- Home

- »

- Plastics, Polymers & Resins

- »

-

Antimicrobial Plastic Market Size, Industry Report, 2033GVR Report cover

![Antimicrobial Plastic Market Size, Share & Trends Report]()

Antimicrobial Plastic Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Engineering Plastics, High-performance Plastics), By End Use (Building & Construction, Packaging, Food & Beverage, Textile, Consumer Goods, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-858-9

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antimicrobial Plastic Market Summary

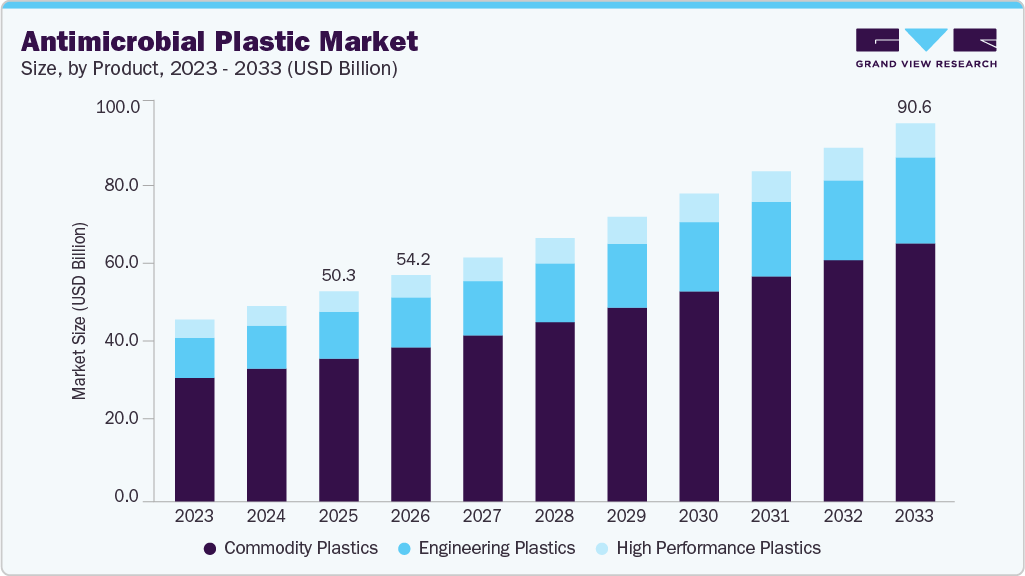

The global antimicrobial plastic market size was estimated at USD 50.35 billion in 2025 andis projected to reach USD 90.65 billion by 2033, growing at a CAGR of 7.6% from 2026 to 2033. Antimicrobial plastic is a synthetic polymeric material containing an integrated active ingredient (antimicrobial additive) that makes it effective against the growth of microbes such as algae, fungi, and mold.

Key Market Trends & Insights

- Asia Pacific dominated the antimicrobial plastic market with the largest revenue share of 40.66% in 2025.

- The U.S. antimicrobial plastic industry is expected to grow at a substantial CAGR of 6.6% from 2026 to 2033.

- By product, the commodity plastic segment accounted for the largest revenue share of 68.0% in 2025 and is expected to grow at a significant CAGR from 2026 to 2033 in terms of revenue.

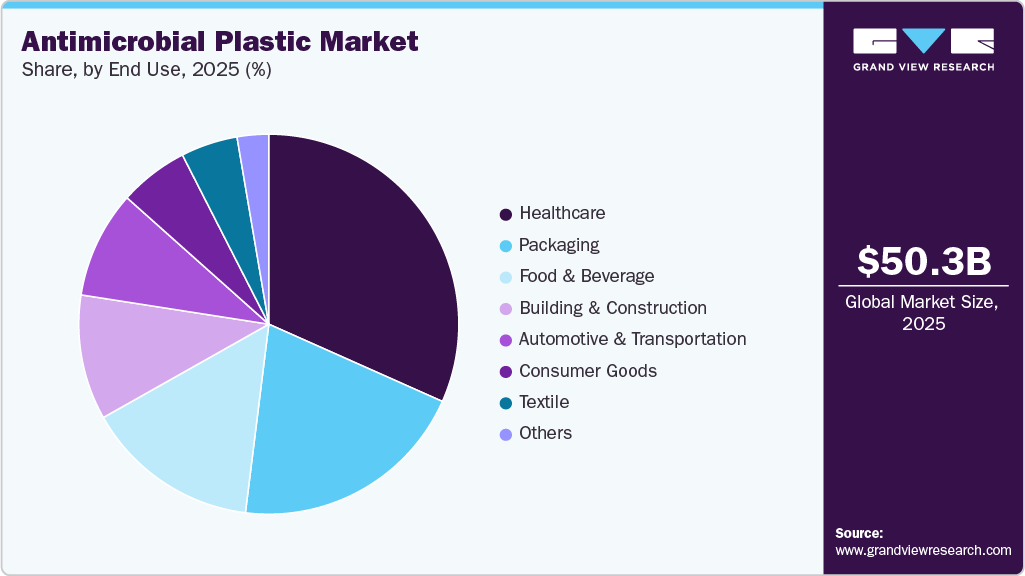

- By end use, the healthcare segment is expected to grow at the fastest CAGR of 8.3% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 50.35 Billion

- 2033 Projected Market Size: USD 90.65 Billion

- CAGR (2026-2033): 7.6%

- Asai Pacific: Largest market in 2025

These microbes tend to shorten the life of plastic products; thus, the use of antimicrobial plastics has increased in recent years in various end-use industries such as food and beverage, packaging, and healthcare, which are expected to be the main drivers of the global market during the forecast period.

Antimicrobial plastics are increasingly being used as a substitute for conventional materials in the healthcare sector for manufacturing medical instruments such as ventilators and anesthesia machines due to their pathogen-inhibiting properties. This plastic helps minimize the growth of pathogens, such as algae, bacteria, and fungi. It exhibits excellent moisture resistance, which also enhances its acceptance as an effective food packaging solution in the food and beverage industry.

These plastics are produced by incorporating antimicrobial additives, such as arsenic-based oxybisphenoxarsine (OBPA) and organometallic biocides, into the material to provide long-lasting protection against microbes and pathogens. These additives help increase the functional life of the plastic and inhibit the growth of bacteria that can cause the plastic to degrade more quickly, making it stronger, rust-proof, odorless, and highly suitable for medical device applications.

Drivers, Opportunities & Restraints

Growing consumer awareness about the health hazards posed by microbial contamination has been a pivotal driver for the antimicrobial plastics market. This heightened vigilance has spurred demand for products like antimicrobial packaging, toys, and personal care items. Additionally, stringent regulatory frameworks that promote improved public health and safety standards have driven the adoption of antimicrobial plastics across various industries. Government initiatives to mitigate the risks of bacterial and viral infections, particularly in public spaces, have further propelled market growth, creating a robust and sustainable demand.

Emerging markets present a lucrative opportunity for the antimicrobial plastics industry, driven by rapid urbanization and industrial growth. These regions are witnessing increased investments in infrastructure, healthcare, and consumer goods, where antimicrobial materials are becoming essential. The rising disposable incomes in countries across Asia-Pacific, Latin America, and the Middle East are fostering demand for high-quality, hygienic products. Furthermore, the untapped potential in sectors such as automotive interiors and electronics in these regions presents manufacturers with opportunities to innovate and capture market share through cost-effective and performance-enhancing solutions.

The high cost of producing antimicrobial plastics is a significant restraint, limiting their widespread adoption, particularly in price-sensitive markets. The incorporation of antimicrobial additives, such as silver ions or copper compounds, often increases manufacturing costs, which are subsequently passed on to consumers. Moreover, material compatibility issues and concerns over the long-term environmental impact of certain antimicrobial additives create challenges in scaling production. These factors, coupled with the availability of cheaper alternatives, pose barriers to market expansion, particularly in industries with tight budget constraints.

Market Concentration & Characteristics

The global antimicrobial plastic industry is characterized by function-centric demand driven by health, hygiene, and contamination control across various end-use industries. Unlike conventional plastics that compete primarily on cost and mechanical properties, antimicrobial plastics are engineered with additives or surface treatments that actively inhibit microbial growth. This functional distinction directly links market growth to sectors where microbial contamination poses a significant risk, including healthcare, medical devices, food processing and packaging, consumer products, HVAC components, and high-traffic public surfaces.

The COVID-19 pandemic and heightened awareness of infectious disease transmission have further solidified antimicrobial performance as a critical value driver, not a peripheral feature, making demand less sensitive to cyclical packaging volumes and more aligned with regulatory and institutional procurement cycles.

From a manufacturing perspective, the antimicrobial plastics market is technology- and formulation-intensive, requiring the integration of active agents, such as silver-based compounds, copper, zinc, quaternary ammonium compounds, and emerging bio-based antimicrobials, into polymer matrices. Masterbatch producers, additive formulators, and compounders play a crucial role, as uniform dispersion, sustained efficacy, regulatory compliance, and minimal impact on base polymer properties are essential for optimal performance and safety. Injection molding, extrusion, and thermoforming remain the primary fabrication routes. Still, upstream R&D and material science drive competitive differentiation more than sheer production scale. Companies that can balance antimicrobial effectiveness with regulatory approvals and maintain physical performance enjoy stronger market positions.

Integration with downstream systems, particularly in medical, food, and consumer hygiene applications, introduces elevated complexity and high switching costs for material users. Antimicrobial plastics often require validation through infection control protocols, biocompatibility testing, and in some sectors certification under health and safety standards. As a result, brand owners and OEMs exhibit long qualification cycles and strong supplier partnerships, preferring proven, certified formulations over frequent material changes. This creates a supplier landscape where technical expertise, quality assurance infrastructure, and compliance support are as important as pricing. Unlike generic polymer markets, where design churn can be rapid, antimicrobial plastics often maintain stable specifications once validated, thereby reinforcing long-term contractual relationships.

Regulatory frameworks, safety standards, and evolving public health policies heavily influence market structure. Government and industry mandates aimed at reducing hospital-acquired infections, improving food safety, and enhancing consumer product hygiene drive demand for antimicrobial plastics, especially in regions with stringent healthcare quality standards. At the same time, sustainability concerns-such as minimizing environmental toxicity, managing additive leaching, and optimizing recyclability-shape both material formulation and end-of-life considerations. Regulatory scrutiny over biocide safety, environmental persistence, and labeling transparency raises compliance costs, but does not diminish demand; instead, it favors established suppliers with robust testing, certification capabilities, and experience navigating multi-jurisdictional frameworks. Consequently, the competitive landscape favors companies that can simultaneously deliver high antimicrobial performance, regulatory compliance, and scalable production.

Product Insights & Trends

Commodity plastic dominated the antimicrobial plastic market, accounting for a revenue share of 68.0% in 2025. The use of commodity plastic in applications such as consumer goods, packaging, food & beverage, and healthcare is expected to fuel market growth over the forecast period. Product growth in these end-use industries is primarily driven by increased consumer awareness regarding personal hygiene and the changing lifestyles of consumers across the world.

Polypropylene and polyethylene antimicrobial plastics are primarily driving the demand for commodity plastics due to their high impact strength, improved biocompatibility, chemical resistance, moisture resistance, and wide range of applications across various end-use industries.

The worldwide spread of the coronavirus disease has positively impacted the demand for these antimicrobial plastics in consumer products. Buying behavior is shifting towards products that are environmentally friendly, trustworthy, and healthy. This shift in consumer purchasing behavior and structural changes in the consumer products industry are expected to increase the demand for consumer plastics with antimicrobial properties in consumer products over the forecast period.

End Use Insights & Trends

Healthcare dominated the antimicrobial plastic industry, accounting for a 31.7% revenue share in 2025. Growth in the home healthcare sector is attributed to the lower costs associated with home care compared to hospital care. The growing demand for intensive-care medical devices is expected to drive the demand for antimicrobial plastics in the healthcare sector in the coming years.

The high demand for advanced medical services, driven by the presence of well-developed healthcare infrastructure, the increasing incidence of cardiovascular diseases, and an aging population worldwide, is expected to drive the demand for medical devices. This, in turn, will positively impact the demand for antimicrobial plastic in healthcare.

Antimicrobial plastics are widely used in care homes, surgical rooms, hospitals, home care, and drop-in centers, with products including ceiling paints, floors, beds, handles, walls, case note holders, pull cords, cubicle curtains, and nurse call systems. Antimicrobial plastics minimize the risk of microbes such as E. coli, MRSA, and Legionella; thus, they play a significant role in infection control protocols. The rising demand for antimicrobial plastics in the manufacturing of infection-prevention and sterilized products, such as orthopaedic sutures, surgical cables, and tubing, is expected to drive product demand in the healthcare sector. Increasing demand for biocompatible, sterile, and non-corrosive products in medical applications to replace metal is projected to propel the product demand.

Regional Insights

Asia Pacific dominated the global antimicrobial plastic polymers market, accounting for the largest revenue share of 40.66% in 2025, attributable to the rapid expansion of healthcare infrastructure and urbanization. Governments in countries such as India, Indonesia, and Vietnam are investing heavily in modernizing their healthcare facilities to meet the growing needs of their populations. Additionally, rising urbanization has led to increased consumer demand for hygienic household items, food packaging, and consumer electronics. The region’s large manufacturing base also contributes to the adoption of antimicrobial plastics in automotive and construction applications, as industries seek durable and hygienic materials to meet safety standards and consumer preferences.

The China antimicrobial plastic market is expected to grow during the forecast period. China’s thriving electronics and consumer goods market is a key driver for the antimicrobial plastics industry. As the world’s largest producer and consumer of electronics, China is integrating antimicrobial materials into smartphones, tablets, and household appliances to meet global and domestic demand for hygienic and durable products. The government’s support for innovation in manufacturing and increasing awareness among Chinese consumers about the benefits of antimicrobial products have also propelled market growth.

North America Antimicrobial Plastic Market Trends

North America is experiencing a surge in demand for antimicrobial plastics, driven by advancements in medical technology and growing consumer awareness of hygiene and health safety. With innovations in medical devices and the growing use of antimicrobial coatings in hospital equipment, the healthcare industry remains a key driver.

U.S. Antimicrobial Plastic Market Trends

In the U.S., stringent regulatory standards and heightened infection control measures are driving the growth of the antimicrobial plastics industry. Agencies such as the FDA and EPA are promoting the use of antimicrobial materials to ensure public health and safety across industries. The focus on reducing healthcare-associated infections (HAIs) has led to widespread adoption of antimicrobial plastics in hospitals, schools, and public transportation systems.

Europe Antimicrobial Plastic Market Trends

Strong sustainability initiatives and industrial adoption of advanced materials drive the growth of the Europe antimicrobial plastics industry. European Union regulations emphasize the need for hygienic and eco-friendly solutions, leading to the incorporation of antimicrobial plastics in packaging, automotive interiors, and public infrastructure. The food and beverage industry, in particular, is adopting antimicrobial plastics to meet stringent safety and quality standards. Additionally, Europe’s focus on green technology has spurred innovation in biodegradable antimicrobial plastics, aligning with the region’s goals for a circular economy.

The antimicrobial plastic market in Germany is experiencing significant growth due to a combination of public health priorities, regulatory frameworks, consumer expectations, and industrial innovation, all of which are rooted in the country’s strong emphasis on hygiene, safety, and technological quality. Germany has one of the most highly regulated healthcare systems in Europe, with stringent infection control standards and preventative strategies aimed at reducing healthcare-associated infections (HAIs) in hospitals, clinics, and care facilities. Antimicrobial plastics, used in high-touch surfaces such as bed rails, door handles, medical device housings, and diagnostic equipment, are increasingly seen as effective supplementary measures to traditional cleaning protocols. This institutional focus on hygiene drives procurement decisions at both public and private healthcare providers, resulting in sustained demand for engineered materials that inhibit microbial growth on contact and support broader infection prevention frameworks.

Key Antimicrobial Plastic Company Insights

The antimicrobial plastic market is highly competitive, with several key players dominating the landscape. The antimicrobial plastic polymers market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Antimicrobial Plastic Companies:

The following are the leading companies in the antimicrobial plastic market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Parx Materials N.V.

- Ray Products Company Inc.

- COVESTRO AG

- King Plastic Corporation

- Palram Industries Ltd.

- Clariant AG

- SANITIZED AG

- RTP Company

- Lonza

- INEOS Styrolution Group GmbH

- Milliken Chemical

- BioCote Limited

- Microban International

- DuPont de Nemours, Inc.

Recent Developments

-

In January 2024, Fibergrate Composite Structures, Inc. partnered with Microban to introduce a new line of fiberglass-reinforced plastic (FRP) products that feature Microban's antimicrobial technology. This enhancement will be available in various products, including molded grating, stair treads, and work platforms, as well as on high-touch surfaces like guardrails and ladders.

-

In April 2020, Premix launched a new active antimicrobial technology called PREXELENT, aimed at reducing food spoilage and enhancing food safety. This innovative solution integrates antimicrobial agents into plastics used in the food supply chain, effectively preventing the growth of harmful microbes, including mold, Salmonella, and MRSA. This technology not only aims to improve food preservation but also seeks to reduce reliance on antibiotics and hazardous substances traditionally used in food production.

Antimicrobial Plastic Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 54.22 billion

Revenue forecast in 2033

USD 90.65 billion

Growth rate

CAGR of 7.6% from 2026 to 2033

Historical data

2021 - 2023

Base Year

2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

BASF SE; Parx Materials N.V.; Ray Products Company Inc.; COVESTRO AG; King Plastic Corporation; Palram Industries Ltd.; Clariant AG; SANITIZED AG; RTP Company; Lonza; INEOS Styrolution Group GmbH; Milliken Chemical; BioCote Limited; Microban International; DuPont de Nemours, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antimicrobial Plastic Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the antimicrobial plastic market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Commodity Plastics

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Acrylonitrile Butadiene Systems (ABS)

-

Polyethylene Terephthalate (PET)

-

-

Engineering Plastics

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Thermoplastic polyurethane (TPU)

-

Others

-

-

High-performance Plastics

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Automotive & Transportation

-

Healthcare

-

Packaging

-

Food & Beverage

-

Textile

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia-Pacific dominated the antimicrobial plastic market with a share of over 40% in 2025. This is attributable to the growing demand for antimicrobial plastic from the healthcare and packaging sector, especially in countries such as India, China, and Japan.

b. Some key players operating in the antimicrobial plastics market include BASF SE, Parx Materials N.V, Ray Products Company Inc., Covestro AG, Steritouch, RTP Company, Compounding Solutions LLC, and The Lubrizol Corporation.

b. The use of antimicrobial plastics has increased in recent years in various end-use industries such as food and beverage, packaging, and healthcare, which are expected to be the main drivers of the global market during the forecast period.

b. The global antimicrobial plastic market size was estimated at USD 50.35 billion in 2025 and is expected to reach USD 54.22 billion in 2026.

b. The global antimicrobial plastic market is projected to grow at a compound annual growth rate (CAGR) of 7.6% from 2026 to 2033, reaching USD 90.65 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.