- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Foil Market Size And Share, Industry Report, 2033GVR Report cover

![Aluminum Foil Market Size, Share & Trends Report]()

Aluminum Foil Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Wrapper Foils, Container Foils, Foil Lids, Pouches, Blister Packs), By End-use (Packaging, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-661-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aluminum Foil Market Summary

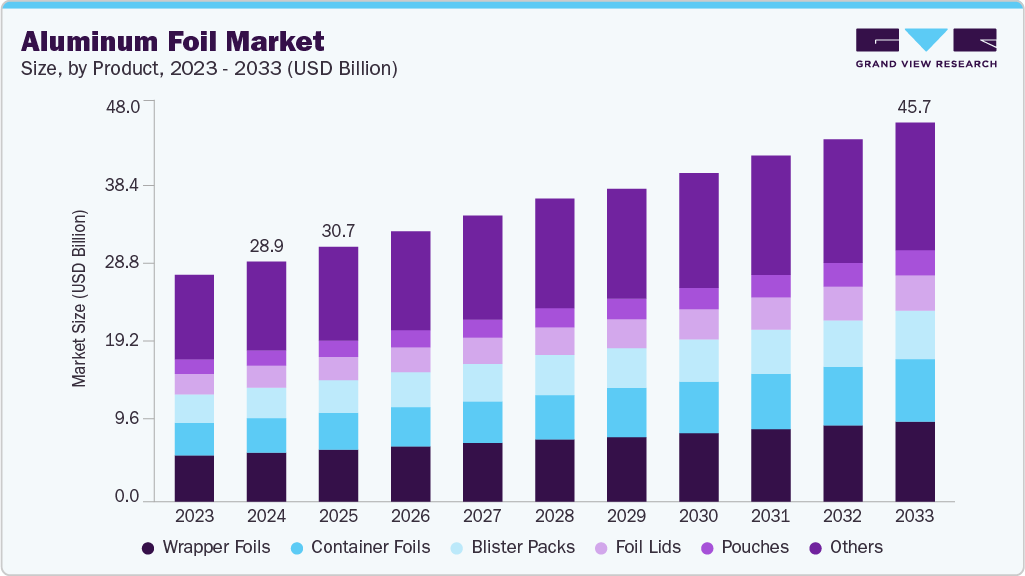

The global aluminum foil market size was estimated at USD 28.93 billion in 2024 and is projected to reach USD 45.67 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. As more people lead busy lives, especially in urban areas, they prefer ready-to-eat meals or packaged snacks that are easy to carry and store.

Key Market Trends & Insights

- Asia Pacific dominated the aluminum foil market with the largest market revenue share of 55.0%.

- The aluminum foil market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, wrapper foils segment led the market with the largest revenue share of 20.4% in 2024.

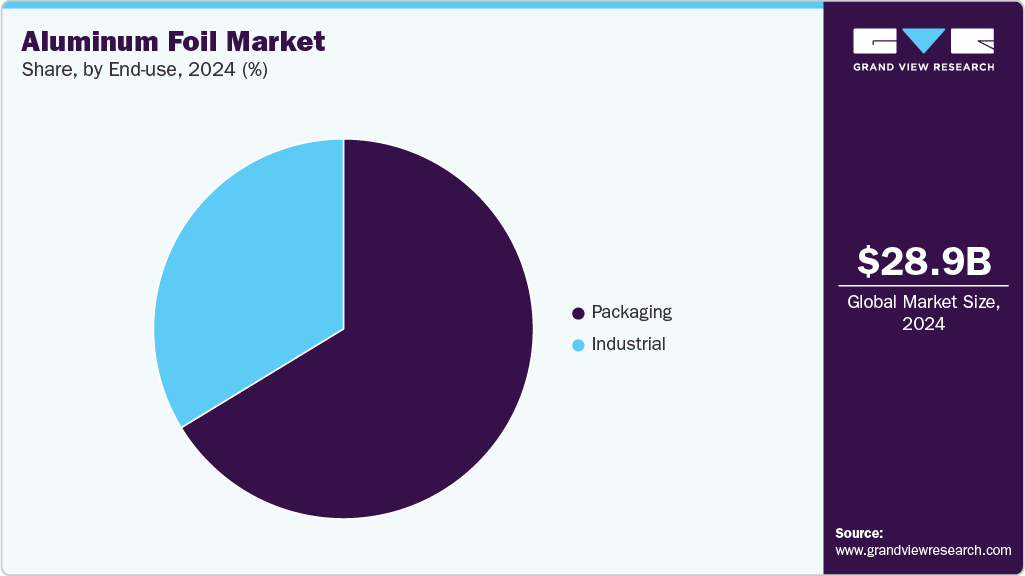

- By end use, the packaging segment led the market with the largest revenue share of % in 2024..

Market Size & Forecast

- 2024 Market Size: USD 28.93 Billion

- 2033 Projected Market Size: USD 45.67 Billion

- CAGR (2025-2033): 5.1%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

Aluminum foil is widely used to wrap and seal these products because it keeps food fresh by protecting it from light, moisture, and air. For example, chocolate bars, instant noodles, and dairy products like butter and cheese are often packed in aluminum foil. In countries like India and China, the shift toward convenience foods due to changing lifestyles has significantly increased aluminum foil usage in the food packaging.Aluminum foil is commonly used in blister packs and strip packs for tablets and capsules, helping to shield medicines from contamination and environmental exposure. This is particularly important in countries with strict pharmaceutical safety regulations, such as the United States and Germany. The growth of the healthcare sector, fueled by an aging population and rising healthcare awareness, has significantly boosted the use of aluminum foil. A clear example was during the COVID-19 pandemic, when the surge in demand for medications and vaccines led to increased production and use of foil-based packaging materials to ensure safe storage and delivery.

Environmental concerns are also pushing the market forward, as aluminum foil is considered a more sustainable alternative to plastic. Unlike many plastic materials, aluminum foil is fully recyclable and can be reused repeatedly without losing its quality. This makes it an attractive choice for companies aiming to reduce their environmental footprint. In Europe and North America, where environmental regulations are stricter and consumer awareness is high, businesses are switching from plastic to foil packaging. For instance, some supermarkets in Germany and the UK have replaced plastic food trays with aluminum foil trays to support their sustainability goals, leading to higher demand for recyclable packaging materials.

Technological advancements in aluminum foil production have further fueled market growth. Modern manufacturing processes allow companies to create thinner, stronger, and more versatile foil that can be used in various industries. This includes multilayered foil for liquids like juices, high-barrier foil pouches for pet foods, and decorative foil wraps for cosmetics and premium chocolates. Some companies now offer foil with embossed logos or colored finishes to enhance product appeal. These innovations not only improve the functionality of the foil but also help brands stand out on the shelves, expanding the use of aluminum foil beyond traditional food applications.

Furthermore, the rapid growth of e-commerce and food delivery services has boosted demand for aluminum foil, especially for takeout packaging. Online food ordering through platforms like Swiggy, Zomato, Uber Eats, and DoorDash has increased the need for packaging to keep food warm, prevent leaks, and handle long delivery times. Aluminum foil containers are ideal, so restaurants, bakeries, and cloud kitchens rely heavily on them. During the pandemic, this demand surged as people avoided dining out and ordered meals at home, and this habit has continued in many parts of the world. As the online food industry grows, so does the need for practical and hygienic packaging solutions like aluminum foil.

Drivers, Opportunities & Restraints

As urbanization increases and lifestyles become more fast-paced, particularly in emerging economies like India, Brazil, and Southeast Asia, consumers rely more on ready-to-eat and packaged food items. Aluminum foil provides an effective barrier against moisture, oxygen, and light, making it ideal for food preservation. Similarly, the pharmaceutical sector is boosting demand due to the use of foil in blister packs and strip packaging, which helps maintain drug safety and shelf life. The growth in global healthcare spending and drug production, particularly in developed markets like the U.S. and Germany, further strengthens the market outlook.

One of the biggest opportunities lies in the global shift toward sustainable and recyclable packaging materials. With rising environmental awareness and tightening regulations on single-use plastics, aluminum foil is increasingly viewed as a viable alternative due to its 100% recyclability. Food service, retail, and personal care brands are turning to aluminum foil-based packaging to meet their sustainability goals. In addition, ongoing innovations in foil manufacturing, such as ultra-thin laminates, embossed designs, and multi-layer foils, are opening up new applications in electronics, construction insulation, and premium product packaging. The growing popularity of online food delivery and cloud kitchens also creates a significant opportunity, as aluminum foil containers are widely used for hot and secure meal packaging.

However, the market faces several restraints that could limit growth. One major challenge is the volatility in raw material prices, particularly aluminum, which is influenced by global trade policies, energy costs, and supply chain disruptions. Rising production costs can affect the pricing and profitability of foil manufacturers.

Product Insights

The wrapper foils segment led the market with the largest market revenue share of 20.4% in 2024. The wrapper foil is widely used for packaging chocolates, candies, chewing gum, and bakery products because it offers excellent barrier protection against moisture, light, and odors. This helps preserve product freshness and extend shelf life. In emerging economies like India, Indonesia, and Mexico, rising disposable incomes and Westernized eating habits are increasing the consumption of packaged sweets and snacks, thereby fueling the demand for wrapper foils.

The container foils segment is anticipated to register at the fastest CAGR over the forecast period. The growth of retail-ready meal offerings in supermarkets and hypermarkets contributes significantly to the rising demand for aluminum container foils. These foil containers are used extensively for packaging pre-cooked and frozen meals that can be directly heated in ovens or microwaves, offering convenience to consumers with busy lifestyles. Ready-meal brands such as Stouffer’s, Amy’s Kitchen, and Tesco have adopted foil containers for various dishes, including lasagna, casseroles, and baked desserts. The packaging extends shelf life and adds value by being both cook- and serve-friendly. This shift in consumer behavior towards easy-to-prepare meal options has directly increased the uptake of aluminum container foils in the retail segment.

End-use Insights

The packaging segment led the market with the largest revenue share of 66.3% in 2024. The aluminum foil is widely used in primary and secondary packaging because of its excellent barrier properties that protect contents from moisture, light, oxygen, and bacteria. In the food industry, it is used to wrap snacks, chocolates, bakery items, dairy products, and ready-to-eat meals, ensuring extended shelf life and freshness. For instance, popular brands like Nestlé and Mondelez use foil to package chocolate bars and confectionery. In the pharmaceutical sector, foil is preferred for blister packs and sachets, particularly for tablets, capsules, and powders, offering product safety and compliance with hygiene regulations. These essential roles in product protection and shelf-life enhancement make aluminum foil a critical material in the global packaging ecosystem.

The industrial segment is anticipated to grow at the fastest CAGR over the forecast period. Aluminum foil plays a critical role as a key component in electric vehicle (EV) manufacturing, particularly in lithium-ion battery cells. It is commonly used as a current collector for heat dissipation layers, enabling efficient energy flow and thermal management. As EV adoption accelerates, the demand for high-performance aluminum foils has increased significantly. In 2024, global EV sales reached 17.1 million units, marking a 25% growth from the previous year. China alone accounted for around 11 million units, highlighting its EV production and consumption dominance. This surge in EV output drives the need for ultra-thin, highly conductive aluminum foils that can withstand thermal stress, support high energy densities, and meet strict safety and performance standards.

Regional Insights

The North America aluminum foil market is primarily driven by the strong demand from the food and beverage industry. Consumers in the U.S. and Canada increasingly opt for ready-to-eat meals, frozen foods, and convenient packaging formats, all of which rely heavily on aluminum foil for its barrier properties and heat resistance. The rise of e-commerce grocery platforms and food delivery services has also fueled the need for efficient and durable packaging materials, further supporting aluminum foil consumption. Additionally, growing awareness of sustainable and recyclable packaging options prompts manufacturers to replace plastic-based materials with aluminum foil.

U.S. Aluminum Foil Market Trends

The aluminum foil market in the U.S. accounted for the largest market revenue share in North America in 2024. As the U.S. accelerates its domestic EV production and battery manufacturing under government initiatives, demand for aluminum foil used in battery components like current collectors is increasing. In addition, sectors such as HVAC and pharmaceuticals are also adopting foil for insulation and blister packaging due to its excellent thermal conductivity and protective properties. The impact of trade policies, such as import tariffs on aluminum, has also stimulated domestic production, further fueling investments and capacity expansions in the U.S. market.

Asia Pacific Aluminum Foil Market Trends

Asia Pacific dominated the aluminum foil market with the largest revenue share of 55.0% in 2024, primarily driven by the expanding packaging sector. Rapid urbanization and a growing middle-class population in countries like China, India, and Southeast Asia have led to a surge in demand for packaged food, beverages, and pharmaceuticals. Aluminum foil is extensively used in flexible packaging due to its excellent barrier properties, lightweight nature, and recyclability. Additionally, rising health awareness and the need for hygienic packaging are prompting food and pharma manufacturers to adopt foil-based solutions for better shelf life and protection from contamination.

Europe Aluminum Foil Market Trends

The aluminum foil market in Europe is primarily driven by the rising demand for sustainable and hygienic packaging, especially in the food and pharmaceutical sectors. European consumers are increasingly prioritizing eco-friendly packaging options, and aluminum foil, being lightweight, fully recyclable, and an excellent barrier against moisture, air, and light, fits well within this trend. The EU's stringent regulations on packaging waste and recyclability further push manufacturers to shift from plastic to aluminum-based packaging. In the pharmaceutical industry, foil is used extensively in blister packs and strip packaging due to its protective qualities and compatibility with automated filling lines. Countries like Germany, Italy, and France are among the largest consumers, given their well-established food processing and healthcare sectors.

Latin America Aluminum Foil Market Trends

The aluminum foil market in Latin America is primarily driven by robust demand from the food sector, which remains the region's largest consumer of aluminum foils. Growing urbanization, rising per capita disposable incomes, and evolving dietary habits contribute to increased consumption of packaged and convenient food products. This surge in food industry activity has led to higher utilization of aluminum foil for packaging, offering benefits such as extended shelf life and improved food safety.

Middle East & Africa Aluminum Foil Market Trends

The aluminum foil market in the Middle East & Africa is anticipated to grow at the fastest CAGR during the forecast period. Governments in the Gulf Cooperation Council (GCC) countries are investing in downstream aluminum industries as part of their national strategies. For instance, the presence of major primary aluminum producers like Emirates Global Aluminium (EGA) and Ma’aden in Saudi Arabia has led to the development of local foil rolling and conversion facilities. These initiatives support domestic supply and aim to make the region a net exporter of value-added aluminum products, including foils used in packaging, insulation, and industrial applications across neighboring African and Asian markets.

Key Aluminum Foil Company Insights

Some of the key players operating in the market include Amcor, Eurofoil, and others

-

Amcor is a global leader in packaging solutions, headquartered in Zurich, Switzerland, with operations in over 40 countries. The company provides various packaging products for industries such as food and beverage, healthcare, personal care, and home care. Amcor is known for its focus on innovation, sustainability, and recyclable packaging materials. Amcor offers specialized foil-based packaging primarily for the food and pharmaceutical industries. Its aluminum foils are used for blister packaging, sachets, and pouches, particularly when moisture and oxygen barriers are critical. Amcor’s foil products are designed to meet strict regulatory standards, especially in the medical and pharma sectors, where product protection and shelf stability are essential.

-

Eurofoil is a prominent European manufacturer specializing in aluminum foil products, with production facilities in Luxembourg and France. The company is part of the AL INVEST Bridgnorth Group and has a strong presence in the European market. Eurofoil’s aluminum foil portfolio includes various thicknesses and formats for food packaging, pharmaceutical wrapping, and technical applications. It produces foil rolls and containers for the food industry that provide excellent barrier properties and thermal resistance.

Key Aluminum Foil Companies:

The following are the leading companies in the aluminum foil market. These companies collectively hold the largest market share and dictate industry trends.

- ACM Carcano

- Amcor

- Assan Aluminyum

- Ess Dee Aluminium

- Eurofoil

- Hindalco Industries Limited

- Huawei Aluminium

- Laminazione Sottile

- Shanghai Metal Corporation

- UACJ Foil Corporation

- Xiamen Xiashun Aluminium Foil Co., Ltd

- Zhejiang Junma Aluminum Industry

Recent Development

-

In June 2024, Amcor Capsules introduced ESSENTIELLE, a groundbreaking plastic-free foil crafted from aluminium and paper. Developed in collaboration with Moët & Chandon, this innovation offers a sustainable packaging solution for still and sparkling wines and spirits, featuring a 31% reduction in carbon footprint compared to traditional plastic-based foils. The material, made with approximately 60% aluminium and specialty European-made paper, is fully recyclable and verified for collection alongside glass bottles, enhancing the eco-friendly credentials of premium beverage packaging.

-

In January 2024, SRF Limited inaugurated a state-of-the-art aluminium foil manufacturing facility in Jetapur, Madhya Pradesh. The newly launched facility stands out for its use of advanced European machinery and precise process controls, and meets good manufacturing practice (GMP) standards. The capacity to produce up to 20,000 metric tons per annum (MTPA) of rolled aluminium foil enables the supply of thinner gauges and wider widths through high-precision rolling mills.

Aluminum Foil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 30.68 billion

Revenue forecast in 2033

USD 45.67 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; Turkey; Russia; China; India; Japan; South Korea; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

ACM Carcano; Amcor; Assan Aluminyum; Ess Dee Aluminium; Eurofoil; Hindalco Industries Limited; Huawei Aluminium; Laminazione Sottile; Shanghai Metal Corporation; UACJ Foil Corporation; Xiamen Xiashun Aluminium Foil Co., Ltd; Zhejiang Junma Aluminum Industry

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Foil Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aluminum foil market report based on the product, end-use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Wrapper Foils

-

Container Foils

-

Foil Lids

-

Pouches

-

Blister Packs

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Food & Beverage

-

Pharmaceutical

-

Tobacco

-

Others

-

-

Industrial

-

HVAC

-

EV Battery

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The wrapper segment dominated the market with a revenue share of 20.4% in 2024.

b. Some of the key players of the global aluminum foil market are ACM Carcano, Amcor, Assan Aluminyum, Ess Dee Aluminium, Eurofoil, Hindalco Industries Limited, Huawei Aluminium, Laminazione Sottile, Shanghai Metal Corporation, UACJ Foil Corporation, Xiamen Xiashun Aluminium Foil Co., Ltd, Zhejiang Junma Aluminum Industry, and others.

b. The key factor driving the growth of the global aluminum foil market is the increasing demand for lightweight, durable, and recyclable packaging solutions across the food and beverage, pharmaceutical, and consumer goods industries.

b. The global aluminum foil market size was estimated at USD 28.93 billion in 2024 and is expected to reach USD 30.68 billion in 2025.

b. The global aluminum foil market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 45.67 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.