- Home

- »

- Pharmaceuticals

- »

-

Autism Spectrum Disorder Treatment Market Report, 2033GVR Report cover

![Autism Spectrum Disorder Treatment Market Size, Share & Trends Report]()

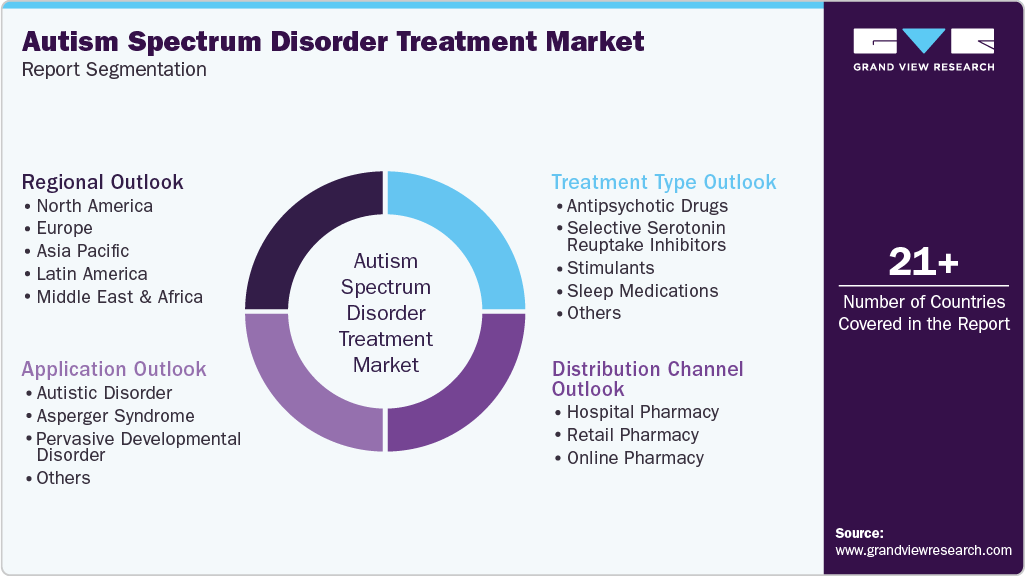

Autism Spectrum Disorder Treatment Market (2025 - 2033) Size, Share & Trends Analysis Report By Treatment Type (Antipsychotic Drugs, Stimulants), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-009-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Autism Spectrum Disorder Treatment Market Summary

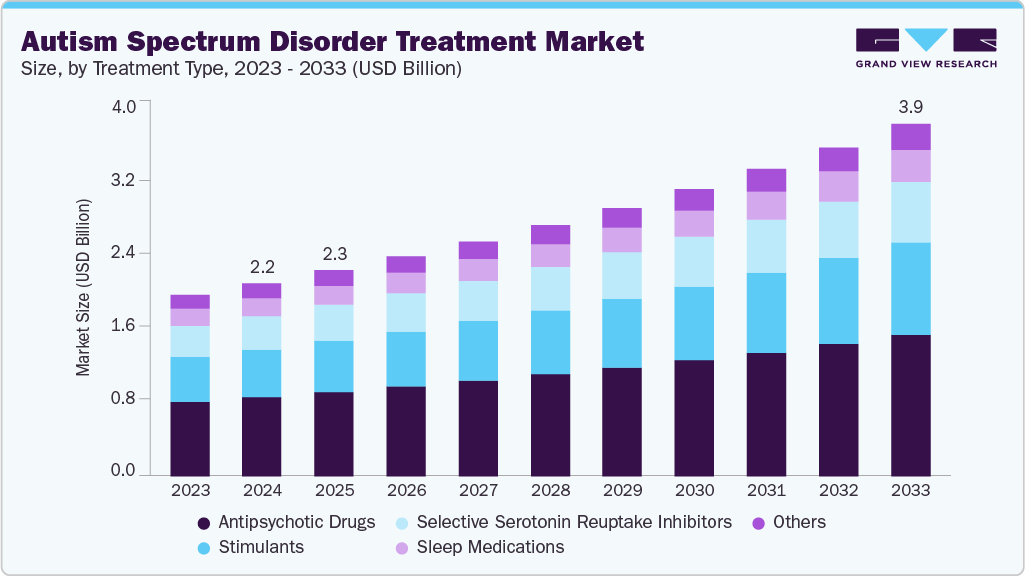

The global autism spectrum disorder treatment market size was estimated at USD 2.16 billion in 2024 and is projected to reach USD 3.95 billion by 2033, growing at a CAGR of 6.92% from 2025 to 2033. The Autism Spectrum Disorder (ASD) treatment market is advancing due to an increasing number of diagnosed individuals and broader access to therapeutic options.

Key Market Trends & Insights

- North America autism spectrum disorder treatment market held the largest share of 42.73% of the global market in 2024.

- The autism spectrum disorder treatment industry in the U.S. is expected to grow significantly over the forecast period.

- By treatment type, the antipsychotic drugs segment held the highest market share of 40.95% in 2024.

- By application, the autistic disorder segment held the highest market share in 2024.

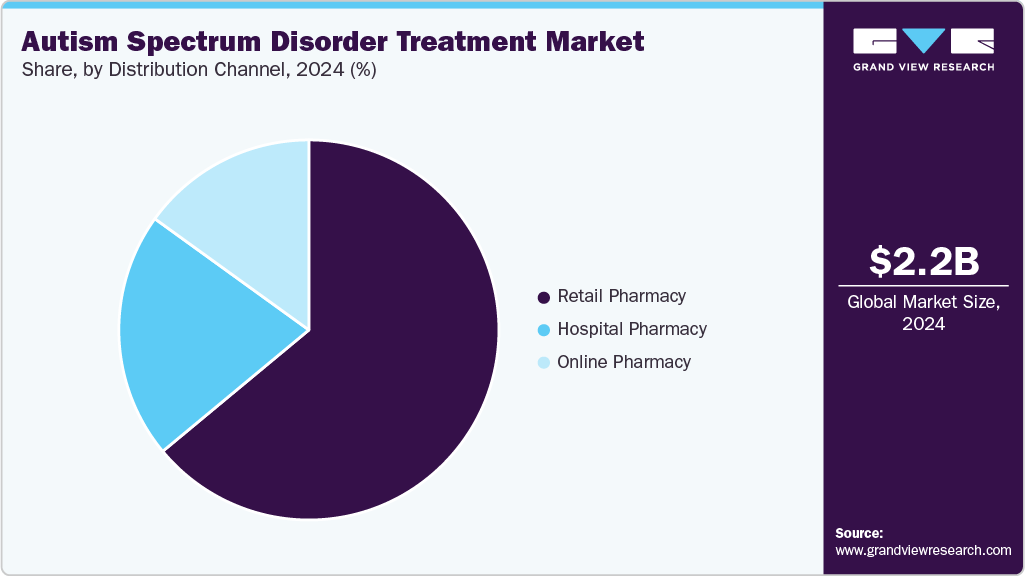

- By distribution channel, the retail pharmacy segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.16 Billion

- 2033 Projected Market Size: USD 3.95 Billion

- CAGR (2025-2033): 6.92%

- North America: Largest market in 2024

The steady rise in awareness among caregivers and healthcare professionals has improved early screening and intervention. Pharmaceutical and behavioral therapy providers are expanding their reach to meet the growing demand for condition-specific management. Diagnostic refinement has enabled clinicians to tailor therapies more precisely, supporting better clinical outcomes. The expanding clinical focus on early developmental support is strengthening treatment adoption rates across major regions. For instance, May 2025, the Centers for Disease Control and Prevention reported that about 1 in 31 children aged 8 years, representing 3.2%, had been identified with autism spectrum disorder. The report indicated that autism occurred among children across all racial, ethnic, and socioeconomic groups. It further stated that autism was more than three times more common among boys than among girls. The agency highlighted that approximately 1 in 6 children aged 3 to 17 years, or nearly 17%, had been diagnosed with a developmental disability including autism between 2009 and 2017. For the 2022 surveillance year, the identified prevalence was 32.2 per 1,000 children, equivalent to 1 in 31.

Pharmaceutical development remains a major growth driver as companies explore new drug classes targeting core and associated symptoms of ASD. The availability of pharmacologic options addressing irritability, hyperactivity, and behavioral dysregulation is enhancing treatment coverage. Several late-stage pipeline therapies are expected to widen therapeutic access across different patient age groups. Digital and behavioral therapy platforms are being integrated into care pathways to improve consistency and scalability of interventions. The market is benefiting from a stronger focus on evidence-based treatment combinations that improve functionality and social engagement. For instance, September 2025, the World Health Organization reported that in 2021 about 1 in 127 persons had autism. The organization noted that this estimate represented an average figure and that prevalence varied substantially across studies. It indicated that the abilities and needs of autistic people varied and could evolve over time. The report stated that some individuals with autism could live independently while others required lifelong care and support. It also highlighted that people with autism often faced co-occurring conditions including epilepsy, depression, anxiety, and attention-deficit/hyperactivity disorder.

Growing investment in research and technology reinforced clinical innovation in autism spectrum disorder (ASD) management. Data-driven approaches enabled better understanding of neurobiological mechanisms, supporting the discovery of novel therapeutic targets. Increased collaboration between academic institutions and industry partners improved trial efficiency and translational outcomes. For instance, in May 2025, the Centers for Disease Control and Prevention outlined that ASD diagnosis involved caregiver descriptions of a child’s development and professional behavioral observations. The agency referred to the Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition, which classified three severity levels-Level 1 requires support, Level 2 requires substantial support, and Level 3 requires very substantial support. Demand for multidisciplinary treatment models increased, reflecting a shift toward holistic care delivery and sustainable market growth.

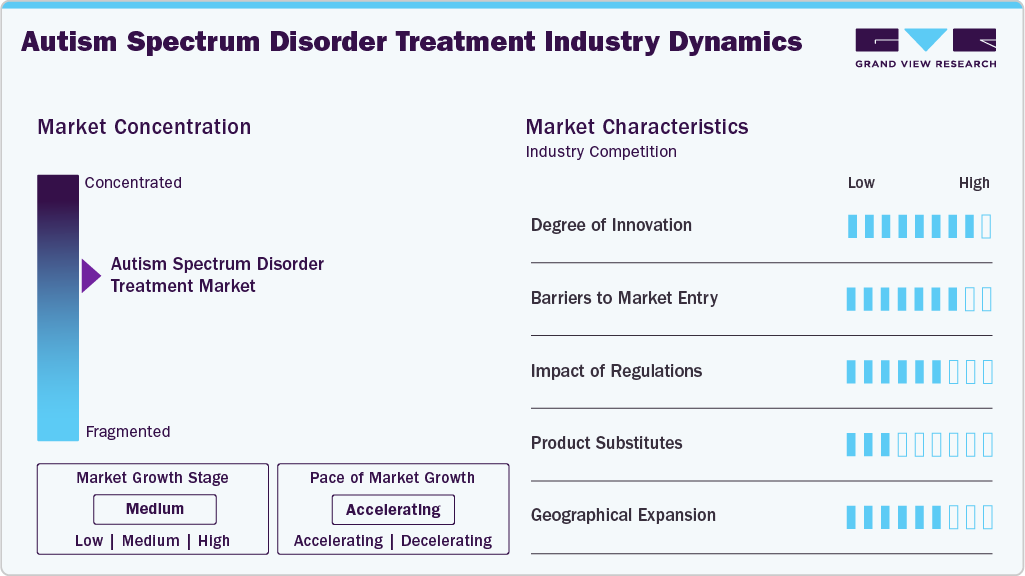

Market Concentration & Characteristics

The Autism Spectrum Disorder treatment market demonstrates moderate to high innovation driven by ongoing research in neurodevelopmental biology and behavioral science. Companies are focusing on developing novel pharmacologic agents that target neurotransmission and synaptic modulation. Digital therapeutics and AI-based behavioral interventions are expanding the treatment spectrum. Advances in biomarker discovery and neuroimaging are supporting precision-based approaches. Continuous innovation is expected to reshape long-term therapy frameworks and patient engagement models.

Market entry is restricted by extensive clinical validation requirements and high research investment. The complex heterogeneity of ASD symptoms increases development time and trial failure risk. Limited availability of validated clinical endpoints constrains new product approvals. High competition from established pharmaceutical and therapy providers further limits new entrants. Strong distribution networks and brand recognition of key players reinforce market dominance.

Regulatory oversight ensures safety and efficacy across both pharmacologic and behavioral treatments. Strict clinical data requirements extend product development timelines and cost. Ethical standards in pediatric and neurodevelopmental trials require detailed compliance documentation. Reimbursement policies are tied to proven clinical outcomes, influencing therapy adoption. Clear regulatory guidance is essential for sustaining market transparency and product credibility.

Product substitution remains limited due to the individualized nature of ASD treatment. Behavioral therapies and pharmacologic interventions serve distinct functions rather than compete directly. Complementary approaches such as digital platforms and social skill training enhance existing treatment efficacy. Over-the-counter supplements and alternative therapies have minimal substitution impact. The market remains anchored on evidence-based clinical interventions.

The ASD treatment market is expanding across North America, Europe, and emerging economies in Asia-Pacific. Growth in diagnostic infrastructure and clinician training supports therapy adoption in new regions. Multinational companies are forming partnerships to access untapped patient populations. Localization of behavioral programs and digital platforms enhances regional adaptability. Expanding awareness and clinical access continue to drive global market penetration.

Treatment Type Insights

The antipsychotic drugs segment dominated the market with the largest revenue share of 40.95% in 2024, driven by strong clinical reliance on these therapies for managing irritability, aggression, and repetitive behaviors in individuals with autism spectrum disorder. These medications remained the primary pharmacologic option with proven symptom control and long-term efficacy data. For instance, in May 2025, the Cochrane Collaboration published a network meta-analysis that included 17 studies with 1,027 randomized participants-of these, 31 adults and 996 children. The analysis found that in children with autism spectrum disorder, risperidone reduced irritability with a mean difference of -7.89, while aripiprazole reduced irritability by -6.26. The review indicated that lurasidone showed little to no difference in symptom control. Availability of FDA-approved agents such as risperidone and aripiprazole supported consistent prescription volume. Continuous research on receptor-targeted mechanisms sustained therapeutic relevance and market presence.

The stimulants segment is projected to grow at the fastest CAGR of 7.58% over the forecast period, due to increasing diagnosis of comorbid attention-deficit and hyperactivity symptoms in individuals with autism spectrum disorder. Clinicians are incorporating stimulants to enhance attention, focus, and impulse control in affected patients. For instance, in June 2023, the World Journal of Psychiatry reported that ADHD was identified in 28%-68% of individuals with autism. A study involving 72 children aged 5-13 years treated with methylphenidate showed a 49% response rate, while 18% discontinued due to adverse effects. Another extended-release methylphenidate study involving 24 children showed clinical benefit. The authors recommended dextroamphetamine trials for its higher potency and 4-6-hour duration. Expanding clinical validation continues to support stimulant therapy adoption.

Application Insights

The autistic disorder segment dominated the market with the largest revenue share of 54.23% in 2024, driven by higher prevalence and diagnostic clarity compared with other spectrum types. Early intervention programs emphasized behavioral and pharmacologic management, while healthcare providers prioritized structured therapy plans to address social and communication challenges. Expanding access to multidisciplinary care supported sustained treatment engagement and improved outcomes. For instance, in July 2022, the Italian Journal of Pediatrics published a meta-analysis including 74 studies with 30,212,757 participants, reporting a global ASD prevalence of 0.6% (95% CI: 0.4%-1%), with regional prevalence at Asia 0.4%, America 1.0%, Europe 0.5%, Africa 1.0%, and Australia 1.7%. Increased prescription of symptom-specific medications ensured continuous demand, and ongoing clinical studies targeting core behavioral deficits enhanced treatment diversity and effectiveness.

The Asperger syndrome segment is projected to grow at the fastest CAGR of 8.08% over the forecast period, driven by increasing recognition of mild-spectrum conditions and broader screening among adolescents and adults. Rising awareness of social and cognitive challenges supports early diagnosis and therapy initiation. For instance, in February 2024, StatPearls (via the National Library of Medicine) reported an estimated prevalence of Asperger Syndrome at 2 to 7 in 1,000 individuals, with a male-to-female ratio of 3:1. Over 70% experienced additional conditions, about 9% of children diagnosed early no longer met criteria in adulthood, and the mean age of diagnosis was around 11 years or later. Demand for cognitive-behavioral and social skills programs, digital therapy platforms, and pharmacologic management is increasing, supporting rapid segment growth.

Distribution Channel Insights

The retail pharmacy segment dominated the market with the largest revenue share of 63.98% in 2024, driven by retail pharmacies remain the preferred channel for medication access due to their widespread presence and trusted service delivery. Patients and caregivers depend on in-person counseling and medication management support from pharmacists. Continuous availability of branded and generic formulations ensures prescription fulfillment consistency. Strong integration with healthcare providers facilitates streamlined prescription processing. Competitive pricing and convenient refill options improve patient adherence rates. The role of pharmacists in monitoring side effects and dosage adjustments enhances treatment reliability. Sustained patient engagement through physical outlets maintains steady revenue contribution.

The online pharmacy segment is projected to grow at the fastest CAGR of 8.06% over the forecast period. This growth is primarily fueled by the shift toward digital healthcare access is accelerating adoption of online pharmacies for ASD medication purchases. Convenience of doorstep delivery and simplified digital payment systems attracts caregivers managing long-term therapies. Platforms offering verified medications and transparent pricing strengthen consumer trust. Expansion of teleconsultation services allows integrated prescription management and direct online ordering. Increasing internet penetration and digital literacy support wider reach among urban and semi-urban populations. Subscription-based refill programs are improving continuity of treatment. These advancements collectively enhance the growth outlook for the online pharmacy segment.

Regional Insights

North America Autism Spectrum Disorder Treatment Market Trends

North America held the largest share of the autism spectrum disorder treatment market in 2024, accounting for 42.73% of global revenue, due to its advanced diagnostic framework and strong clinical infrastructure. High awareness among healthcare professionals and caregivers supports early identification and sustained therapy engagement. Widespread access to pharmacologic and behavioral interventions strengthens overall treatment coverage. Presence of leading pharmaceutical and digital therapy developers drives continuous innovation. Increasing collaboration between clinical institutions enhances research output and therapy validation. The region maintains steady revenue growth through broad treatment accessibility and established care networks.

U.S. Autism Spectrum Disorder Treatment Market Trends

The U.S. represents the largest share within North America due to a well-structured healthcare system and extensive clinical practice integration. High diagnosis rates and consistent treatment adherence among pediatric and adult populations sustain strong market performance. Expanding availability of approved medications supports prescription volume growth. Behavioral and occupational therapy services are widely embedded across specialized centers. Private sector investment in digital intervention tools enhances treatment diversity. Ongoing clinical trials focused on novel mechanisms further reinforce the country’s leadership in ASD therapeutics.

Europe Autism Spectrum Disorder Treatment Market Trends

Europe holds a significant position in the global market supported by structured diagnostic programs and multidisciplinary care models. Increasing clinical focus on early behavioral intervention has improved long-term therapy outcomes. The region demonstrates strong demand for pharmacologic and non-pharmacologic management approaches. Partnerships among research institutions are enhancing innovation and clinical data generation. Growing participation in awareness initiatives drives therapy adoption among newly diagnosed populations. Established healthcare systems ensure consistent access to qualified specialists and evidence-based treatments.

The UK market shows steady expansion supported by comprehensive clinical protocols and broad specialist availability. High diagnostic accuracy and improved screening in educational and healthcare settings strengthen treatment demand. Pharmaceutical and behavioral therapies addressing core and associated symptoms are gaining consistent uptake. Digital health platforms are improving therapy continuity through remote engagement. Expanding research participation supports advancement in personalized treatment programs. The country’s structured patient management framework sustains reliable growth within the regional landscape.

Germany contributes substantially to the European market through strong clinical infrastructure and active pharmaceutical research. The country exhibits high treatment adherence driven by organized care coordination among specialists. Continuous advancements in neuropsychiatric research promote innovation in symptom-specific therapies. Integration of behavioral and occupational interventions enhances therapy effectiveness. The presence of key pharmaceutical manufacturers ensures stable product availability. Rising diagnostic precision and consistent care delivery sustain long-term market strength.

France demonstrates consistent market growth supported by robust clinical networks and expanding early intervention programs. The country’s healthcare institutions emphasize individualized therapy approaches for ASD management. Increasing demand for pharmacologic agents targeting behavioral symptoms contributes to rising prescription rates. Collaboration between hospitals and academic centers fosters continuous research activity. Structured follow-up and adherence monitoring improve treatment consistency. The steady expansion of therapy adoption across care settings reinforces market stability.

Asia Pacific Autism Spectrum Disorder Treatment Market Trends

Asia Pacific autism spectrum disorder treatment market is expected to register the significant CAGR of 8.19% over the forecast period, driven by improving awareness and diagnostic expansion. Rapid development of clinical infrastructure in emerging economies enhances patient identification. Rising investment in behavioral therapy centers supports broader access to structured interventions. Pharmaceutical companies are extending product portfolios to meet diverse regional needs. Increasing availability of digital treatment solutions strengthens patient engagement. Expanding healthcare access across populous nations underpins the region’s strong growth trajectory.

Japan’s market growth is supported by its advanced healthcare system and increasing focus on neurodevelopmental research. Rising diagnosis rates among children and adolescents contribute to expanding therapy demand. Clinicians emphasize early behavioral and educational interventions supported by evidence-based guidelines. Local pharmaceutical companies are introducing innovative formulations targeting symptom-specific relief. Integration of technology-driven support programs enhances long-term treatment adherence. The country’s continuous focus on clinical precision sustains its strong regional position.

China is emerging as a key growth contributor due to rapid improvement in diagnostic infrastructure and professional training. Increasing parental awareness drives early evaluation and therapy initiation. Expanding private healthcare services enhances access to pharmacologic and behavioral treatments. Growing clinical research activity supports the introduction of new therapeutic options. Digital platforms for therapy delivery are gaining traction across urban areas. Rising investment in developmental disorder management reinforces future market potential.

Latin America Autism Spectrum Disorder Treatment Market Trends

Latin America is experiencing gradual market expansion supported by growing diagnosis rates and therapy adoption. Increased training among clinicians and therapists strengthens clinical capability in ASD management. Pharmaceutical access is improving through expanded distribution networks across key countries. Demand for behavioral and occupational therapy services is growing in urban centers. Awareness initiatives are encouraging early evaluation and intervention. The region’s evolving healthcare infrastructure supports consistent long-term growth.

Brazil leads the Latin American market due to strong concentration of specialized treatment centers and research institutions. Growing diagnosis among children supports higher therapy enrollment rates. Pharmacologic interventions addressing behavioral symptoms are increasingly prescribed by specialists. Development of structured care frameworks improves therapy follow-up and adherence. Collaboration between private clinics and academic centers promotes research-based clinical practices. Continuous urban healthcare expansion supports the country’s leading regional share.

Middle East & Africa Autism Spectrum Disorder Treatment Market Trends

MEA shows moderate growth supported by gradual improvements in diagnostic reach and clinical education. Expanding availability of neurodevelopmental specialists is enhancing patient access to structured care. Increased establishment of therapy centers in major cities supports treatment continuity. Growing awareness of ASD symptoms encourages early intervention among caregivers. Multinational pharmaceutical presence strengthens product availability across key markets. Continued investment in clinical capacity is supporting progressive market development.

Saudi Arabia contributes prominently to the MEA market through rising clinical focus on neurodevelopmental disorders. Expanding healthcare infrastructure supports higher diagnostic throughput across major hospitals. Growing adoption of behavioral and pharmacologic therapies enhances patient outcomes. Increased participation of private providers in therapy delivery strengthens market activity. Pharmacists and clinicians are integrating evidence-based protocols to improve treatment consistency. Rising awareness of long-term management needs sustains steady market growth.

Key Autism Spectrum Disorder Treatment Company Insights

Curemark LLC holds a significant position in the autism spectrum disorder treatment market with enzyme-based therapies targeting core symptoms. Bristol-Myers Squibb Company and Merck & Co., Inc. advance neuropsychiatric research through compounds aimed at neural pathway modulation. Novartis AG and Eli Lilly and Company strengthen their portfolios with diversified central nervous system therapies and late-stage clinical programs. Pfizer Inc. and Johnson & Johnson Services Inc. expand therapeutic offerings through innovation in behavioral modulation. Otsuka Pharmaceutical Co., Ltd. and Yamo Pharmaceuticals enhance access to pharmacologic and adjunctive treatments, while F. Hoffmann-La Roche Ltd. and Axial Therapeutics Inc. focus on precision neurobiology and gut-brain research.

Key Autism Spectrum Disorder Treatment Companies:

The following are the leading companies in the autism spectrum disorder treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Curemark LLC

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- Novartis AG

- Eli Lilly and Company

- Pfizer Inc.

- Johnson & Johnson Services Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Yamo Pharmaceuticals

- F.Hoffmann-La Roche Ltd.

- Axial Therapeutics Inc.

Recent Developments

-

In May 2025, The Clinical Trial Vanguard reported that Yamo Pharmaceuticals’s drug L1‑79 had delivered statistically significant results in a Phase 2 trial for autism spectrum disorder: in a 12‑week randomized, double‑blind, placebo‑controlled crossover study of 58 participants aged 12-21, L1‑79 achieved a 7.94‑point advantage over placebo on the Vineland‑3 Socialization Standard Score (VSSS), which was nearly double the minimal clinically important difference.

-

In April 2025, Bristol Myers Squibb reported topline results from the Phase 3 ARISE trial evaluating Cobenfy (xanomeline and trospium chloride) as an adjunctive treatment in adults with schizophrenia. The trial included 190 participants in the Cobenfy arm and 196 in placebo.

-

In April 2024, Otsuka Pharmaceutical Co., Ltd. and Jolly Good Inc. announced that they had launched a world‑first VR training program named FACEDUO Emotion Recognition Training VR, targeted at individuals who found life challenging because of the difficulty in reading others’ emotions. The programme can be used by those with mental illnesses and those with developmental traits such as autism spectrum disorder, and it incorporates gamification elements such as graphics and sound effects in order to be easier to understand and more engaging.

Autism Spectrum Disorder Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.31 billion

Revenue forecast in 2033

USD 3.95 billion

Growth rate

CAGR of 6.92% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Treatment type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Curemark LLC; Bristol-Myers Squibb Company; Merck & Co., Inc.; Novartis AG; Eli Lilly and Company; Pfizer Inc.; Johnson & Johnson Services Inc.; Otsuka Pharmaceutical Co., Ltd.; Yamo Pharmaceuticals; F.Hoffmann-La Roche Ltd.; Axial Therapeutics Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autism Spectrum Disorder Treatment Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global autism spectrum disorder treatment market report based on treatment type, application, distribution channel, and region:

-

Treatment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Antipsychotic Drugs

-

Selective Serotonin Reuptake Inhibitors

-

Stimulants

-

Sleep Medications

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Autistic Disorder

-

Asperger Syndrome

-

Pervasive Developmental Disorder

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global autism spectrum disorder treatment market size was valued at USD 2.16 billion in 2024 and is anticipated to reach USD 2.31 billion in 2025.

b. The global autism spectrum disorder treatment market is expected to witness a compound annual growth rate of 6.92% from 2025 to 2033 to reach USD 3.95 billion by 2033.

b. North America held the largest share of the autism spectrum disorder treatment market in 2024, accounting for 42.73% of global revenue, due to its advanced diagnostic framework and strong clinical infrastructure.

b. Some of the key players in autism spectrum disorder treatment market are Curemark LLC; Bristol-Myers Squibb Company; Merck & Co., Inc.; Novartis AG; Eli Lilly and Company; Pfizer Inc.; Johnson & Johnson Services Inc.; Otsuka Pharmaceutical Co., Ltd.; Yamo Pharmaceuticals; F.Hoffmann-La Roche Ltd.; Axial Therapeutics Inc.

b. The major factors driving the market growth are the increasing prevalence of ASD, increasing funding for ASD R&D, and the presence of a strong product pipeline and their expected approvals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.