- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Asia Pacific Prebiotics Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Prebiotics Market Size, Share & Trends Report]()

Asia Pacific Prebiotics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Source (Roots, Fruits & Vegetables, Cereal & Grains, Others), By Form, By Functionality, By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-601-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Prebiotics Market Size & Trends

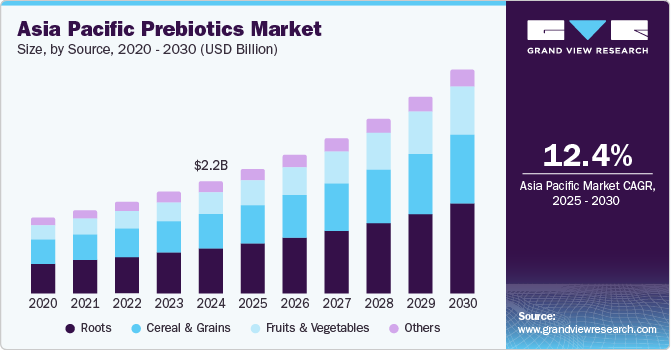

The Asia Pacific prebiotics market size was valued at USD 2.20 billion in 2024 and is expected to grow at a CAGR of 12.4% from 2025 to 2030. The increasing gut health problems coupled with the rise in demand for preventative healthcare products in countries such as India, China, and Japan are expected to fuel the growth of this market. The increasing availability of prebiotic products offered by global brands, ease of accessibility, and focus of multiple market participants on the thriving regional market are primarily driving the growth of this market.

In recent years, the regional market has experienced significant growth in a number of customers who incorporate healthy food products and supplements into their regular diets. Increasing exposure to health risks driven by changed lifestyles and growing awareness regarding the role of dietary preferences in overall health have resulted in noteworthy growth in demand for functional foods, supplements, and nutrition-rich products.

Increasing inclination among customers toward the consumption of products that facilitate health and nutritional benefits has stimulated multiple major market participants in the food and dairy products industry to develop new products featuring prebiotics. For instance, in January 2024, Danone India launched AptaGrow, a new addition to its toddler nutrition product range. The product features a distinctive blend of prebiotics designed to support improved toddler nutrition.

The demand for inulin in China is expected to grow steadily due to the ease of incorporation into the food & beverage industry. Inulin is used in dairy product formulations such as yogurts, cheese, and ice creams. Dairy industry growth is expected to be a key driver for the inulin market over the next few years. The technological progress in the field of functional ingredients involves heavy spending on research & development. The research & development costs can be in the form of clinical trials or research on ingredients that adhere to the food regulations in countries.

The importance of nutritional and fortified food products has been growing across the region. This is expected to encourage food manufacturers to incorporate ingredients such as prebiotics into their products to increase their nutritional value in order to attract consumers. Consumers have been consuming products with functional ingredients as part of preventive health, which benefits the probiotics market as well.

Product Insights

The inulin segment dominated the Asia Pacific prebiotics market, with a revenue share of 26.9% in 2024. The rising demand for nutraceuticals due to growing health awareness is expected to fuel the demand for inulin as a functional ingredient. Inulin is important in enhancing selected beneficial bacteria's activity, inhibiting the growth of certain pathogenic bacteria, and improving colon health. According to the International Trade Centre, in 2024, China imported 4,720 tons of inulin from different countries, primarily Chile, Belgium, and others. This marked a nearly 46.1% increase from 3,231 tons imported in 2023.

The beta-glucans segment is expected to grow at the fastest CAGR over the forecast period. This is attributed to several factors, including its potential heart health benefits. Often sourced from mushrooms, yeast, and oats, beta-glucans facilitate improved health by assisting in lowering cholesterol and supporting the well-being of the immune system. Ongoing research activities associated with including prebiotics in food products and supplements, the launch of new products, and novel ingredients introduced by key market participants in the functional ingredients industry are expected to influence the growth of this segment. For instance, in February 2025, Layn Natural Ingredients, a natural ingredient supplier, announced the launch of a new beta glucan solution, Galacan.

Source Insights

The roots segment dominated the Asia Pacific prebiotics industry with the largest revenue share in 2024. Prebiotics are derived from a variety of natural sources, including roots such as Chicory root, Jerusalem artichoke, Dandelion Greens, Garlic, Onions, and others. Prebiotics obtained from roots and tubers such as manioc, salep, arrowroot, artichokes, taro, yam, chicory roots, and sweet potatoes in the human nutrition segment improve colonic integrity. Additionally, it also enhances immune function, reduces the duration and incidence of intestinal infections, and improves digestion and elimination processes in the gut.

Strategic initiatives and advancements by major companies are likely to facilitate growth. For instance, in November 2023, BENEO, one of the major market participants in functional ingredients industry, announced expansion of production line at its Pemuco (Chile) plant which mainly produces its liquid chicory root fiber, Orafti Oligofructose LL. Such developments are anticipated to add lucrative growth opportunities for this segment. BENEO has a presence across Singapore and India in Asia Pacific.

The fruits and vegetables segment is expected to grow at the fastest CAGR over the forecast period. Fruits and vegetable-based prebiotics help regulate lower blood sugar levels and forestall a swift increase in blood insulin levels, which, in turn, is linked with the risks of diabetes and obesity. Moreover, health benefits associated with consuming fruits & vegetables, such as assistance in preventing chronic diseases and cognitive improvement, are anticipated to boost the overall market growth. Inulin, fructans, and pectin are some of the key prebiotics derived from fruits and vegetables.

Form Insights

The powder/crystal form segment dominated the regional market in 2024. Powder/crystal-based prebiotics are mainly used to process nutritional dairy products, snacks, cereals, and infant foods. Rapid incorporation of crystalized/powdered prebiotics in various pet food products on account of easy availability, taste refining characteristics, and economical nature is anticipated to spur market demand for powder/crystal-based prebiotics over the next few years. These ingredients are commonly used to enhance the fiber content of food products and supplements, supporting gut health by promoting the growth of beneficial bacteria.

Prebiotic powder is typically fine and can easily be added to beverages, smoothies, or baked goods, while prebiotic crystals are more solid and are often used for similar applications. Moreover, the growing demand for powdered prebiotic ingredients to manufacture nutritional supplement products such as ready-to-drink (RTD) and bars, which increase immune function, help maintain a healthy weight, and lower inflammation in the body, are anticipated further to enhance the overall market growth in the coming years.

The liquid segment is expected to experience significant growth during the forecast period. The rising demand for naturally derived functional ingredients, driven by greater consumer awareness and changed dietary preferences, is fueling the growth of liquid prebiotics. Liquid prebiotics are more cost-effective than powder or crystal forms, attracting more consumers. While powder and crystal prebiotics face high costs and water removal challenges, liquid prebiotics overcome this issue. Their excellent fiber profile and high water solubility make them ideal for pharmaceutical applications, further driving their demand.

Application Insights

The food & beverages segment dominated the Asia Pacific prebiotics market in 2024. This is attributed to the factors such as increasing inclusion of prebiotic ingredients in formulation of dairy products, infant foods, cereals, beverages, meat products, and others. Rising awareness among consumers regarding a healthy and nutritious diet and growing demand for energy drinks and high-fiber foods are likely to fuel the demand for prebiotic ingredients such as Galacto-oligosaccharide (GOS). The rising food industry, on account of the growing population and changing lifestyle of consumers, is likely to drive the market over the coming years. The dietary supplements application segment is likely to accelerate owing to the rising demand for prebiotics-based digestive health products and the growing preventative healthcare industry.

The dietary supplements segment is expected to grow at the highest CAGR over the forecast period. A rise in gastrointestinal issues such as bloating, constipation, and irritable bowel syndrome has heightened interest in prebiotic supplements which can provide assistance in treatment of these conditions. Prebiotic supplements deliver an accurate dosage of beneficial fibers and nutrients, ensuring individuals get the exact amount needed for optimal gut health. For those with dietary restrictions, such as allergies, intolerances, or vegan preferences, supplements provide an accessible alternative. Additionally, they offer a convenient and efficient way to incorporate prebiotics into a busy lifestyle, especially for those who struggle to consume prebiotic-rich foods consistently.

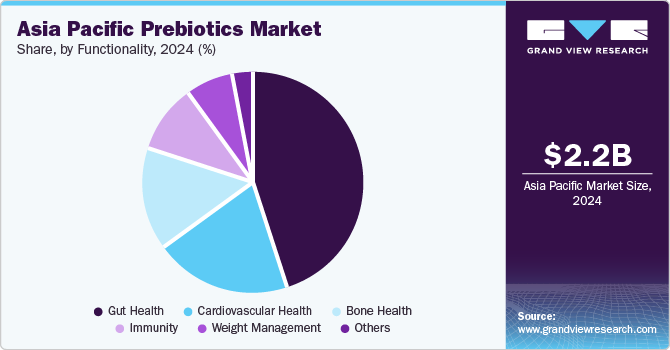

Functionality Insights

The gut health segment dominated the prebiotics market with the highest revenue share in 2024. The gut health segment accounted for the largest revenue share in 2024. The human digestive system relies on various dietary fibers to function optimally. Prebiotics, which nourish the mucosal tissue lining the digestive tract, assist in removing waste and ensure normal digestion. Thus, the demand for prebiotics is projected to grow due to their ability to advance gut health and combat disorders. Supplements are mainly consumed to ensure the intake of important nutritional constituents for the human body.

The cardiovascular health segment is expected to experience the fastest growth over the forecast period. Rising occurrences of cardiovascular diseases due to the lack of physical activities and sedentary lifestyles, mainly among individuals aged 20 to 40 years, are likely to drive the demand for prebiotic-based nutritional supplements in the market over the coming years. According to WHO, cardiovascular diseases lead to 17.9 million estimated deaths every year.

Dietary supplements rich in prebiotic fibers are known to boost and maintain the energy levels in the human body. Furthermore, the consumption of prebiotic ingredients in any form assists in rapid fat/calorie burning, reduced absorption of fats, and decreased appetite, which aids in reducing the consumption of calories and maintaining the overall body weight.

Country Insights

China Prebiotics Market Trends

China dominated the Asia Pacific prebiotics market, with the largest revenue share of 29.9% in 2024. The growth is attributed to the growing awareness of gut health and the broader trend toward functional foods. Prebiotics are gaining popularity in China, particularly in the fermentation of traditional foods such as suancai, a fermented vegetable widely consumed in Northeast China. This surge is driven by prebiotics, such as inulin, xylooligosaccharides (XOS), and fructooligosaccharides (FOS), to enhance fermentation, improve food quality, and promote gut health. Prebiotics lower pH and increase acidity in suancai, boosting Lactobacillus growth. These are increasingly used to produce high-quality, consistent suancai, meeting the demand for healthier fermented foods.

Thailand Prebiotics Market Trends

Thailand prebiotics market is expected to grow at the fastest CAGR from 2025 to 2030. Thailand offers a significant demand for prebiotics-based food and beverages, driven by a health-conscious population. Increasing awareness regarding the benefits provided by prebiotics and the growing focus of multiple consumers on embracing diets that facilitate improved health and nutrition are expected to fuel the growth of this market over the forecast period.

Key Asia Pacific Prebiotics Market Company Insights

Some key companies in the Asia Pacific prebiotics market include Baolingbao Biology Co., Ltd.; Tata Chemicals Ltd.; Quantum Hi-Tech (Guangdong) Biological Co., Ltd.; and Samyang Holdings Corporation.

-

Baolingbao Biology Co., Ltd. is a Chinese company that produces functional food ingredients, including prebiotics. It manufactures a wide range of prebiotic fibers, such as inulin and oligosaccharides, which are derived from natural sources such as chicory and other plant materials. These prebiotics are widely used in the food, beverage, and supplement industries to promote digestive health, improve gut microbiota, and offer other health benefits.

-

Tata Chemicals Ltd. is an Indian chemical and agricultural solutions company that offers functional ingredients aimed at improving human health, including prebiotics. It offers prebiotic fibers such as inulin, which are derived from natural sources such as chicory. These prebiotics are used in various applications, including food, beverages, and dietary supplements, to promote gut health, improve digestion, and support overall wellness.

Key Asia Pacific Prebiotics Companies:

- BAOLINGBAO BIOLOGY CO., LTD.

- Tata Chemicals Ltd.

- Quantum Hi-Tech (Guangdong) Biological Co., Ltd.

- Samyang Holdings Corporation

- CJ CHEILJEDANG CORP.

- Meiji Holdings Co., Ltd.

- Layn Natural Ingredients

- Fuji Nihon Corporation

Recent Developments

-

In September 2024, Samyang Corporation held a groundbreaking ceremony for its new Specialty Plant in Ulsan, investing approximately USD 105 million. The facility includes an allulose production plant with a 13,000-ton annual capacity, the largest in South Korea, and a prebiotics plant producing resistant dextrin and fructo-oligosaccharide powder. Samyang aims to expand its market reach in North America, Japan, and Southeast Asia.

Asia Pacific Prebiotics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.45 billion

Revenue forecast in 2030

USD 4.38 billion

Growth rate

CAGR of 12.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, form, application, functionality, and country

Country scope

China; India; Japan; Taiwan; Australia; Thailand; Malaysia; Indonesia; Philippines; Vietnam; Singapore; South Korea

Key companies profiled

Baolingbao Biology Co., Ltd.; Tata Chemicals Ltd.; Quantum Hi-Tech (Guangdong) Biological Co., Ltd.; Samyang Holdings Corporation; CJ CHEILJEDANG CORP.; Layn Natural Ingredients; Meiji Holdings Co., Ltd.; and Fuji Nihon Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Prebiotics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific prebiotics market report based on product, source, form, application, functionality, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Inulin

-

Fructooligosaccharides (FOS)

-

Mannan-oligosaccharides (MOS)

-

Galacto-oligosaccharides (GOS)

-

Xylo-oligosaccharides (XOS)

-

Resistant maltodextrin

-

Isomalto-oligosaccharides

-

Resistant starch

-

Beta-glucans

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Roots

-

Fruits & Vegetables

-

Cereal & Grains

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder/crystal

-

Liquid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Dairy Products

-

Infant Foods

-

Cereals

-

Beverages

-

Meat Products

-

Others

-

-

Dietary Supplements

-

Food Supplements

-

Nutritional Supplements

-

Specialty Supplements

-

-

Animal Feed

-

Poultry

-

Swine

-

Cattle

-

Aquaculture

-

Pet Food

-

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Gut Health

-

Cardiovascular Health

-

Bone Health

-

Immunity

-

Weight Management

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

Taiwan

-

Australia

-

Thailand

-

Malaysia

-

Indonesia

-

Philippines

-

Vietnam

-

Singapore

-

South Korea

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.