- Home

- »

- Pharmaceuticals

- »

-

Antidiabetics Market Size & Share, Industry Report, 2030GVR Report cover

![Antidiabetics Market Size, Share & Trends Report]()

Antidiabetics Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (GLP-1 Receptor Agonists, Insulin), By Diabetes Type (Type 1, 2), By Route Of Administration (Oral, Intravenous), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-304-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antidiabetics Market Summary

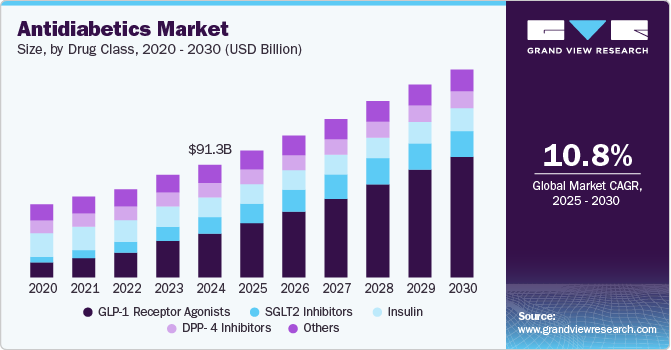

The global antidiabetics market size was estimated at USD 91,344.9 million in 2024 and is projected to reach USD 168,553.6 million by 2030, growing at a CAGR of 10.75% from 2025 to 2030. The antidiabetics industry is driven by rising diabetes prevalence, advancements in GLP-1 receptor agonists and SGLT2 inhibitors, and increasing adoption of combination therapies.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, glp-1 receptor agonists accounted for a revenue of USD 35,405.6 million in 2024.

- GLP-1 Receptor Agonists is the most lucrative drug class segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 91,344.9 Million

- 2030 Projected Market Size: USD 168,553.6 Million

- CAGR (2025-2030): 10.75%

- North America: Largest market in 2024

Regulatory approvals, biosimilar insulin expansion, and cardiovascular benefits enhance market growth. Innovations in drug delivery, personalized medicine, and AI-driven R&D accelerate development. Favorable reimbursement policies and healthcare expansion in emerging markets further drive adoption, strengthening pharmaceutical investments in diabetes treatment.

The industry is driven by the rising global diabetes prevalence, projected to increase from 536.6 million in 2021 to 783.7 million by 2045 (IDF Diabetes Atlas, 10th edition). The growing burden of undiagnosed diabetes (44.7% in 2021) further supports the demand for diagnostics and early intervention therapies. The increasing incidence of impaired glucose tolerance (541 million in 2021) and impaired fasting glucose (319 million in 2021) highlights the need for preventive and therapeutic solutions. Additionally, diabetes-related health expenditures reached $966 billion in 2021, reflecting a growing economic burden and investment in advanced treatment options. Expanding healthcare access, regulatory approvals, and innovative drug classes such as GLP-1 receptor agonists further accelerate market growth.

The expanded approval of a leading GLP-1 receptor agonist is expected to drive market growth by broadening its use across cardiometabolic conditions, enhancing its clinical utility and reinforcing demand within the antidiabetic therapeutics segment. For instance, in January 2025, Novo Nordisk announced FDA approval of Ozempic (semaglutide) to reduce the risk of kidney disease worsening, kidney failure, and cardiovascular death in adults with type 2 diabetes and chronic kidney disease (CKD). This approval follows the FLOW phase 3b trial, which demonstrated a 24% relative risk reduction. Ozempic is now the most broadly indicated GLP-1 RA. CKD affects 37 million U.S. adults, with 40% of type 2 diabetes patients experiencing CKD. The approval expands Ozempic’s cardiometabolic benefits.

Pipeline Analysis

The antidiabetic therapeutics market demonstrates a strong and evolving pipeline, reflecting ongoing innovation and competitive activity. Multiple candidates are progressing through Phase 2 to Phase 4 trials, with semaglutide-based combinations playing a central role. Key sponsors such as Novo Nordisk, Eli Lilly, and other emerging players are exploring mono- and combination therapies targeting glycemic control and weight reduction. The presence of novel agents like retatrutide, cagrilintide, and orforglipron indicates a shift toward multi-target approaches. Given the robust clinical activity and diversification in mechanisms of action, the market is positioned for sustained growth over the forecast period.

Interventions

Sponsor

Phases

DRUG: semaglutide|DRUG: oral glucose-lowering medications (commercially available)

Novo Nordisk A/S

PHASE4

DRUG: Oral semaglutide|DRUG: Placebo (semaglutide)

Novo Nordisk A/S

PHASE3

DRUG: Antidiabetics|DRUG: Placebo (semaglutide)

Novo Nordisk A/S

PHASE3

DRUG: GZR18|DRUG: Antidiabetics

Gan and Lee Pharmaceuticals, USA

PHASE2

DRUG: HEC88473, Placebo, Dulaglutide

Dongguan HEC Biopharmaceutical R&D Co., Ltd.

PHASE2

DRUG: Orforglipron|DRUG: Placebo

Eli Lilly and Company

PHASE3

DRUG: Retatrutide|DRUG: Antidiabetics

Eli Lilly and Company

PHASE3

DRUG: Cagrilintide|DRUG: Antidiabetics|DRUG: Tirzepatide

Novo Nordisk A/S

PHASE3

DRUG: HRS9531 Injection|DRUG: Antidiabetics Injection

Fujian Shengdi Pharmaceutical Co., Ltd.

PHASE3

DRUG: Cagrilintide|DRUG: Antidiabetics|DRUG: Tirzepatide

Novo Nordisk A/S

PHASE3

DRUG: Cagrilintide|DRUG: Antidiabetics|DRUG: Placebo cagrilintide|DRUG: Placebo semaglutide

Novo Nordisk A/S

PHASE3

DRUG: Retatrutide|DRUG: Placebo

Eli Lilly and Company

PHASE3

DRUG: Pioglitazone + Alogliptin|DRUG: Alogliptin|DRUG: Metformin|DRUG: Dapagliflozin

Celltrion Pharm, Inc.

PHASE4

Source: Clinicaltrial.gov

Expanded Clinical Utility of SGLT2 Inhibitors

As per the study titled "SGLT2 inhibitors and clinical outcomes in patients with heart failure: a systematic review and meta-analysis" published in 2024 in The Lancet, several findings may act as drivers for the antidiabetic market. The study highlights that SGLT2 inhibitors demonstrate consistent benefits in reducing cardiovascular death and worsening heart failure across diverse patient populations-including those without diabetes. These findings support the use of SGLT2 inhibitors beyond glycemic control, indicating their potential role in managing multimorbidity involving diabetes, heart failure, and chronic kidney disease. As the study shows efficacy independent of diabetic status, it could promote broader clinical adoption and inclusion in treatment guidelines. Such expanded indications and cross-specialty utility align with current healthcare trends favoring integrated chronic disease management, which may support increased prescribing, improved reimbursement scenarios, and ultimately drive growth in the antidiabetic market.

In addition, the 2025 study titled "Sodium-Glucose Cotransporter-2 (SGLT-2) Inhibitors: Antidiabetic Medications for Treating Diabetes" highlights the role of SGLT-2 inhibitors in managing type 2 diabetes by promoting urinary glucose excretion. Beyond glycemic control, the study emphasizes cardiovascular and renal benefits, particularly with agents like dapagliflozin. It also discusses newer drugs such as enavogliflozin and henagliflozin, offering improved selectivity and efficacy. The evolution from natural compounds like phlorizin to modern SGLT-2 inhibitors reflects advancements in diabetes therapy. Overall, the study positions SGLT-2 inhibitors as key contributors to both glycemic management and broader clinical outcomes in type 2 diabetes treatment.

Market Concentration & Characteristics

The industry demonstrates continuous innovation in therapeutic classes, drug delivery mechanisms, and digital health integration. Developments include long-acting insulin analogs, GLP-1 receptor agonists, SGLT2 inhibitors, and fixed-dose combinations. Increasing focus on precision medicine, smart insulin pens, and adjunct digital platforms supports individualized disease management. Innovations aim to improve glycemic control, reduce cardiovascular risks, and enhance adherence through less frequent dosing and fewer side effects.

M&A activities in the antidiabetic market are driven by the pursuit of advanced therapies and pipeline diversification. Companies acquire or partner with biotech firms to gain access to novel drug candidates, such as oral insulin formulations and next-generation GLP-1 drugs. Strategic collaborations also target integrated digital solutions and biosimilar insulin development. These transactions aim to strengthen competitive positioning, especially in addressing rising global prevalence and demand for cost-effective therapies.

The antidiabetic drug market is regulated by agencies such as the FDA and EMA, with stringent approval pathways for new molecular entities and biosimilars. Clinical efficacy, safety in long-term use, and cardiovascular outcome trials are critical regulatory benchmarks. Pricing and reimbursement decisions are influenced by comparative effectiveness and economic evaluations. In emerging regions, regulatory harmonization efforts aim to expedite access to essential diabetes medications.

While lifestyle interventions such as diet, exercise, and behavioral therapy remain essential in diabetes care, pharmacologic treatments dominate moderate-to-severe cases. Substitution pressures also arise from alternative therapies, including bariatric surgery for type 2 diabetes remission and emerging cell-based treatments. However, established antidiabetic drugs maintain demand due to guideline inclusion, scalable use, and real-world effectiveness.

Growth in the antidiabetic market is accelerating in emerging economies across Asia-Pacific, Africa, and Latin America, driven by urbanization, dietary shifts, and rising obesity rates. Multinational firms expand local production and patient access programs to meet growing needs. Developed regions, notably North America and Europe, sustain revenue through the uptake of innovative therapies, value-based care models, and increasing use of combination and personalized treatments.

Drug Class Insights

GLP-1 receptor agonists segment dominated the market in 2024 with a share of 38.76% due to their dual benefits in glycemic control and weight reduction, which are critical for managing type 2 diabetes. These agents, including liraglutide and semaglutide, enhance insulin secretion, suppress glucagon, and slow gastric emptying. Their cardiovascular benefits, demonstrated in major clinical trials, have further strengthened their adoption. Additionally, the introduction of once-weekly formulations and combination therapies has improved patient compliance. Rising global diabetes prevalence and increasing preference for effective, multi-functional therapies continue to drive growth in this segment across major pharmaceutical markets.

SGLT2 inhibitors are experiencing significant growth in the antidiabetic market due to their unique mechanism of reducing glucose reabsorption in the kidneys, promoting glycemic control and weight loss. Their added cardiovascular and renal protective effects, supported by clinical evidence, have expanded their usage beyond diabetes to heart failure and chronic kidney disease management. Increasing physician preference, favorable clinical outcomes, and expanding label approvals contribute to the segment’s rising demand globally. Leading molecules such as dapagliflozin and empagliflozin continue to drive growth, supported by strategic launches and ongoing clinical research.

Diabetes Type Insights

Diabetes type 2 segment dominated the market in 2024 with a market share of 79.34% and is expected to grow at the fastest CAGR from 2024 to 2030. This growth be attributed to the increasing prevalence of this chronic condition globally. According to the IMHE report June 2023, the global diabetes cases to soar from 529 million to 1.3 billion by 2050 As more individuals are diagnosed with type 2 diabetes, the demand for effective management and treatment options grows, leading to the segment's substantial market share. The increasing awareness about diabetes prevention management and the development of innovative therapies and technologies are projected to drive this growth.

The Type 1 diabetes segment is witnessing significant growth in the antidiabetic market, driven by advancements in insulin delivery systems, continuous glucose monitoring technologies, and increased awareness of early diagnosis and disease management. Improved access to treatment and innovations in insulin analogs are enhancing patient outcomes and adherence. Additionally, growing research into adjunct therapies, including SGLT2 inhibitors for Type 1 diabetes, is expanding therapeutic options. The rising global prevalence of Type 1 diabetes, particularly among younger populations, is further contributing to the segment’s expanding market share across both developed and developing regions.

Route of Administration Insights

The intravenous segment dominated the market in 2024 with a share of 41.98% due to its critical role in managing acute complications such as diabetic ketoacidosis and severe hyperglycemia. Hospitals and emergency care settings widely adopted intravenous administration for rapid therapeutic effect, especially in patients requiring immediate glycemic control. The segment’s growth was further supported by increasing hospitalization rates linked to diabetes-related complications and enhanced access to healthcare infrastructure in developing regions. Additionally, intravenous routes remained essential for administering insulin in intensive care units, contributing to its continued market dominance.

The subcutaneous segment is estimated to grow at the fastest rate during the forecast period. This method of administering diabetes medication is more convenient for patients, allowing for self-injection or the use of less invasive devices, thereby reducing the need for frequent doctor visits or hospital stays. Subcutaneous diabetic drugs also act quickly, helping to manage blood glucose levels more effectively-an essential factor in diabetes care. Several prominent companies are partnering with technology firms to develop smart insulin pens that connect to mobile apps, enabling better tracking of blood sugar levels and dosage recommendations. This reflects the ongoing transformation and advancement in diabetes care. For instance, in August 2023, Insulet launched the Omnipod 5 Automated Insulin Delivery System in Germany, marking a significant step forward in diabetes treatment. The growing adoption of such innovative delivery solutions is expected to drive the segment’s growth.

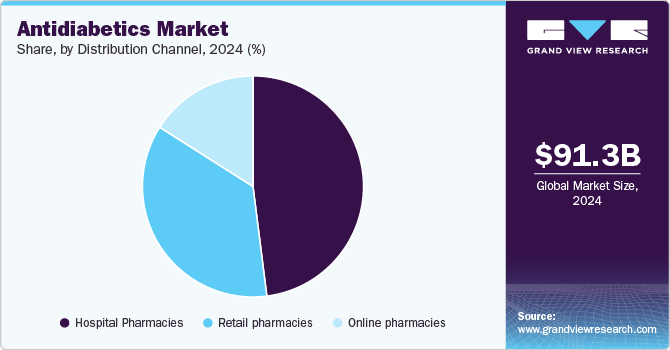

Distribution Channel Insights

The hospital pharmacies segment held the largest market share in 2024, with a share of 47.34%. This dominance is attributed to the high volume of prescriptions filled and administered within hospital settings, especially for patients requiring intensive diabetes management or combination therapies. Hospitals are also the primary points of care for newly diagnosed cases and for those with severe complications, leading to increased dispensing of antidiabetic drugs. Additionally, hospitals often stock a broad range of medications, including newer and injectable therapies, further contributing to the segment's leading position in the market.

The online pharmacies segment is estimated to grow at the fastest growth rate during the forecast period. This growth is driven by increasing internet penetration, rising preference for doorstep delivery, and improved access to medications in remote areas. The convenience of online ordering, availability of discounts, and ease of comparing product options contribute to higher consumer adoption. Additionally, the growing use of mobile health platforms and e-prescriptions is streamlining the purchase process for chronic disease treatments like diabetes, supporting the segment's rapid expansion.

Regional Insights

North America antidiabetics market accounted for the largest share of 41.48% in 2024. The region has a notably high prevalence of diabetes, primarily type 2, which is increasing due to lifestyle changes and an aging population. Moreover, the presence of a well-established healthcare infrastructure and high healthcare spending facilitates widespread access to treatment and disease management solutions. The region is home to several leading pharmaceutical firms and research institutes that consistently develop and introduce innovative antidiabetic drugs and technologies, fueling overall market growth.

U.S. Antidiabetics Market Trends

The antidiabetics market in the U.S. is projected to witness sustained growth during the forecast period. This is attributed to advancements in clinical research, an increasing number of FDA-approved drugs, and a robust pipeline of ongoing R&D. The increasing focus on personalized diabetic therapy and improved access to newer drug classes is also supporting market growth. As of mid-2022, nearly 100 antihyperglycemic agents were under evaluation for type 2 diabetes, and over 60 had already received approval, underscoring the dynamic development landscape.

Europe Antidiabetics Market Trends

The antidiabetics market in Europe is expanding, driven by the high prevalence and financial burden of diabetes. It remains a leading cause of mortality across the region. However, prevalence and mortality rates differ among countries. The market is witnessing strong growth due to increased disease awareness, supportive health policies, and the rising adoption of modern therapeutic options. The surge in the use of DPP-4 inhibitors and GLP-1 receptor agonists also reflects a shift toward more effective drug regimens, contributing to the regional market’s expansion.

The UK antidiabetics market is supported by rising prescription volumes and the growing adoption of innovative treatment options. There is increasing demand for newer classes of antidiabetic drugs as public health authorities focus on enhancing disease management outcomes. Ongoing national initiatives to reduce diabetes-related health complications are creating a favorable environment for market growth, particularly in terms of drug availability, reimbursement, and physician engagement.

The antidiabetics market in France is expected to grow steadily over the coming years. Rising public awareness around disease management and increasing screening activities are contributing to the demand for early and effective interventions. DPP-4 inhibitors and GLP-1 receptor agonists remain the most prescribed drug classes in the country, reflecting physicians' preference for well-tolerated and effective therapies. Government programs focusing on chronic disease management are also expected to support long-term market development.

Germany antidiabetics market is projected to grow at a lucrative rate over the forecast period. Market growth is driven by ongoing advancements from both public and private organizations and a rising elderly population. Several companies headquartered in Germany are engaged in extensive R&D activities, which are contributing to the commercialization of novel antidiabetic therapies. These developments are fostering enhanced treatment outcomes and expanding therapeutic options, thereby boosting market performance.

Asia Pacific Antidiabetics Market Trends

The antidiabetics market in Asia Pacific is estimated to register the fastest growth during the forecast period. The surge in type 2 diabetes cases is fueled by changes in lifestyle, urbanization, and dietary habits. The region’s large and aging population base makes it a critical market for diabetes therapeutics. Additionally, the rapid expansion of telemedicine and digital health platforms is improving access to diabetes care. The integration of technology into diabetes management is expected to further accelerate market penetration in the region.

China antidiabetics market is expected to witness substantial growth in the near future. China has one of the highest numbers of diabetes patients globally, with nearly 114 million individuals currently affected. This massive disease burden is spurring increased demand for antidiabetic therapies. The government and healthcare providers are focusing on improving early diagnosis and access to modern treatment options, which is expected to drive the expansion of the therapeutic landscape in the country.

The antidiabetics market in Japan is forecasted to grow consistently due to the presence of a strong healthcare infrastructure. Over 7.4 million individuals were living with diabetes in 2020, and the number continues to rise due to a westernized lifestyle, unhealthy eating patterns, lack of physical activity, and an aging demographic. Japan’s emphasis on early intervention, continuous patient monitoring, and adoption of advanced treatment options is expected to drive the overall market growth.

Latin America Antidiabetics Market Trends

The antidiabetics market in Latin America is gaining traction, with the region recognized as a promising area for industry expansion. A significant portion of the population is entering older age groups, which is associated with a higher risk of diabetes. Increasing healthcare expenditure, coupled with efforts to improve access to chronic disease treatments, supports regional market growth. Local governments are working on strengthening health systems and expanding access to antidiabetic drugs and services.

Brazil antidiabetics market is expected to expand during the forecast period. Several reforms have been introduced to diversify financing, develop new service organizations, and increase the distribution of medical professionals. Additionally, quality improvement programs and policy frameworks aimed at reducing diabetes-related complications are shaping a more favorable market. These efforts also reflect a growing interest in integrating comprehensive diabetes therapy and management strategies at the national level.

Middle East and Africa (MEA) Antidiabetics Market Trends

The antidiabetics market in the Middle East and Africa is advancing, supported by increased government focus on addressing the growing diabetes epidemic. Lifestyle and dietary changes have led to rising obesity rates, which in turn elevate diabetes risk. Efforts by national authorities to raise awareness and invest in chronic disease programs are expected to foster long-term market development. The shift towards structured care models and integrated disease management solutions is expected to support the consistent adoption of diabetic medications.

Saudi Arabia antidiabetics market is showing strong momentum, attributed to considerable government investment in pharmaceutical infrastructure and education. Public health organizations, including the Saudi Diabetes & Endocrine Association, are actively engaged in awareness campaigns aimed at early diagnosis and treatment. At the same time, investments in R&D and the adoption of modern drug delivery systems are expected to enhance patient compliance and improve outcomes, further contributing to the market’s growth trajectory.

Key Antidiabetics Company Insights

The antidiabetics market is experiencing notable growth driven by the prevalence of diabetes globally, coupled with advancements in drug research and technology leading to more effective and targeted treatment options. This presents significant opportunities for major players to capitalize. Key market participants are proactively pursuing strategic initiatives such as mergers, acquisitions, and collaborations to enhance their market share and cater to the rising demand for antidiabetic products and services.

Key Antidiabetics Companies:

The following are the leading companies in the antidiabetics market. These companies collectively hold the largest market share and dictate industry trends.

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- Merck & Co., Inc.

- AstraZeneca plc

- Johnson & Johnson Services Inc.

- Boehringer Ingelheim

- Novartis AG

- Takeda Pharmaceutical Company

- Bayer AG

Recent Developments

-

In February 2025, the U.S. FDA approved Merilog (insulin-aspart-szjj), the first rapid-acting insulin biosimilar to Novolog, for adults and children with diabetes. Approved in 3ml prefilled pen and 10ml vial forms, Merilog aims to improve mealtime glycemic control. Manufactured by Sanofi-Aventis U.S. LLC, it is the third insulin biosimilar approved in the U.S. This milestone supports the FDA’s goal to expand access to cost-effective insulin therapies and foster a competitive biosimilar market for diabetes treatment.

-

In May 2024, Soliqua (Insulin Glargine 100IU + Lixisenatide 33mcg/ml) is indicated for adults with type 2 diabetes inadequately controlled on basal insulin or GLP-1 receptor agonist alone. Each 3ml prefilled pen is priced at ₹1,850 (approximately 22.30 USD). Manufactured by Sanofi India, Soliqua combines basal insulin and a GLP-1 RA for glycemic control. It is administered subcutaneously once daily, with the dosage adjusted individually based on prior therapy, metabolic needs, and glycemic response.

-

In January 2024, Glenmark launched the first biosimilar of Liraglutide in India. Liraglutide is a popular drug used to treat type 2 diabetes mellitus in adults. The drug will be marketed under the brand name Lirafit for USD 1.20 and will be available only under prescription. The biosimilar launch will make the drug more accessible to patients in India as the cost will lower by up to 70%.

-

In June 2023, the FDA approved Jardiance (empagliflozin) and Synjardy (empagliflozin with metformin) for treating type 2 diabetes in children aged 10 and older. These drugs, previously used in adults, now offer pediatric patients new options beyond metformin. A clinical trial showed empagliflozin significantly reduced HbA1C levels. Common side effects include low blood sugar, urinary tract infections, and gastrointestinal issues. These medications are not recommended for type 1 diabetes or patients with severe kidney problems.

Antidiabetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 102.75 billion

Revenue forecast in 2030

USD 168.55 billion

Growth rate

CAGR of 10.75% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated April 2025

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, diabetes type, route of administration, distribution channel and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada, Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

AstraZeneca plc; Bayer AG; Takeda Pharmaceutical Company Limited; Eli Lilly and Company; Boehringer Ingelheim; Bristol-Myers Squibb; Pfizer, Inc.; Johnson & Johnson Services Inc.; Merck & Co. Inc ; Novartis AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Antidiabetics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antidiabetics market report on the basis of drug type, diabetics type, route of administration, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin

-

Insulin By Type

-

Long-acting insulin

-

Premix insulin

-

Fast-acting insulin

-

Human insulin

-

-

-

GLP-1 Receptor Agonists

-

DPP- 4 Inhibitors

-

SGLT2 Inhibitors

-

Others

-

-

Diabetes Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Type 1

-

Type 2

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Subcutaneous

-

Intravenous

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online pharmacies

-

Hospital Pharmacies

-

Retail pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The antidiabetics market is driven by rising diabetes prevalence, advancements in GLP-1 receptor agonists and SGLT2 inhibitors, and increasing adoption of combination therapies.

b. The global antidiabetics market size was estimated at USD 91.34 billion in 2024 and is expected to reach USD 102.75 billion in 2025.

b. The global antidiabetics market is expected to grow at a compound annual growth rate of 10.75% from 2025 to 2030 to reach USD 168.55 billion by 2030.

b. Based on drug class, GLP-1 receptor agonists segment dominated the market in 2024 with a share of 38.76% due to their dual benefits in glycemic control and weight reduction, which are critical for managing type 2 diabetes.

b. Some key players operating in the antidiabetics market include AstraZeneca plc, Bayer AG, Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Boehringer Ingelheim, Bristol-Myers Squibb, Pfizer, Inc., Johnson & Johnson Services Inc., Merck & Co. Inc , Novartis AG

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.