- Home

- »

- Next Generation Technologies

- »

-

Artillery Systems Market Size, Share & Growth Report, 2030GVR Report cover

![Artillery Systems Market Size, Share & Trends Report]()

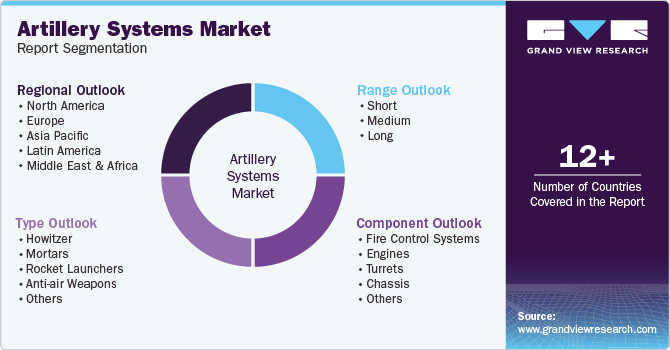

Artillery Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Range (Short, Medium, Long), By Component (Fire Control Systems, Engines, Turrets, Chassis), By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-467-6

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Artillery Systems Market Summary

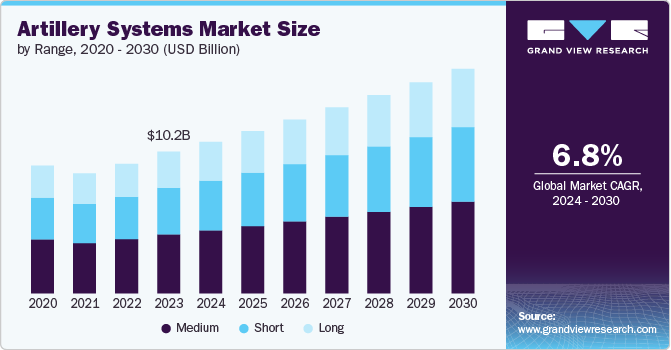

The global artillery systems market size was estimated at USD 10.24 billion in 2023 and is expected to reach USD 16.22 billion by 2030, growing at a CAGR of 6.8% from 2024 to 2030. Key factors, including increased global defense spending, military modernization programs, and rising geopolitical tensions, drive the market growth.

Key Market Trends & Insights

- North America accounted for the largest revenue share, around 40% in 2023.

- Based on range, the medium range segment held the largest revenue share in the market in 2023.

- Based on type, the howitzer segment captured the largest revenue share of over 42.5% in 2023.

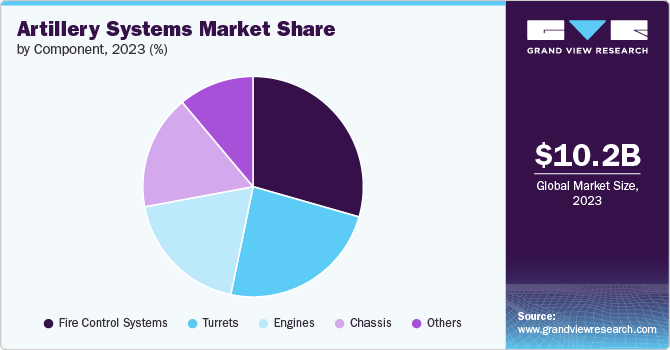

- Based on component, the fire control systems segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.24 Billion

- 2030 Projected Market Size: USD 16.22 Billion

- CAGR (2024-2030): 6.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Moreover, the rising threats from asymmetric warfare and the need for improved counter-artillery capabilities are pushing governments to invest in cutting-edge artillery systems. In addition, the market is further fueled by regional conflicts, military exercises, and the growing significance of modern artillery.

Countries are investing in upgrading their artillery capabilities to enhance range, mobility, and precision, leading to a surge in demand for advanced systems like howitzers, rocket launchers, and self-propelled artillery. For instance, in July 2024, BAE Systems plc received a USD 579.3 million contract from the U.S. Army to build additional self-propelled howitzers. As part of this deal, the company will manufacture the M992A3 ammunition carrier vehicles and M109A7 Paladin self-propelled howitzers. This deal reinforces the company’s position as one of the prominent suppliers of artillery systems to the U.S. military.

The market growth is further driven by the growing emphasis on long-range precision strike capabilities and network-centric warfare, which are driving technological innovations, such as automated fire control systems, enhanced mobility solutions, and precision-guided munitions. Improvements in fire control systems, including advanced sensors, computers, and communication systems, have enabled artillery units to engage targets more rapidly and accurately. Integrating automation and robotics into artillery systems improves efficiency, reduces human error, and enhances safety.

The market is poised for growth in the coming years as artillery systems are increasingly integrated with other military systems, such as command and control centers and intelligence platforms, to enhance situational awareness and operational effectiveness. These artillery units can receive real-time intelligence and target information, improving their ability to respond to threats and make informed decisions. By linking artillery systems with intelligence platforms, units can acquire precise target coordinates and adjust their fire accordingly. These factors are expected to expedite the market expansion over the coming years.

Range Insights

The medium range segment held the largest revenue share in the market in 2023. The increasing demand for precision-guided munitions and the need for enhanced range capabilities have made medium-range artillery systems more attractive to military forces. Besides, the versatility of medium-range systems, which can be used for direct and indirect fire support, has contributed to their popularity. In addition, the availability of a variety of medium-range artillery systems, including towed and self-propelled options, has provided military forces with greater flexibility and adaptability. These factors underline the dominance of the medium range segment in the market.

The long-range segment is poised to register a considerable CAGR from 2024 to 2030. The long-range segment within the market is witnessing significant growth due to several factors. The increasing range capabilities of artillery systems, enabled by advancements in propulsion and guidance technologies, have expanded their operational effectiveness. The demand for long-range artillery systems has grown in response to the need for precision strikes against targets located beyond traditional artillery ranges. Furthermore, the development of advanced counter-battery radars and fire control systems has further enhanced the capabilities of long-range artillery, driving their demand and creating lucrative opportunities for the segment.

Type Insights

Howitzer captured the largest revenue share of over 42.5% in 2023. The increasing demand for precision-guided artillery, coupled with advancements in technology such as improved range, accuracy, and mobility, has increased the demand for howitzers among military forces. Furthermore, the growing focus on counter-insurgency and irregular warfare operations, where howitzers can provide effective fire support in complex environments, drives the segment's growth. Moreover, the development of lightweight and transportable howitzers has made them more suitable for deployment in various operational scenarios, contributing to the overall expansion of the howitzer segment.

The anti-air weapon segment is expected to record a significant CAGR of 8.0% from 2024 to 2030 due to the increasing need for advanced air defense capabilities to counter modern aerial threats such as drones, helicopters, and precision-guided munitions. With the advent of unmanned aerial vehicles (UAVs) and the growing susceptibility to air attacks, militaries across the globe are increasingly deploying anti-aircraft artillery systems that offer rapid response, precision targeting, and enhanced range. Moreover, integrating radar and automated fire control systems into these weapons has improved their effectiveness, making them crucial components of air defense strategies and favoring segmental growth.

Component Insights

The fire control systems segment accounted for the largest revenue share in 2023. The growth is credited to increasing demand for precision, automation, and integration with modern battlefield technologies. Fire control systems play a critical role in improving targeting accuracy, reducing response times, and enhancing the effectiveness of artillery strikes. Advancements in sensors, radar systems, and software-driven targeting solutions enable more precise and coordinated firepower, essential for modern combat operations. Moreover, the growing adoption of networked warfare and the need for systems that can quickly adjust to dynamic combat environments drive demand for advanced fire control solutions, fueling segmental growth.

The turrets segment is expected to record a notable CAGR from 2024 to 2030 owing to advancements in turret technology, such as improved stabilization systems, integration with other weapon systems, and automation that have enhanced their capabilities. The demand for turrets that can operate effectively in challenging environments, such as urban areas and mountainous terrain, further stimulates the product demand. In addition, increasing focus on precision-guided artillery and the need for enhanced fire control capabilities have contributed to the growing demand for advanced turrets in the market.

Regional Insights

The artillery systems market in North America accounted for the largest revenue share, around 40%, in 2023, owing to increased defense spending, modernization of military forces, and rising geopolitical tensions. The U.S. Department of Defense is investing heavily in upgrading its artillery systems, enhancing long-range precision strike capabilities, and improving ground forces' mobility. Moreover, the adoption of advanced technologies like automation, precision-guided munitions, and next-generation fire control systems is also contributing to the market growth in the region and driving demand.

U.S. Artillery Systems Market Trends

The artillery system market in the U.S. is expected to record significant growth in the coming years, owing to increasing demand for advanced artillery systems driven by concerns related to terrorism, border control, and other public safety measures. In addition, several artillery systems manufacturers in the country engaged in developing innovative solutions for the defense sectors are further driving market growth.

Asia Pacific Artillery Systems Market Trends

The artillery system market in Asia Pacific is expected to record the fastest growth rate of 7.8% from 2024 to 2030, with growing investments in defense equipment driven by increasing inclination to strengthen military capabilities. Moreover, border disputes, territorial conflicts, and regional security concerns drive the demand for advanced artillery systems to strengthen armed forces. In addition, the region's large and growing population, coupled with increasing urbanization and industrialization, has made it a lucrative market for artillery systems to protect critical infrastructure and civilian areas.

Europe Artillery Systems Market Trends

The artillery system market in Europe accounted for a notable revenue share of over 19% in 2023, owing to increasing geopolitical tensions and the need to modernize military capabilities that have led to increased investments in artillery systems. Moreover, the development of advanced artillery technologies, such as precision-guided munitions and unmanned aerial vehicles (UAVs), has enhanced the effectiveness and versatility of artillery systems. Furthermore, the growing focus on the region's border security and counter-terrorism operations has created a demand for advanced artillery solutions to deter potential threats. These factors are driving the growth of the regional market.

Key Artillery Systems Company Insights

Some of the key players in the market are Northrop Grumman, Leonardo S.p.A., KNDS France, and BAE Systems plc.

-

Northrop Grumman delivers a broad range of products, services, and solutions to the U.S. and global customers, mainly to the U.S. Department of Defense (DoD) and intelligence community. The company’s major segments include aeronautics systems, defense systems, mission systems, and space systems.

-

Leonardo S.p.A. is an industrial group that offers technological capabilities in the aerospace, defense, and security sectors. The company plays a crucial role in several major international strategic programs and is a technological partner for governments, defense agencies, enterprises, and institutions. The company's major business segments include helicopters, defense electronics & security, aircraft, aerostructures, and space.

-

BAE Systems plc delivers advanced defense and aerospace systems. The company manufactures military aircraft, submarines, surface ships, radar, communications, avionics, electronics, and guided weapon systems. Its major business segments include electronic systems, platforms & services, air, maritime, and cyber & intelligence.

-

KNDS France focuses on creating innovative, state-of-the-art solutions for global defense markets. It covers the entire lifecycle of land defense systems, including design, production, maintenance, and upgrades. The company is actively involved in major defense programs across Europe and other international markets.

Key Artillery Systems Companies

The following are the leading companies in the artillery system market. These companies collectively hold the largest market share and dictate industry trends.

- Elbit Systems Ltd.

- RTX Corporation

- Leonardo S.p.A

- BAE Systems plc

- General Dynamics

- Thales Group

- Lockheed Martin Corporation

- KNDS France

- Hanwha Corporation

- RUAG International Holding Ltd.

- Denel SOC Ltd.

- Singapore Technologies Engineering Ltd

- Aubert & Duval

- Avibras

Recent Developments

-

In August 2024, Elbit Systems Ltd. received an approximately USD 270 million contract to supply rocket artillery to an international customer over four years. This deal has strengthened the company’s position as a prominent advanced artillery solutions provider, enhancing clients' operational capabilities.

-

In July 2024, RTX Corporation received a USD 1.2 billion contract to supply additional Patriot air and missile defense systems to Germany to enhance the country's existing air defense infrastructure. The contract scope includes the latest Patriot Configuration 3+ radars, command and control stations, launchers, required spares, and support.

-

In June 2024, Aubert & Duval signed a distribution agreement with Tri Star Metals for North America, a U.S. distributor of nickel alloy, stainless steel, aluminum bar, and wire long products. This strategic initiative aligns with the former collaboration’s aim to expand its reach in the defense sector, especially in the small calibers market.

Artillery Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.96 billion

Revenue forecast in 2030

USD 16.22 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, range, component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Elbit Systems Ltd.; RTX Corporation; Leonardo S.p.A; BAE Systems plc; General Dynamics; Thales Group; Lockheed Martin Corporation; KNDS France; Hanwha Corporation; RUAG International Holding Ltd.; Denel SOC Ltd.; Singapore Technologies Engineering Ltd.; Aubert & Duval; Avibras

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artillery Systems Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global artillery systems market report based on type, range, component, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Howitzer

-

Mortars

-

Rocket Launchers

-

Anti-air Weapons

-

Others

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Short

-

Medium

-

Long

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Fire Control Systems

-

Engines

-

Turrets

-

Chassis

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global artillery systems market size was estimated at USD 10.24 billion in 2023 and is expected to reach USD 10.96 billion in 2024.

b. The global artillery systems market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 16.22 billion by 2030.

b. The North America region dominated the industry with a revenue share of 39.9% in 2023. This can be attributed to the increased defense spending and modernization of military forces, driven by concerns related to terrorism, border control, and other public safety measures.

b. Some key players operating in artillery systems market include Elbit Systems Ltd., RTX Corporation, Leonardo S.p.A, BAE Systems plc, General Dynamics, Thales Group, Lockheed Martin Corporation, KNDS France, Hanwha Corporation, RUAG International Holding Ltd., Denel SOC Ltd., Singapore Technologies Engineering Ltd., Aubert & Duval, and Avibras

b. Key factors that are driving artillery systems market growth include increased global defense spending amid rising geopolitical tensions, military modernization programs, and technological advancements in artillery systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.