- Home

- »

- Animal Health

- »

-

Animal Drug Compounding Market Size, Industry Report 2030GVR Report cover

![Animal Drug Compounding Market Size, Share & Trends Report]()

Animal Drug Compounding Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Anti-infective Agents, CNS Agents), By Animal Type (Companion Animal, Livestock Animals), By Route Of Administration, By Dosage Form, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-040-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Drug Compounding Market Summary

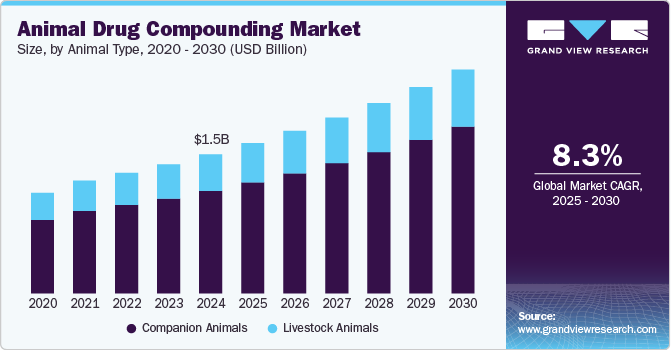

The global animal drug compounding market size was estimated at USD 1.52 billion in 2024 and is projected to reach USD 2.45 billion by 2030, growing at a CAGR of 8.29% from 2025 to 2030. The animal drug compounding industry is driven by the increasing demand for customized medications to address the diverse therapeutic needs of various animal species.

Key Market Trends & Insights

- North America animal drug compounding market dominated the global market with the largest revenue share of 40.51% in 2024.

- The animal drug compounding market in the U.S. accounted for the largest revenue share in North America in 2024.

- Based on product, the CNS agents segments led the market with the largest revenue share of 33.38% in 2024.

- Based on animal type, the companion animal segment led the market with the largest revenue share of 73.65% in 2024.

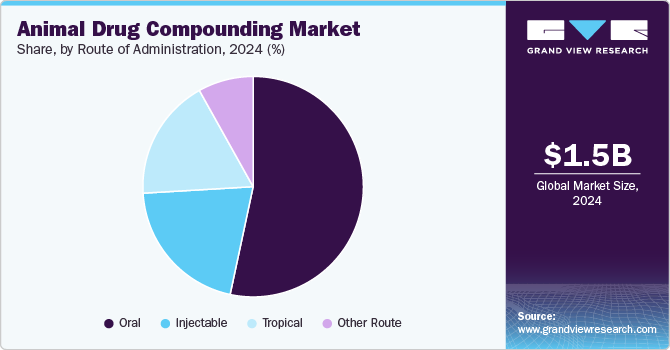

- Based on route of administration, the oral segment led the market with the largest revenue share of 53.34% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.52 Billion

- 2030 Projected Market Size: USD 2.45 Billion

- CAGR (2025-2030): 8.29%

- North America: Largest market in 2024

The limited number of FDA-approved veterinary drugs for all possible species and conditions highlights the necessity of compounded medications. These drugs allow veterinarians to provide tailored treatments when no suitable FDA-approved alternatives exist, ensuring better therapeutic outcomes. For instance, there is no FDA-approved medication currently available for treating megacolon in cats. Cisapride, which was previously the only safe and effective treatment for chronic constipation in cats, was discontinued in the U.S. market in 2000. In such cases, compounded cisapride remains the only viable option for effective pro-kinetic drug therapy.

The ability to modify drug formulations, such as incorporating flavoring or alternative administration methods, significantly improves medication adherence in animals, particularly those challenging to medicate. For instance, in September 2024, WEDGEWOOD PHARMACY launched compounded molnupiravir, a promising treatment for first- and second-line therapy of Feline Infectious Peritonitis (FIP), into its formulary. Originally developed for human viral infections, the drug was flavored and compounded specifically for feline use. With this offering, WEDGEWOOD PHARMACY became the first U.S. veterinary compounding pharmacy to provide cat-friendly molnupiravir formulations in various doses, tailored to treat different forms of FIP, including Effusive, Non-effusive, Neurological, and Ocular. These formulations are available as flavored suspensions and capsules.

Regulatory support, government initiatives, and other awareness programs contribute to the increased adoption of compounded animal drugs. For instance, the implementation of regulatory guidelines, such as the FDA’s Guidance for Industry (GFI) #256, provides a structured framework for the quality, sterility, and safety of compounded drugs. GFI #256, issued on April 14, 2022, balances the need for access to bulk drugs and compounded medications with the importance of safety and quality standards. It ensures that veterinarians can provide appropriate care for diverse animal species while maintaining safeguards to protect animal and human health. These regulations build trust among veterinarians and pet owners, supporting the growth of the market by ensuring that compounded medications meet high safety and efficacy standards.

Product Insights

The CNS agents segments led the market with the largest revenue share of 33.38% in 2024, as CNS agents are the most frequently prescribed medications for treating neurological conditions such as a change in behavior, blindness, seizures, etc. in pets. Several categories of drugs are used as CNS agents or psychotropic agents in veterinary medicine. Some include anticonvulsants, tranquilizers, analgesics, sedatives, antidepressants, antipsychotics, mood-stabilizing drugs, and anxiolytics, among others. Companies such as Wedgewood Pharmacy have enormous CNS agents compounded for specific medical needs.

The hormones & substitutes segment is anticipated to grow at the fastest CAGR of 9.79% during the forecast period, since compounded bioidentical hormones and substitutes are both better and more potent in veterinary hormonal replacement therapy. Compounded hormones are gaining traction globally among veterinary practitioners for various therapeutic use, regulating reproduction or enhancing production, and largely used to interfere with physiological function. Some commonly used veterinary hormones include endogenous steroids, testosterone, synthetic steroids, synthetic non-steroidal estrogens, progesterone, and several other hormones.

Animal Type Insights

Based on animal type, the companion animal segment led the market with the largest revenue share of 73.65% in 2024 and is expected to grow at the fastest CAGR of 8.66% during the forecast period. The growing companion animal population, rising pet care expenditure, growing awareness among pet parents and veterinarians about animal drug compounding, and several benefits associated with it for pet animals all contribute to this segment's growth.

Moreover, the need for customized veterinary medication to increase patient compliance is also expected to boost market growth during the forecast period. For example, a member of the AVMA compounding task force claims that medicating cats can be difficult for many owners and, occasionally, for vets as well. Thus, the demand for compounding in feline medicine is fueled by the need to have medications accessible in a way that maintains the human-animal bond while increasing and ensuring patient compliance in administering it. This could necessitate compounding the medicine into a small, palatable chew, a transdermal gel, or a palatable liquid form.

Route Of Administration Insights

Based on route of administration, the oral segment led the market with the largest revenue share of 53.34% in 2024. Oral formulations are the preferred, easiest, and most acceptable route of drug administration. It is preferred widely due to its advantages, such as non-invasiveness, patient compliance, and simplicity of medication distribution. The oral route of administration is used in both livestock and companion animals frequently, owing to their systemic effects after rapid drug absorption in the GI tract. However, oral drugs require careful formulations as they can lead to irregular absorption, slow onset of action, and other possible side effects.

The topical segment is anticipated to grow at the fastest CAGR of 9.31% during the forecast period, as its gaining popularity in recent years due to its advantages in pets that cannot or refuse to take pills. This route serves as a local treatment of skin, transdermal delivery of therapeutic drugs, parasite controls, and other conditions. The topical drugs include ointments, gels, creams, pastes, dusting powders, and other semisolid based veterinary drugs. These are commonly used for conditions like skin infections, wound care, and dermatological disorders, which are prevalent among companion and farm animals. These formulations are easier to apply, reduce stress for animals compared to oral or injectable routes, and allow for targeted drug delivery directly to the affected area. In addition, advancements in compounding techniques and the increasing demand for customized topical medications, including those incorporating anti-inflammatory or antimicrobial agents, are driving growth in this segment.

Dosage Form Insights

Based on dosage form, the suspension segments led the market with the largest revenue share of 49.03% in 2024. Several veterinarians formulate drug suspensions to enhance the drug’s efficacy and shelf life as well as to increase patient compliance. When it's necessary for the material to be present in a finely divided form in the GI system or to administer insoluble or poorly soluble drugs, suspensions are known to be a useful method. In addition, most medications taste less detectable in suspension than in solution, making suspensions a commonly recommended dosage form in the compounding of animal medications.

The solutions segment is anticipated to grow at the fastest CAGR of over 8.92% during the forecast period. Compared to other dosage types, solutions have several benefits. Solutions are usually more GI mucosa-friendly than solid dosage forms as they are more quickly absorbed. In addition, unlike suspensions, phase separation during storing is not an issue with solutions. Thus, solutions are expected to gain popularity during the forecast period.

Regional Insights

North America animal drug compounding market dominated the global market with the largest revenue share of 40.51% in 2024. The presence of well-established compounding pharmacies such as Summit Veterinary Pharmacy Ltd., PETSCRIPTIONS.CA, Victoria Compounding Pharmacy, and others in countries like Canada have significantly contributed to the region's market growth. In addition, several strategic initiatives undertaken by t. For instance, in December 2024, Grey Wolf Animal Health Corp, a Toronto-based company, acquired the Compounding Pharmacy of Manitoba. By expanding its pharmacy business unit and increasing its capacity to serve both veterinary and human compounding markets, Grey Wolf enhances its ability to meet the growing demand for customized veterinary medications. This acquisition, along with Grey Wolf’s previous purchase of Trutina, allows the company to broaden its customer base and improve access to specialized compounded drugs for animals and fuel market growth.

U.S. Animal Drug Compounding Market Trends

The animal drug compounding market in the U.S. accounted for the largest revenue share in North America in 2024, due to consistent expansion by key players in the region. For instance, in December 2024, Covetrus, Inc. expanded its pharmaceutical compounding facility in Phoenix, Arizona. The company has nearly doubled its footprint and has adopted new facilities with modern, automated equipment to meet regulatory compliance and ensure the delivery of high-quality, customized treatments to a broader market. Covetous has significantly enhanced its ability to meet the growing demand for customized veterinary medications, offering a wide variety of flavor and dosage form options for both veterinarians and pet owners. With more centralized production, Covetrus can serve veterinary clinics and homes across the U.S., thus contributing to market growth.

Europe Animal Drug Compounding Market Trends

The animal drug compounding market in Europe was identified as a lucrative region, driven by several factors, including the increasing demand for personalized veterinary care and the need for tailored medications that address specific health conditions in animals. With a limited number of FDA or EMA-approved veterinary drugs for certain species or medical conditions, compounded drugs play a crucial role in providing effective alternatives. In addition, regulations within the European Union, such as the Veterinary Medicinal Products Regulation, support the safe use of compounded medications, ensuring that veterinary pharmacies maintain high standards of quality and safety, which helps build trust in compounded animal drugs. This regulatory environment, along with advancements in compounding technology, contributes to the expansion of the market.

The UK animal drug compounding market is experiencing growth driven by strategic partnerships and the introduction of innovative, life-saving treatments. For instance, in May 2024, Stokes Pharmacy and the Bova Group entered into a collaboration to offer a U.S.-made oral treatment for FIP. This treatment is now available in the UK, filling a gap in the market for effective, high-quality FIP medications that were previously unavailable. The growing demand for specialized treatments like GS-441524 tuna-flavored tablets, which are backed by clinical research, highlights the increasing reliance on compounded medications to address conditions that lack FDA-approved alternatives. As these treatments gain credibility, their availability strengthens the UK's market, providing veterinarians with reliable, scientifically-backed solutions and enhancing the standard of care for animals.

Asia Pacific Animal Drug Compounding Market Trends

The animal drug compounding market in Asia Pacific is anticipated to grow at the fastest CAGR of 10.34% during the forecast period, driven by growing investment by global players to expand their presence in this region. For instance, in November 2024, My Compounding Pharmacy expanded its services by introducing bespoke veterinary compounding services across major cities and regions in Australia. The pharmacy provides tailored solutions such as custom dosages, innovative delivery systems, and allergy-friendly formulations for a wide range of animal patients, including domestic pets, exotic animals, and livestock. This initiative demonstrates a commitment to bridge the gap in veterinary care for hard-to-treat cases and unique species. Such strategic expansions bolster market growth by meeting the rising demand for personalized and specialized animal health solutions, ensuring better compliance and treatment outcomes.

The Japan animal drug compounding market is anticipated to grow at a significant CAGR during the forecast period. The emergence of research studies and innovations related to potential veterinary treatment in Japan underscores a key market driver for the animal drug compounding industry in the region. For instance, research led by Dr. Okihiro Sase at the You-Me Animal Clinic in Japan demonstrated significant remission rates in FIP-affected cats treated with molnupiravir, with minimal side effects, marking a pivotal step in addressing this once-fatal condition. These findings spurred interest among global players, such as Wedgewood Pharmacy, to explore compounded formulations that align with such research outcomes. This growing focus on innovative treatments for niche veterinary conditions positions Japan as a hub for advancements in veterinary drug compounding and, thereby, propelling market growth.

Latin America Animal Drug Compounding Market Trends

The animal drug compounding market in Latin America is anticipated to grow at a substantial CAGR during the forecast period. The growing demand for customized veterinary treatments in Latin America is a significant driver for the market growth in the region. The increasing ownership of companion animals, coupled with rising awareness among pet owners about personalized care, has created a robust need for compounded medications tailored to specific species, conditions, and preferences. The veterinary compounding sector in Latin America benefits from a lack of widespread regulatory barriers compared to developed markets, enabling pharmacies to meet the diverse needs of veterinarians across urban and rural areas. This flexibility in addressing unmet medical needs not only enhances veterinary care standards but also positions the region as a growing market for global and local players in the compounding pharmacy space.

The Brazil animal drug compounding market is anticipated to grow at a significant CAGR during the forecast period, due to the country’s significant agricultural and livestock sectors, combined with the growing pet ownership trend. Brazil has one of the largest populations of companion animals globally, with a high demand for tailored veterinary medications that address specific needs, such as dosage adjustments and palatable formulations. The livestock industry, critical to Brazil’s economy, also drives the need for compounded medications to manage diseases and improve productivity in cattle, poultry, and swine.

MEA Animal Drug Compounding Market Trends

The animal drug compounding market in the Middle East and Africa is primarily driven by the region's growing focus on improving veterinary care for both livestock and companion animals. The Middle East's robust livestock industry, particularly in countries like Saudi Arabia and the UAE, underscores the need for customized medications to address region-specific challenges such as heat stress and endemic diseases. The market is poised for growth as governments and private entities invest in modernizing veterinary services.

The Saudi Arabia animal drug compounding market is fueled by the country’s significant investment in veterinary healthcare and its focus on ensuring the health of livestock and companion animals. As a major global player in the livestock and poultry sectors, Saudi Arabia emphasizes disease management and the prevention of outbreaks, creating a demand for customized medications tailored to the specific needs of animals in the region. In addition, the growing popularity of companion animals in urban areas has led to increased awareness among pet owners about the benefits of personalized veterinary treatments. These factors present substantial growth opportunities for compounding pharmacies in the coming years.

Key Animal Drug Compounding Company Insights

The market is relatively competitive and fragmented due to multiple small and large companies. Moreover, companies are increasingly adopting various strategies, such as mergers and acquisitions, geographic expansions, and product launches, to expand their market shares. Owing to constant research initiatives, this industry can be seen as moderate to high in innovation.

Key Animal Drug Compounding Companies:

The following are the leading companies in the animal drug compounding market. These companies collectively hold the largest market share and dictate industry trends.

- WEDGEWOOD PHARMACY

- Vimian

- Pharmaca.

- Akina Animal Health

- Triangle Compounding.

- Davis Islands Pharmacy and Compounding Lab

- Custom Med Compounding Pharmacy

- Central Compounding Center South

- Wellness Pharmacy of Cary

- Miller's Pharmacy

Recent Developments

-

In November 2024, My Compounding, a leading compounding pharmacy based in Brisbane, announced its nationwide expansion, offering personalized medication solutions across the country. This development positions the pharmacy as a key player in advancing customized healthcare for patients nationwide.

-

In May 2024, Mixlab acquired NexGen Animal Health and expanded its state-of-the-art compounding pharmacy services beyond companion animals into large animals. Mixlab plans to utilize its proprietary technology platform to enhance the pharmacy experience for large animal practitioners and owners while improving production efficiency and driving continued growth.

Animal Drug Compounding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.65 billion

Revenue forecast in 2030

USD 2.45 billion

Growth rate

CAGR of 8.29% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, route of administration, dosage form, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE and Kuwait.

Key companies profiled

WEDGEWOOD PHARMACY; Vimian; Pharmaca; Akina Animal Health; Triangle Compounding; Davis Islands Pharmacy and Compounding Lab; Custom Med Compounding Pharmacy; Central Compounding Center South; Wellness Pharmacy of Cary; Miller's Pharmacy

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Drug Compounding Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal drug compounding market report based on product, animal type, route of administration, dosage form, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-infective Agents

-

Anti-inflammatory Agents

-

Hormones & Substitutes

-

CNS Agents

-

Other Products

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animal

-

Dogs

-

Cats

-

Others

-

-

Livestock Animal

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

Other Routes

-

-

Dosage Form (Revenue, USD Million, 2018 - 2030)

-

Suspensions

-

Solutions

-

Capsules

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global animal drug compounding market size was estimated at USD 1.52 billion in 2024 and is expected to reach USD 1.65 billion in 2025.

b. The global animal drug compounding market is expected to grow at a compound annual growth rate (CAGR) of 8.29% from 2025 to 2030 to reach USD 2.45 billion by 2030.

b. North American region registered the highest market revenue share of about 40.51% in 2024 owing to growing pet ownership, implementing strategic initiatives by the key manufacturers, and the increasing product launches in the region.

b. Some key players operating in the global animal drug compounding market include WEDGEWOOD PHARMACY, Vimian, Pharmaca, Akina Animal Health, Triangle Compounding, Davis Islands Pharmacy and Compounding Lab, Custom Med Compounding Pharmacy, Central Compounding Center South, Wellness Pharmacy of Cary, Miller's Pharmacy.

b. The key factors driving the market growth include a rise in pet adoption, huge animal healthcare spending, increased pet owner awareness regarding specialty pharmaceuticals, the high cost of branded veterinary products, pet humanization trends, and increased demand for custom-made, compounded animal medications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.