- Home

- »

- Pharmaceuticals

- »

-

Amyloidosis Treatment Market Size, Industry Report, 2033GVR Report cover

![Amyloidosis Treatment Market Size, Share & Trends Report]()

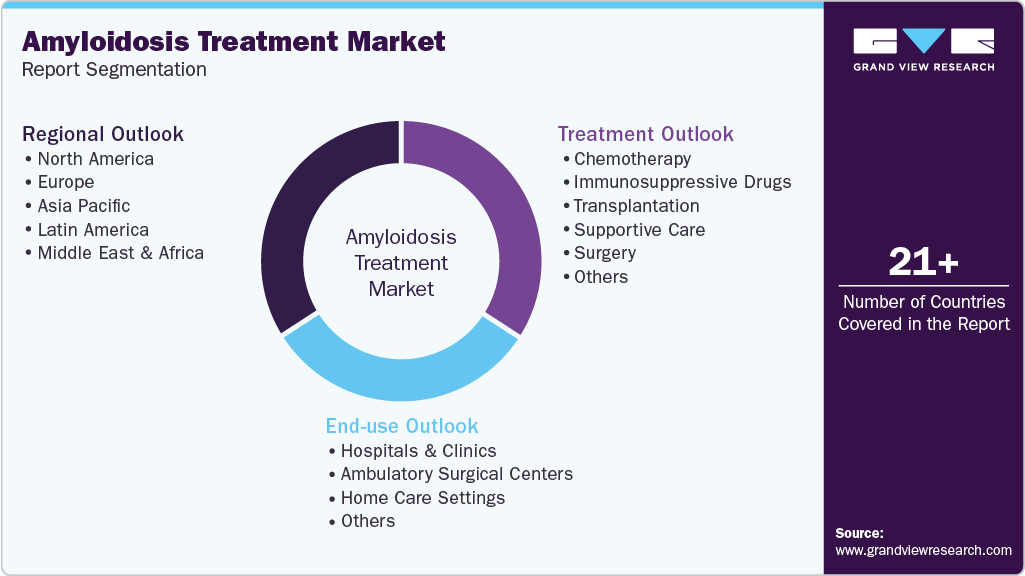

Amyloidosis Treatment Market (2025 - 2033) Size, Share & Trends Analysis Report By Treatment (Chemotherapy, Immunosuppressive Drugs, Transplantation, Supportive Care), By End Use ( Hospitals & Clinics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-443-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Amyloidosis Treatment Market Summary

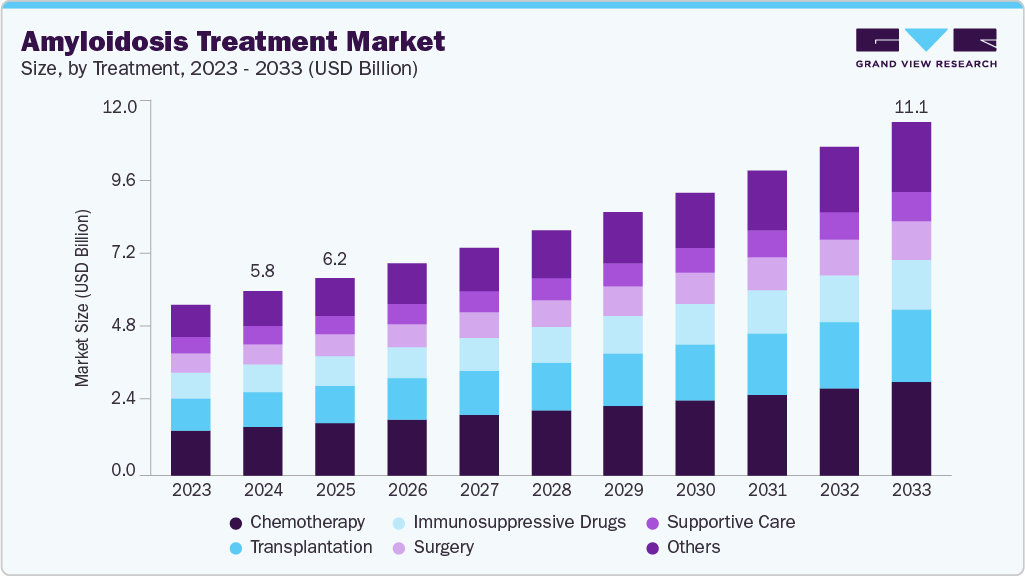

The global amyloidosis treatment market size was estimated at USD 5.80 billion in 2024 and is projected to reach USD 11.13 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The industry is experiencing growth due to rising awareness of the disease, advancements in diagnostic methods, and an increasing number of patients being identified at earlier stages with accurate diagnoses.

Key Market Trends & Insights

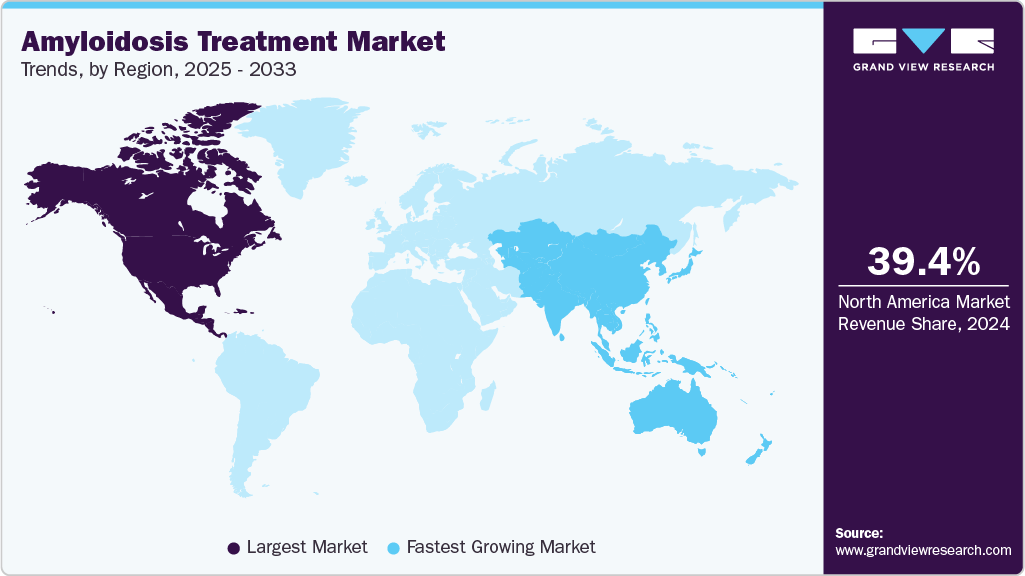

- North America amyloidosis treatment market held the largest share of 39.36% of the global market in 2024.

- The amyloidosis treatment industry in the U.S. is expected to grow significantly over the forecast period.

- By treatment, the chemotherapy segment held the highest market share of 26.5% in 2024.

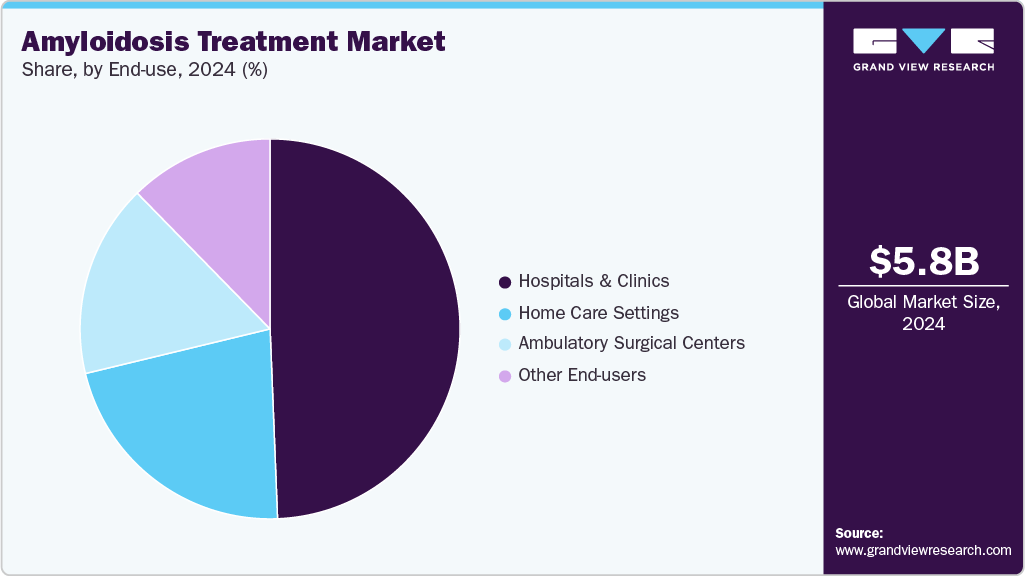

- By end use, the hospitals & clinics segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.80 Billion

- 2033 Projected Market Size: USD 11.13 Billion

- CAGR (2025-2033): 7.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Innovations such as advanced imaging, mass spectrometry, and genetic testing are allowing healthcare providers to better distinguish between amyloidosis subtypes, supporting more precise and effective treatment approaches. The establishment of specialized care centers and the availability of trained medical experts are further enhancing access to comprehensive care. Additionally, the growing incidence of age-related transthyretin amyloidosis, particularly among older populations, is driving demand for long-term therapeutic solutions. These factors are prompting pharmaceutical companies to expand their research pipelines, while the recognition of amyloidosis as a condition that can be effectively managed with timely treatment is transforming global patient care practices.One of the key drivers fueling the amyloidosis treatment market is the regulatory advancement of gene-silencing therapies for transthyretin amyloidosis. For instance, in March 2025, the U.S. FDA approved Amvuttra (vutrisiran) as the first gene-silencing therapy for transthyretin amyloid cardiomyopathy (ATTR-CM). The approval was backed by Phase III HELIOS-B trial results showing a 28% reduction in all-cause mortality and cardiovascular events. Patients also experienced notable improvements in functional capacity and quality of life. This advancement offers a new treatment pathway directly reducing TTR protein production with only four annual injections. The approval is expected to boost early diagnosis, expand RNA-based therapy adoption, and intensify competition in the ATTR-CM market.

The regulatory approval of highly effective small-molecule stabilizers targeting transthyretin amyloidosis is a major development boosting the amyloidosis treatment market. For instance , in December 2024, the U.S. FDA approved Attruby (acoramidis), a near-complete transthyretin (TTR) stabilizer developed by BridgeBio Pharma, for the treatment of transthyretin amyloid cardiomyopathy (ATTR-CM) (BridgeBio). Acoramidis demonstrated over 90% stabilization of TTR and significantly reduced cardiovascular death and hospitalizations in the pivotal ATTRibute-CM trial. The approval introduces a convenient oral alternative that expands treatment options beyond RNAi-based therapies and meets the needs of a broader patient base. It is expected to intensify market competition and accelerate innovation in ATTR-CM therapeutics. With improved efficacy, tolerability, and ease of administration, acoramidis is positioned to reshape treatment paradigms for newly diagnosed and long-term ATTR-CM patients.

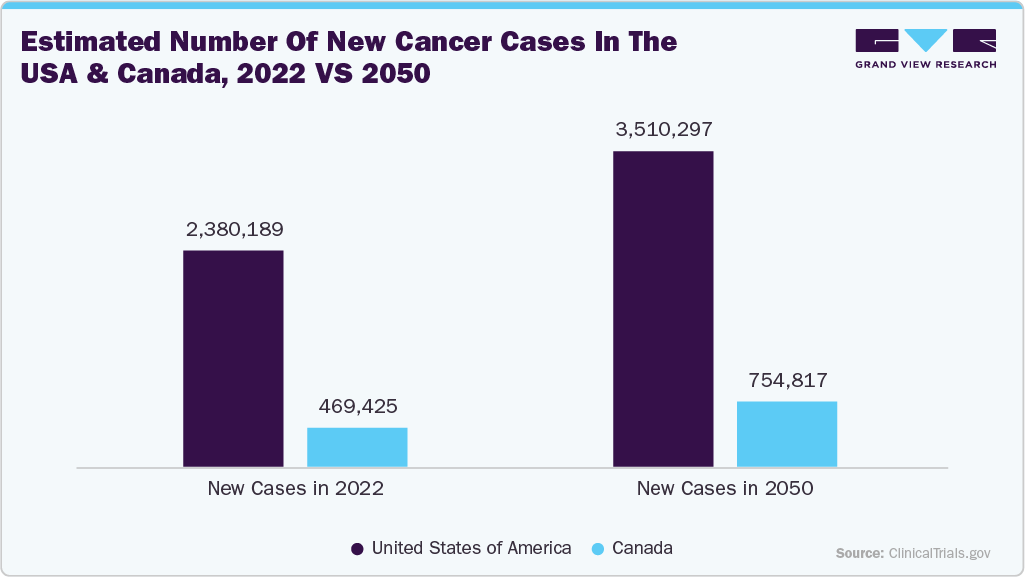

The projected surge in cancer cases, with the United States expected to see a 47.5% increase and Canada a 60.7% increase by 2050, the rising prevalence of chronic and complex diseases. This trend emphasizes the growing strain on healthcare systems, which in turn accelerates demand for advanced diagnostics and treatment solutions. Given that cancer and amyloidosis share overlapping clinical challenges such as organ dysfunction, protein misfolding, and systemic inflammation, the increase in cancer incidence indirectly raises awareness and identification of related conditions like amyloidosis. This linkage is likely to enhance patient screening, expand healthcare investments, and strengthen treatment infrastructure.

Consequently, the industry is expected to benefit from these dynamics as rising cancer prevalence fuels both clinical awareness and therapeutic innovation. With heightened demand for precision therapies, there will be an increased focus on monoclonal antibodies, targeted treatments, and supportive care solutions that address disease progression more effectively. Moreover, pharmaceutical companies and healthcare providers are likely to increase research funding and collaborations, leveraging advancements in oncology to accelerate drug development for amyloidosis. This synergy will position the amyloidosis market for significant growth in the coming decades.

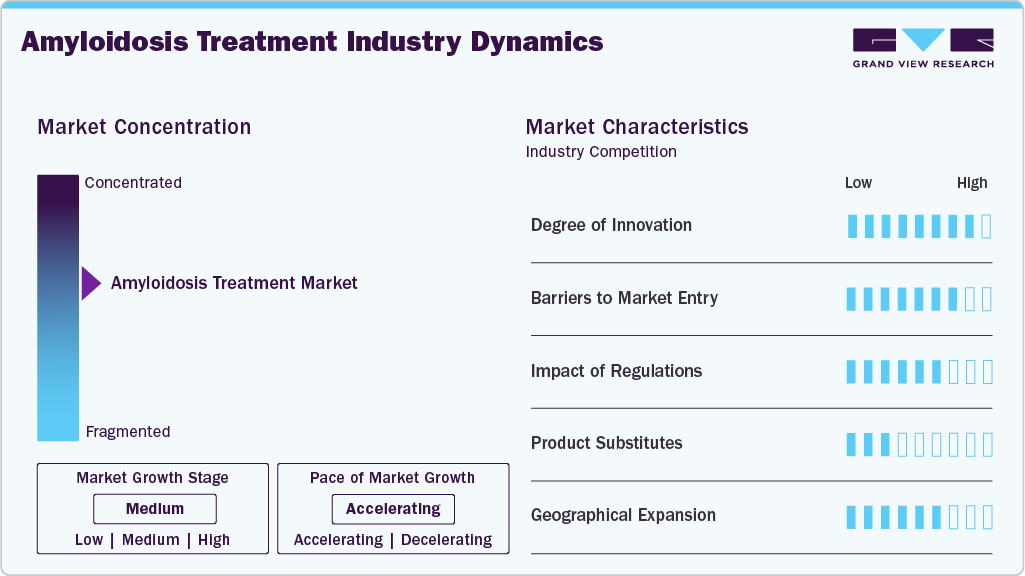

Market Concentration & Characteristics

The industry demonstrates high innovation, particularly with RNA-based therapeutics, monoclonal antibodies, and gene silencing techniques. Companies are prioritizing the development of disease-modifying drugs over traditional symptom management. Advances in diagnostics, including biomarker testing and AI-enhanced imaging, support personalized treatment strategies. Patents and orphan drug designations have further accelerated innovation across niche subtypes. Continued pipeline activity highlights a strong commitment to novel, targeted approaches.

Barriers to entry are significant due to high R&D costs, strict regulatory requirements, and the specialized nature of amyloidosis. Orphan drug development requires long clinical timelines and substantial financial resources. The dominance of key players with strong IP portfolios limits opportunities for new entrants. Disease rarity often constricts access to patient populations for clinical trials. Additionally, expertise in rare disease commercialization is necessary for sustained success.

Regulations have a mixed impact, offering incentives and hurdles in the market. Orphan drug frameworks provide market exclusivity, tax benefits, and expedited review pathways for eligible products. However, regulatory bodies impose rigorous safety and efficacy standards given the complexity of the condition. Global discrepancies in approval timelines and reimbursement policies can slow market access. Post-approval monitoring remains critical due to the long-term nature of treatment outcomes.

Product substitutes are limited, but supportive therapies such as corticosteroids, diuretics, or off-label use of multiple myeloma drugs may serve temporary roles. For specific subtypes, such as ATTR amyloidosis, tafamidis and siRNA-based treatments dominate with few close alternatives. Bone marrow transplantation can serve as a substitute for pharmacologic therapy in AL amyloidosis, though it is suitable only for select patients. Alternative medicine plays a negligible role due to disease severity. The low interchangeability between treatments strengthens brand loyalty for approved therapies.

Geographical expansion remains a key growth lever as companies target underdiagnosed regions in Asia, Latin America, and the Middle East. North America and Europe lead in diagnosis rates and drug access, driven by advanced healthcare systems. Emerging markets show untapped potential, but face limitations in diagnostics, specialist care, and affordability. Multinational firms are forming partnerships to expand distribution and clinical outreach in underserved areas. Regional awareness campaigns and infrastructure investments are gradually improving detection and treatment availability.

Treatment Insights

The chemotherapy segment dominated the market with the largest revenue share of 26.5% in 2024, driven by chemotherapy, which remained a primary treatment option in 2024 due to its established role in managing AL amyloidosis. It is widely used to target underlying plasma cell dyscrasias, offering effective disease control for eligible patients. For instance, in March 2024, Fred Hutchinson Cancer Center described that chemotherapy remained the cornerstone treatment for AL amyloidosis, with physicians administering agents such as bortezomib (Velcade), cyclophosphamide, and dexamethasone either intravenously, subcutaneously, or orally to destroy abnormal plasma cells.

The transplantation segment is projected to grow at the fastest CAGR of 8.5% over the forecast period, fueled by the anticipated rise in autologous stem cell transplantation, supported by improving patient selection and advancements in procedural safety. Greater access to transplant centers and experienced hematology teams has expanded the eligible patient pool. Long-term survival benefits and deep hematologic responses associated with transplantation are driving demand. Enhanced pre-transplant risk assessment tools have reduced complication rates and improved treatment outcomes. For instance, in April 2025, the American Journal of Hematology reported that optimized autologous stem cell transplantation protocols using full-dose melphalan and high CD34⁺ cell counts significantly improved survival in 1,704 AL amyloidosis patients. Rising awareness among specialists about its curative potential is influencing referral patterns, and as more patients are diagnosed early, transplantation adoption is expected to increase steadily across developed regions.

End Use Insights

The hospitals & clinics segment dominated the market with the largest revenue share of 49.37% in 2024, which can be attributed to hospitals and clinics serving as the primary hubs for diagnosis, treatment, and follow-up care for amyloidosis patients. These facilities are equipped with advanced diagnostic tools, specialized care teams, and supportive infrastructure for complex treatment protocols. Multidisciplinary care coordination, including hematology, cardiology, and nephrology, is centralized within hospital settings. For instance, in May 2025, Mayo Clinic reported that its Cardiac Amyloidosis Clinic operating across Arizona, Florida, and Minnesota managed over 2,500 amyloidosis patients annually, utilizing mass spectrometry-based proteomics, cardiac MRI, and integrated care teams across key specialties. Access to infusion therapies, transplantation services, and clinical trials is largely hospital-based. Reimbursement structures also favor treatment administration in hospital environments for rare diseases. This comprehensive care delivery model underpins the dominant revenue contribution of hospitals and clinics.

The home care settings segment is projected to grow at a fastest CAGR of 8.7% over the forecast period, as home care settings are gaining traction with the increasing availability of oral therapies and subcutaneous formulations for chronic management. Patients prefer at-home treatment options for comfort, convenience, and reduced risk of hospital-acquired infections. Digital health monitoring tools and remote consultation services support the shift toward decentralized care. Improvements in caregiver training and home-based nursing support have enhanced treatment adherence. As payers emphasize value-based care, home-based models are integrated into long-term management plans. This trend is expected to accelerate, particularly in regions with aging populations and rising chronic disease burdens.

Regional Insights

North America amyloidosis treatment market held the largest share of 39.36% in 2024, due to advanced diagnostic capabilities and access to specialized care centers. The high prevalence of systemic and light-chain amyloidosis is accelerating early diagnosis and long-term management. Pharmaceutical companies in the region are actively investing in precision therapies and conducting multiple late-stage clinical trials. Improved patient awareness and high insurance coverage rates support wider adoption of advanced treatment options. Market players are benefiting from streamlined regulatory pathways, allowing faster drug approvals. Ongoing expansion of RNA-based and monoclonal antibody therapies further enhances the market landscape.

U.S. Amyloidosis Treatment Market Trends

The amyloidosis treatment market in the U.S. holds the largest share in the North American region owing to its robust healthcare infrastructure and significant patient pool affected by hereditary and acquired forms of amyloidosis. The presence of major pharmaceutical firms such as Pfizer, Johnson & Johnson, and Alnylam enables faster commercial launch and patient outreach. Increasing clinical trial participation and academic collaboration encourage more rapid innovation in therapeutic approaches. Access to tertiary care centers and the use of advanced biomarkers contribute to early disease recognition. High treatment affordability due to widespread insurance coverage is improving access to novel therapies. Emerging RNA interference drugs are rapidly gaining traction in specialized care settings.

Europe Amyloidosis Treatment Market Trends

The amyloidosis treatment market in Europe is supported by rising clinical research and a growing base of treatment centers. Countries across the region are witnessing increased uptake of biologics and targeted agents for treating light-chain and transthyretin amyloidosis. Expanding diagnostic programs enables earlier identification of disease subtypes, leading to more precise interventions. The pharmaceutical ecosystem is strengthened by active participation in international clinical trials. Partnerships between regional hospitals and biotech firms accelerate access to advanced treatment protocols. Focusing on quality of life and outcome-based therapies guides long-term adoption trends.

The UK amyloidosis treatment market is driven by strong academic involvement and national health initiatives for rare disease management. Clinical experts are increasingly employing genetic testing and cardiac imaging for more accurate diagnosis of hereditary and wild-type ATTR. Local research centers like the National Amyloidosis Centre collaborate with global firms to support evidence-based treatment protocols. The growing adoption of tafamidis and RNA-targeted therapies is expanding patient therapeutic options. A well-organized referral system ensures timely specialist intervention and disease monitoring. Patient engagement initiatives are boosting trial enrollment and improving clinical awareness.

Germany is a key contributor to the European amyloidosis treatment market due to its advanced diagnostic infrastructure and strong focus on precision medicine. Regional hospitals are adopting integrated care models involving cardiologists, hematologists, and genetic counselors for better disease management. Pharmaceutical firms are introducing novel therapies through local partnerships and educational programs for clinicians. Rising awareness among primary care physicians enhances early-stage referrals and reduces diagnostic delays. The reimbursement environment supports the use of high-cost biologics and gene-silencing therapies. Innovation in imaging and laboratory testing facilitates broader disease stratification and treatment optimization.

The amyloidosis treatment market in France is witnessing steady growth as national research institutes and hospitals lead efforts in clinical innovation. Increasing diagnosis of transthyretin amyloidosis among older people is shaping demand for long-term therapy solutions. Collaboration with biotech companies is improving access to RNA-based and antibody-based therapeutics. Regional health networks are enhancing disease surveillance and expanding referral pathways for quicker patient onboarding. The development of multidisciplinary care centers is streamlining care delivery across regions. Focused physician education contributes to recognizing subtle disease symptoms in the early stages.

Asia Pacific Amyloidosis Treatment Market Trends

The amyloidosis treatment market in Asia Pacific is expected to register the fastest CAGR of 8.2% over the forecast period, due to growing healthcare infrastructure and a rising pool of undiagnosed patients. Expanding access to diagnostic tools such as mass spectrometry and cardiac MRI is increasing disease detection rates. Governments and private providers are enhancing specialty care access in urban and semi-urban areas. Local and international pharmaceutical firms are introducing therapies targeting both hereditary and age-related forms. Medical tourism is accelerating demand for advanced treatments among international patients. Educational programs raise awareness among primary care professionals about amyloidosis symptoms and treatment options.

Japan amyloidosis treatment market is growing as its aging population faces a higher incidence of wild-type ATTR and cardiac involvement. Healthcare institutions offer genetic counseling and biomarker testing to facilitate targeted therapy use. Domestic pharmaceutical companies are developing and marketing RNA-interference drugs and stabilizers with proven efficacy. Hospital networks are integrating care pathways for cardiology and neurology to manage complex cases efficiently. Clinical societies are setting diagnostic and treatment guidelines that align with international best practices. Government-certified centers of excellence are promoting consistency in diagnosis and long-term patient follow-up.

The amyloidosis treatment market in China is driven by higher disease awareness and healthcare modernization. Hospitals are adopting advanced pathology techniques and molecular diagnostics to improve case identification. Local biotech companies invest in innovative treatments and partner with global firms. Increasing access to tertiary care in metropolitan areas is facilitating specialized intervention. Clinical research is gaining momentum, supported by funding from private and academic sources. Demand for therapies targeting hereditary ATTR in regions with high genetic prevalence is rising.

Latin America Amyloidosis Treatment Market Trends

The amyloidosis treatment market in Latin America is growing due to expanding diagnostic capabilities and improved referral systems. Awareness campaigns and professional education are increasing the early identification of systemic amyloidosis subtypes. International collaborations are allowing faster entry of new therapies and diagnostics. Urban hospitals are starting to offer advanced care through integrated specialty clinics. Limited access in rural areas remains challenging, though mobile outreach and telemedicine are bridging gaps. Insurance penetration growth contributes to greater access to high-cost therapies across select urban markets.

Brazil amyloidosis treatment market is growing due to rising investments in rare disease research and a growing number of specialized clinics. The expansion of public-private collaborations facilitates early detection programs and patient registries. Physicians are increasingly trained in identifying multisystemic symptoms of amyloidosis, improving diagnosis accuracy. Novel therapies are entering the market through local distributors and clinical trial networks. Urban healthcare systems are leading the way in delivering complex treatment protocols involving monoclonal antibodies and gene therapies. Regional innovation hubs are supporting the development of local diagnostics and therapeutic solutions.

Middle East & Africa Amyloidosis Treatment Market Trends

The amyloidosis treatment market in the MEA region is fueled by increased investment in diagnostic capabilities and tertiary care. Countries are adopting teleconsultation platforms and centralized referral networks to support patient navigation. Multinational pharmaceutical firms are expanding operations in high-potential markets with unmet needs. Limited awareness is being addressed through targeted training programs for healthcare providers. Research centers in key regions are beginning to collaborate on rare disease identification and therapeutic innovation. Rising private healthcare expenditure is enabling more patients to access novel amyloidosis therapies.

Saudi Arabia amyloidosis treatment market is making notable progress by establishing rare disease programs in major hospitals. Advances in cardiac imaging and biopsy-based diagnostics enhance the detection of ATTR and AL amyloidosis. The country focuses on workforce training to build expertise in managing multisystemic disorders. Partnerships with global firms are facilitating access to innovative therapies and clinical trial opportunities. Demand is increasing for RNA-based therapies supported by rising diagnostic accuracy and patient education. Regional centers in the GCC region are evolving into referral hubs for amyloidosis care.

Key Amyloidosis Treatment Companies Insights

Key players operating in the amyloidosis treatment market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Amyloidosis Treatment Companies:

The following are the leading companies in the amyloidosis treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- GSK plc

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Bristol-Myers Squibb Company

- Novartis AG

- F. Hoffmann-La Roche Ltd

- Merck KGaA

- Sanofi

- Alnylam Pharmaceuticals, Inc.

Recent Developments

-

In June 2025, Alnylam Pharmaceuticals secured European Commission approval for AMVUTTRA (vutrisiran) for the treatment of adult patients with both hereditary and wild-type ATTR amyloidosis with cardiomyopathy. This decision followed results from the HELIOS-B Phase 3 study, which demonstrated notable reductions in overall mortality and repeated cardiovascular complications.

-

In May 2025, Johnson & Johnson reported that JNJ‑79635322 achieved an 86.1% overall response rate in a Phase 1 trial (NCT05652335) among 36 heavily pretreated patients, including 100% ORR in BCMA/GPRC5D‑naïve cases. The trispecific antibody showed a manageable safety profile with no Grade 3+ cytokine release or oral toxicities at the recommended dose.

-

In January 2024, Ultromics partnered with Pfizer to accelerate the development and FDA clearance of EchoGo Amyloidosis, an AI tool that uses a single echocardiogram view to detect cardiac amyloidosis early. The algorithm, granted Breakthrough Device Designation, aims to support faster diagnosis and earlier treatment initiation in clinical practice.

Amyloidosis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.23 billion

Revenue forecast in 2033

USD 11.13 billion

Growth rate

CAGR of 7.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Treatment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Pfizer Inc.; Johnson & Johnson Services, Inc.; GSK plc; Takeda Pharmaceutical Company Limited; Amgen Inc.; Bristol-Myers Squibb Company; Novartis AG; F. Hoffmann-La Roche Ltd; Merck KGaA; Sanofi; Alnylam Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Amyloidosis Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global amyloidosis treatment market report based on treatment, end-use, and region:

-

Treatment Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemotherapy

-

Immunosuppressive Drugs

-

Transplantation

-

Supportive Care

-

Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global amyloidosis treatment market size was estimated at USD 5.80 billion in 2024 and is projected to reach USD 11.13 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033.

b. The global amyloidosis treatment market is projected to grow at a CAGR of 7.5% from 2025 to 2033 to reach USD 11.13 billion by 2033.

b. Based on treatment, chemotherapy segment dominated the market with the largest revenue share of 26.5% in 2024, driven by chemotherapy, which remained a primary treatment option in 2024 due to its established role in managing AL amyloidosis.

b. Some key players operating in the amyloidosis treatment market include Pfizer Inc., Johnson & Johnson, Services, Inc., GSK plc, Takeda Pharmaceutical Company Limited, Amgen Inc., Bristol-Myers Squibb Company, Novartis AG, F. Hoffmann-La Roche Ltd, Merck KGaA, Sanofi, Alnylam Pharmaceuticals, Inc.

b. Key factors that are driving market growth include innovations such as advanced imaging, mass spectrometry, and genetic testing allowing healthcare providers to better distinguish between amyloidosis subtypes, supporting more precise and effective treatment approaches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.