- Home

- »

- Next Generation Technologies

- »

-

Augmented Reality Market Size, Share, Industry Report 2033GVR Report cover

![Augmented Reality Market Size, Share & Trends Report]()

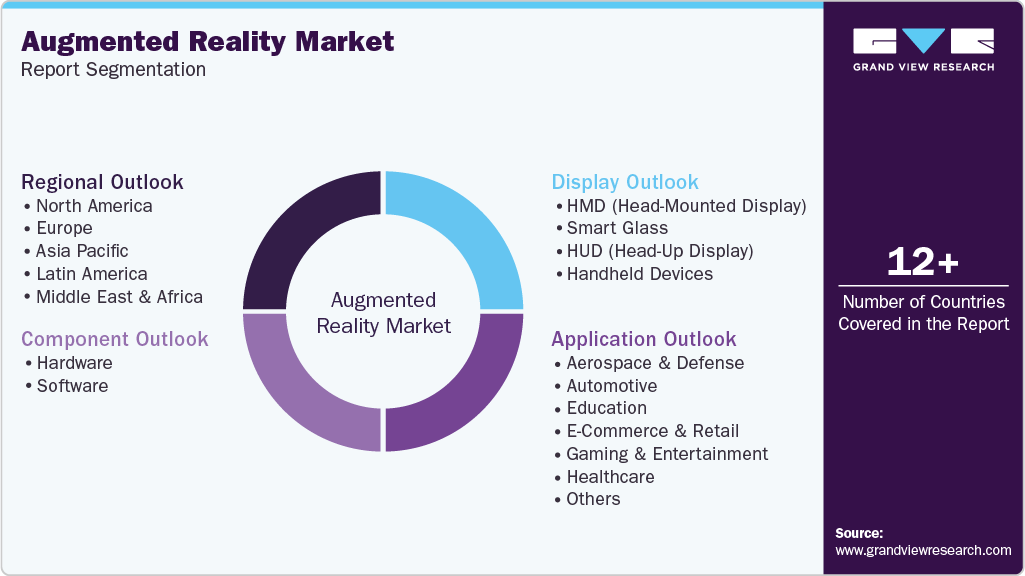

Augmented Reality Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Display (HMD, Smart Glass, HUD (Head-Up Display), Handheld Devices), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-820-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Augmented Reality Market Summary

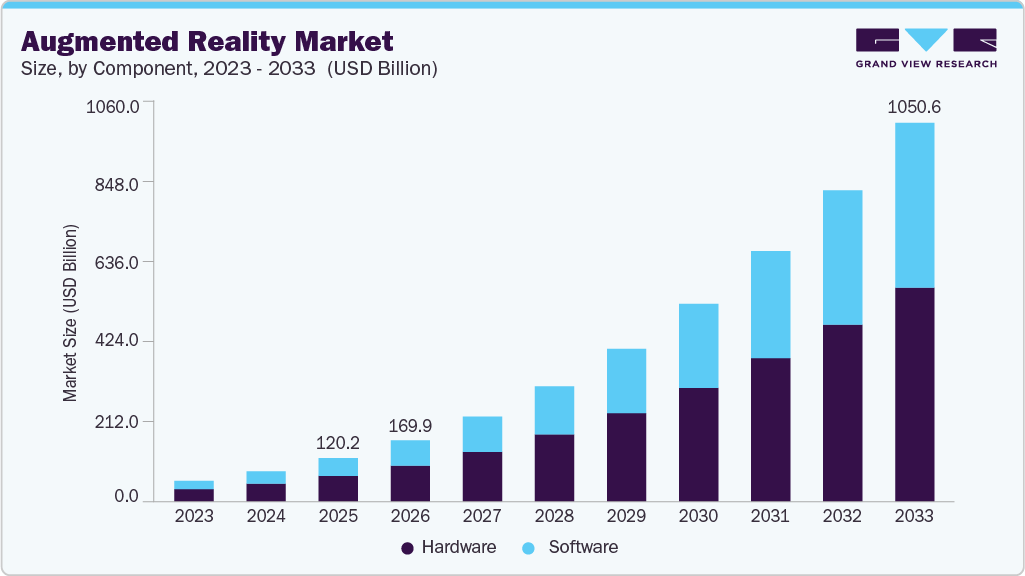

The global augmented reality market size was estimated at USD 120.21 billion in 2025 and is projected to reach USD 1,050.56 billion by 2033, growing at a CAGR of 29.7% from 2026 to 2033. The industry is primarily driven by the growing technological advancements in augmented reality (AR) hardware and software.

Key Market Trends & Insights

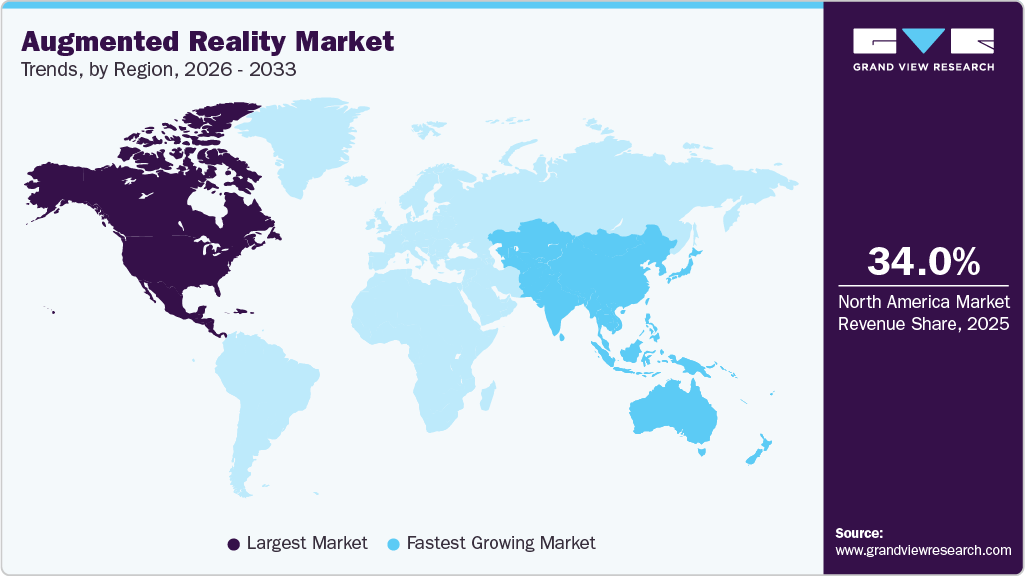

- North America dominated the global augmented reality market with the largest revenue share of over 34% in 2025.

- By component, hardware accounted for the largest market share of over 59% in 2025.

- By Application, the industrial & manufacturing segment in the market dominated the market in 2025.

- By display, the smart glasses segment is expected to grow at the highest CAGR of over 38% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 120.21 Billion

- 2033 Projected Market Size: USD 1,050.56 Billion

- CAGR (2026-2033): 29.7%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

Enhanced processing power, better graphics, and the integration of artificial intelligence (AI) have enabled more realistic and immersive AR experiences, thereby driving innovation and the popularity of augmented reality experiences across various industries. Furthermore, companies are leveraging AR for applications such as virtual try-ons, 3D mapping, and interactive gaming, driving increased adoption across industries, which is expected to further fuel the market growth in the coming years.The AR VR market, encompassing the augmented reality and advertising sector alongside virtual reality advertising, continues to exhibit robust expansion within the augmented reality industry 4.0, driven by innovations in the AR and VR display market and the AR and VR smart glasses market. These advancements enable seamless integration of immersive overlays in retail, gaming, and industrial applications, where AR gaming market experiences and AR glass market devices facilitate real-time interactions such as virtual product trials and predictive visualizations, significantly boosting user engagement and monetization opportunities across digital ecosystems. Additionally, the convergence of virtual reality advertising with the AR and VR smart-glass wearables market further amplifies consumer reach, positioning the overall AR/VR market for sustained growth in the coming years.

In addition, the expansion of AR use in medical training, surgical visualization, and patient care is enhancing the precision and effectiveness of medical procedures. Companies are actively developing AR tools to assist in complex surgeries and to train medical professionals, which significantly boosts the demand for AR solutions in this field, further driving the augmented reality in healthcare market expansion. Furthermore, the growing prevalence of mobile devices equipped with AR capabilities has transformed how consumers interact with digital content. Mobile AR applications allow users to engage with products and services in real time, creating personalized experiences that enhance consumer satisfaction. This trend is expected to grow in the coming years, further accelerating the augmented reality industry demand.

Moreover, the increasing collaborations between technology providers and various industries are fostering innovation in AR applications. These partnerships enable companies to leverage each other's strengths to develop unique solutions tailored to specific market needs. For instance, collaborations between AR firms and educational institutions are enhancing learning experiences through immersive technologies, while partnerships in retail are revolutionizing customer engagement strategies.

Component Insights

The hardware segment accounted for the largest market share of over 59% in 2025, owing to the rising adoption of AR headsets, smart glasses, and displays across industries such as education, gaming & entertainment, and manufacturing. These devices are critical for delivering immersive experiences in areas like remote assistance, real-time training, and virtual simulations. The surge in demand for high-quality AR hardware in gaming & entertainment and aerospace & defense is also contributing significantly to the segmental growth. In addition, advancements in hardware technologies, such as improved optics, processors, and sensors, are driving the adoption of AR devices across professional and consumer applications.

The software segment is expected to witness the fastest CAGR of over 30% from 2026 to 2033, driven by the growing need for AR applications that enhance user experience across various sectors, such as retail and education. Cloud-based AR solutions, coupled with the increasing demand for AR app development platforms, are further driving the software segment. Moreover, the growing interest in AR for enterprise applications, including workflow optimization and remote collaboration, is fueling the expansion of AR software offerings.

Application Insights

The industrial & manufacturing segment in the market dominated the market in 2025. This growth can be attributed to the growing use of AR for enhancing productivity, training, and operational efficiency. AR applications in this sector, such as real-time equipment maintenance, remote assistance, and assembly line monitoring, have been proven to reduce downtime and improve worker performance. The ability to overlay digital information on physical environments allows manufacturers to optimize workflows, minimize errors, and improve safety. With Industry 4.0 initiatives and smart factory adoption rising, AR has become a critical tool in modern manufacturing, further solidifying its dominance in this segment.

The healthcare segment is anticipated to record the fastest growth from 2026 to 2033, driven by the increasing integration of AR in medical training, diagnostics, and surgery. AR is being used for advanced visualization in complex surgeries, helping surgeons perform minimally invasive procedures with greater precision. In medical education, AR offers immersive training solutions, allowing students to interact with 3D models of human anatomy. In addition, the rise of AR-based telemedicine and remote assistance tools for diagnostics and patient care is fueling growth. The ongoing innovations in AR applications for rehabilitation, mental health, and patient engagement are also key factors driving this rapid expansion.

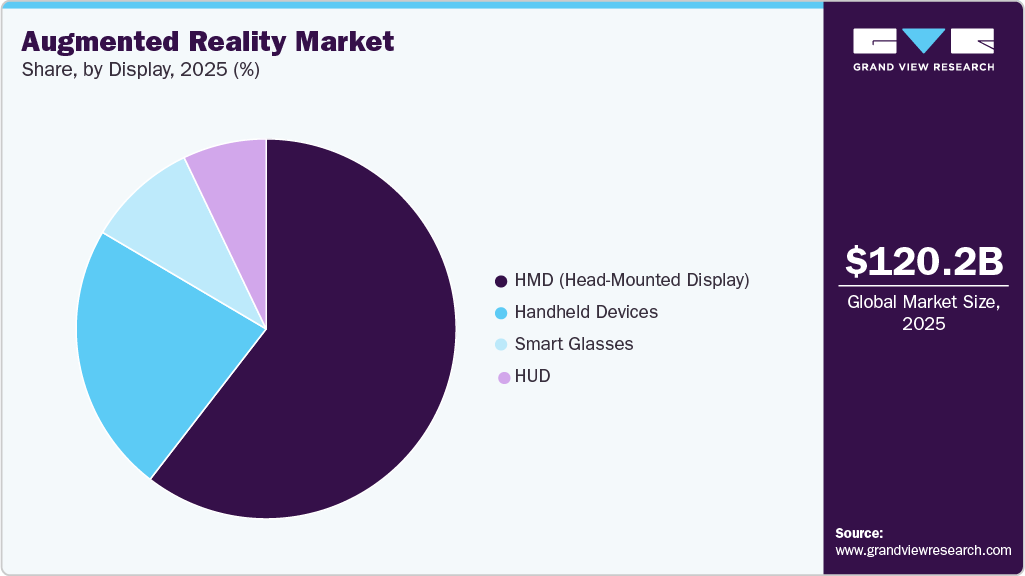

Display Insights

The head-mounted segment dominated the market in 2025, owing to its widespread adoption across industries such as Education, defense, and manufacturing. Head-mounted displays (HMDs) are integral for immersive training, simulations, and real-time problem-solving, making them essential in sectors where hands-free operation and enhanced situational awareness are crucial. The surge in demand for AR-based Gaming & Entertainment, Aerospace & Defense, and the growing use of HMDs in remote assistance and maintenance further propelled the market. Technological advancements in optics, lightweight designs, and improved comfort also made HMDs more appealing for long-duration use, contributing to their segmental growth.

The smart glasses segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the increasing adoption in enterprise applications, particularly in logistics, manufacturing, and education, where real-time data overlay and hands-free navigation improve efficiency. Smart glasses are increasingly used for remote collaboration, enabling experts to guide field technicians without being on-site. Consumer demand is also rising, with smart glasses offering augmented navigation, fitness tracking, and virtual assistants. In addition, advancements in miniaturization, improved battery life, and integration with AI and IoT systems have made smart glasses more practical and versatile, driving their adoption across various sectors and thereby driving the segmental growth.

Regional Insights

The augmented reality market in North America accounted for the highest revenue share of over 34% in 2025, driven by technological advancements, the strong presence of AR startups, and major investments in research and development. The rise of industries such as Gaming & Entertainment, retail, and Education utilizing AR to enhance customer experience and improve training and diagnostics has led to increasing demand.

U.S. Augmented Reality Market Trends

The augmented reality market in the U.S. held a dominant position in 2025, fueled by the growing integration of AR in mobile applications, gaming & entertainment, and aerospace & defense, led by companies such as Apple, Inc., and Google LLC. The demand for AR in Education for enhanced medical training and remote assistance is also on the rise. The U.S. Department of Defense’s increasing use of AR for training and simulations contributes significantly to market expansion. In addition, the rapid growth of AR in e-commerce and retail, where virtual try-on solutions are becoming mainstream, further propels the market. Consumer demand for immersive experiences continues to shape innovation in this space.

Europe Augmented Reality Market Trends

The augmented reality market in Europe is expected to grow at a CAGR of over 28% from 2026 to 2033. The strong demand from industries such as gaming & entertainment, education, and manufacturing primarily drives the European market. Companies in Germany, France, and the UK are leveraging AR to enhance operational efficiency and product design. In addition, Europe's burgeoning focus on the metaverse and immersive technologies accelerates growth in the aerospace & defense and media sectors.

The UK augmented reality market is expected to grow rapidly in the coming years. The UK has a vibrant ecosystem of startups focusing on AR applications in gaming, retail, and education. This entrepreneurial environment fosters creativity and technological advancements, further driving the market growth in the country.

The augmented reality market in Germany held a substantial market share in 2025. In Germany, AR technology is increasingly adopted across various sectors, including manufacturing, automotive, and healthcare. The focus is on enhancing productivity and training through immersive experiences, which is expected to drive market growth in the coming years.

Asia Pacific Augmented Reality Market Trends

The augmented reality market in the Asia Pacific region is expected to grow at the highest CAGR of over 33% from 2026 to 2033. The AR market is fueled by rapid digital transformation. The region is a manufacturing hub where AR is used to streamline production processes and train workers more efficiently. The widespread use of smartphones and government initiatives promoting AR in education and retail are key growth drivers in the region. Moreover, Asia-Pacific's robust gaming & entertainment culture, along with rising demand for AR-based mobile gaming & entertainment and virtual social platforms, continues to stimulate market growth.

Japan augmented reality market is expected to grow rapidly in the coming years, driven by the growing focus on enhancing user experiences through immersive technologies across various industries, including gaming, retail, and education. Furthermore, Japan's emphasis on advanced manufacturing and robotics complements the development of AR technologies, driving innovation and adoption.

The augmented reality market in China held a substantial market share in 2025, driven by rapid technological advancements and strong government support. The rise of affordable and innovative AR devices, such as smart glasses from companies, has significantly contributed to this growth, alongside increasing applications in sectors like healthcare and entertainment.

Key Augmented Reality Company Insights

Some key market players operating include Apple, Inc., and Microsoft Corporation, among others.

-

Apple, Inc. is one of the key players in the augmented reality (AR) market, leveraging its extensive ecosystem of hardware, software, and services. The company’s AR capabilities are embedded within its devices, including iPhones, iPads, and the newly launched Vision Pro headset, through its ARKit platform. The company has been heavily investing in AR technologies, focusing on creating seamless, user-friendly AR experiences that integrate with its broader product ecosystem. Apple's vision of AR is geared towards enhancing user experiences through intuitive interaction and real-world applications.

-

Google LLC is a technology company that plays a significant role in the augmented reality (AR) market through its innovative AR platform, ARCore, which utilizes advanced technologies such as environmental understanding, motion tracking, and light estimation to blend digital content with the real world seamlessly. The company has also been involved in various partnerships and initiatives aimed at enhancing user engagement through AR applications across different sectors, including retail and education.

Lenovo Group and Snap, Inc. are some of the emerging market participants in the market.

-

Lenovo Group is an emerging player in the AR market, with a focus on developing AR solutions for both consumer and enterprise applications. The company offers its AR devices through the ThinkReality platform, which includes the ThinkReality A3 smart glasses designed for productivity, remote collaboration, and real-time data access. Lenovo’s AR products are particularly aimed at enhancing workforce efficiency in industries such as manufacturing, logistics, and Education by providing hands-free, immersive experiences.

-

Snap, Inc., known for its popular social media platform Snapchat, is a prominent emerging market player, focusing on consumer-driven AR experiences. The company pioneered AR filters and lenses on Snapchat, allowing users to interact with digital elements overlaid on real-world environments. Snap has expanded its AR capabilities with the launch of Spectacles, smart glasses designed to deliver immersive AR experiences. The company is heavily investing in AR for advertising and e-commerce, offering AR tools to brands for creating engaging, interactive campaigns. Snap’s AR strategy is centered on enhancing user engagement and making AR accessible to the broader consumer market.

Key Augmented Reality Companies:

The following key companies have been profiled for this study on the augmented reality market.

- Apple, Inc.

- Blippar Limited

- Google LLC

- Lenovo Group

- Magic Leap, Incorporated

- Meta Platforms, Inc.

- PTC Inc.

- Snap, Inc.

- Sony Corporation

- TeamViewer AG

- Vuzix Corporation

- Wikitude GmbH

- Xiaomi Corporation

- Zappar Limited

Recent Developments

-

In October 2025, Magic Leap and Google LLC showcased a next-gen AR glasses prototype at a major XR event, extending their 2024 partnership into a three-year agreement combining Magic Leap's waveguide optics with Google's Raxium microLED displays for Android XR ecosystem devices.

-

In October 2025, Samsung unveiled the Galaxy XR headset in Seoul, the first device powered by the Android XR platform developed collaboratively with Google and Qualcomm Technologies, featuring a Snapdragon XR2+ Gen 2 processor, Gemini AI integration for real-time object recognition, multi-app support, and a lightweight design for mixed reality experiences.

-

In September 2024, Meta Platforms, Inc. introduced Orion, its first true augmented reality glasses, which are designed to blend digital content seamlessly with the real world. These lightweight glasses feature high-resolution displays and advanced sensors that enable users to interact with virtual elements in their environment. Orion aims to enhance everyday experiences across navigation, communication, and gaming, showcasing Meta's dedication to creating immersive technologies that connect the physical and digital worlds.

Augmented Reality Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 169.97 billion

Revenue forecast in 2033

USD 1,050.56 billion

Growth rate

CAGR of 29.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, display, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Apple, Inc.; Blippar Limited; Google LLC; Lenovo Group; Magic Leap, Incorporated; Meta Platforms, Inc.; PTC Inc.; Snap, Inc.; Sony Corporation; TeamViewer AG; Vuzix Corporation; Wikitude GmbH; Xiaomi Corporation; Zappar Limited

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Augmented Reality Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global augmented reality market report based on component, display, application, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

-

Display Outlook (Revenue, USD Million, 2021 - 2033)

-

HMD (Head-Mounted Display)

-

Smart Glass

-

Cinema Display Glasses

-

XR Glasses

-

-

HUD (Head-Up Display)

-

Handheld Devices

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Aerospace & Defense

-

Automotive

-

Education

-

E-Commerce & Retail

-

Gaming & Entertainment

-

Healthcare

-

Industrial & Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the augmented reality market include Apple, Inc., Blippar Limited, Google LLC, Lenovo Group, Magic Leap, Incorporated, Meta Platforms, Inc., PTC Inc., Snap, Inc., Sony Corporation, TeamViewer AG, Vuzix Corporation, Wikitude GmbH, Xiaomi Corporation, and Zappar Limited.

b. The growing demand for remote assistance and coaction from industries working in optimization and workflow management also bodes well for the growth of the AR market.

b. The global augmented reality market is expected to grow at a compound annual growth rate of 29.7% from 2026 to 2033 to reach USD 1,050.56 billion by 2033.

b. The global augmented reality market size was estimated at USD 120.21 billion in 2025 and is expected to reach USD 169.97 billion by 2026.

b. The head-mounted display (HMD) & smart glass dominated the AR market with a share of around 58% in 2025. This is attributable to the rise in R&D expenditure for developing HMDs with advanced AR features.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.