- Home

- »

- Organic Chemicals

- »

-

Aprotic Solvents Market Size & Analysis, Global Industry Report, 2025GVR Report cover

![Aprotic Solvents Market Size & Forecast By Product (NMP, Toluene, Benzene, Acetone), By Application (Oil &Gas, Pharmaceuticals, Paints & Coatings, Electronics), By Region (North America, Europe, Asia Pacific, CSA, MEA) And Trend Report]()

Aprotic Solvents Market (MEA) And Trend Analysis From 2018 To 2025) Size & Forecast By Product (NMP, Toluene, Benzene, Acetone), By Application (Oil &Gas, Pharmaceuticals, Paints & Coatings, Electronics), By Region (North America, Europe, Asia Pacific, CSA

- Report ID: GVR-1-68038-296-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2013 - 2015

- Forecast Period: 2016 - 2025

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global aprotic solvents market size was valued at USD 15.23 billion in 2015. It is expected to grow at a significant CAGR over the forecast period owing to growing demand from various end-use industries such as oil & gas, pharmaceuticals, paints & coatings, and electronics. The growing use of bio-based products is expected to further drive the market.

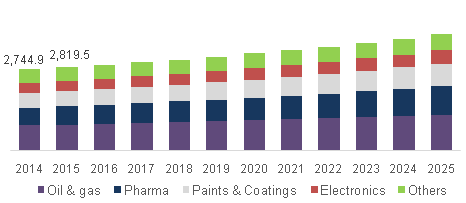

U.S. Aprotic Solvents market, by application, 2014 - 2025 (USD Million)

Growing demand for aprotic solvents in the oil & gas industry is expected to play a key role in the overall growth of the market. Oil & gas is a source of power, the consumption of which, eventually determines the strength of a country’s economy.

The pharmaceutical industry is projected to be the fastest-growing application sector over the forecast period. This industry is also witnessing growing demand for environment-friendly products, due to stringent regulations pertaining to environment protection.

The U.S. is one of the major markets for the aprotic solvent owing to the presence of a large pharmaceutical industry in the region. The pharmaceutical industry is dominated by global players such as Novartis, Pfizer, GlaxoSmithKline, Johnson & Johnson, and many more.

Product Insights

Some of the majorly used aprotic solvents include chemicals such as N-Methyl-2-pyrrolidone (NMP), toluene, benzene, acetone, hexane, chloroform, and so on. The aprotic solvents industry was dominated by toluene in 2015 accounting for more than 15% of revenue share.

Toluene can also be used as a raw material to produce other chemicals such as xylene, benzene, and trinitrotoluene (TNT). Growing demand from end-use industries such as paints & coatings and pharmaceuticals is expected to drive the market for toluene over the forecast period. It is an inflammable and colorless liquid, that resembles the appearance of paint thinner.

N-Methyl-2-pyrrolidone (NMP) is one of the widely used aprotic solvents in the industry. As seen above, this product has found a major application in the oil & gas industry. This is due to the property to dissolve a wide range of metals, making it an ideal solvent in the plastic industry too. This product is projected to witness the highest CAGR over the forecast period.

Application Insights

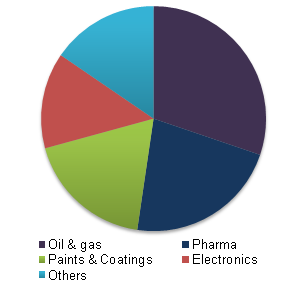

Oil & gas, pharmaceuticals, paints & coatings, and electronics were some of the major application areas of aprotic solvents in 2015. The oil & gas industry was the largest consumer of these solvents in the same year, followed by the pharmaceutical industry. The oil & gas industry was dominated by the U.S., Russia, and the Middle Eastern countries. These are the major exporters of these products to other countries.

Global Aprotic Solvents market, by application, 2015

The demand for these solvents from the pharmaceutical industry is projected to grow at the highest CAGR of over 4% from 2016 to 2025. This is due to increasing innovations in the pharmaceutical industry, giving rise to new drugs. Besides, increasing use of green and environment-friendly aprotic solvents has also propelled the growth of this market.

Regional Insights

Asia Pacific is projected to be the fastest-growing region with a CAGR of 4.2% from 2016 to 2015. The industry in this region is growing courtesy rapidly developing economies such as China, India, and South Korea. The growth of the market in this region is attributed to growing end-use industries such as paints & coatings, electronics, and pharmaceuticals.

The Asia Pacific region is home to some of the major paints & coatings companies such as Nippon Paint and Asian Paints. Similarly, major electronic companies such as Samsung, Sony, Nikon, and Hitachi are also headquartered in this region. Thus, owing to growing demand from these industries, the market for aprotic solvents is expected to witness significant growth.

North America accounted for the second-largest share in 2015. The industry in this region is dominated by the U.S. which held a share of over 70% in the same year. This region has witnessed a resurgence in several industries including oil & gas, automobile, construction, and electronics among others, since the economic slowdown from 2007 to 2009. This has provided the necessary boost to the industry.

Key Companies & Market Share Insights

The industry is fragmented in nature with several manufacturers scattered across the globe. The key players include Eastman Chemical Company, BASF SE, Ashland, Mitsubishi Chemical, and Asahi Kasei.

Agreements, partnerships, joint ventures, and collaborations were some of the major development strategies adopted by the players from 2011 to 2016. In June 2014, Linde and BASF entered into an agreement to develop the butadiene technology, jointly. This agreement was in accordance with the growing demand for butadiene globally.

Aprotic Solvents Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 17.32 billion

Revenue forecast in 2025

USD 21.79 billion

Growth Rate

CAGR of 3.7% from 2016 to 2025

Base year for estimation

2015

Historical data

2014

Forecast period

2016 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2016 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America & MEA

Country scope

U.S.; U.K.; Germany; China; Japan; India; Brazil;

Key companies profiled

Eastman Chemical Company, BASF SE, Ashland, Mitsubishi Chemical, and Asahi Kasei.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Market segments covered in the reportGrand View Research has segmented the global aprotic solvents market on the basis of product, application, and region:

- Global Product Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

N-Methyl-2-pyrrolidone (NMP)

-

Toluene

-

Benzene

-

Acetone

-

Others(Chloroform, Pentane, Diethyl Ether and Hexane)

-

- Global Application Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

Oil & gas

-

Pharmaceuticals

-

Paints & Coatings

-

Electronics

-

Others (Agrochemicals, Printing Inks and Personal Care)

-

- Regional Outlook (Volume, Kilo Tons; Revenue, USD Million; 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East& Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global aprotic solvents market size was estimated at USD 17.32 billion in 2019 and is expected to reach USD 17.94 billion in 2020.

b. The global aprotic solvents market is expected to grow at a compound annual growth rate of 3.7% from 2016 to 2025 to reach USD 21.79 billion by 2025.

b. Asia Pacific dominated the aprotic solvents market with a share of 43.8% in 2019. This is attributable to growing end-use industries such as paints & coatings, electronics, and pharmaceuticals.

b. Some key players operating in the aprotic solvents market include Eastman Chemical Company, BASF SE, Ashland, Mitsubishi Chemical, and Asahi Kasei.

b. Key factors that are driving the market growth include growing use of bio-based products and growing demand for aprotic solvents in the oil & gas industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.