- Home

- »

- Medical Devices

- »

-

ASEAN Laboratory Equipment Market Size Report, 2030GVR Report cover

![ASEAN Laboratory Equipment Market Size, Share & Trends Report]()

ASEAN Laboratory Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (General, Analytical, Clinical, Support, Specialty), By End-use (Research Institutions, Healthcare, Veterinary), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-168-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

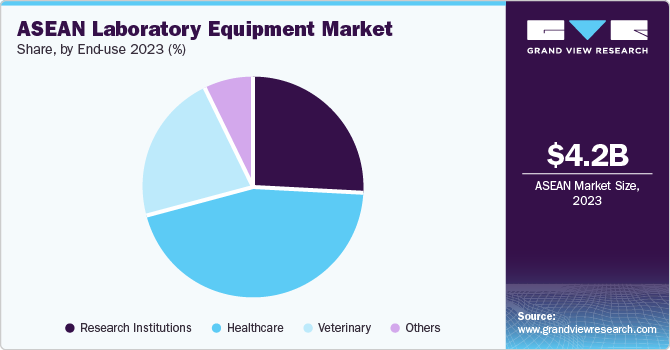

The ASEAN laboratory equipment market size was estimated at USD 4.19 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.43% from 2024 to 2030. The growth is due to increased contract research organizations (CROs), expanding life science research, and the rise in importing laboratory equipment. Moreover, increased investments and government funding for research activities will drive demand further. In addition, the rising prevalence of chronic diseases such as diabetes, heart conditions, and cancer has led to a heightened focus on quality control in industries such as pharmaceuticals, food & beverage, and manufacturing. This emphasis highlights the need for safety equipment such as personal protective gear (PPE), fume hoods, and biosafety cabinets, showing a greater awareness of lab safety in the region. Government initiatives in ASEAN countries encourage lab equipment adoption, contributing to the market's expansion.

The rising investments and increased government research funding significantly impact the market. For instance, in recent years, countries such as Singapore and Malaysia have increased government funding for research and development initiatives. Singapore's National Research Foundation (NRF) launched various programs, such as the Research, Innovation, and Enterprise (RIE) 2025 Plan, allocating substantial funds to support scientific advancements. Similarly, Malaysia's Ministry of Science, Technology, and Innovation (MOSTI) has introduced schemes such as the Science to Action (S2A) Fund, aiming to boost research activities across various sectors. In addition, in Singapore, the government, through the Agency for Science, Technology, and Research (A*STAR), is actively raising funds for R&D efforts. It is providing financial support for advanced laboratory tools to boost scientific research.

In addition, Malaysia's Ministry of Science, Technology and Innovation (MOSTI) is also investing in research infrastructure, including laboratory equipment. Such initiatives drive the demand for laboratory equipment and technologies as research institutions and laboratories seek cutting-edge tools to facilitate their studies. This rise in funding enables scientists, researchers, and academic institutions to access advanced equipment, fostering innovation and pushing the market in ASEAN toward growth and expansion.

Technological advancements in laboratory equipment are driving the demand for more precise and accurate tools in ASEAN countries. This increased demand is fueled by a growing focus on pharmaceutical research and development, the need for enhanced food and water safety testing, and a rising interest in advanced manufacturing processes. Automation and robotics integration in lab tools has revolutionized workflows, enabling higher throughput and reduced errors. Companies such as Thermo Fisher Scientific and Agilent Technologies have introduced automated systems capable of handling samples, performing analyses, and processing data, streamlining operations in ASEAN laboratories.

Moreover, the convergence of technologies such as artificial intelligence (AI) and the Internet of Things (IoT) has led to the development of smart laboratory tools for real-time monitoring and analysis, exemplified by innovators such as Shimadzu Corporation and Bio-Rad Laboratories. These advancements not only improve experimental accuracy but also drive up the demand for advanced laboratory equipment in the ASEAN market by cutting operational costs.

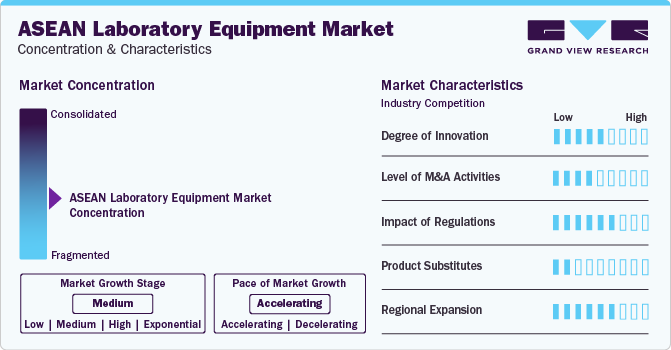

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. This is due to the increased investments in research and development, rising demand for innovative technologies, expanding healthcare infrastructure, and the region's focus on advancements in scientific research, all contributing to the market's rapid growth momentum.

The ASEAN laboratory equipment market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. The market is witnessing a surge in strategic acquisitions as companies seek to consolidate their market positions, broaden their product offerings, and acquire cutting-edge expertise. This trend is fueled by the escalating demand for advanced equipment, the urge to penetrate untapped markets, and the aspiration to integrate complementary technologies that enhance existing solutions.

The ASEAN laboratory equipment market is facing increasing regulatory scrutiny due to a growing emphasis on ensuring quality, safety, and compliance with stringent standards across the region. Regulatory bodies are intensifying their oversight to safeguard public health and foster reliability in scientific research. This scrutiny is driven by a collective effort to enforce adherence to established regulations, guarantee accurate testing methodologies, and maintain the integrity of laboratory practices.

In the ASEAN laboratory equipment market, product substitutes often emerge due to technological advancements or innovative methodologies that offer similar functionalities to traditional laboratory equipment. For example, the adoption of point-of-care testing devices, such as portable diagnostic tools or handheld analyzers, can serve as substitutes for larger, conventional laboratory equipment. These substitutes provide rapid results and can be utilized outside centralized laboratory settings, offering convenience and cost-effectiveness.

The market caters to a diverse range of end users, including academic and research institutions, pharmaceutical and biotechnology companies, healthcare facilities, environmental testing laboratories, and the food and beverage industries. These end users have specific demands for specialized laboratory equipment tailored to their distinct requirements.

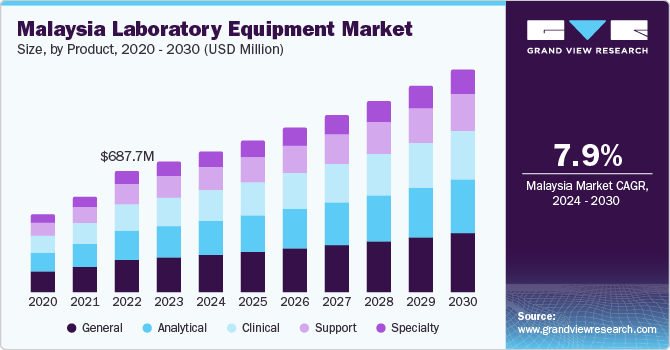

Product Insights

The general laboratory equipment segment held the largest revenue share of 26.97% in 2023. The general laboratory equipment segment encompasses various instruments and tools crucial across multiple scientific fields and industries. Industries such as food & beverages, environmental testing, and pharmaceuticals heavily depend on rigorous quality control protocols to guarantee their products' safety, purity, and effectiveness. Devices such as pH meters, titration systems, and spectrophotometers play pivotal roles in conducting quality control tests, ensuring regulatory compliance, and upholding product integrity within these sectors. The robust demand for general tools arises from the indispensable requirement for precise measurements, adherence to stringent quality standards, and product quality and safety assurance.

The support segment shows the fastest CAGR over the forecast period. This can be attributed to the increasing recognition of the critical role that maintenance, calibration, and comprehensive support services play in ensuring the efficiency and longevity of laboratory equipment. This includes products such as safety cabinets and ventilation systems that create a safe and controlled environment for conducting experiments. Proper lab infrastructure is vital for the accuracy and reliability of scientific data. The increasing need to establish suitable laboratory setups that comply with safety regulations, enable efficient workflows and provide researchers with a conducive environment to carry out their work are some of the factors driving the demand for support products.

Moreover, support equipment such as chemical storage cabinets, safety showers, and fume hoods help ensure the proper containment and management of potentially harmful substances. Stringent regulatory requirements necessitate adherence to precise calibration standards, compelling laboratories to seek reliable support solutions. The trend toward outsourcing support services to specialized providers further contributes to the rapid growth of this segment.

End-use Insights

The healthcare segment accounted for the largest revenue share in 2023. The healthcare industry relies heavily on laboratory equipment for several purposes, including disease diagnosis, patient monitoring, R&D, and quality control. Continuous monitoring of patient health parameters is essential for effective healthcare management, which involves using laboratory equipment such as patient monitors, vital signs monitors, and point-of-care testing devices. The healthcare sector continually invests in cutting-edge laboratory equipment for diagnostics, research, and treatment.

The growing demand for advanced diagnostic tools, such as imaging systems and diagnostic analyzers, within hospitals, clinics, and research institutions across the ASEAN region fuels this significant investment. In addition, stringent regulatory requirements and the need for adherence to quality standards within the healthcare industry contribute to the prominence of this segment, encouraging the procurement of certified and high-quality laboratory equipment.

The veterinary segment is estimated to register the fastest CAGR over the forecast period. This is due tothe increasing emphasis on animal health and welfare, leading to substantial investments in veterinary diagnostics and research tools. The escalating demand for precise diagnostic equipment for animal diseases, such as imaging systems, hematology analyzers, and molecular diagnostic tools, is propelling the expansion of this segment. Furthermore, laboratory equipment plays a crucial role in monitoring and controlling the spread of diseases among animals, conducting tests to diagnose and monitor infectious diseases such as parvovirus, rabies, and feline leukemia. Reliable laboratory equipment is essential for detecting, identifying, and studying these diseases, facilitating the development of effective treatment strategies and preventive measures. For instance, in February 2023, VolitionRx Limited announced the accessibility of its Nu.Q Vet Cancer Test for veterinarians through Heska Corporation, utilizing Heska's Element i+ Immunodiagnostic Analyzer, designed to offer accurate, rapid, and cost-effective testing in veterinary clinics, aiming to aid clinical decision-making and enhance patient outcomes.

Regional Insights

Indonesia dominated the overall market in 2023. Indonesia's growing economy, increasing investments in research and development initiatives, and strategic geographical location have boosted the demand for laboratory equipment across various sectors. The country's expanding healthcare industry, including pharmaceuticals and biotechnology, fuels the need for sophisticated research, diagnostics, and development laboratory tools. Furthermore, Indonesia has relied more on imports to meet its growing demand for lab tools, and the trend is shifting towards reducing imports. In Indonesia, several major players are competing to gain a higher market share, including Thermo Fisher Scientific, Agilent Technologies, Shimadzu, PerkinElmer, and Eppendorf. These well-established companies offer various laboratory equipment and solutions, including analytical instruments, reagents, consumables, and lab automation systems.

Cambodia is expected to grow fastest during the forecast period. The demand for advanced laboratory equipment in the country has been steadily increasing due to the growth in healthcare infrastructure and educational institutions. The country's evolving healthcare landscape and initiatives to improve healthcare services contribute to the rising demand for laboratory tools in hospitals, clinics, and research institutions. Several local and international laboratory tools suppliers vie for market share, with companies such as Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, Danaher Corporation, and Bio-Rad Laboratories renowned for their diverse laboratory equipment and scientific solutions.

Key Companies & Market Share Insights

Some of the key players operating in the market include Sartorius AG, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., Agilent Technologies, Inc.

-

Sartorius AG is a pharmaceutical & laboratory equipment provider headquartered in Göttingen, Germany. The company operates through two major divisions: bioprocess solutions and lab products & services. It has a global presence with manufacturing & sales operations in more than 110 countries

-

Bio-Rad Laboratories, Inc. manufactures systems & products used in separating complex biological and chemical materials, as well as analyzing, identifying, and purifying their respective components. The company works in two segments: clinical diagnostics and life sciences. The company invests significantly in R&D to introduce new technologies and enhance its product offerings. The company has a global presence with sales & distribution channels in more than 100 countries

-

Thermo Fisher Scientific, Inc. is among the leading biotechnology company that operates through four business segments: analytical instruments, specialty diagnostics, laboratory products & biopharma services, and life sciences solutions

PerkinElmer Inc., Shimadzu Corporation, Waters Corporation are some of the emerging market players functioning in the market.

-

PerkinElmer Inc. is a global supplier of imaging technologies, informatics solutions, consumables, accessories, and various services.

-

Shimadzu is known for its analytical instruments used in scientific research, quality control, and process analysis. The company offers a comprehensive range of instruments.

Key ASEAN Laboratory Equipment Companies:

- Sartorius AG

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- PerkinElmer Inc.

- Shimadzu Corporation

- Waters Corporation

Recent Developments

-

In June 2023, Waters Corporation and Sartorius have extended their collaboration to provide a comprehensive range of bioanalytical solutions for downstream biomanufacturing.

-

In April 2023, Yamato's team participated in PITTCON 2020, the premier laboratory science conference & expo held at McCormick Place in Chicago, Illinois. The event provided them with the opportunity to keep up with the latest advancements in scientific instrumentation.

-

In March 2023, Bio-Rad Laboratories, Inc. launched the PTC Tempo Deepwell Thermal Cyclers and PTC Tempo 96, specifically designed to enhance & optimize PCR applications, including cloning, sequencing, and genotyping.

-

In July 2022, Agilent has introduced two new products as part of its gas/liquid chromatography and mass spectrometry product lines. These tools combine cutting-edge technologies, including artificial intelligence and machine learning, and offer improved sensitivity & accuracy.

ASEAN Laboratory Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.54 billion

Revenue forecast in 2030

USD 7.38 billion

Growth rate

CAGR of 8.43% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

ASEAN

Country scope

Brunei; Cambodia; Indonesia; Malaysia; Philippines; Singapore; Thailand; Vietnam

Key companies profiled

Sartorius AG; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; PerkinElmer Inc.; Shimadzu Corporation; Waters Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

ASEAN Laboratory Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 – 2030. For this study, Grand View Research has segmented the ASEAN laboratory equipment market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018- 2030)

-

General

-

Analytical

-

Clinical

-

Support

-

Specialty

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Institutions

-

Healthcare

-

Veterinary

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

ASEAN

-

Brunei

-

Cambodia

-

Indonesia

-

Malaysia

-

Philippines

-

Singapore

-

Thailand

-

Vietnam

-

-

Frequently Asked Questions About This Report

b. The ASEAN laboratory equipment market size was estimated at USD 4.19 billion in 2023 and is expected to reach USD 4.54 billion in 2024.

b. The ASEAN laboratory equipment market is expected to grow at a compound annual growth rate of 8.43% from 2024 to 2030 to reach USD 7.38 billion by 2030.

b. Malaysia dominated the ASEAN laboratory equipment market with a share of 17.6% in 2023. This is attributable to the rising prevalence of cardiovascular disorders, diabetes, and cancer in the region.

b. Some key players operating in the ASEAN laboratory equipment market include Sartorius AG, Bio-Rad Laboratories, Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., PerkinElmer Inc., Shimadzu Corporation, Waters Corporation and others

b. Key factors that are driving the ASEAN laboratory equipment market growth include increasing demand for laboratory equipment, rise in funding and investment in R&D activities in pharmaceutical and biotechnology and continuous and stable supply of laboratory equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.