- Home

- »

- Communications Infrastructure

- »

-

Automotive Cyber Security Market Size & Share Report, 2030GVR Report cover

![Automotive Cyber Security Market Size, Share & Trends Report]()

Automotive Cyber Security Market (2023 - 2030) Size, Share & Trends Analysis Report By Security (Application, Wireless Network), By Vehicle Type (Passenger, EVs), By Application (Infotainment, Powertrain), By Service, And Segment Forecasts

- Report ID: GVR-2-68038-971-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Cyber Security Market Summary

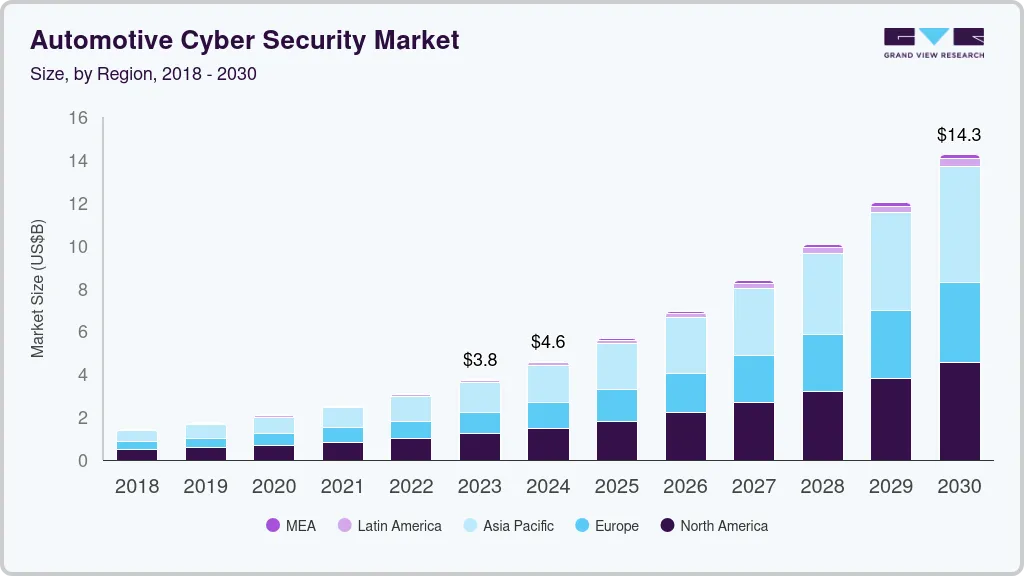

The global automotive cyber security market size was estimated at USD 3,090.6 million in 2022 and is projected to reach USD 14,258.5 million by 2030, growing at a CAGR of 20.93% from 2023 to 2030. Automotive cyber security is undergoing a fast revolution that is driven by socio-economic and environmental trends due to new manufacturing methods and consumer-challenging technologies.

Key Market Trends & Insights

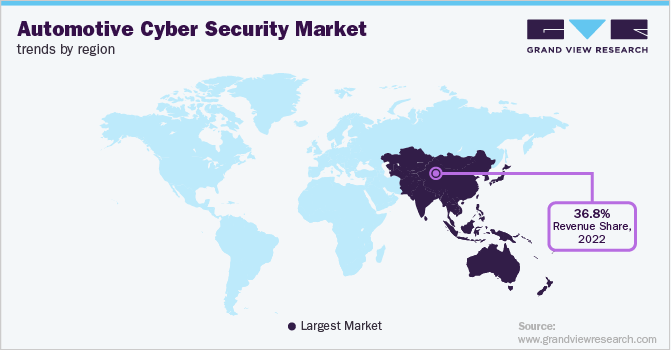

- Asia Pacific accounted for a 36.80% market share in 2022 and is expected to grow steadily during the forecast period.

- Based on application, the infotainment segment dominated the market with a share of 36.27% in 2022.

- Based on security insights, the wireless network security dominated the market with a share of 42.5% in 2022.

- Based on vehicle type, the EV segment led the market and is poised to expand at a CAGR of 28.57% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3,090.6 Million

- 2030 Projected Market Size: USD 14,258.5 Million

- CAGR (2023-2030): 20.93%

- Asia Pacific: Largest market in 2022

Vehicle connectivity is expanding quickly, creating many chances for innovative new features and appealing business strategies. The risk of cyber-attacks on automotive networks is also rising at the same time. Cyber-attacks have resulted in financial losses and damage to vehicular safety and reliability. With the incorporation of technologies like artificial intelligence, machine learning, private 5G, edge computing, and high-performance processing units, autonomous vehicles have made significant improvements recently. Edge computing assists autonomous EVs in managing a large amount of information at the edge to reduce latency and enable vehicles to make decisions based on data in real time.

Moreover, due to the adopting technologies, it is crucial for the suppliers and manufacturers in the automobile industry to adopt National Highway Traffic Safety Administration NHTSA's rules and prioritize vehicle cyber security. Setting internal procedures and policies to ensure systems will be secure in anticipated real-world circumstances, including the presence of potential vehicle cyber security threats, is another aspect of giving vehicle cyber security a high priority. The environment for automotive cyber security is dynamic and is anticipated to evolve frequently.

There are numerous cybersecurity vulnerabilities specific to the automobile sector. A vehicle's safety and advanced driver assistance systems could be damaged by cybercriminals, or even worse, they could alter any automated capabilities to directly cause a disaster. Security experts are concentrating on research and development on integrating defense mechanisms to counter the growing cyberattacks on EVs. Integrating a defense mechanism becomes a crucial design element as self-driving software and hardware characteristics undergo technical advancements.

The technology that connects driverless vehicles to the internet is typical with the help of a cloud platform. Connecting vehicles to the networks is dangerous. The attack surface grows as more vehicles are linked to the networks. In current scenarios, there is a surge in the installation of sensors and software used in automobiles. Connected automobiles gather data from more than 150 sensing devices placed all over the car. Everything may be tracked with it, including the user's driving habits and the location of the vehicle.

In the post-pandemic period, cyberattacks became more frequent and sophisticated due to the smart mobility ecosystem's ongoing progress. New attack avenues have been shown by financial and geopolitical concerns, and supply chains and these are anticipated to propel automotive and smart mobility players to increase their cybersecurity spending.

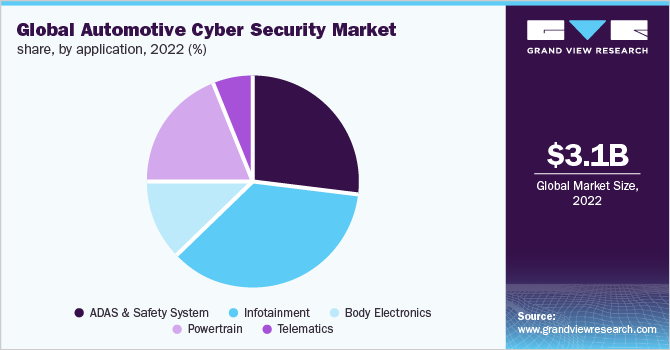

Application Insights

Based on application, the automotive cyber security market is segmented into ADAS & Safety System, Infotainment, Body Electronics, Powertrain, and Telematics. The infotainment segment dominated the market with a share of 36.27% in 2022 and is expected to expand at a significant growth rate during the forecast period.

To provide improved connection options, increase vehicle safety, and improve in-car user experience, the whole automotive sector is pushing toward developing innovative technologies. The "In-Vehicle Infotainment System" is one of the essential technologies that serve as the point of focus of all contemporary automotive systems and integrate their operations to be controlled and monitored from one central unit.

Furthermore, the ADAS & Safety System segment is likely to expand at a CAGR of 22.1% during the forecast period. With the help of ADAS technology, vehicles may operate in a way that is comparable to a driver monitoring the weather, spotting items on the road, and making a judgment in real time to increase safety. Automatic clutch control, driver monitoring, front pedestrian detection, and collision avoidance are some instances of ADAS capabilities.

The market is witnessing drastic developments in autonomous driving technologies, which are anticipated to increase demand for a continuous connection from the car's ECU to a number of cloud services that improve sensor processing and subsequent vehicle navigation.

Security Type Insights

Based on security insights, the market is segmented into endpoint, application, and wireless network security. Wireless network security dominated the market with a share of 42.5% in 2022. The Wi-Fi-based wireless system enables automotive experts to simultaneously monitor hundreds of data channels during test runs to track vehicle operational factors and alter the test as it is being performed. To support varied application circumstances, a modern vehicle contains many networks for information sharing, including wireless channels.

In the future, vehicles will support more complex wireless communication use cases as the automotive industry develops, hence it will be essential to consider constructing protected wireless technology based on a solid equipment foundation and software layers invented to secure software development methodologies.

In 2022, the application security segment accounted for a significant revenue share of 34.6% in the market. In recent years, it has become common for car OEMs to offer mobile applications that allow a smooth owner and user interface. These programs offer a wide range of functions, including the ability to start the car wirelessly, monitor the fuel level, and perform advanced inspections. Moreover, the invention of new mobile applications has embedded various leverages for vehicle users.

Vehicle Type Insights

Based on vehicle type, the market can be segmented into commercial vehicles, passenger cars, and Electric Vehicle (EV). In 2022, the EV segment led the market and is poised to expand at a CAGR of 28.57%. The market has expanded as a result of more individuals paying attention to economic development and realizing the drawbacks of driving hybrid vehicles. Additionally, local authorities from a number of areas are offering subsidies to promote the purchase of electric vehicles in anticipation of broader infrastructure development.

Energy and information technology advancements are changing how EVs produce, manage, store, and utilize energy. This has raised the chances that cyberattacks lead to negative effects. Electric and modern vehicles are more automated and linked, which has increased the risk of cybersecurity threats. Due to the proliferation of cyberattacks and managing this increasingly complicated environment, whether it is network security or in-vehicle security, the majority of OEMs and other significant electric vehicle operators rely on security. In the absence of knowledge or control, many firms also feel compelled to rely on independent producers and publicly accessible resources.

Service Insights

In 2022, the in-vehicle segment led the market, accounting for a revenue share of 69.57%. Technologies that enable connections between inside-vehicle systems and those found in external systems or remote are known as in-vehicle-connected services. The most linked device in the modern vehicle owing to its mobile connectivity. Automobile OEMs have had to adapt to rising consumer expectations and demands, which has led to increasingly more advanced technologies.

Moreover, due to the advancement of cloud infrastructure and framework, external cloud services are expanding at the highest rate. Considering that automated vehicles produce a significant amount of data, cloud services provide a highly reliable technology. Additionally, as the number of vehicles and gadgets connected to the cloud increases, cloud technology will result in a faster rate of information exchange.

Regional Insights

Asia Pacific accounted for a 36.80% market share in 2022 and is expected to grow steadily during the forecast period. In APAC, the number of cyberattacks has steadily increased. However, the growing acceptance of work-from-home arrangements and a lack of protection measures have resulted in a sharp rise in cyberattacks. Malware and ransomware attacks are the two most common types of cyberattacks. APAC countries still experience 1.6 times higher malware and ransomware attacks than the rest of the globe respectively. Ransomware attacks have become more frequent worldwide since 2018. As connected vehicles and digitization have proliferated, cyberattacks against the automobile industry have increased in frequency. By focusing on the vehicle and compromising vital vehicle data, these attacks lead owners to suffer huge losses.

North America emerged as the second-largest automotive cybersecurity market during the forecast period. The adoption of automated passenger vehicles will fuel the growth of the automotive cybersecurity market in North America. The automotive industry's attention has shifted to hybrid cars, which are leading the market, as a result of the growing emphasis on lowering vehicle emissions.

Government bodies and environmental agencies are implementing emission standards, rules, and laws in response to growing environmental concerns, which could increase the cost of providing electrical drivetrain components and energy diesel engines in the forecast period.

Key Companies & Market Share Insights

Companies are entering into organic and inorganic growth strategies such as solution/product launches & developments, geographical expansions, mergers & acquisitions, and partnerships to stay ahead in the competitive market scenario. For instance, in Jan 2023, the International Centre for Automotive Technology (ICAT), which certifies automobiles for their security and adherence to local legislation, stated that it aims to invest in a facility that will build cyber security capabilities. Some of the prominent players in the global automotive cyber security market include:

-

Sheelds

-

Vector Informatik GmbH

-

NXP Semiconductors N.V.

-

Harman International

-

Broadcom Inc.

-

Denso Corporation

-

Honeywell International, Inc.

-

Guard Knox Cyber-Technologies Ltd.

Automotive Cyber Security Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,769.9 million

Revenue forecast in 2030

USD 14.22 billion

Growth rate

CAGR of 20.93% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Security type, vehicle type, application, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Sheelds; Vector Informatik GmbH; NXP Semiconductors N.V.; Harman International; Broadcom Inc.; Denso Corporation; Honeywell International, Inc.; Guard Knox Cyber-Technologies Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Automotive Cyber Security Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive cyber security market report based on security type, vehicle type, application, service, and region:

-

Security Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Endpoint

-

Application

-

Wireless Network

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Car

-

Commercial Vehicle

-

Electrical Vehicle

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

ADAS & Safety System

-

Infotainment

-

Body Electronics

-

Powertrain

-

Telematics

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-Vehicle Services

-

External Cloud Services

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive cyber security market size was estimated at USD 3,090.6 million in 2022 and is expected to reach USD 3,769.9 million in 2023.

b. The global automotive cyber security market is expected to grow at a compound annual growth rate of 20.93% from 2023 to 2030 to reach USD 14.22 billion by 2030.

b. Asia Pacific dominated the automotive cyber security market with a share of 36.80% in 2022. This is attributable to changing consumer lifestyle along with increasing purchasing power and rapid growing urbanization in the region.

b. Some key players operating in the automotive cyber security market Argus Cyber Security Ltd.; Arilou Technologies; Vector Informatik GmbH; NXP Semiconductors N.V.; HARMAN International; Symantec Corporation; Denso Corporation; Honeywell International, Inc.; and Guardknox Cyber Technologies Ltd.

b. Key factors that are driving the market growth include the growing emphasis of OEMs on autonomous driving as well as connected car systems that have increased the risk of data breaching and increasing usage of e-mobility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.