- Home

- »

- Advanced Interior Materials

- »

-

Aircraft Fairings Market Size & Share, Industry Report, 2030GVR Report cover

![Aircraft Fairings Market Size, Share & Trends Report]()

Aircraft Fairings Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Fuselage, Nose, Engine, Landing Gear), By End-use (Commercial, Commercial, General Aviation), By Region (North America, Asia Pacific, Central & South America), And Segment Forecasts

- Report ID: GVR-4-68040-552-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aircraft Fairings Market Summary

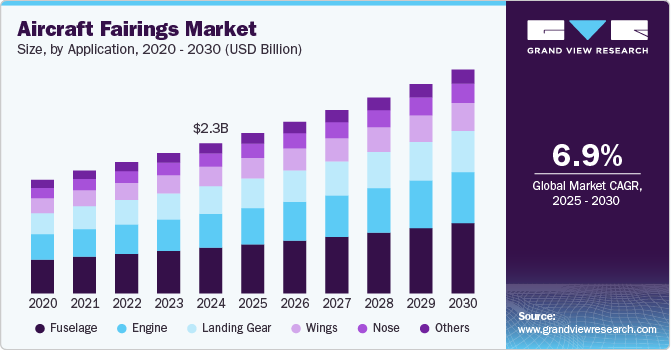

The global aircraft fairings market size was estimated at USD 2.28 billion in 2024 and is projected to reach USD 3.40 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The demand is driven by ongoing focus by aviation industry on fuel efficiency, noise reduction, and overall aerodynamic performance.

Key Market Trends & Insights

- Asia Pacific dominated the aircraft fairings market with the largest revenue share of 44.8% in 2024.

- The aircraft fairings market in Middle East & Africa is expected to grow at the fastest CAGR during the forecast period.

- Based on application, the fuselage segment led the market with the largest revenue share of 30.4% in 2024.

- Based on end use, the commercial aviation segment led the market with the largest revenue share of 66.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.28 Billion

- 2030 Projected Market Size: USD 3.40 Billion

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

Fairings reduce drag by streamlining the aircraft’s external surface, which is critical for improving fuel economy and cutting emissions-both high priorities for commercial airlines and regulatory bodies. This makes fairings essential components in next-generation aircraft design. In addition, as global air travel continues to rebound and expand, airlines are upgrading their fleets with newer, more efficient models. Military aviation is also seeing modernization trends, with newer platforms requiring advanced, lightweight fairings that can withstand high-performance conditions. Innovations in composite materials and 3D printing are further expected to push demand by making production more efficient and customizable.

The demand for aircraft fairings is likely to be hampered by high cost associated with the development and certification of new fairing technologies. Strict safety and performance regulations in aviation require extensive testing and long approval timelines, which may delay product rollouts or deter smaller manufacturers from entering the market.

Prominent market players are investing heavily in R&D to develop lighter, more durable fairings using composite materials and advanced manufacturing techniques like additive manufacturing. Many are also forming long-term supply agreements with aircraft OEMs to secure stable demand and reduce procurement cycles. These partnerships enable quicker adoption of newer designs while ensuring compliance with strict aerospace standards.

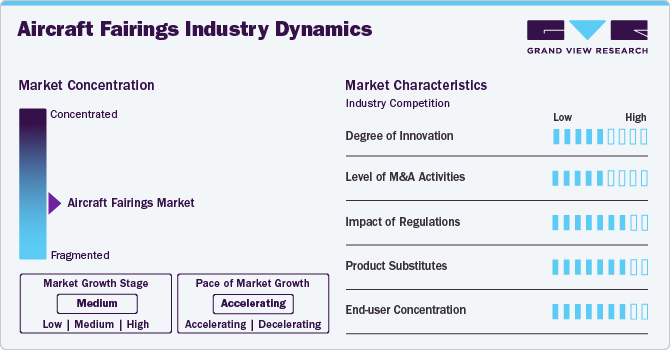

Market Concentration & Characteristics

The aircraft fairings industry shows moderate to high concentration, with a few key players holding significant shares. These firms leverage their technical capabilities, global supply networks, and economies of scale to stay competitive. Smaller or niche firms often compete through specialization, offering customized fairings for military or UAV applications.

The threat of substitution in the aircraft fairings industry is relatively low, as fairings serve a highly specialized function in aircraft aerodynamics and systems protection. While advancements in aircraft design could lead to slight design modifications or material changes, it is unlikely that fairings themselves could be replaced entirely by another solution, due to the strict performance and safety requirements.

Application Insights

Based on application, the fuselage segment led the market with the largest revenue share of 30.4% in 2024. Fuselage fairings are increasingly in demand as aircraft manufacturers strive to improve overall aerodynamics. These components reduce drag along the body of the aircraft, directly enhancing fuel efficiency which is a critical cost-saving measure for airlines. With the increasing fleet renewal, the fuselage fairings are being upgraded with advanced composites that are lighter and more durable, leading to rise in demand for fuselage in the coming years.

The engine fairings segment is expected to grow at a significant CAGR over the forecast period. The growth is accelerated by rising demand due to the push for more efficient and quieter propulsion systems. As newer, high-bypass engines become standard, fairings must be redesigned to fit larger, more powerful engines while minimizing noise and drag. This evolution is likely to drive a need for highly engineered fairing components tailored to specific engine architectures.

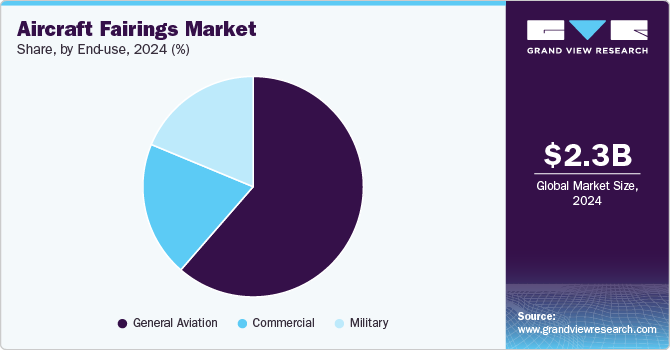

End-use Insights

Based on end use, the commercial aviation segment led the market with the largest revenue share of 66.8% in 2024. Commercial aviation is the largest consumer of aircraft fairings, with airlines worldwide focusing on reducing operating costs through improved aerodynamics. With rising passenger travel across countries, the demand for aircraft fairings due to the need for new, fuel-efficient aircraft is expected to increase over the forecast period.

The military segment is anticipated to grow at the fastest CAGR during the forecast period, owing to rising defense budgets and modernization programs which are likely to fuel the demand for stealth-optimized and high-performance fairings. Moreover, next-gen fighter jets and drones, which require precision aerodynamic components, often rely on custom-engineered fairings made from radar-absorbing or thermal-resistant materials. These factors are anticipated to boost the demand for aircraft fairings in military end use in the coming years.

Regional Insights

The aircraft fairings market in North America is growing as the region remains a core market due to the presence of major aircraft OEMs, a large commercial fleet, and strong defense spending. Ongoing investments in next-gen commercial and military aircraft in the region are expected to keep fairing demand consistently high.

U.S. Aircraft Fairings Market Trends

The aircraft fairings market in the U.S. is growing due to robust commercial aviation activity and substantial military R&D programs. American aerospace firms are pushing innovation in fairing design, especially in the fields of lightweight composites and stealth technologies.

Asia Pacific Aircraft Fairings Market Trends

Asia Pacific dominated the aircraft fairings market with the largest revenue share of 44.8% in 2024. The Asia Pacific region is witnessing a boom in air traffic and domestic aircraft production, especially in countries like India and Indonesia. As local airlines expand their fleets and governments invest in aviation infrastructure, demand for high-performance fairings is naturally rising.

The airing fairings market in China is aggressively developing its domestic aviation capabilities, including the C919 and military aircraft programs. With a strong emphasis on reducing dependency on Western components, the country is investing in local fairing manufacturing, driving the demand for technologically advanced solutions.

Europe Aircraft Fairings Market Trends

The aircraft fairings market in Europe is heavily focused on sustainable aviation, pushing for lower-emission aircraft. This regional priority is boosting demand for aerodynamic components like fairings that contribute to greener flight. Collaborative aerospace programs (e.g., Airbus initiatives) also create steady demand.

The Germany aircraft fairings market is expected to grow at a significant CAGR over the forecast period. Germany, as a key hub of precision engineering and aircraft parts manufacturing, plays a vital role in the European fairings market. With strong ties to Airbus and a thriving defense sector, demand for high-spec fairings is strong and consistent.

Latin America Aircraft Fairings Market Trends

The aircraft fairings market in Latin America is growing steadily, driven by fleet expansion of regional airlines and cargo carriers. The region is also seeing rising MRO (maintenance, repair, and overhaul) activity, contributing to aftermarket fairing demand.

Middle East & Africa Aircraft Fairings Market Trends

The aircraft fairings market in Middle East & Africa is expected to grow at the fastest CAGR during the forecast period. Gulf carriers are continuing to invest in next-gen fleets, which supports fairing demand, particularly for widebody and luxury aircraft. Moreover, in Africa, infrastructure development and growing air connectivity are setting the stage for increased long-term demand.

Key Aircraft Fairings Company Insights

Some of the prominent players operating in global industry include Airbus and Boeing.

-

Airbus was established in 1970 and is headquartered in Leiden, Netherlands. The group operates through three business segments, namely Airbus commercial aircraft, Airbus Helicopters, and Airbus defense & space. Its global presence includes France, Germany, Spain, and the UK, fully owned subsidiaries in the U.S., China, Japan, India, and the Middle East, and spare parts centers in Hamburg, Frankfurt, Washington, Beijing, Dubai, and Singapore.

-

Boeing was established in 1916 and is headquartered in Washington, U.S. It operates through four business segments, namely Commercial Airplanes (BCA), Defense, Space & Security (BDS), Global Services (BGS), and Boeing Capital (BCC).

Kaman Aerosystems and FDC Composites are some of the emerging market participants in aircraft fairings industry.

-

Kaman Aerosystems was established in 1945 and is headquartered in Bloomfield, Connecticut, United States. The company operates as a division of Kaman Corporation and specializes in the design and manufacturing of complex aerospace components and systems. Its offerings include composite structures, metallic assemblies, precision bearings, and flight-critical parts for both commercial and defense aircraft. Kaman maintains operations across the U.S. and supports a global customer base through strategic partnerships and service networks.

-

FDC Composites was founded in 2004 and is headquartered in Saint-Jean-sur-Richelieu, Quebec, Canada. The company specializes in the manufacturing of high-performance composite parts for the aerospace and transportation sectors. Its core capabilities include advanced fabrication of aircraft interiors, fairings, and structural components using carbon fiber and other lightweight materials. FDC Composites serves clients across North America and Europe, with a strong focus on custom solutions and quality certifications such as AS9100.

Key Aircraft Fairings Companies:

The following are the leading companies in the aircraft fairings market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus

- Boeing

- ShinMaywa

- NORDAM

- Malibu Aerospace

- Strata Manufacturing

- Royal Engineered Composites

- Fiber Dynamics Inc.

- FDC Composites

- Kaman Aerosystems

Aircraft Fairings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.43 billion

Revenue forecast in 2030

USD 3.40 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Airbus; Boeing; ShinMaywa; NORDAM; Malibu Aerospace; Strata Manufacturing; Royal Engineered Composites; Fiber Dynamics Inc.; FDC Composites; Kaman Aerosystems

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft Fairings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aircraft fairings market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fuselage

-

Nose

-

Engine

-

Landing Gear

-

Wings

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Military

-

General Aviation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global aircraft fairings market size was estimated at USD 2.28 billion in 2024 and is expected to reach USD 2.43 billion in 2025.

b. The global aircraft fairings market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 3.40 billion by 2030.

b. The fuselage segment led the market and accounted for the largest revenue share of 30.4% in 2024, driven as aircraft manufacturers strive to improve overall aerodynamics. These components reduce drag along the body of the aircraft, directly enhancing fuel efficiency which is a critical cost-saving measure for airlines.

b. Some of the key players operating in the aircraft fairings market include Airbus, Boeing, ShinMaywa, NORDAM, Malibu Aerospace, Strata Manufacturing, Royal Engineered Composites, Fiber Dynamics Inc., FDC Composites, Kaman Aerosystems

b. The key factors driving the aircraft fairings market are the aviation industry's ongoing focus on fuel efficiency, noise reduction, and overall aerodynamic performance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.