- Home

- »

- Pharmaceuticals

- »

-

Asia Pacific Bioanalytical Testing Services Market, Industry Report, 2030GVR Report cover

![Asia Pacific Bioanalytical Testing Services Market Size, Share & Trends Report]()

Asia Pacific Bioanalytical Testing Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Molecule (Small, Large), By Test (ADME, PD, PK), By Workflow, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-288-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

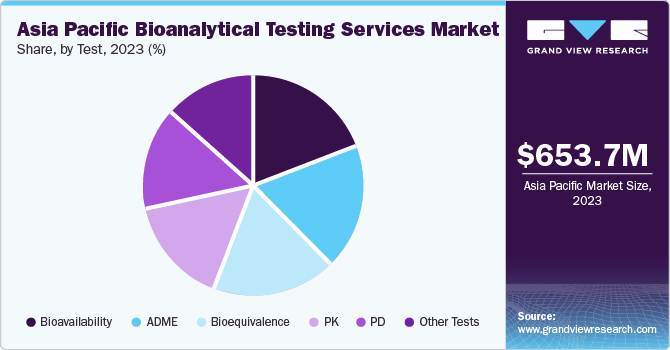

The Asia Pacific bioanalytical testing services market size was estimated at USD 653.7 million in 2023 and is projected to grow at a CAGR of 9.7% from 2024 to 2030. The market growth can be attributed to the substantial development of the pharmaceutical industry and the growing complexity of therapeutics. In addition, noticeable advances have been made in the development and approval of drugs, along with a sharp growth in the popularity of testing service outsourcing. The expansion of the region’s healthcare contract research organization market has also positively influenced growth. Rising investments in R&D programs, preference for outsourcing due to time and cost constraints, and patent expiration of blockbuster drugs are key factors expected to drive growth in this space in the coming years.

Contract research organization (CRO) initiatives offer advanced services, leading pharmaceutical and biopharmaceutical companies to prefer assigning projects to CROs, facilitating expansion. The market accounted for a share of 15.1% of the global bioanalytical testing services market revenue in 2023. Asia Pacific, being a promising region in terms of technological know-how and product innovations, is expected to witness a significant need for advanced testing services in the near future. Precision-focused advancements in medical diagnostics & therapies are showing rapid growth via the integration of Artificial Intelligence (AI). While 2023 witnessed the emergence and widespread adoption of generative AI across various critical industries in the region, clinical & bioanalytical laboratories are actively seeking avenues to harness AI methodologies for improved operational efficiency, flexibility, & patient-centric outcomes.

For instance, digital pathology solutions facilitate a more distributed workforce and present the prospect of employing AI algorithms for image recognition. In the field of genetic medicine and pharmacogenomics applications, AI emerges as a practical means to consolidate vast datasets related to clinical risks, personalized diagnoses, and customized treatment plans into actionable intelligence. Furthermore, the development and usage of advanced bioanalytical technologies for establishing accurate methods to generate regulatory-driven bioanalytical data is expected to drive regional market growth. The impact of regulatory framework and guidelines, both on regional and country levels, is expected to strengthen further and shape the development of the bioanalytical testing services market.

Changes in regulations, compliance standards, and industry guidelines have been observed to impact testing requirements and methodologies significantly. The National Medical Products Administration (NMPA) regulates pharmaceutical products and drugs in China. This body is responsible for the registration and approval of clinical trials. NMPA’s Center for Drug Evaluation (CDE) evaluates drug marketing authorization applications, drug production registration applications, and clinical trial applications. Meanwhile, the Central Drug Standard Control Organization (CDSCO) governs these regulations in India. The CDSCO’s primary responsibility is to approve, control, and regulate pharmaceutical products in the country. In Japan, the comparative body is the Pharmaceutical & Medical Device Agency (PMDA). It is responsible for regulating, approving, and post-market surveillance of pharmaceutical drugs & products.

Molecule Insights

The small molecule segment accounted for a dominant revenue share of 57.3% in 2023. The small molecule sector has witnessed frequent developments in recent years in the region, while there are still substantial unmet requirements in countries, such as Malaysia, Indonesia, and others. The large molecule segment is anticipated to register a comparatively faster CAGR of 10.4% during the forecast period. The research-to-market journey in drug development can be expedited through the bioanalytical testing of large-molecule drugs.

Therapeutics in this segment have seen a noticeable increase in the past few years owing to their features, such as target specificity, higher potency, and lower toxicity. Some well-known services in this area include assay development & validation, clinical testing, and biopharmaceutical & toxicological assays. Pharmaceutical companies are increasingly incorporating large-molecule bioanalysis into their services portfolio. They have developed Good Laboratory Practice (GLP)-certified and Good Clinical Laboratory Practice (GCLP)-compliant bioanalytical laboratories that offer immunoassays for Pharmacodynamics (PD), PK, immunogenicity, and biomarkers.

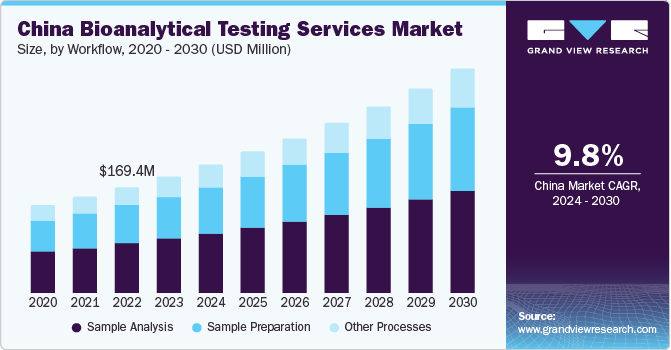

Workflow Insights

The sample analysis workflow segment emerged as the largest contributor with a revenue share of 45.8% in 2023. This workflow constitutes a vital part of the stages of medication research and marketing, explaining its significant industry share. The growing potential of sample analysis to aid with pharmacokinetic (PK) studies is a notable factor anticipated to boost market expansion. Within sample analysis, the hyphenated technique constitutes a dominant share, as it is used to address complex analytical problems. This technique combines on-line spectroscopic detection and separation techniques that help in the qualitative and quantitative analysis of complex compounds. Another notable analytical procedure is ligand binding assays (LBAs) that are used to quantify antibodies, proteins, DNA, biosimilars, ribonucleic acids, and other large molecules in Toxicokinetic (TK), PK, immunogenicity, and Pharmacodynamic (PD) studies during preclinical & clinical development.

The sample preparation segment is anticipated to register a CAGR of 10.1% from 2024 to 2030. The need for cleaner samples and the importance of minimizing matrix risks has highlighted the requirement for proper sample preparation. In this workflow, protein precipitation (PPT) is a notable step that is used for sample cleaning and extraction of pharmaceuticals from blood samples, such as whole blood, serum, & plasma, during the drug discovery process. Recently, advances have been made in PPT sample preparation methods used during bioanalytical testing services. These include the development of novel techniques to enhance the sample preparation process, integrate different sample preparation steps, and apply these advancements to biological samples. Moreover, introducing an improved protein purification method can enhance the quality, efficiency, & cost-effectiveness of sample preparation in the bioanalytical testing services market.

Test Insights

The bioavailability segment accounted for the largest revenue share in 2023. Bioavailability studies offer several notable benefits concerning the studying of new drugs post their administration, while also helping establish an equivalence between early and late clinical trial formulations. The technique is widely used as it helps establish equivalence between formulations utilized in clinical trials and stability studies. Moreover, it aids in ensuring therapeutic equivalence between a pharmaceutically equivalent test drug and a generic or reference drug.

The bioequivalence segment is anticipated to expand at the fastest CAGR from 2024 to 2030. This is a critical parameter that is utilized by drug makers while developing generic versions of branded products. The positive developments in the biosimilar space are expected to elevate the popularity of bioequivalence studies in the coming years. Moreover, the increasing need for developing cost-effective biosimilars or generics has further boosted the adoption of bioequivalence tests.

Country Insights

China Bioanalytical Testing Services Market Trends

The China bioanalytical testing services market accounted for a major share in 2023. The country has become an appealing destination for clinical trial outsourcing due to its diverse patient demographics, large population, and economical nature. This has led to domestic as well as international pharmaceutical organizations outsourcing their clinical trial processes to CROs in this economy, elevating the demand for bioanalytical testing services. Furthermore, there has been an increase in the frequency of acquisitions and expansion activities by both regional and global organizations that has served to boost market growth.

Australia Bioanalytical Testing Services Market Trends

The bioanalytical testing services market in Australia is anticipated to witness the fastest growth from 2024 to 2030. Australia is highly cost-competitive for early-phase clinical trials when compared to the U.S. It operates a Clinical Trial Notification scheme, which means that the regulator delegates the trial review process to ethics committees and only needs to be notified of the outcome. This, in turn, minimizes the regulatory burden on clinical trial sponsors, enabling them to save time & money. The Australian government is also implementing reforms to reduce study start-up times, boost patient recruitment, and standardize clinical trial costs. All these factors are projected to elevate the country’s contribution to the overall market.

Key Asia Pacific Bioanalytical Testing Services Company Insights

Leading companies that have established their presence in this market include SGS SA, ICON plc, IQVIA, Eurofins, and Syneos Health. These organizations compete among themselves and other regional companies to generate higher revenues and boost their contribution.

-

Laboratory Corporation of America Holdings (LabCorp) was created as a result of the merger of National Health Laboratory Holdings, Inc. and Roche Biomedical Laboratories, Inc. The company is involved in the development of genetic test solutions based on microarray, NGS, and PCR technology. It serves over 220,000 clients across 60 countries, and its clients include hospitals, physicians, employers, governmental agencies, and other independent clinical laboratories

-

Syneos Health is a fully integrated biopharmaceutical solutions organization. The company offers both standalone & integrated biopharmaceutical product development solutions, ranging from early phase (Phase I) clinical trials to the commercialization of products in the biopharmaceutical industry

Key Asia Pacific Bioanalytical Testing Services Companies:

- Charles River Laboratories

- ICON plc

- Eurofins Scientific

- Syneos Health

- Labcorp Drug Development

- Intertek Group plc

- IQVIA Inc.

- SGS Société Générale de Surveillance SA

- Pharmaron

- Thermo Fisher Scientific Inc. (PPD, Inc.)

Recent Developments

-

In November 2023, Resolian announced the successful acquisition of Denali Medpharma, a leading bioanalytical contract research organization located in China. This acquisition has helped Resolian expand its operations in bioanalysis laboratories across the UK, the U.S., China, and Australia

-

In September 2023, LabCorp announced the opening of a new integrated laboratory in Singapore, thus expanding its bioanalytical service offerings in Asia Pacific. This facility features Liquid Chromatography Mass Spectrometry (LC-MS) and Immunochemistry platforms and provides Good Laboratory Practice (GLP) and Good Clinical Practice (GCP)-compliant bioanalysis

-

In March 2023, SGS launched the SGS China bioanalysis center in Shanghai. The newly-opened laboratory has been equipped with advanced instruments, such as MSD, Microplate Reader, MESO Sector S600, ciex Triple Quad 6500 LC-MS/MS, Bio-Rad bio-Plex 3D & Molecular device SpectraMax M5, a WinNonlin software, and Watson LIMS system for pharmacokinetics. The center analyzes biological samples, designs testing schemes, and offers complete data analysis reports

Asia Pacific Bioanalytical Testing Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.3 billion

Growth rate

CAGR of 9.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Molecule, test, workflow, country

Country scope

India; China; Japan; South Korea; Australia; Thailand; Indonesia; Malaysia; Singapore; Taiwan

Key companies profiled

Charles River Laboratories; ICON plc; Eurofins Scientific; Syneos Health; Intertek Group plc; Labcorp Drug Development; IQVIA Inc.; SGS Société Générale de Surveillance SA; Pharmaron; Thermo Fisher Scientific Inc. (PPD, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Bioanalytical Testing Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific bioanalytical testing services market report based on molecule, test, workflow, and country:

-

Molecule Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecule

-

Large Molecule

-

LC-MS Studies

-

Immunoassays

-

PK

-

ADA

-

Others

-

-

Others

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

ADME

-

In-Vivo

-

In-Vitro

-

-

PK

-

PD

-

Bioavailability

-

Bioequivalence

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Preparation

-

Protein Precipitation

-

Liquid-Liquid Extraction

-

Solid Phase Extraction

-

-

Sample Analysis

-

Hyphenated Technique

-

Chromatographic Technique

-

Electrophoresis

-

Ligand Binding Assay

-

Mass Spectrometry

-

Nuclear Magnetic Resonance

-

-

Other Workflow Processes

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Malaysia

-

Singapore

-

Taiwan

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.