- Home

- »

- Petrochemicals

- »

-

Aromatic Solvents Market Size, Share & Growth Report 2030GVR Report cover

![Aromatic Solvents Market Size, Share & Trends Report]()

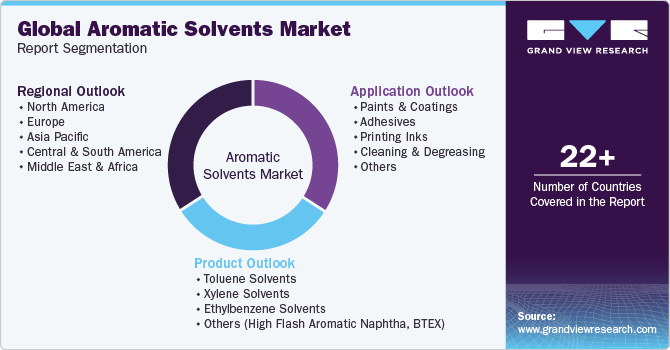

Aromatic Solvents Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Toluene Solvents, Xylene Solvents, Ethylbenzene Solvents), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-270-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aromatic Solvents Market Size & Trends

The global aromatic solvents market size was estimated at USD 5.18 billion in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. The market is expected to grow in developing nations such as China and India. The market has experienced high expansion, mostly because of an increase in building activity and the demand for vehicles. In addition, the world's growing urbanization and industrialization have significantly contributed to this expansion.

The growth of the global aromatic solvents market is primarily driven by rising demand across various end-use sectors including automotive, printing inks, adhesives, and pharmaceuticals. Moreover, the utilization of aromatic solvents in applications such as furniture varnishing and cosmetics reflects a growing trend of diversifying their usage beyond conventional industries.

Aromatic solvents encompass organic compounds characterized by a benzene ring structure, including benzene, toluene, ethylbenzene, mixed xylenes (BTEX), and high-flash aromatic naphtha. These hydrocarbons exhibit superior solvency power due to their chemical configuration based on the aromatic 6-membered benzene ring. Toluene and xylene stand out as the most widely utilized aromatics, finding applications in producing high-performance surface coatings, rubbers, and lacquers and serving as fundamental components for pharmaceutical compounds. Moreover, high-purity xylenes are cleaning agents in manufacturing electronic components.

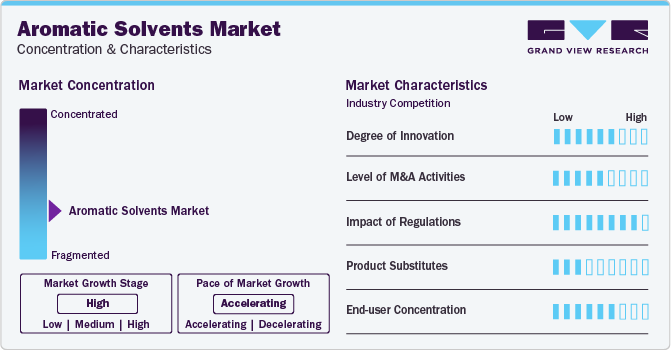

Market Concentration & Characteristics

The aromatic solvents market is fragmented with the presence of several prominent manufacturers. Aromatic solvents are of various types, such as toluene, xylene, ethylbenzene, and others. The market is influenced by factors such as technological advancements, consumer behavior, regulatory changes, and environmental concerns. The aromatic solvents offer high solvency, corrosion resistance, and viscosity control, making them essential in industries such as paints, coatings, oil and gas, and automotive sectors.

In addition, there is a shift towards green and bio-based solvents derived from renewable sources to reduce environmental impact, presenting opportunities for safer and more sustainable alternatives. This transition to substitute solvents may pose challenges for traditional aromatic solvent manufacturers, requiring them to adapt to changing market dynamics, invest in research and development for innovative products, and potentially face increased competition from substitute solvent procedures.

Product Insights

The toluene solvents segment accounted for a sizable market share of 50.9% in 2023. This can be attributed to toluene’s versatility, which makes it ideal for various applications such as paints, coatings, and adhesives. Moreover, toluene is relatively inexpensive compared to other aromatic solvents, which could make it an attractive choice for manufacturers looking to reduce costs. Toluene's favorable properties, such as its ability to dissolve various substances and low volatility, could make it a preferred option for certain applications.

Xylene is used in the pharmaceutical product manufacturing. The xylene segment is expected to experience the highest growth during the forecast period. In addition, with the growth of the glue and leather manufacturing industries, sales of benzene products are expected to soar. In the industries’ production processes, benzene serves as an essential aromatic solvent.

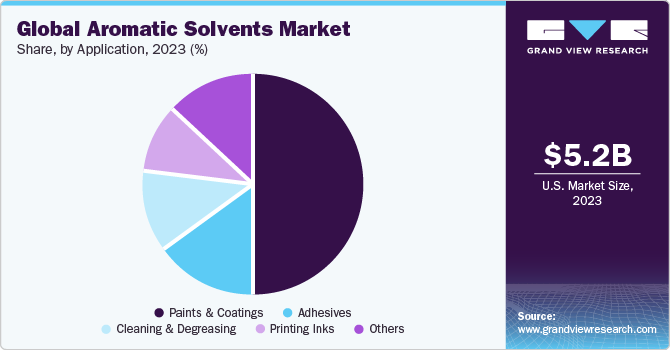

Application Product

The paints & coatings segment accounted for a share of 50.0% in 2023. This trend is projected to continue throughout the assessment period. In many end-user industries, such as paints and coatings, aromatic solvents are primarily used as diluents and thinners. In the near future, there will likely be a significant increase in demand for paints and coatings due to the expanding global construction industry. The market growth is expected to be driven by the increasing product consumption in the construction, automotive, and general industries. Rapid urbanization and industrialization in the emerging countries, such as India, China, and Southeast Asia, are also anticipated to fuel the product demand in various application sectors.

The global market has grown moderately in the past few years despite various uncertainties, such as the economic slowdown of major economies, positive & negative influence of the low crude oil prices, the high growth rate of the U.S. automotive and construction industry, the tenuousness of the recovery of various European nations, and developments in regulatory norms globally.

Regional Insights

The North America aromatic solvents market is expected to grow significantly during the forecast period with the growing construction industry and projects leading to a rising demand for paints and coatings resulting in rising demand for aromatic solvents in the region.

U.S. Aromatic Solvents Market Trends

The need for aromatic solvents may increase with the construction and automotive industry in the country leading to rise in demand for the aromatic solvents which are used in paints and coatings used by construction industry and automotive manufacturers.

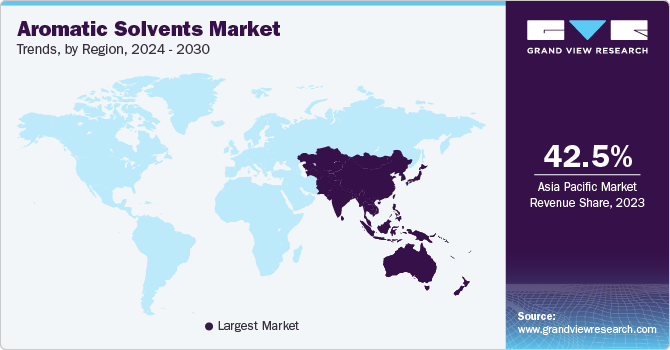

Asia Pacific Aromatic Solvents Market Trends

Asia Pacific is expected to dominate the global aromatic solvents market, followed by North America and Europe. This is due to the presence of emerging economies like India, China, and others, as well as the increasing use of these solvents in this region's construction and automotive industries. Furthermore, the emergence of various industries in this region also contributes to the market's growth.

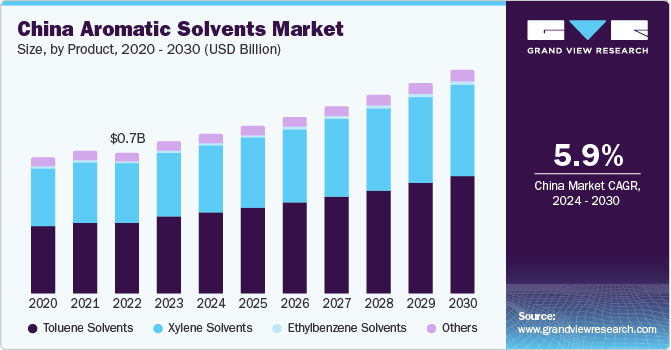

The China aromatic solvents market led the Asia-Pacific region with a share of 35.48% in 2023. China is a significant player in the market due to rapid industrialization and favorable government regulations. China’s dominance in production of raw materials for aromatic solvents contributes to its growth in the market.

Europe Aromatic Solvents Market Trends

The aromatic solvents market in Europe is expected to grow over the forecast period. This growth is attributed to rising automotive industry in the region leading to rising demand for aromatic solvents which are used in the paints and coatings industry.

The aromatic solvents market in Germany is expected to grow during the forecast period. The rising automotive industry in the country leads to a rise in demand for aromatic solvents which are used in the paints and coatings industry. Germany is also considered as the automotive hub of the world.

Central & South America Aromatic Solvents Market Trends

The aromatic solvents market in Central & South America is expected to grow over the forecast period due to a rise in construction projects in the region leading to rising demand for aromatic solvents which find applications in paints and coatings used in the construction industry.

The Brazil aromatic solvents market is expected to grow over the forecast period.A rise in automobile production plants and construction sector in the country has led to a rise in demand for aromatic solvents. They are used in the adhesives industry which is used in the construction business in Brazil.

Middle East & Africa Aromatic Solvents Market Trends

The aromatic solvents market in Middle East & Africa is expected to grow over the forecast period. This growth is attributed to rising construction projects in the region leading to a rise in demand for aromatic solvents used in paints and coatings.

The aromatic solvents market in Saudi Arabia is expected to witness growth over the forecast period. Saudi Arabia is growing its presence in the global automotive market at an incredible pace. This growth can be attributed to the rising demand for aromatic solvents in the country.

Key Aromatic Solvents Company Insights

Some of the key players operating in the market include BASF SE and LyondellBasell Industries Holdings B.V.

-

BASF SE is a chemical manufacturer and supplier with a presence across Europe, North America, Asia Pacific, South America, Africa, and the Middle East. The company is involved in the manufacturing of a wide range of products such as solvents, amines, resins, glues, petrochemicals, thermoplastics, foams, and polymers.

-

LyondellBasell Industries Holdings B.V. manufactures chemicals, fuels, refining products, and plastic polymers. It operates its business through aromatic solvents, intermediates; refining; technology; and advanced polymer solutions segments.

Top Solvents Co. Ltd; Recochem Inc.; and Reliance Industries Limited are some of the emerging participants in the aromatic solvents market.

-

Top Solvents Co. Ltd. is a leading supplier and manufacturer of high-quality solvents and chemicals. The company has years of experience and offer a wide range of solvents to meet specific needs. It provides solvents for industrial and pharmaceutical industries.

-

Recochem Inc. manufactures and distributes chemical products for industrial, commercial, and retail markets. The company operates in several countries, including Canada, the United States, and Australia, and serves various customers across various industries.

Key Aromatic Solvents Companies:

The following are the leading companies in the aromatic solvents market. These companies collectively hold the largest market share and dictate industry trends.

- ExxonMobil Corporation

- China Petroleum & Chemical Corporation

- BASF SE

- Royal Dutch Shell PLC

- LyondellBasell Industries Holdings B.V.

- Total S.A.

- Indian Oil Corporation Limited

- Bharat Petroleum Corporation Limited

- Chevron Phillips Chemical Company

- Reliance Industries Limited

Recent Developments

-

In January 2023, Clariter and TotalEnergies Fluids, a division of TotalEnergies, have recently launched the world's first sustainable ultra-pure solvent. This solvent is made from plastic waste and is used in the pharmaceutical, cosmetics, and other highly demanding markets. The products in these markets require safe, colorless, odorless, and tasteless solvents that meet the highest pharmacopoeia-standard purity criteria. By producing these solvents from plastic waste, the environmental impact is significantly reduced, and it helps address the issue of end-of-life plastics.

-

In January 2021, Ineos Group Ltd. announced the acquisition of BP plc's global aromatics & acetyls division for USD 5 billion. The acquisition will strengthen Ineos's global position, advance its petrochemical business, and expand its international reach.

Aromatic Solvents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.40 billion

Revenue forecast in 2030

USD 7.26 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

ExxonMobil Corporation; China Petroleum & Chemical Corporation; BASF SE; Royal Dutch Shell PLC; LyondellBasell Industries Holdings B.V.; Total S.A.; Indian Oil Corporation Limited; Bharat Petroleum Corporation Limited; Chevron Phillips Chemical Company; Reliance Industries Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aromatic Solvents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aromatic solvents market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Toluene Solvents

-

Xylene Solvents

-

Ethylbenzene Solvents

-

Others (High Flash Aromatic Naphtha, BTEX)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Adhesives

-

Printing Inks

-

Cleaning & Degreasing

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aromatic solvents market size was valued at USD 5.18 billion in 2023

b. The global aromatic solvents market size is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2030.

b. The paints & coatings segment accounted for a share of 50.0% in 2023, and it is predicted that this trend will continue throughout the assessment period. In many end-user industries, such as paints and coatings, aromatic solvents are primarily used as diluents and thinners.

b. Some prominent players in the global aromatic solvents market include: ● Exxonmobil Corporation ● China Petroleum & Chemical Corporation ● BASF SE ● Royal Dutch Shell PLC ● Lyondellbasell Industries Holdings B.V. ● China National Petroleum Corporation (CNPC) ● Total S.A.

b. The market has experienced high expansion, mostly because of an increase in building activity and the demand for vehicles. Additionally, the world's growing urbanization and industrialization have significantly driven aromatic solvents market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.