. This segment is also experiencing growth due to the increasing adoption of advanced flooring technologies, such as waterproof and slip-resistant materials, which provide improved functionality and safety.

Product Insights

Carpets accounted for the largest revenue share in the automotive flooring market in 2023. Carpets provide a premium feel and look to vehicle interiors, making them a preferred choice for both original equipment manufacturers (OEMs) and consumers. Additionally, these products offer excellent sound absorption and insulation features, contributing to a quieter and more comfortable driving experience. The versatile nature of carpets also allows them to be easily customized to fit various vehicle designs and models. Furthermore, advancements in carpet technology have improved their durability, stain resistance, and ease of maintenance, solidifying their position as the leading product segment in this industry.

The mats segment is expected to witness the fastest CAGR from 2024 to 2030. Floor mats offer superior protection against dirt, dust, and moisture, making them an essential accessory for vehicle owners. The growing popularity of sport utility vehicles (SUVs) and trucks has driven the demand for 7D floor mats, as these vehicles require more durable and easy-to-clean flooring solutions. Additionally, advancements in material technology have led to the development of high-quality and customized floor mats that provide a precise fit and superior performance. The rising trend of vehicle personalization and customization has contributed to the growth of this market segment, as consumers seek to enhance their vehicle's interior with premium and functional accessories.

Regional Insights

Asia Pacific dominated the global market with a revenue share of 54.8% in 2023. This is attributed to the region's large and steadily growing automotive industry, driven by the presence of leading automotive manufacturing hubs in countries such as China, Japan, India, and South Korea. Additionally, the growing middle-income population and increasing disposable income levels have led to a rise in vehicle ownership, further fueling the demand for automotive flooring solutions. For instance, the Society of Indian Automobile Manufacturers (SIAM) estimated that approximately 3.9 million passenger vehicles were sold in India in the financial year 2022-2023, which was significantly higher than the preceding year’s numbers. Similar observations were made in other regional economies, which has positively impacted the demand for automotive flooring in this region in recent years.

China Automotive Flooring Market Trends

China accounted for the largest share of the regional market in 2023. The economy benefits from the presence of a well-established supply chain and manufacturing infrastructure, which enables efficient production and distribution of automotive flooring products. Furthermore, government initiatives and investments in the automotive sector have created a favorable business environment, contributing to the country’s high market share. As a result, China has become home to a significant number of original equipment manufacturers (OEMs) and suppliers, which drives the demand for automotive flooring solutions.

North America Automotive Flooring Market Trends

North America held a notable share of the global market in 2023. The region's high vehicle production volume and a strong focus on comfort and aesthetics have contributed to the adoption of advanced flooring materials and technologies. The industry also benefits from a strong aftermarket segment, driven by consumer preference for vehicle customization and upgrading, which further fuels the demand for automotive flooring products. Moreover, the presence of key suppliers and manufacturers, such as Magna International Inc. and others, has enabled the region to maintain a competitive edge in the global market.

The U.S. accounted for the largest share of the regional market in 2023. The country is home to a significant number of major automotive manufacturers, including the Big Three automakers, Ford, General Motors, and Stellantis, which generate substantial demand for automotive flooring solutions. Moreover, according to the 2022 automotive sales statistics report by the Alliance for Automotive Innovation, a significant rise in the popularity of light trucks was observed in the U.S. These factors have collectively fueled the demand for innovative, aesthetic, and durable automotive flooring solutions in the economy.

Europe Automotive Flooring Market Trends

The European region held a significant market share in 2023. Regional economies such as Germany, Italy, and the UK are hubs for innovative automotive manufacturing. The historical economic affluence in the region has led to a large number of consumers owning personal vehicles. In addition, the European Automobile Manufacturers’ Association (ACEA) has stated that a significant rise in the registration of commercial vehicles in the region was observed in the first half of 2024. This has contributed to a proportional growth in demand for functional and customizable automotive flooring products in the region.

Germany accounted for a substantial share of the European market in 2023. The German Association of the Automotive Industry (VDA) observed a substantial rise in demand for SUVs and off-road vehicles in the country in 2022, with an increase of 14.0% observed over 2021 figures. These vehicles require the use of robust and innovative flooring materials to withstand extreme indoor and outdoor conditions such as dust and moisture. This has led to an increased demand for sturdy and easy-to-maintain automotive carpets and floor mats in the economy.

Key Automotive Flooring Company Insights

Some key companies involved in the automotive flooring market include IDEAL Automotive GmbH; TOYOTA BOSHOKU CORPORATION; and Kotobukiya Fronte Co., Ltd., among others.

-

IDEAL Automotive GmbH is a Germany-based manufacturer of automotive interiors with operations in over 15 locations worldwide. The company offers a variety of automotive interior coverings, such as floor mats with Thermoplastic Polyolefin (TPO) coating, latex coating, textile anti-slip coating, and floor covering with tufting, dilours, and nonwoven surfaces. In addition, the company also offers side trim panels, loading floors, trim tailgates, parcel shelves, and many other interior vehicle accessories.

-

Kotobukiya Fronte Co., Ltd. is a Japan-based manufacturer of fabric interiors for the automotive sector. The company offers floor carpet, trunk and luggage floor, dash engine room insulators, and other interior accessories for automotive. It further provides customizable floor mats, which aid in sound-insulating and waterproofing functions. The company primarily serves the Asia Pacific region, with manufacturing bases in China, Thailand, Indonesia, and Latin and North America.

Key Automotive Flooring Companies:

The following are the leading companies in the automotive flooring market. These companies collectively hold the largest market share and dictate industry trends.

- HAYAKAWA EASTERN RUBBER CO., LTD

- IDEAL Automotive GmbH

- Kotobukiya Fronte Co., Ltd.

- SHANDONG EXCEEDING AUTO INTERIOR PARTS CO., LTD

- Suminoe Textile Co., Ltd.

- HAYASHI TELEMPU CORPORATION

- Magna International Inc.

- Shanghai Shenda Co., Ltd.

- TOYOTA BOSHOKU CORPORATION

- Feltex

Recent Developments

-

In September 2023, GUANGZHOU INTEX AUTO PARTS CO., LTD., the Chinese subsidiary of Toyota Boshoku Corporation, held a groundbreaking event for constructing a new facility in Guangzhou’s Xiaohudao Industrial Park. The building construction is expected to be completed by September 2024, while production of door trims, seats, and other interior components would tentatively start in 2025, which would then be supplied to GAC Toyota Motor Co., Ltd.

-

In April 2022, Auria Solutions and Feltex Automotive announced a new joint venture with the aim to cater to a selection of regional automotive OEMs. Auria Solutions is a notable global supplier of vehicle flooring, acoustical, and fiber-based products. The JV is expected to operate from an advanced manufacturing facility located in East London, manufacturing products such as flooring systems, trunk trim, parcel shelves, and dash insulators.

Automotive Flooring Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 39.13 billion

Revenue Forecast in 2030

USD 48.09 billion

Growth Rate

CAGR of 3.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Material, product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

HAYAKAWA EASTERN RUBBER CO., LTD; IDEAL Automotive GmbH; Kotobukiya Fronte Co., Ltd.; SHANDONG EXCEEDING AUTO INTERIOR PARTS CO., LTD; Suminoe Textile Co., Ltd.; HAYASHI TELEMPU CORPORATION; Magna International Inc.; Shanghai Shenda Co., Ltd.; TOYOTA BOSHOKU CORPORATION; Feltex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

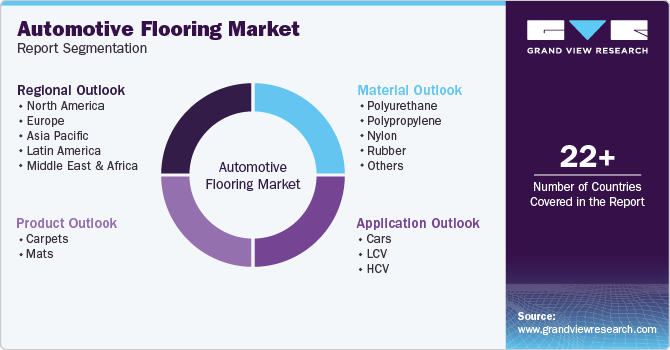

Global Automotive Flooring Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive flooring market report based on material, product, application, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Polypropylene

-

Nylon

-

Rubber

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carpets

- Mats

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cars

-

LCV

-

HCV

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.