- Home

- »

- Organic Chemicals

- »

-

Aminoethylethanolamine Market Size, Industry Report, 2030GVR Report cover

![Aminoethylethanolamine Market Size, Share & Trends Report]()

Aminoethylethanolamine Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (>99%, <99%), By Application (Cheating Agents, Surfactants, Textile Additives, Fabric Softeners), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68038-636-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aminoethylethanolamine Market Trends

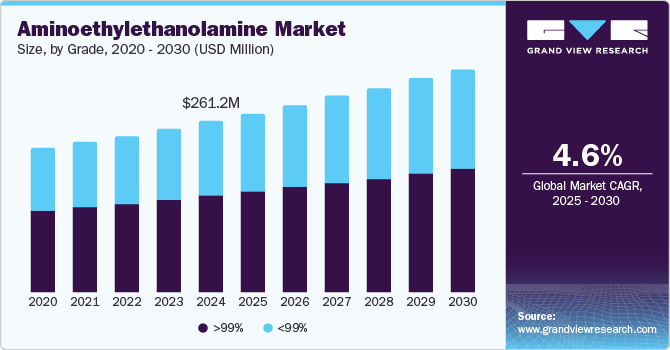

The global aminoethylethanolamine market was valued at USD 261.2 million in 2024 and is projected to grow at a CAGR of 4.6% from 2025 to 2030. Rising demand for cleaner agents and detergents is projected to be a key driving factor for the market. Chelating agents react with metal ions to form a water-soluble complex. In water, minerals such as calcium and magnesium are a persistent issue globally. Hence, cleaner & detergent manufacturers continuously focus on developing formulations to reduce the deposition of these minerals on different surfaces, such as clothes or appliances. In hard water, soap & detergent formulation reacts with magnesium and calcium salts to form a scum that is insoluble in water.

The chelating agents form water-soluble metal complexes that help form more lather and reduce surface tension. Amino Ethyl Ethanol Amine (AEEA) is used as a chelating agent as it comprises a primary and secondary amine group that can be used to form metal complexes. It replaces chemicals such as phosphonates and citric acid as prospective chelating agents. Detergents and household cleaners have had significant demand in the past few years. Changing consumer habits, such as adopting online channels to purchase household products, have assisted the market growth. The demand for household cleaning products is higher in the U.S., China, and Japan due to the rising population and general awareness about personal hygiene.

Consumers in emerging economies such as India, Indonesia, the Philippines, Argentina, and Vietnam are adopting a similar trend. As most high-growth markets are present in Asia, manufacturers are expected to invest more in the region over the coming years. Private-label products are expected to assist in the market growth of chelating agents as their volumetric consumption is increasing rapidly in emerging economies.

The demand for chelating agents is expected to grow synonymously with detergents as they have become an indispensable component of detergent formulations. Water quality degradation in emerging economies due to heavy industrialization is expected to benefit market growth. The rising adoption of a healthy lifestyle and increased penetration of online distribution channels will boost the demand further as more detergents will be produced to meet the increasing demand.

Drivers, Opportunities & Restraints

As a key raw material in the manufacturing of emulsifiers and corrosion inhibitors, AEEA's demand is increasing in industries such as agriculture, automotive, and coatings. The rise of industrialization and urbanization, particularly in emerging markets, is boosting the demand for these products, further driving the market. Additionally, the versatility of AEEA in producing a range of chemicals like detergents, textiles, and coatings makes it an attractive compound for various end-use industries.

The increasing demand for environmentally friendly and bio-based products presents an opportunity for the development of sustainable AEEA variants. Additionally, as global demand for cleaning and personal care products rises, particularly in Asia-Pacific, the market for AEEA-based surfactants and emulsifiers is expected to expand. Moreover, the growing trend of technological advancements in chemical manufacturing processes can produce AEEA with better performance characteristics, opening new application areas in industries such as pharmaceuticals and agrochemicals. These opportunities are likely to propel market growth in the coming years.

One significant challenge is the fluctuating prices of raw materials, particularly ethanolamine, from which aminoethylethanolamine is derived. These price variations can impact on the overall cost structure, leading to uncertainty in the market. Moreover, the growing concern over environmental regulations and the potential health risks associated with certain chemicals used in AEEA production could limit its usage in specific applications. These factors may prompt industries to seek safer or more cost-effective alternatives, restricting the market's expansion.

Grade Insights

The >99% segment accounted for the largest revenue market share, 55.8%, in 2024. This high share is attributable to the wider application of the grade type across various end-use industries. Aminoethylethanolamine is used in multiple industries due to its properties, such as low vapor pressure, versatility, and high viscosity. Companies such as Dow Chemical, Nouryon, Prasol Chemicals, and Huntsman Corp. are some of the leading producers of <99% and >99% purity grade AEEA products.

<99% is expected to register the fastest CAGR of 4.8% over the forecast period. AEEA, with a purity of less than 99%, is often used to formulate low-cost surfactants that serve as key components in cleaning products. These surfactants are critical in everyday household and industrial cleaning, driving the demand for <99% grade AEEA. The cost-effective nature of this grade makes it an attractive option for manufacturers seeking to optimize their production processes while keeping costs competitive.

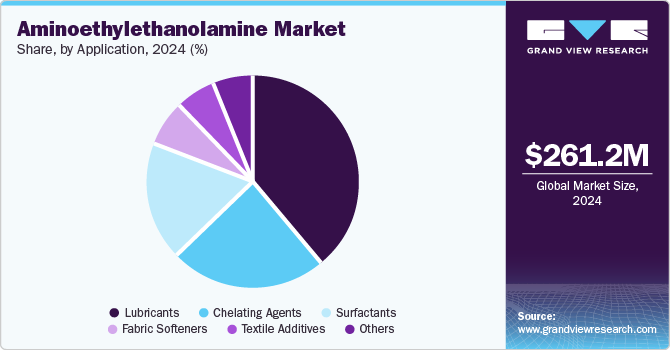

Application Insights

The lubricants segment dominated the market with a market share of 38.9% in 2024. Aminoethylethanolamine, a versatile chemical compound, is a key ingredient in the formulation of advanced lubricants due to its ability to improve the final product's stability, viscosity, and performance. The automotive industry is a major consumer of lubricants, and the growing production and sales of vehicles, including electric vehicles (EVs), are driving the demand for specialized lubricants with enhanced properties, which in turn fuels the use of AEEA in lubricant formulations.

Chelating Agents is anticipated to register the fastest CAGR of 5.2% over the forecast period. Chelating agents, which are chemicals capable of forming stable complexes with metal ions, are essential in numerous applications, such as preventing scale formation in water systems, enhancing agricultural productivity, and improving the stability of pharmaceutical formulations. As industrialization and urbanization grow, the need for effective water treatment solutions and agricultural chemicals, which often rely on chelating agents, expands, fueling the demand for AEEA-based products.

Regional Insights

With North America's robust manufacturing capabilities and significant demand for cleaning solutions, the need for AEEA as a chemical building block is anticipated to expand. The rising awareness of hygiene and cleanliness, especially post-pandemic, has further accelerated the demand for cleaning products, thus boosting the AEEA market.

U.S. Aminoethylethanolamine Market Trends

The ongoing advancements in the construction and oil and gas industries drive the demand for AEEA in the U.S. AEEA is used to produce epoxy resins, commonly employed in coatings, paints, and adhesives for commercial and residential buildings. These industries require high-performance materials that provide corrosion protection, durability, and aesthetic finishes. Additionally, expanding infrastructure projects and energy exploration activities in the U.S. has steadily increased AEEA consumption within these sectors.

Asia Pacific Aminoethylethanolamine Market Trends

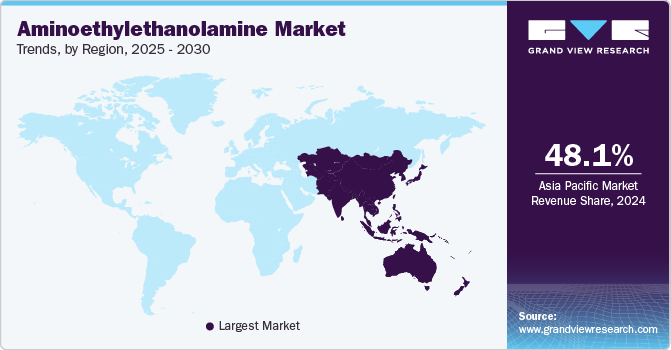

Asia Pacific aminoethylethanolamine market dominated the global market and accounted for the largest revenue share of 48.1% in 2024 and is anticipated to register the fastest CAGR over the forecast period. AEEA is widely used as a precursor for synthesizing surfactants essential in detergents, cosmetics, and cleaning products. As disposable incomes rise and the middle class expands in countries such as China, India, and Southeast Asia, the demand for consumer products such as personal care items and home cleaning solutions has surged, directly contributing to the growth of AEEA consumption.

Europe Aminoethylethanolamine Market Trends

Aminoethylethanolamine is essential in formulating various drugs, particularly in producing active pharmaceutical ingredients (APIs). The increasing prevalence of chronic diseases, an aging population, and rising healthcare spending in countries such as Germany, the UK, and France fuel the demand for AEEA in the pharmaceutical market, making it one of the key growth drivers for the product in Europe.

Latin America Aminoethylethanolamine Market Trends

Countries such as Brazil, Mexico, and Argentina are witnessing a surge in industrial activity where AEEA is used to produce emulsifiers, surfactants, and corrosion inhibitors. These chemicals play a critical role in enhancing the performance of products in various applications, such as coatings, cleaning agents, and lubricants. The ongoing industrialization and infrastructure development projects in Latin America are expected to continue boosting the demand for AEEA as companies strive for higher performance and better product protection.

Middle East Aminoethylethanolamine Market Trends

The Middle East and Africa aminoethylethanolamine market is expected to grow significantly over the forecast period. The Middle East is a global leader in oil production, and the demand for AEEA is strongly linked to its use as a corrosion inhibitor and stabilizer in the oil and gas sector. As the demand for oil and gas increases, so does the need for high-performance chemicals like AEEA to safeguard assets and enhance operational efficiency, fueling market growth in the region.

Key Aminoethylethanolamine Company Insights

Some of the key players operating in the market include AkzoNobel, Ashland, and Dow Inc.

-

AkzoNobel offers high-purity AEEA products, primarily used as chelating agents and additives in various applications, including latex paints and lubricants. With a commitment to sustainability and innovation, AkzoNobel focuses on developing solutions that enhance product performance while minimizing environmental impact.

-

Ashland Inc. is a global company in specialty chemicals, providing innovative solutions across various industries, including personal care, pharmaceuticals, and industrial applications. Ashland offers high-purity AEEA products that serve as effective chelating agents and additives. These products are essential in formulating cleaners and detergents, where they help mitigate the effects of hard water by forming water-soluble complexes with metal ions such as calcium and magnesium.

Key Aminoethylethanolamine Companies:

The following are the leading companies in the aminoethylethanolamine market. These companies collectively hold the largest market share and dictate industry trends.

- AkzoNobel

- Ashland

- Dow Inc.

- Huntsman International

- TCI Chemicals Ltd.

- Tosoh Corporation

Aminoethylethanolamine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 273.8 million

Revenue forecast in 2030

USD 342.6 million

Growth Rate

CAGR of 4.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million, volume in kilotons and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Spain; France; Italy; Russia; The Netherlands; China; India; Japan; South Korea; Australia; Indonesia; Malaysia; Philippines; Thailand; Vietnam; Brazil; Argentina; Turkey; Egypt; Iran; UAE; Saudi Arabia; South Africa

Key companies profiled

AkzoNobel; Ashland; Dow, Inc.; Huntsman International; TCI Chemicals Ltd.; Tosoh Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

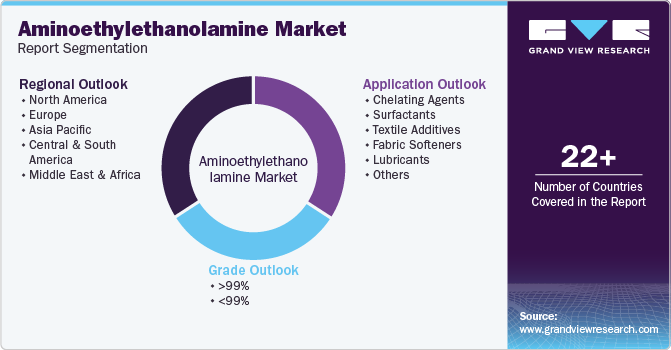

Global Aminoethylethanolamine Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global aminoethylethanolamine market report on the basis of grade, application, and region.

-

Grade Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

>99%

-

<99%

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Chelating Agents

-

Surfactants

-

Textile Additives

-

Fabric Softeners

-

Lubricants

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Malaysia

-

Philippines

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Turkey

-

Egypt

-

Iran

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aminoethylethanolamine market size was estimated at USD 261.2 million in 2024 and is expected to reach USD 273.7 million in 2025.

b. The aminoethylethanolamine market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 342.6 million by 2030.

b. Asia Pacific dominated the aminoethylethanolamine market with a share of 48.1% in 2024. This is attributable to the rising end-use industries such as textiles, lubricants and more across countries such as China, Indonesia, Japan, India, and Thailand and increasing intervention of multinationals in the region due to easy availability of raw materials and skilled labor.

b. Some key players operating in the aminoethylethanolamine market include AkzoNobel, Ashland, Dow Inc., Huntsman International, TCI Chemicals Ltd., and Tosoh Corporation.

b. Key factors that are driving the market growth include rising demand for polyurethane products as well as increasing consumption of chelating agents in detergents and cleaning products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.