- Home

- »

- Automotive & Transportation

- »

-

Automotive Emission Test Equipment Market Report, 2030GVR Report cover

![Automotive Emission Test Equipment Market Size, Share & Trends Report]()

Automotive Emission Test Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Emission Test Software, Emission Test Services), By Emission Equipment, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-771-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global automotive emission test equipment market size was valued at USD 722.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. The rising need for permissible emission limits for road vehicles, regulations pertaining to the release of harmful compounds, and stringent compliance with mandates & guidelines are factors projected to drive market expansion. The rising awareness and concerns regarding pollution caused by vehicle exhausts, especially from passenger cars and light-duty vehicles, are resulting in an increased need for enforcement of stringent rules and regulations by governments of various countries.

Governments across the world have drafted regulations with the objective of limiting hazardous releases from vehicles. For instance, the European Union has specified stringent norms for vehicles, such as the Euro 6/VI standard, to control vehicular emissions. Moreover, there are strict rules, regulations, and standards for periodic technical inspections & maintenance to monitor automotive emissions, across countries such as the U.S., Canada, Germany, the U.K., France, Italy, Spain, China, and Japan.

The opacity meter is a cost-effective device used to measure particulate matter in automotive exhaust systems. Surging demand for periodic technical inspections (PTI) to regulate the release of harmful gases is one of the key factors propelling market expansion worldwide. Thus, the increasing incorporation of opacity meters in inspection and maintenance programs is poised to boost the growth of the market. Technological advancements, such as portable emissions measurement systems (PEMS), are used to measure any type of particulate content on roads emitted from various vehicle exhaust systems. Such devices are also playing a key role in the development of the market.

The development of several modes of transportation and the strong dependency of the transportation sector on alternative fuels and liquid-mineral fuels is expected to intensify the concentration of greenhouse gases and hazardous particulate matter in the environment. Staggering volumes of gases and particulates emitted by vehicles necessitate control, monitoring, and regulation, thus driving the use of vehicle emission testing systems, which drives the growth of the global automotive emission test equipment market.

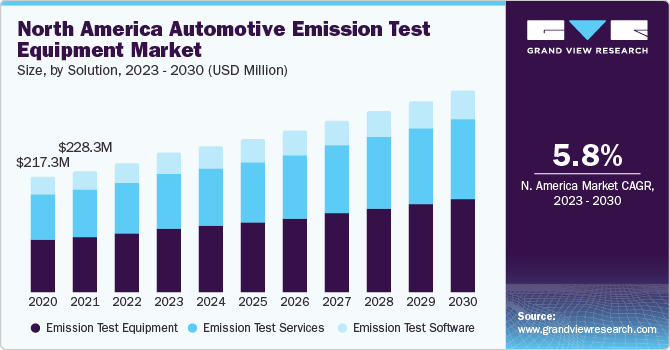

Solution Insights

The emission test equipment segment held the largest share in the market for automotive emission test equipment and accounted for 47.1% of the global revenue in 2022. Moreover, this segment is anticipated to continue its dominance over the forecast period on account of the rising demand for testing equipment worldwide. The segment holds a substantial market share as compared to the software segment.

The emission test services segment, on the other hand, is expected to register the highest CAGR of 5.8% during the forecast period. The strong demand can be attributed to the increasing emphasis placed on reducing the release of greenhouse gases by passenger and light-duty vehicles, especially in developing countries such as China and India.

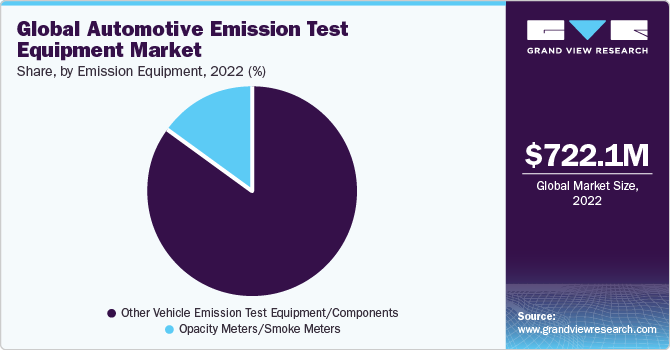

Emission Equipment Insights

The other vehicle emission test equipment/components segment dominated the market with 85.0% of the global revenue share in 2022. The segment is anticipated to maintain its dominance over the forecast period. The growth is attributed to the rising demand for automotive emission test systems by a large number of automobile manufacturers across the world. Advancements in vehicle emission diagnostic systems, such as onboard diagnostic tools, are also driving the growth of the other equipment segment.

The opacity meters/smoke meters segment is projected to expand at a significant CAGR of 3.1% during the forecast period. The demand for smoke meters is rising steadily, as they are used to detect and measure smoke emitted from diesel engines. Opacity meters find significant utilization in periodic technical inspection (PTI) and inspection & maintenance (I&M) programs.

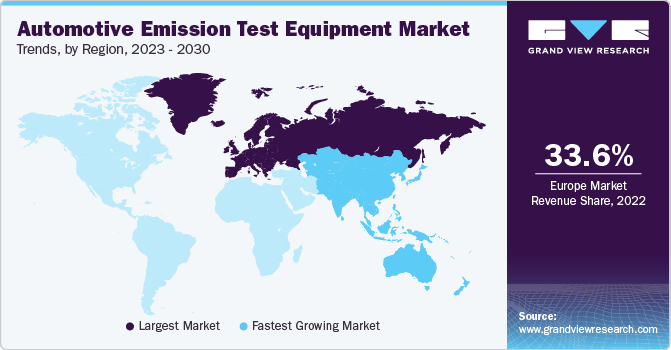

Regional Insights

Europe dominated the market for automotive emission test equipment, accounting for 33.6% of the global revenue share in 2022. Countries in the region, such as the U.K., Germany, and the Netherlands, are at the forefront of adopting vehicle emission testing norms, as well as stringent rules and regulations as prescribed by the European Union.

On the other hand, the Asia Pacific region is expected to expand at the fastest CAGR of 6.2% during the forecast period. The increasing urbanization in this region is encouraging the introduction and implementation of numerous initiatives taken by regional countries that are aimed at regulating and monitoring vehicle exhausts. Besides, the region is transforming into the largest automobile manufacturing hub owing to the low production costs, creating significant market opportunities.

Key Companies & Market Share Insights

Industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in March 2023, Applus+, a Spanish vehicle inspection company, developed a digital platform, eReformas, to improve the PTI test user experience in the country. The platform aims to carry out vehicle approval processes online, thus bypassing the time restrictions posed by the MOT service stations.

Key Automotive Emission Test Equipment Companies:

- Opus Inspection

- GEMCO Equipment Ltd.

- TÜV Nord Group

- CAPELEC

- HORIBA, Ltd.

- Applus+

- SGS SA

- AVL List GmbH

- TEXA S.p.A.

Recent Developments

-

In February 2021, HORIBA announced that its vehicle emission test automation software, STAR VETS, had been made available for the Windows 10 64-bit operating system. The software ensures that vehicle emission tests run efficiently and smoothly with preloaded processes, configuration data, and results calculations for a broad range of regulatory compliances

-

In January 2021, Capelec, in partnership with IFPEN, developed Real-e, a connected tool that measures emissions in a vehicle’s exhaust gases in actual driving conditions. These measurements are based on the driving style, traffic conditions, and the kind of journey

Automotive Emission Test Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 760.0 million

Revenue forecast in 2030

USD 1,067.9 million

Growth Rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, emission equipment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Opus Inspection; GEMCO Equipment Ltd.; TÜV Nord Group; CAPELEC; HORIBA, Ltd.; Applus+; SGS SA; AVL List GmbH; TEXA S.p.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

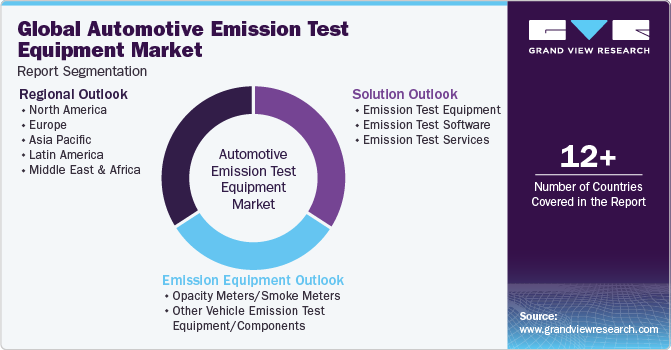

Global Automotive Emission Test Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive emission test equipment market report on the basis of solution, emission equipment, and region:

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Emission Test Equipment

-

Emission Test Software

-

Emission Test Services

-

-

Emission Equipment Outlook (Revenue, USD Million, 2017 - 2030)

-

Opacity Meters/Smoke Meters

-

Other Vehicle Emission Test Equipment/Components

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Europe dominated the automotive emission test equipment market with a share of 33.6% in 2022. This is attributable to greater compliance with regulations and vehicle emission testing norms in the region.

b. Some key players operating in the automotive emission test equipment market include Gemco Equipment Ltd, TÜV Nord Group, CAPELEC, HORIBA, Ltd., Applus+, SGS SA, AVL LIST GmbH, and TEXA S.p.A.

b. Key factors that are driving the automotive emission test equipment market growth include the soaring need for permissible emission limits for road vehicles, regulations pertaining to the release of harmful compounds, and stringent compliance with mandates & guidelines worldwide.

b. The global automotive emission test equipment market size was estimated at USD 722.1 million in 2022 and is expected to reach USD 760 million in 2023.

b. The global automotive emission test equipment market is expected to grow at a compound annual growth rate of 4.98% from 2023 to 2030 to reach USD 1,067.9 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.