- Home

- »

- Automotive & Transportation

- »

-

Automotive E-axle Market Size, Share, Growth Report, 2030GVR Report cover

![Automotive E-axle Market Size, Share & Trends Report]()

Automotive E-axle Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Front, Rear), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-651-6

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive E-axle Market Size & Trends

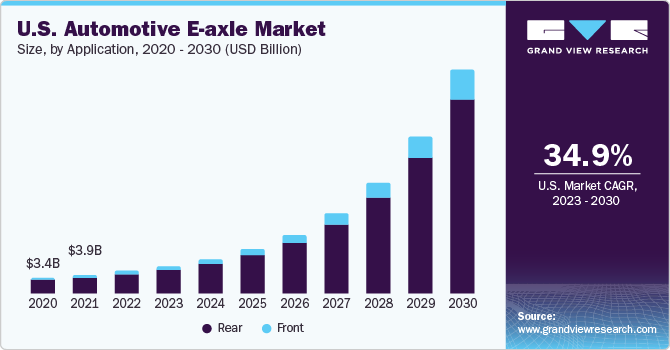

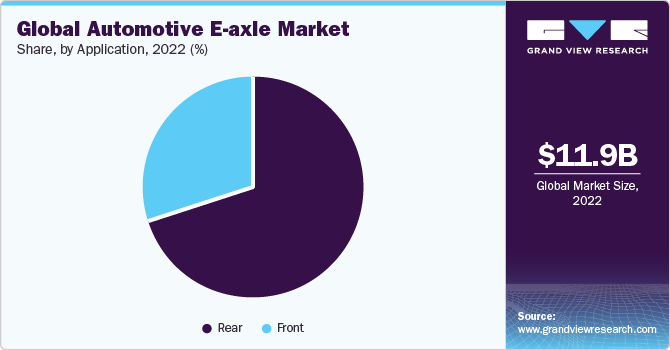

The global automotive E-axle market size was valued at USD 11.93 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 37.7% from 2023 to 2030. The market is primarily driven by the growing sales of battery electric vehicles and the growing adoption of automotive e-axles in the light commercial vehicle segment. Furthermore, introducing automotive e-axles for heavy commercial vehicles and increasing investments in the R&D of electric vehicles have led to improvements in the design of e-axles. The modular e-axle design has enabled automotive manufacturers to increase the vehicles' battery capacity, enhancing the driving range with a single charge.

The growing demand for lightweight, structurally safe, and cost-effective chassis and automotive systems has compelled manufacturers to focus on developing technologically advanced products. For instance, AxleTech has developed an integrated e-axle that delivers higher performance in smaller packaging. The e-axle is primarily suited for medium- and heavy-duty commercial trucks.

Technological advancements in recent years have empowered manufacturers to roll out electric vehicles with extended ranges on a single charge. Although the average driving range has the potential for further refinement, the current improvement in driving range is expected to impact market growth for automotive e-axles significantly. Moreover, regulatory and policy reforms by various governments globally have amplified the adoption of electric vehicles, resulting in increased sales of automotive e-axles. The Zero-emission vehicle (ZEV) resolution and complementary policy changes by the European Union to roll out all-electric passenger cars by 2030 are expected to positively impact the European market for automotive e-axles during the forecast period.

Application Insights

Based on application, the industry is segmented into rear and front. The rear segment held the highest market share of 70.3% in 2022 and is estimated to register the fastest CAGR of 41.5% over the forecast period. With the increasing popularity of electric vehicles, there is a growing demand for efficient and high-performance electric drivetrain systems. The rear segment of vehicles, especially passenger cars, and SUVs, is critical for integrating electric axles (e-axles) as they house the electric motor, power electronics, and other components necessary for electric propulsion. The shift towards electrification in the automotive industry has propelled the demand for e-axles in the rear segment.

The front segment is estimated to register a significant CAGR of over the forecast period. This can be attributed to the increasing production of entry and mid-level electric passenger cars in cost-sensitive economies. As the demand for electric vehicles continues to rise, automakers are actively developing and promoting EV models. E-axles, which combine the electric motor, power electronics, and transmission in a single unit, are a key component in electric drivetrains. The front segment, in particular, is seeing growth as automakers focus on developing compact and efficient electric powertrains for front-wheel-drive vehicles.

Regional Insights

North America accounted for the largest market share of 43.9% in 2022. This growth is attributed to a rise in passenger vehicle sales in the region. The North American region is estimated to witness significant changes in the dynamics of passenger vehicle production. The shifting preference of the U.S. population from high horsepower vehicles and large SUVs to compact electric cars is expected to drive market growth for automotive e-axle in the region.

On the other hand, Europe is projected to demonstrate growth at the fastest CAGR of 39.6% over the forecast period. The European Union and various European governments have been implementing stringent emissions regulations and promoting the adoption of electric vehicles (EVs). These policies aim to reduce greenhouse gas emissions and combat air pollution. As a result, there are incentives and subsidies provided for EVs, which include e-axle-equipped vehicles. Such supportive policies have created a favorable environment for the growth of the automotive e-axle industry.

The market for Asia Pacific is expected to grow over the forecast period. Developing economies such as India and China, Japan, and South Korea are expected to help the region retain its dominance over the forecast period. The European region has been one of the early adopters of electric vehicles. Also, the region witnessed sluggish growth in conventional fuel vehicle production recently.

Key Companies & Market Share Insights

Key players operating in the market for automotive e-axles include Dana Incorporated, Melrose Industries PLC, and Robert Bosch GmbH. These companies are increasingly investing in e-axle technology, which can be attributed to the diversified customer base. The market is consolidated and dominated by a few key players, such as Dana Incorporated and Robert Bosch GmbH. However, investments by other prominent players and startups have also increased recently. Other leading vendors operating in the industry include Schaeffler AG, ZF Friedrichshafen AG, and Continental AG.

Key Automotive E-axle Companies:

- Continental AG

- ZF Friedrichshafen AG

- Melrose Industries PLC

- Dana Limited

- Robert Bosch GmbH

- Meritor, Inc.

- LINAMAR

- NIDEC CORPORATION

- Magna International Inc.

- Schaeffler AG

Recent Developments

-

In June 2023, Idemitsu Kosan Co., Ltd., a global leader in energy and chemical products, is pleased to announce the successful development of a groundbreaking solution called "E AXLE and Electric Parts Cooling Oil." This cutting-edge innovation is designed to enhance the performance and efficiency of electric and hybrid vehicles' drive units, electronics, and battery systems.

-

In June 2023Musashi Auto Parts India Pvt. Ltd., a wholly-owned subsidiary of Musashi Seimitsu Industries in Japan and a manufacturer of transmission components for two-wheelers and four-wheelers in India, announced its entry into the Indian electric mobility (E-mobility) market. Leveraging its robust design and engineering capabilities, Musashi aims to manufacture a comprehensive EV unit that includes the motor, power control unit (PCU), and gearbox. With a strong focus on producing high-performance and safe automotive components, Musashi will begin manufacturing its E-Axle at its Bengaluru plant starting in October 2023.

-

In June 2023, NIDEC CORPORATION and Renesas Electronics Corporation have recently announced a collaborative partnership to develop semiconductor solutions for an advanced next-generation E-Axle system. This innovative X-in-1 system will integrate an electric vehicle (EV) drive motor and power electronics, further enhancing the performance and efficiency of electric vehicles.

-

In May 2023, Schaeffler India Limited, an automotive and industrial parts manufacturer and a subsidiary of the Germany-based Schaeffler Group, has recently received a significant order worth Rs 2700 crore (Euro 300 million). The order is for their innovative two-in-one electric axles as the company strategically transitions from internal combustion engines to electric powertrains.

Automotive E-axle Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.82 billion

Revenue forecast in 2030

USD 139.15 billion

Growth rate

CAGR of 37.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Continental AG; ZF Friedrichshafen AG; Melrose Industries PLC; Dana Limited; Robert Bosch GmbH; Meritor, Inc.; LINAMAR; NIDEC CORPORATION; Schaeffler AG; Magna International Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive E-axle Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automotive e-axle market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Front

-

Rear

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global automotive E-axle market size was estimated at USD 11.93 billion in 2022 and is expected to reach USD 14.82 billion in 2023.

b. The global automotive E-axle market is expected to grow at a compound annual growth rate of 37.7% from 2023 to 2030 to reach USD 139.15 billion by 2030.

b. Asia Pacific registered a considerable market share of 25.1% in 2022. This is attributable to the growing sales of battery electric vehicles along with the growing adoption of automotive e-axles in the light commercial vehicle segment.

b. Some key players operating in the automotive E-axle market include Dana Incorporated, Melrose Industries PLC, Robert Bosch GmbH, Schaeffler AG, and Magna International Inc.

b. Key factors that are driving the market growth include instability in the Middle Eastern oil-producing region, an increase in electric vehicle production and sales, and growing public EV charging infrastructure, subsidies, and tax exemptions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.