- Home

- »

- Consumer F&B

- »

-

Almond Milk Market Size And Share, Industry Report, 2030GVR Report cover

![Almond Milk Market Size, Share & Trends Report]()

Almond Milk Market (2024 - 2030) Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Flavor (Flavored, Non-Flavored), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-868-8

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Almond Milk Market Summary

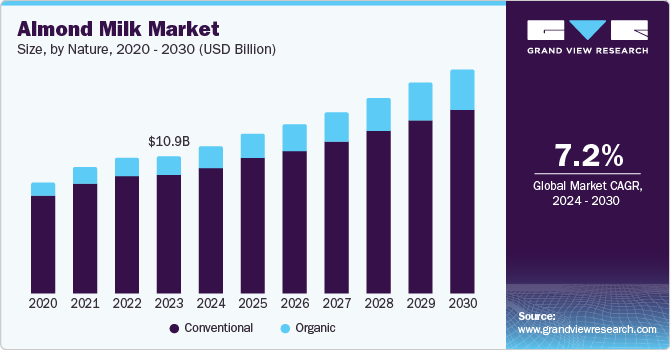

The global almond milk market size was estimated at USD 10.89 billion in 2023 and is projected to reach USD 17.71 billion by 2030, growing at a CAGR of 7.2% from 2024 to 2030. This growth is owing to the increasing health consciousness among consumers.

Key Market Trends & Insights

- The almond milk market in the Asia Pacific region accounted for the dominant share of 45.8% in 2023.

- The almond milk market in the U.S. is expected to be majorly driven by innovations in product offerings and flavors during the forecast period.

- Based on nature, conventional almond milk dominated the market with 86.2% share in 2023.

- Based on flavor, non-flavored almond milk held a dominant market share in 2023.

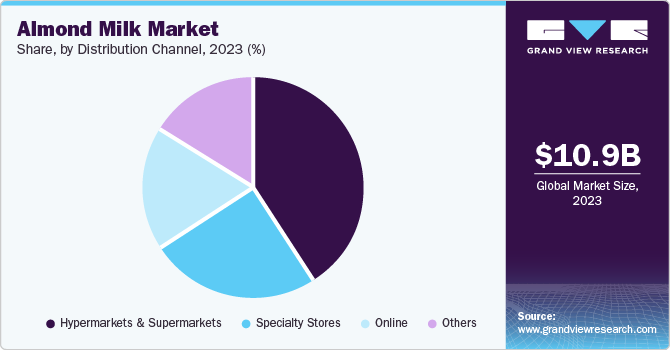

- Based on distribution channel, hypermarkets and supermarkets registered the dominant market share of 41.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.89 Billion

- 2030 Projected Market Size: USD 17.71 Billion

- CAGR (2024-2030): 7.2%

- Asia Pacific: Largest market in 2023

Consumers have increasingly inclined toward almond milk as a plant-based dairy alternative that is rich in vitamin E and omega-3 fatty acids and low in calories and cholesterol. Moreover, the rising prevalence of lactose intolerance and dairy allergies such as hypercholesterolemia are projected to fuel the market demand over the forecast period. Individuals who are unable to consume dairy products due to lactose intolerance, which causes digestive issues, prefer almond milk as a suitable alternative, thereby contributing to its growing demand. Additionally, as more people adopt vegan lifestyles for ethical, environmental, or health reasons, the demand for plant-based milk alternatives including almond milk continues to rise.

In addition, innovation in product offerings and flavors contributed to the market’s growth. Manufacturers have continuously developed new flavors and formulations to cater to diverse consumer preferences. This includes the introduction of flavored almond milk, such as vanilla and chocolate, and fortified versions with added vitamins and minerals. Almond milk has varied applications such as beverages, frozen desserts, and personal care products and is used as a major ingredient for manufacturing chocolates, cream liquor, and bakery products. For instance, together with protein, the product is a rich source of zinc that helps to prevent hair graying and thus keeps the skin free from blemishes. Several cosmetic manufacturers use the formulation to produce face creams and hair care products, thereby propelling the demand for almond milk in the industry.

Furthermore, consumers have progressively become more environmentally conscious and have sought sustainable and eco-friendly products. Almond milk is perceived as a more sustainable option compared to dairy milk, as it has a lower carbon footprint and requires less water and land for production. This shift towards sustainability is further supported by the growing trend of ethical consumerism, where consumers prefer products that align with their values and contribute to environmental conservation.

Nature Insights

Conventional almond milk dominated the market with 86.2% share in 2023. As more consumers shift towards plant-based diets for digestive needs, inorganic almond milk, rich in vitamins and minerals, gained popularity due to its nutritional benefits and versatility. Furthermore, compared to organic almond milk, inorganic varieties are generally more affordable, which makes them accessible to a broader range of consumers. This affordability is particularly appealing in price-sensitive markets where consumers are looking for budget-friendly yet healthy alternatives to dairy milk.

Organic almond milk is projected to emerge as the fastest-growing segment during the forecast period. Consumers have increasingly preferred organic almond milk as a healthier alternative to conventional dairy milk due to its lower calorie content, absence of cholesterol, and high levels of vitamins and minerals, particularly vitamin E. This makes it an attractive option for health-conscious individuals and those following specific dietary regimes, such as vegan or plant-based diets. In addition, the rise in lactose intolerance and dairy allergies has led consumers who are lactose intolerant or allergic to dairy products to turn to almond milk as a suitable alternative. Organic almond milk, in particular, has appealed to these consumers due to its natural and clean-label attributes.

Flavor Insights

Non-flavored almond milk held a dominant market share in 2023. Non-flavored almond milk is perceived as a healthier alternative to flavored varieties as it typically contains fewer additives and sugars. This aligns with the growing trend of consumers seeking minimally processed foods with natural ingredients. In addition, non-flavored almond milk is often seen as a more eco-friendly option compared to dairy milk, as the production involves more sustainable farming practices and has a lower carbon footprint.

Flavored almond milk is expected to grow at a CAGR of 8.3% over the forecast period owing to the increasing demand for variety and innovation in plant-based beverages. Consumers have increasingly sought more diverse and enjoyable flavors in their diets, and flavored almond milk offers an appealing alternative to traditional dairy milk. Popular flavors such as vanilla, chocolate, and strawberry enhance the taste and attract a broader audience, including children and those who might not typically consume plain almond milk. Moreover, the addition of flavors does not significantly compromise the health benefits of almond milk, which remains low in calories and cholesterol-free.

Distribution Channel Insights

Hypermarkets and supermarkets registered the dominant market share of 41.3% in 2023. The market surge can be credited to the rising consumer preference for hands-on shopping experiences. Many consumers prefer to physically inspect products before purchasing, which is possible in these retail environments. Such experience allows consumers to compare different brands, check expiration dates, and read nutritional labels, which can be particularly important for health-conscious buyers. Another significant factor is the widespread availability and accessibility of almond milk in supermarkets and hypermarkets. These retail outlets have extensive distribution networks, ensuring that almond milk is readily available to a broad consumer base. They typically offer a wide variety of almond milk options, including different brands, flavors, and packaging sizes, catering to diverse consumer preferences.

Online distribution channel is projected to grow at the fastest CAGR over the forecast period due to the increasing consumer preference for convenience and ease of access. Online shopping platforms such as Amazon, BigBasket, Blinkit allow consumers to purchase almond milk from the comfort of their homes, offering a wide variety of brands and products. Additionally, online platforms often offer competitive pricing and promotions, attracting cost-conscious consumers. The ability to compare prices and read reviews online helps consumers make informed purchasing decisions, further driving the popularity of online shopping for almond milk.

Regional Insights

The almond milk market in the Asia Pacific (APAC) region accounted for the dominant share of 45.8% in 2023 owing to the rising per capita incomes in developing economies such as China and India. The market witnessed a rising shift toward plant-based milk including almond milk that suits the dietary needs of consumers. In addition, the product demand was further driven by the widespread presence of major product manufacturers. Moreover, the marketing and promotional strategies employed by manufacturers have played a significant role in raising awareness and driving demand for almond milk. Companies have heavily invested in advertising campaigns, social media promotions, and influencer partnerships to highlight the benefits of almond milk and attract health-conscious consumers. These efforts have helped create a positive perception of almond milk and increase its popularity among a broader consumer base.

North America Almond Milk Market Trends

The North America almond milk market held 23.5% of the market share in 2023 owing to the increasing prevalence of lactose intolerance and dairy allergies. Many individuals in the region have sought effective alternatives such as almond milk to traditional dairy milk. This trend is further supported by the growing awareness of the health benefits associated with plant-based diets. Furthermore, the growing adoption of vegan and plant-based diets has surged the demand for almond milk.

U.S. Almond Milk Market Trends

The almond milk market in the U.S. is expected to be majorly driven by innovations in product offerings and flavors during the forecast period. Manufacturers have continuously developed new flavors and formulations including the introduction of flavored almond milk such as vanilla and chocolate to cater to diverse consumer preferences. For instance, leading manufacturers in the U.S. such as The Hain Celestial Group and Blue Diamond Growers produce a wide variety of packaged almond milk.

Europe Almond Milk Market Trends

The Europe almond milk market registered 23.1% of the share in 2023. This growth can be credited to the rising environmental concerns. Consumers in Europe have become increasingly aware of the environmental impact of their food choices and prefer products that are sustainably sourced and produced. The market witnessed a growing demand for almond milk as a more eco-friendly option compared to dairy milk, as it involves more sustainable farming practices.

Key Almond Milk Company Insights

The global almond milk market is fragmented in nature. Major market participants include Blue Daimond Growers, Califia Farms LLC, SunOpta, and others. Companies have majorly focused on new product development with intensive research and development activities, acquisitions and mergers to retain their dominance in the market.

Key Almond Milk Companies:

The following are the leading companies in the almond milk market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Diamond Growers

- Califia Farms LLC

- Danone SA

- Nestlé

- SunOpta

- The Hain Celestial Group

- Ripple Foods

- Malk Organics

- Three Trees

- Milkadamia

Recent Developments

-

In April 2024, Blue Diamond Growers, a leading almond marketer and processor, announced a partnership with Kagome Co., Ltd. to produce and distribute Almond Breeze in Japan. This collaboration aims to boost market growth and generate new demand for Almond Breeze.

-

In January 2023, Califia Farms introduced USDA-certified Organic Almondmilk to expand its dairy-free product line. Its new offering contains no oils or gums and are made with almonds, sea salt, and purified water.

Almond Milk Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.64 billion

Revenue forecast in 2030

USD 17.71 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

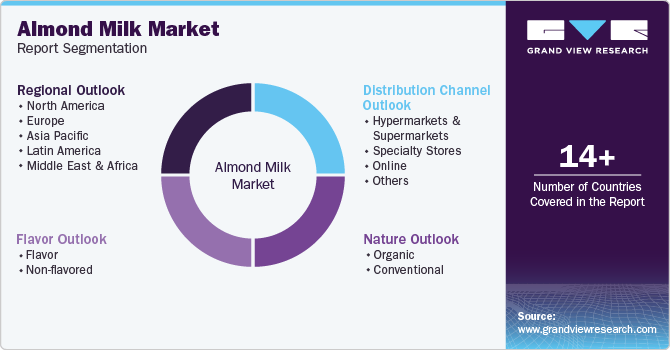

Segments covered

Nature, flavor, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Blue Diamond Growers; Califia Farms LLC; Danone SA; Nestlé; SunOpta; The Hain Celestial Group; Ripple Foods; Malk Organics; Three Trees; Milkadamia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Almond Milk Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global almond milk market report based on nature, flavor, distribution channel, and region.

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavor

-

Non-Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.