- Home

- »

- Automotive & Transportation

- »

-

Automotive Blind Spot Detection System Market Report 2030GVR Report cover

![Automotive Blind Spot Detection System Market Size, Share & Trends Report]()

Automotive Blind Spot Detection System Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology, By Vehicle Type (Passenger Cars, Commercial Vehicles), By Propulsion Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-404-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

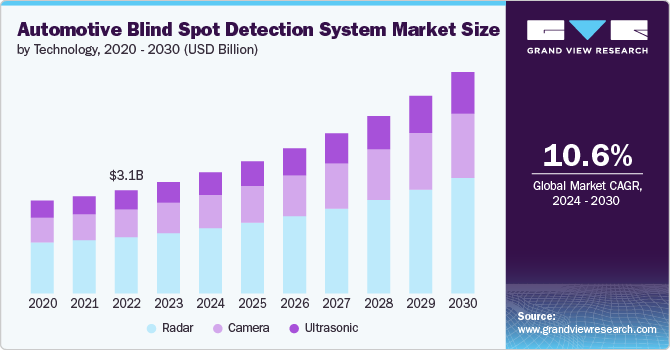

The global automotive blind spot detection system market size was valued at USD 3.30 billion in 2023 and is expected to grow at a CAGR of 10.6% from 2024 to 2030. The increasing number of road accidents is a major factor driving the adoption of blind spot detection (BSD) systems, as they help mitigate the risk of collisions. According to an article published by the European Commission, in 2023, around 20,400 people died in road accidents in Europe. Furthermore, according to the National Highway Traffic Safety Administration (NHTSA), around 40,990 people died in vehicle traffic crashes in the U.S. in 2023. Blind spots are a significant contributor to such accidents, particularly during lane changes and merging.

Passenger safety is a paramount concern for both consumers and regulatory bodies. BSD systems enhance passenger safety by providing drivers with additional awareness of their surroundings. The growing demand for safer vehicles is propelling the adoption of BSD systems, as they contribute to reducing the likelihood of accidents caused by blind spots. Moreover, governments across the globe are implementing policies and initiatives to promote road safety. For instance, the European Union’s general safety regulation mandates the inclusion of advanced safety features, including BSD systems in vehicles manufactured from 2022 onwards. Similarly, the NHTSA in the U.S. has been advocating for the inclusion of BSD systems as part of its New Car Assessment Program (NCAP). These supportive policies are driving the adoption of BSD systems.

The automotive industry is witnessing rapid advancements in sensor technologies, including radar, LiDAR, and camera systems. These technologies are becoming more affordable and efficient, enabling the widespread adoption of BSD systems. The continuous improvement in sensor accuracy and reliability is driving the growth of the BSD market. Furthermore, development of autonomous vehicles has accelerated the adoption of advanced BSD systems. Autonomous vehicles rely heavily on a suite of sensors and detection systems to navigate safely, and BSD systems are a crucial component further driving the demand for the market.

The rise of electric vehicles (EVs) has also positively impacted the demand for the BSD system market. Many new EV models come equipped with advanced BSD systems as part of their standard safety features. This shift toward electrification is expected to drive further innovation and adoption in the BSD market. Growing awareness among the consumers about the benefits of advanced safety features is anticipated to drive the demand for BSD systems over the forecast period. For instance, according to a survey conducted by the Insurance Institute for Highway Safety (IIHS), a significant percentage of car buyers consider BSD systems as a crucial factor when purchasing a new vehicle.

Technology Insights

The radar segment dominated the market in 2023 and accounted for a 54.21% share of global revenue. Radar sensors utilize radio waves to identify objects near the vehicle. They are particularly effective at detecting vehicles over long distances and in adverse weather conditions. Many premium and high-end vehicles integrate radar-based blind spot detection as part of their ADAS due to its effectiveness and reliability, thereby driving the segment's growth.

The camera segment is projected to witness significant growth from 2024 to 2030. Cameras deliver visual insights into the vehicle’s surroundings and are especially used for spotting smaller objects, such as motorcycles or bicycles, that might be in the blind spot. Advances in camera technology, such as high-resolution and 360-degree camera systems, enhance the capability to capture detailed images and improve overall safety. This technology is increasingly being incorporated into mid-range and higher-end passenger vehicles, thus boosting the segment’s growth.

Vehicle Type Insights

Passenger cars dominated the market in 2023. Passenger cars are experiencing high adoption rates of blind spot detection systems, driven by increasing consumer demand for enhanced safety features. Thus, automakers are incorporating blind spot detection systems to meet these expectations and differentiate their products in a competitive market. Additionally, the increasing adoption of passenger cars such as SUVs, sedans, and luxury cars across the world is further driving the demand for blind spot detection systems in this segment.

The commercial vehicles segment is projected to witness significant growth from 2024 to 2030. An advanced blind spot detection system assists drivers with lane change and passing maneuvers aimed at preventing side collisions involving commercial vehicles. These systems are crucial for improving safety and efficiency in commercial vehicles, especially in fleet operations. They help reduce accidents, enhance driver awareness, and protect vulnerable road users, leading to increased adoption among commercial fleets.

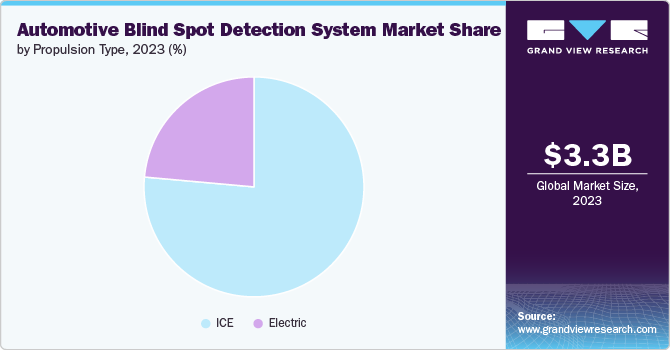

Propulsion Type Insights

The ICE segment dominated the market in 2023, due to the large number of existing or in-use ICE vehicles. As the automotive industry shifts toward newer technologies, there is a growing market for retrofitting older ICE vehicles with advanced safety features. This trend is driven by both consumers looking to upgrade their existing vehicles and fleet operators aiming to improve safety standards without replacing their entire fleet. Additionally, many ICE vehicles have extended lifecycles due to their durability and the large volume of vehicles still on the road. This longevity creates a sustained demand for retrofitting older models with modern safety technologies, including blind spot detection systems.

The electric segment is projected to witness significant growth from 2024 to 2030. The growing production, sales, and adoption of electric vehicles (EVs) across the globe are driving the segment’s growth. As EVs often come equipped with the latest technology, the integration of sophisticated ADAS features is more prevalent in this segment. In addition, many governments offer incentives for EV adoption, which often include requirements or benefits for advanced safety technologies. This regulatory support drives the inclusion of blind spot detection systems in electric vehicles.

Regional Insights

North America automotive blind spot detection system market is expected to witness steady growth from 2024 to 2030. In North America, particularly the U.S. and Canada, the automotive blind spot detection system market is experiencing growth owing to factors such as high demand for advanced safety features and stringent government regulations. The region’s robust automotive industry, marked by a strong presence of both domestic and international car manufacturers, drives innovation and adoption of advanced driver assistance systems (ADAS), thereby driving the market’s growth.

U.S. Automotive Blind Spot Detection System Market Trends

The automotive blind spot detection system market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. Increasing consumer awareness about road safety and a growing preference for premium vehicles equipped with state-of-the-art safety technologies drive market growth in the country. Moreover, the U.S. government is increasingly implementing regulations that mandate advanced safety features in new vehicles, which further drives the demand for blind spot detection systems.

Asia Pacific Automotive Blind Spot Detection System Market Trends

The automotive blind spot detection system market in the Asia Pacificregion dominated the global automotive BSD system market in 2023 and accounted for a 35.45% share of the global revenue. This growth is fueled by the region’s growing automotive industry, rising disposable incomes, and increasing urbanization, which lead to higher vehicle ownership and demand for advanced safety features. Additionally, the growing trend toward electric and autonomous vehicles further drives the demand for sophisticated safety technologies in the region.

Europe Automotive Blind Spot Detection System Market Trends

The automotive blind spot detection system market in Europe is expected to register a moderate CAGR from 2024 to 2030. The European Union's rigorous safety standards and incentives for incorporating advanced safety technologies contribute to the market's growth. European automakers are early adopters of innovative ADAS solutions, integrating them into both luxury and mainstream vehicles. Additionally, the market is also driven by consumer demand for high-tech features and the growing trend of autonomous driving technology.

Key Automotive Blind Spot Detection System Company Insights

Key players operating in the automotive blind spot detection system market include Sensata Technologies, Inc., Robert Bosch GmbH, Continental AG, Rear View Safety, Inc., Valeo Service, NXP Semiconductors, Infineon Technologies AG, VOXX Electronics Corp., Exeros Technologies Ltd., and Quanzhou Minpn Electronic Co., Ltd. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Automotive Blind Spot Detection System Companies:

The following are the leading companies in the automotive blind spot detection system market. These companies collectively hold the largest market share and dictate industry trends.

- Sensata Technologies, Inc.

- Robert Bosch GmbH

- Continental AG

- Rear View Safety, Inc.

- Valeo Service

- NXP Semiconductors

- Infineon Technologies AG

- VOXX Electronics Corp.

- Exeros Technologies Ltd.

- Quanzhou Minpn Electronic Co., Ltd.

- AeroVironment, Inc.

Recent Developments

-

In October 2023, Sensata Technologies launched the PreView Sentry79, a blind spot monitoring radar system. The PreView Sentry79 is an innovative 79 GHz radar sensor for both front and rear detection, aimed at improving driver awareness and reducing the risk of blind spot accidents. This sensor features a fully adjustable detection zone and can identify objects up to 40 meters (131 feet) away.

-

In October 2022, Taiwan's OToBrite Electronics, a manufacturer of Advanced Driver Assistance Systems (ADAS) technologies and products, launched a blind spot information system (BSIS) for large commercial vehicles, which leverages visual AI technology.

Automotive Blind Spot Detection System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.58 billion

Revenue forecast in 2030

USD 6.56 billion

Growth rate

CAGR of 10.6% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Technology, vehicle type, propulsion type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

Sensata Technologies, Inc., Robert Bosch GmbH, Continental AG, Rear View Safety, Inc., Valeo Service, NXP Semiconductors, Infineon Technologies AG, VOXX Electronics Corp., Exeros Technologies Ltd., and Quanzhou Minpn Electronic Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Blind Spot Detection System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive blind spot detection system market report based on technology, vehicle type, propulsion type, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Radar

-

Camera

-

Ultrasonic

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive blind spot detection system market size was estimated at USD 3.30 billion in 2023 and is expected to reach USD 3.58 billion in 2024.

b. The global automotive blind spot detection system market is expected to grow at a compound annual growth rate of 10.6% from 2024 to 2030, reaching USD 6.56 billion by 2030.

b. The radar segment dominated the market in 2023 and account for a 54.21% share of global revenue. Radar sensors utilize radio waves to identify objects near the vehicle. They are particularly effective at detecting vehicles over long distances and in adverse weather conditions. Many premium and high-end vehicles integrate radar-based blind spot detection as part of their ADAS due to its effectiveness and reliability, thereby driving the segment's growth.

b. Some of the players operating in the automotive blind spot detection system market include Sensata Technologies, Inc., Robert Bosch GmbH, Continental AG, Rear View Safety, Inc., Valeo Service, NXP Semiconductors, Infineon Technologies AG, VOXX Electronics Corp., Exeros Technologies Ltd., and Quanzhou Minpn Electronic Co., Ltd.

b. Passenger safety is a paramount concern for both consumers and regulatory bodies. BSD systems enhance passenger safety by providing drivers with additional awareness of their surroundings. The growing demand for safer vehicles is propelling the adoption of BSD systems, as they contribute to reducing the likelihood of accidents caused by blind spots.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.