- Home

- »

- Advanced Interior Materials

- »

-

Alloy Steel Market Size, Share, Growth, Industry Report 2030GVR Report cover

![Alloy Steel Market Size, Share & Trends Report]()

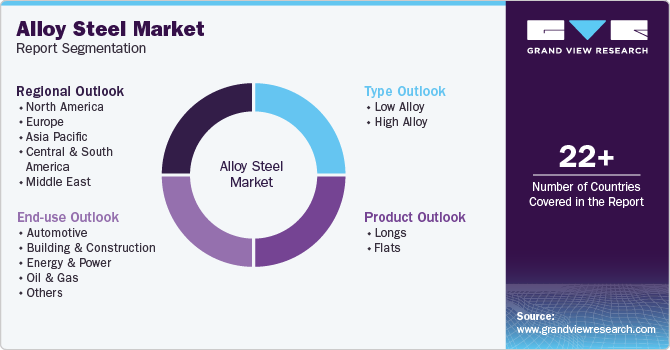

Alloy Steel Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Low Alloy, High Alloy), By Product (Longs, Flats), By End-use (Automotive, Building & Construction, Energy & Power), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-508-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Alloy Steel Market Summary

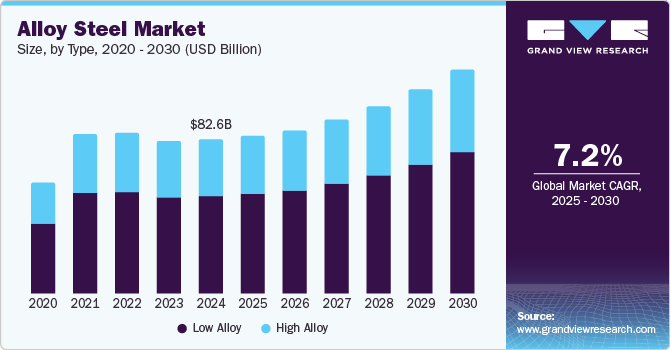

The global alloy steel market size was estimated at USD 82,566.8 million in 2024 and is projected to reach USD 119,418.4 million by 2030, growing at a CAGR of 7.2% from 2025 to 2030. The continuous expansion of the construction, automotive, and manufacturing sectors proliferates the market. These industries require durable and high-performance materials, which alloy steels are known for.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, low alloy accounted for a revenue of USD 53,310.5 million in 2024.

- High Alloy is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 82,566.8 Million

- 2030 Projected Market Size: USD 119,418.4 Million

- CAGR (2025-2030): 7.2%

- Asia Pacific: Largest market in 2024

Their unique properties, such as enhanced strength, corrosion resistance and ability to endure high temperatures, make them a suitable choice in critical applications such as infrastructure development, automotive parts, and machinery manufacturing. As these sectors continue to grow, the demand for alloy steel will rise proportionally.

The energy industry relies heavily on materials that can handle extreme environmental conditions, such as high pressure and temperature. Alloy steels, with their specialized characteristics, are essential for equipment used in energy production, such as wind turbines, offshore oil rigs, and gas pipelines. As the shift toward renewable energy sources accelerates, the demand for alloy steels in these applications is expected to continue to grow. For instance, in November 2024, India achieved a significant milestone in its renewable energy journey, surpassing a total capacity of 200 GW (gigawatts). This achievement aligns with the nation's ambitious goal of reaching 500 GW from non-fossil sources by 2030.

The development of new manufacturing techniques, such as electric arc furnace technology and continuous casting, has made the production of alloy steels more cost-efficient and scalable. Additionally, advancements in heat treatment processes and alloy compositions have created specialized alloys with improved performance characteristics. These innovations enable the alloy steel industry to cater to a broader range of industries and applications, further boosting its market potential.

As industries adopt advanced manufacturing techniques, the need for high-strength, reliable materials becomes even more critical. Due to their durability and ability to withstand high mechanical stress, alloy steels are used in the production of robotic components, machinery parts, and structural elements of automated systems. This trend towards automation, particularly in emerging economies, is expected to contribute significantly to the market's growth.

Rapid urbanization, particularly in Asia-Pacific, Latin America, and parts of Africa, contributes to significant investments in infrastructure projects, including roads, bridges, airports, and residential buildings. With their superior mechanical properties, alloy steels are ideal for use in these large-scale construction projects, where strength, durability, and longevity are essential. As urban populations grow, the need for advanced building materials like alloy steel will continue to rise.

Drivers, Opportunities & Restraints

Alloy steels, made by adding elements such as chromium, nickel, molybdenum, and vanadium to carbon steel, are crucial for applications in automotive, construction, aerospace, and heavy machinery industries. The ongoing industrialization, particularly in emerging economies, is propelling the demand for alloy steels, as they are vital in producing robust and durable parts and components for various industrial operations. Moreover, their application in manufacturing high-performance tools and machinery further supports the market's growth.

The increasing focus on technological advancements, such as developing high-performance alloys with improved properties for specialized applications, offers significant potential. For example, the rising demand for lightweight and fuel-efficient vehicles drives innovation in the automotive sector, where alloy steels are used for engine components and structural parts. Furthermore, the ongoing infrastructure development in emerging economies presents a strong growth opportunity, as alloy steels are essential for constructing buildings, bridges, and transportation systems.

The high cost of production, driven by the expensive alloying elements and complex manufacturing processes, can restrict the widespread adoption of alloy steels, particularly in price-sensitive markets. Additionally, fluctuations in raw material prices, such as the cost of chromium and nickel, can further challenge the profitability of alloy steel producers. The environmental concerns associated with steel manufacturing and the pressure to adopt more sustainable practices also pose significant challenges, as the alloy steel production process is energy-intensive and contributes to carbon emissions.

Type Insights

Low alloy steels, which typically contain small amounts of alloying elements such as chromium, nickel, and molybdenum, offer superior strength, toughness, and corrosion resistance compared to carbon steels. These properties make them ideal for applications that require enhanced performance under harsh conditions, contributing to their growing adoption across various sectors.

High alloy is anticipated to register the fastest CAGR over the forecast period. Industries are increasingly adopting technologies like 3D printing and precision casting, which require materials that can withstand complex processes and deliver superior mechanical properties. High-alloy steels, with their tailored compositions, provide the necessary strength, toughness, and wear resistance in these advanced manufacturing applications. As industries push for more innovative products and solutions, the need for high-alloy steels becomes more pronounced, particularly in applications such as turbine blades, aircraft parts, and oil rigs.

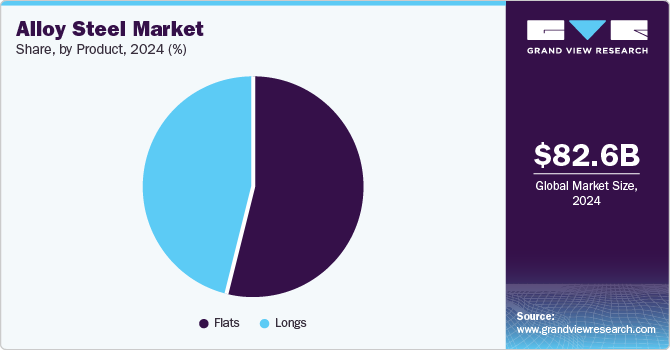

Product Insights

As global car production and demand continue to rise, alloy steel flats are widely used to manufacture components such as chassis, body panels, and structural parts. According to OICA, global car production reached 93,546,599 in 2023. Alloy steels offer high strength, durability, and excellent formability, crucial for automotive manufacturers aiming to improve fuel efficiency, safety, and overall vehicle performance. The ongoing transition towards lighter and more fuel-efficient vehicles further drives the demand for high-quality alloy steel flats.

Long is anticipated to register the fastest CAGR over the forecast period. Long products, which primarily include long steel bars, rods, beams, and structural sections, are vital for various industries like construction, automotive, infrastructure, and machinery manufacturing. The growth of the longs segment is largely driven by increasing demand in the construction sector, particularly in emerging economies where rapid urbanization is taking place. As urban centres expand and infrastructure projects proliferate, the need for durable, high-strength long products made from alloy steel continues to rise, helping to stimulate demand for these materials.

End-use Insights

Alloy steel, prized for its strength, durability, and resistance to corrosion, plays a crucial role in the automotive industry, especially in producing critical components such as engine parts, transmission systems, suspension systems, and chassis. As the global automotive sector expands, particularly with the growth of emerging markets, the demand for alloy steel in vehicle manufacturing continues to rise. This growth is especially evident in the production of lightweight vehicles, which require high-strength, low-weight materials like high-strength, low-alloy (HSLA) steel to improve fuel efficiency and reduce carbon emissions.

Energy & power is anticipated to register the fastest CAGR over the forecast period. As countries strive to meet the growing energy needs of their populations, the demand for reliable and efficient power generation systems rises. Alloy steel, with its superior strength, durability, and resistance to extreme temperatures, is essential in the production of turbines, generators, boilers, and other critical power generation equipment, driving the growth of the alloy steel industry in this sector.

Regional Insights

The growth of the alloy steel market in the Asia Pacific region is largely driven by the rapid industrialization and urbanization occurring across key countries such as China, India, and Japan. As these economies expand, there is an increasing demand for materials that can meet the needs of industries like automotive, construction, and infrastructure.

North America Alloy Steel Market Trends

North America’s alloy steel market is anticipated to grow significantly over the forecast period. The automotive sector is one of the key drivers of demand for alloy steel in North America. As the region experiences a shift towards EVs, the need for advanced materials that can offer both strength and lightness become crucial. Alloy steel is essential in manufacturing critical automotive components such as engines, transmission systems, and chassis, as well as in structural elements of EVs.

Europe Alloy Steel Market Trends

Europe’s ongoing focus on modernizing its infrastructure, particularly with the European Green Deal and sustainability initiatives, creates a demand for materials supporting energy-efficient and long-lasting construction. Alloy steel is extensively used in constructing bridges, tunnels, skyscrapers, and other critical infrastructure, providing strength and durability to withstand environmental pressures and heavy loads. Additionally, as urbanization in Europe continues to increase, the demand for alloy steel in residential and commercial building construction also grows.

Central & South America Alloy Steel Market Trends

Countries such as Brazil, Mexico, and Argentina are seeing significant investments in infrastructure, including roads, bridges, and urban developments. This demand for durable and high-performance materials directly boosts the need for alloy steel, essential for constructing reliable, long-lasting infrastructure. Alloy steel's ability to withstand heavy loads, corrosion, and environmental stress makes it an ideal material for these applications, supporting ongoing regional growth.

Middle East Alloy Steel Market Trends

As one of the world’s largest oil and natural gas producers, countries in the region, especially Saudi Arabia and the UAE, require high-performance materials for their energy infrastructure. Alloy steel is used extensively in producing oil and gas pipelines, drilling equipment, refineries, and power plants, where resistance to high pressures, temperatures, and corrosion is essential.

Key Alloy Steel Company Insights

Some of the key players operating in the market include Kobe Steel, SAIL, Outokumpu, and others

-

Kobe Steel is a prominent Japanese steel manufacturer that operates through various segments, including iron and steel, aluminum and copper, machinery, construction machinery, and welding. The company’s alloy steels are characterized by their superior strength, durability, and resistance to wear and corrosion. These properties make them ideal for critical components such as automotive parts, construction materials, and machinery.

Key Alloy Steel Companies:

The following are the leading companies in the alloy steel market. These companies collectively hold the largest market share and dictate industry trends.

- Kobe Steel

- SAIL

- Outokumpu

- Thyssenkrupp

- Baoshan Iron Steel

- HBIS Group

- Carpenter Technology

- POSCO

- JFE Steel

- Hyundai Steel

- Aperam

- Nippon Steel

- ArcelorMittal

- Tata Steel

Alloy Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 84.24 billion

Revenue forecast in 2030

USD 119.42 billion

Growth Rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; China; India; Japan; Indonesia; Brazil; Saudi Arabia

Key companies profiled

Kobe Steel; SAIL; Outokumpu; Timken; Thyssenkrupp; Baoshan Iron Steel; HBIS Group; Carpenter Technology; POSCO; JFE Steel; Hyundai Steel; Aperam; Nippon Steel; ArcelorMittal; Tata Steel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alloy Steel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global alloy steel market report on the basis of type, product, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Low Alloy

-

High Alloy

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Longs

-

Flats

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Automotive

-

Building & Construction

-

Energy & Power

-

Oil & Gas

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global alloy steel market size was estimated at USD 82.57 billion in 2024 and is expected to reach USD 84.24 million in 2025.

b. The global alloy steel market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 119.42 billion by 2030.

b. The low alloy segment dominated the market with a revenue share of over 63.0% in 2024.

b. Some of the key vendors of the global alloy steel market are Kobe Steel; SAIL; Outokumpu; Thyssenkrupp; Baoshan Iron Steel; HBIS Group; Carpenter Technology; POSCO; JFE Steel; Hyundai Steel; Aperam; Nippon Steel; ArcelorMittal; Tata Steel.

b. The key factor that is driving the growth of the global alloy steel market is growing demand from industries like automotive, construction, and aerospace, seeking high-performance materials and technological advancements and the shift towards lightweight, durable materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.