- Home

- »

- Automotive & Transportation

- »

-

Automotive Ethernet Market Size And Share Report, 2030GVR Report cover

![Automotive Ethernet Market Size, Share & Trends Report]()

Automotive Ethernet Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Bandwidth, By Vehicle (Passenger Cars, Commercial Vehicles), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-419-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Ethernet Market Summary

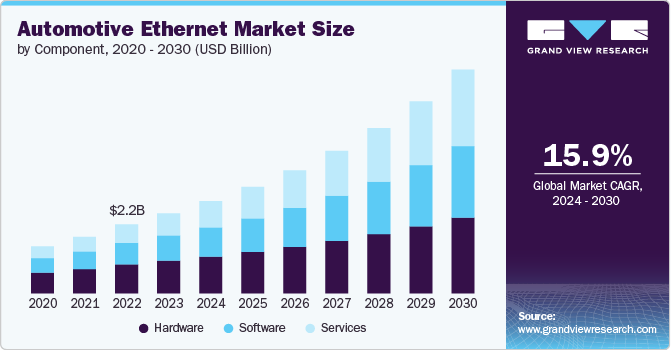

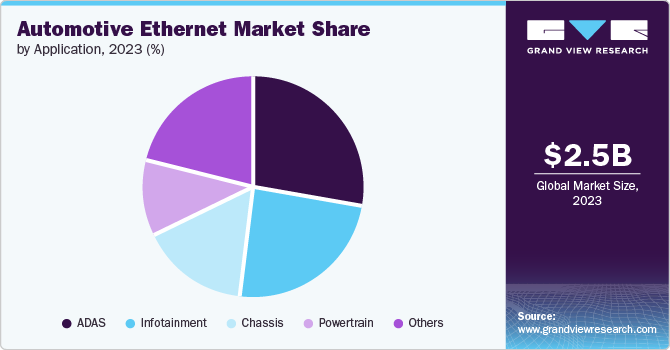

The global automotive ethernet market size was estimated at USD 2,516.4 million in 2023 and is projected to reach USD 7,043.7 million by 2030, growing at a CAGR of 15.9% from 2024 to 2030. Automotive ethernet is a communication technology used in vehicles to enable high-speed, reliable data transfer between various electronic components and systems.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- The automotive ethernet market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030.

- Based on component, the hardware segment dominated the market in 2023 and accounted for a 40.85%.

- Based on bandwidth, the 100 Mbps segment dominated the market in 2023.

- Based on application, the ADAS segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,516.4 Million

- 2030 Projected Market Size: USD 7,043.7 Million

- CAGR (2024-2030): 15.9%

- Asia Pacific: Largest market in 2023

The market's growth can be attributed to the increasing adoption of automotive ethernet technology owing to its benefits, such as high bandwidth, reliability, scalability, cost efficiency, integration with IP-based systems, and support for time-sensitive networking. In addition, the growing trend of connected cars and rising consumer preference for in-vehicle infotainment systems are further expected to drive the market's growth.

The demand for higher data transfer rates in vehicles is driving the adoption of advanced ethernet standards, such as 10BASE-T1S and 100BASE-T1. These standards support higher speeds, including 1 Gbps and 10 Gbps, which are crucial for handling the increasing data loads from high-definition cameras, infotainment systems, and other high-bandwidth applications. The adoption of these higher-speed Ethernet standards is enabling more advanced vehicle systems and improving the performance and responsiveness of in-vehicle networks. Thus, as vehicles become more connected and data-intensive, the shift towards these advanced ethernet technologies is essential for meeting the growing demands of modern automotive applications.

The automotive industry is increasingly shifting towards software-defined vehicles (SDVs), where most of the vehicle's functionality and features are controlled and updated through software rather than hardware alone. Automotive ethernet is crucial for this transformation, as it provides the high-speed, reliable data communication needed for real-time software updates and feature enhancements. With ethernet's bandwidth capabilities, automakers can enable more flexible and scalable vehicle architectures, allowing for over-the-air updates and the integration of advanced features such as autonomous driving systems and enhanced infotainment solutions. This trend towards SDVs is transforming the automotive landscape, highlighting the importance of robust and adaptable communication networks, thereby boosting the market's growth.

Furthermore, as 5G and Vehicle-to-Everything (V2X) communication become more widely adopted, automotive ethernet is anticipated to be pivotal in facilitating real-time data exchange. This enhances safety, improves traffic management, and supports a range of connected car services. In addition, V2X enables vehicles to communicate with each other and with infrastructure, pedestrians, and networks, enhancing safety and traffic management. Automotive ethernet provides the necessary bandwidth and reliability for these real-time communications, making it a vital technology for the implementation of V2X systems, which in turn boosts the market's growth.

The complexity and high cost associated with automotive ethernet technology are some of the major factors that could hamper the growth of the market. In addition, ensuring interoperability and compatibility across different manufacturers and systems can be difficult, given the diverse range of standards and proprietary technologies in use. The harsh automotive environment also demands that ethernet components meet stringent durability and reliability requirements, adding to the complexity of implementation. Thus, the complex nature of automotive networks and vulnerability to cyberattacks could further hinder the market’s growth.

Component Insights

The hardware segment dominated the market in 2023 and accounted for a 40.85% share of global revenue. The hardware segment includes components such as ethernet switches, connectors, cables, and ICs. These components are essential for managing and facilitating data flow efficiently within vehicles. Innovations such as compact, high-performance connectors and multi-gigabit transceivers are enabling more sophisticated vehicle architectures, supporting advanced driver-assistance systems (ADAS), infotainment systems, and real-time data processing, thereby boosting the growth of the segment.

The services segment is projected to witness significant growth from 2024 to 2030. The segment includes services such as consultation, design, testing, integration, maintenance, and support services tailored for complex ethernet-based systems. As vehicles become more connected, autonomous, and data-driven, the demand for specialized services to ensure seamless integration, reliability, and adherence to stringent automotive regulations is increasing. In addition, the growing complexity of automotive networks requires robust testing and integration services to maintain optimal performance and safety, thereby increasing the segment’s growth.

Bandwidth Insights

The 100 Mbps segment dominated the market in 2023. The 100 Mbps bandwidth segment, defined by the 100BASE-T1 automotive ethernet standard, is witnessing notable growth in the market due to its balance of cost, complexity, and performance. The 100 Mbps standard is ideal for basic control functions and less demanding data transmission needs, such as simple sensor data, infotainment system communication, and networked control modules. Its lower cost and reduced complexity make it an attractive option for automakers seeking to implement ethernet connectivity without incurring significant expenses or design challenges.

The 1 Gbps segment is projected to witness significant growth from 2024 to 2030. The 1 Gbps bandwidth segment, specified by the 1000BASE-T1 automotive ethernet standard, is experiencing significant growth driven by its ability to handle higher data rates required for advanced automotive applications. This bandwidth is essential for supporting high-speed communication needed by sophisticated systems such as ADAS, high-definition cameras, and real-time data processing modules. The rapid evolution of automotive technology and the push for more autonomous and connected vehicles necessitate robust networking solutions that can manage extensive data volumes efficiently, which in turn boosts the segment’s growth.

Vehicle Insights

The passenger cars segment dominated the market in 2023. Increasing demand for advanced connectivity and infotainment features in consumer vehicles is the major driving factor behind the segment’s growth. As passenger cars become more connected, automakers are integrating ethernet to support high-speed data transfer for applications such as ADAS, high-definition infotainment systems, and real-time diagnostics. Moreover, the growing trend towards electric and hybrid vehicles, which often require sophisticated control systems and data management, further accelerates the adoption of automotive ethernet in passenger cars.

The commercial vehicles segment is projected to witness significant growth from 2024 to 2030. The need for enhanced connectivity and operational efficiency in fleet management can be attributed to the segment’s growth. Ethernet technology is increasingly used in commercial vehicles to support advanced telematics systems, real-time vehicle tracking, and sophisticated driver assistance features, all of which contribute to improved safety and operational effectiveness. The growing emphasis on fleet management solutions and the integration of Internet of Things (IoT) capabilities into commercial vehicles drive the demand for reliable, high-speed communication networks, which further propels the adoption of automotive ethernet in commercial vehicles.

Application Insights

The ADAS segment dominated the market in 2023. The growing emphasis on safety and automation has driven the demand for Advanced Driver-Assistance Systems (ADAS) in modern vehicles. As automotive manufacturers integrate several ADAS systems, the need for high-bandwidth and low-latency communication networks becomes paramount. Automotive Ethernet, with its ability to support high-speed data transmission, is becoming the preferred choice for connecting various sensors and cameras that are essential for these systems. Thus, factors such as the rising shift towards automated and connected driving and the increasing need to improve vehicle safety and performance can be attributed to the segment’s growth.

The infotainment segment is projected to witness significant growth from 2024 to 2030. The growing demand for advanced, high-quality in-car entertainment and connectivity features is a major factor behind the segment’s growth. As consumer expectations for digital experiences rise, automakers are integrating ethernet to support high-bandwidth applications such as streaming media, navigation systems, and interactive displays. In addition, the shift towards more sophisticated infotainment systems, including those with multiple screens and high-definition interfaces, further drives the need for robust ethernet networks.

Regional Insights

The automotive ethernet market in North America is expected to witness notable growth from 2024 to 2030. The region's automotive industry is at the forefront of adopting cutting-edge technologies, including ethernet, to support sophisticated in-car connectivity, ADAS, and autonomous driving features. Major automotive manufacturers and technology providers in the U.S. and Canada are investing heavily in research and development to enhance vehicle performance and safety. The growing emphasis on connected vehicles and smart infrastructure drives the demand for automotive ethernet in the region.

U.S. Automotive Ethernet Market Trends

The automotive ethernet market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The U.S.-based automotive manufacturers are increasingly incorporating ethernet into their vehicles to meet the rising demand for high-speed data transfer and enhanced connectivity features. The competitive landscape in the U.S. automotive sector, with numerous players investing in next-generation technologies, drives continuous advancements and adoption of ethernet technologies in vehicles.

Asia Pacific Automotive Ethernet Market Trends

The Asia Pacific region dominated the automotive ethernet market in 2023 and accounted for a 35.83% share of the global revenue. Factors such as rapid urbanization, technological advancements, and a booming automotive industry contribute to the market growth in the region. In addition, the increasing demand for electric vehicles (EVs) and the expansion of automotive research and development contribute to the growth of automotive ethernet in the region.

Europe Automotive Ethernet Market Trends

The automotive ethernet market in Europe is expected to grow at the highest CAGR from 2024 to 2030. European automotive manufacturers are adopting ethernet technology to meet stringent regulatory requirements and enhance vehicle safety features. The emphasis on ADAS, autonomous driving, and electric vehicles (EVs) drives the need for high-speed, reliable communication networks in the region, thereby driving the market’s growth.

Key Automotive Ethernet Company Insights

Key players operating in the automotive ethernet market include Broadcom Inc., Marvell, Microchip Technology Inc., NXP Semiconductors, Texas Instruments Incorporated, Cadence Design Systems, Inc., TE Connectivity, Infineon Technologies AG, Toshiba Electronic Devices & Storage Corporation, and Intrepid Control Systems. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2024, Analog Devices, Inc., a semiconductor manufacturing company and the BMW Group, a manufacturer of luxury vehicles and motorcycles, announced an early adoption of Analog Devices, Inc.’s E²B technology, which utilizes 10BASE-T1S ethernet to facilitate edge bus connectivity in the automotive sector. This advancement in automotive ethernet connectivity is crucial for enabling new zonal architectures in vehicle design and supports significant trends such as software-defined vehicles. BMW Group will be among the first original equipment manufacturers (OEMs) to integrate this technology, applying Analog Devices, Inc.’s E²B™ in the development of their ambient lighting systems for future BMW vehicles.

-

In April 2023, SMK Corporation, a prominent electronic connector manufacturer, developed the smallest ethernet connector, SE-R1, specifically for automotive applications. The SE-R1 connector is designed to handle multiple ethernet lines and connections within a single device. It achieves the industry's smallest width of 8.1mm, while supporting transmission speeds of both 1000BASE-T1 (1 Gbps) and 100BASE-T1 (100 Mbps).

Automotive Ethernet Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.90 billion

Revenue forecast in 2030

USD 7.04 billion

Growth rate

CAGR of 15.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, bandwidth, Vehicle, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Broadcom Inc.; Marvell; Microchip Technology Inc.; NXP Semiconductors; Texas Instruments Incorporated; Cadence Design Systems, Inc.; TE Connectivity; Infineon Technologies AG; Toshiba Electronic Devices & Storage Corporation; and Intrepid Control Systems

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Ethernet Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive ethernet market based on component, bandwidth, vehicle, application, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Bandwidth Outlook (Revenue, USD Billion, 2018 - 2030)

-

10 Mbps

-

100 Mbps

-

1 Gbps

-

2.5/5/10 Gbps

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

ADAS

-

Infotainment

-

Powertrain

-

Chassis

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive ethernet market size was estimated at USD 2.52 billion in 2023 and is expected to reach USD 2.90 billion in 2024.

b. The global automotive ethernet market is expected to grow at a compound annual growth rate of 15.9% from 2024 to 2030, reaching USD 7.04 billion by 2030.

b. The hardware segment dominated the component segment in 2023. The growing adoption of components such as ethernet switches, connectors, cables, and ICs in automotive vehicles is boosting the growth of the market.

b. Some key players operating in the automotive instrument cluster market include Broadcom Inc., Marvell, Microchip Technology Inc., NXP Semiconductors, Texas Instruments Incorporated, Cadence Design Systems, Inc., TE Connectivity, Infineon Technologies AG, Toshiba Electronic Devices & Storage Corporation, and Intrepid Control Systems.

b. The key drivers attributed to the market expansion include the growing trend of connected cars and rising consumer preference for in-vehicle infotainment systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.