- Home

- »

- Communications Infrastructure

- »

-

Air Traffic Management Market Size & Share Report, 2030GVR Report cover

![Air Traffic Management Market Size, Share & Trends Report]()

Air Traffic Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Communication Systems, Navigation, Surveillance), By Component (Hardware, Software & Solutions), By Airport Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-346-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Traffic Management Market Summary

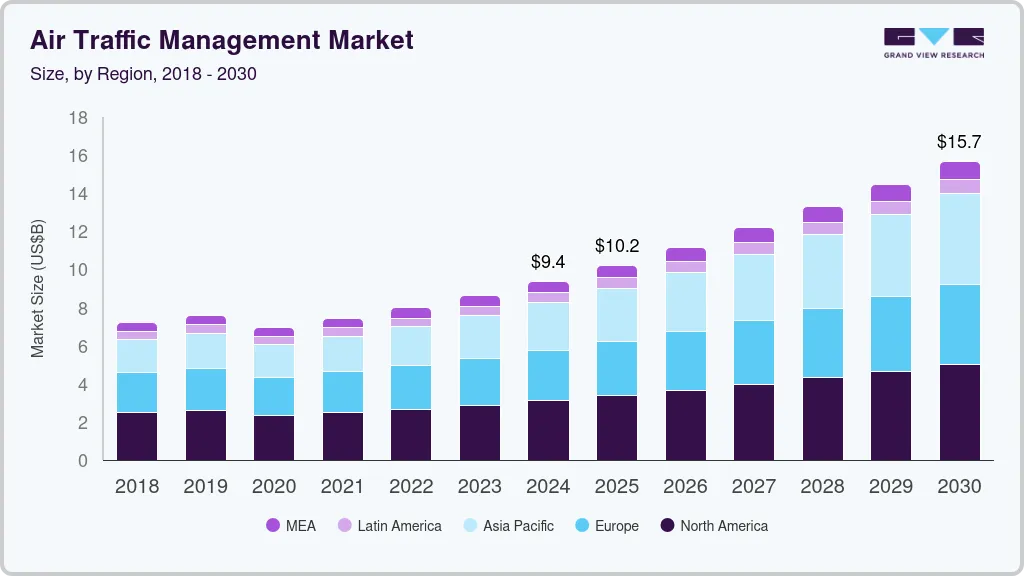

The global air traffic management market size was estimated at USD 8.64 billion in 2023 and is projected to reach USD 15.42 billion by 2030, growing at a CAGR of 8.6% from 2024 to 2030. The market growth can be attributed to the integration of advanced technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), into air traffic management systems to improve efficiency and safety.

Key Market Trends & Insights

- North America dominated the air traffic management market with the largest revenue share of 33.2% in 2023.

- The air traffic management market in the U.S. is anticipated to grow at the fastest CAGR of 7.8% from 2024 to 2030.

- Based on technology, the communication systems segment accounted the largest revenue share of 33.2% in 2023.

- Based on component, the hardware segment accounted the largest revenue share of 59.4% in 2023.

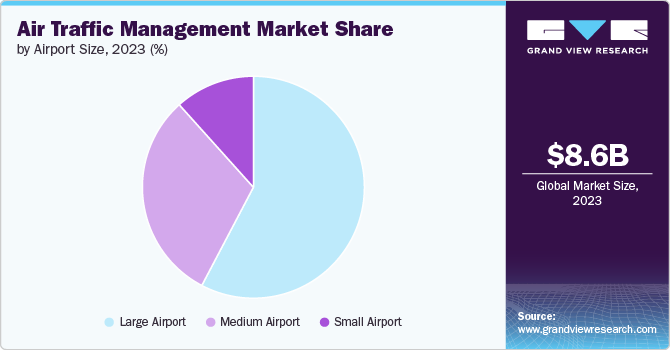

- Based on airport size, the large airport size segment accounted the largest revenue share of 57.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.64 Billion

- 2030 Projected Market Size: USD 15.42 Billion

- CAGR (2024-2030): 8.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

These technologies enable more precise tracking and management of air traffic, reducing delays, and optimizing airspace usage. Automation of air traffic control processes reduces human error, further enhancing operational reliability. The evolution of satellite-based navigation systems offers better accuracy than traditional radar, supporting the market growth. Air travel is significantly rising, driven by economic growth and affordable airfares. This increase in air traffic volume demands more efficient air traffic management to prevent congestion and delays. As airports operate closer to their capacity limits, the need for effective airspace management becomes critical. Enhanced air traffic management systems are crucial for handling the growing number of flights safely and efficiently, which is expected to drive market growth in coming years.Stricter regulatory standards regarding air traffic safety and efficiency drive the demand for modernized air traffic management solutions. Regulatory bodies globally are imposing new requirements for real-time monitoring and reporting, pushing the market towards innovative solutions. These requirements aim to increase the safety, reliability, and efficiency of air travel, benefiting passengers and the aviation industry alike. Compliance with these regulations necessitates the adoption of innovative air traffic management systems.

The aviation industry is under increasing pressure to reduce its environmental impact, including noise pollution and greenhouse gas emissions. Efficient air traffic management plays a significant role in achieving these environmental goals by optimizing flight paths and reducing unnecessary fuel consumption. By minimizing the time aircraft spend in holding patterns or on the ground, emissions and noise pollution are significantly reduced. This shift towards sustainability fuels the demand for advanced air traffic management solutions.

Significant investments in airport infrastructure development and expansion worldwide create a supportive environment for the market growth. New and upgraded airports require innovative air traffic management systems to handle increased traffic and ensure passenger safety. These infrastructural developments are backed by government and private investments, highlighting the importance of efficient air traffic management in the broader aviation ecosystem. As airports modernize, the integration of advanced air traffic management technologies becomes important, thereby driving the market growth in coming years.

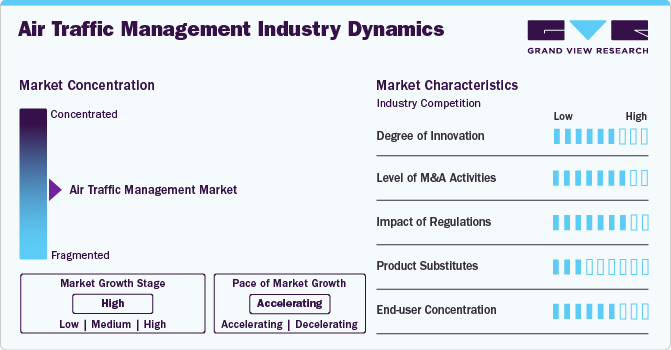

Market Concentration & Characteristics

The market exhibits a high degree of innovation, driven by advancements in technologies like AI, automation, and satellite-based navigation systems. These innovations aim to enhance safety, efficiency, and capacity of air traffic control operations globally.

Regulations in the global market ensure safety and efficiency but can be expensive and limit how companies operate. However, good regulations can also encourage new technologies and make the system more reliable.

The market is also being influenced by the rising number of mergers & acquisition activities that help companies increase market share, expand the customer base, and strengthen product portfolios.

The impact of product substitutes in the market is minimal due to the specialized nature and stringent regulatory requirements of the industry. However, advancements in autonomous flight technology and unmanned aerial vehicles (UAVs) could pose potential long-term challenges.

End-user concentration in the global market is characterized by a significant focus on airports and airlines, as they are the primary users of air traffic management systems. These stakeholders rely heavily on advanced technologies and services to ensure safe and efficient air traffic operations.

Technology Insights

Based on technology, the communication systems segment led the market with the largest revenue share of 33.2% in 2023, driven by the increasing need for real-time data exchange and enhanced communication between aircraft and ground control. Advancements in digital data link communication, such as Controller-Pilot Data Link Communications (CPDLC), are improving the accuracy and reliability of information transmission. In addition, the integration of satellite-based communication systems is expanding coverage and reducing latency. These innovations are crucial for supporting the growing volume of air traffic and enhancing overall safety and efficiency in airspace management, thereby driving the segment growth.

The surveillance segment is expected to grow at the fastest CAGR of 9.7% from 2024 to 2030. The growth is driven by advancements in radar, ADS-B (Automatic Dependent Surveillance-Broadcast), and satellite-based systems. These technologies enhance real-time tracking and monitoring of aircraft, improving safety and operational efficiency. Increased air traffic, coupled with the need for enhanced situational awareness and regulatory mandates for modern surveillance systems, further supports the expansion of the segment.

Component Insights

Based on component, the hardware segment led the market with the largest revenue share of 59.4% in 2023, driven by advancements in radar systems, communication equipment, and surveillance technologies. Increasing investments in modernization projects by airports and regulatory bodies are fueling demand for innovative hardware solutions. Moreover, the integration of automation and digitalization in air traffic control systems is further driving the adoption of latest hardware components, enhancing operational efficiency and safety across global airspace networks, thereby driving the growth of the segment.

The software & solutions segment is estimated to register at the fastest CAGR during the forecast period. The growth is attributed to the increasing adoption of advanced technologies such as automation, AI, and cloud-based solutions. These innovations are enhancing operational efficiency, safety, and scalability for air traffic management systems globally. The segment's growth is further propelled by ongoing upgrades and modernization initiatives across airports and aviation authorities, aimed at meeting rising air traffic demands and regulatory requirements efficiently.

Airport Size Insights

Based on airport size, the large airport size segment led the market with the largest revenue share of 57.7% in 2023. The segment growth is attributed to the increasing air travel demand and the need for enhanced operational efficiency. These airports typically handle substantial passenger and cargo volumes, requiring advanced air traffic management systems to manage complex traffic flows. Investments in technologies like radar systems, communication networks, and automated decision-making tools are crucial to optimizing airspace utilization and ensuring safety at busy airports, thereby driving the segment growth.

The medium airport size segment is anticipated to expand at the fastest CAGR from 2024 to 2030. The growth of the medium airport size segment can be attributed to the increasing air traffic and the need for enhanced operational efficiency. These airports typically handle moderate passenger and cargo volumes, requiring scalable and cost-effective solutions. Advances in digital technologies and automation are enabling medium-sized airports to adopt sophisticated air traffic management systems that improve safety, reduce delays, and optimize airspace utilization.

Regional Insights

North America dominated the air traffic management market with the largest revenue share of 33.2% in 2023. Significant advancements in air traffic management technologies, combined with increasing investments in the modernization of air traffic control infrastructure, drive the market's growth.

U.S. Air Traffic Management Market Trends

The air traffic management market in the U.S. is anticipated to grow at the fastest CAGR of 7.8% from 2024 to 2030. The continuous growth in air passenger traffic, coupled with the government's focus on enhancing national airspace system efficiency through the Next Generation Air Transportation System (NextGen) initiative, propels the air traffic management market forward.

Asia Pacific Air Traffic Management Market Trends

The air traffic management market in Asia Pacific is anticipated to grow at the fastest CAGR of 10.2% from 2024 to 2030. The market growth in Asia Pacific regional can be attributed to the surging air travel demand and escalating investments in airport infrastructure across the region.

The India air traffic management market is estimated to record at a significant CAGR from 2024 to 2030, owing to the rapid modernization of air traffic control systems, combined with significant growth in civil aviation, drives the demand for advanced air traffic management solutions in the country.

The air traffic management market in China is expected to grow at a considerable CAGR from 2024 to 2030. The commitment to enhancing airspace efficiency and safety, along with substantial state investments in airport development and air traffic technologies, propels market growth in the country.

The Japan air traffic management in Japan is projected to witness at a considerable CAGR from 2024 to 2030. Japan's growing demand for air traffic managements can be attributed to theinnovations in satellite-based navigation systems and the push for efficient air traffic control to accommodate increasing flight capacities.

Europe Air Traffic Management Market Trends

The air traffic management market in Europe accounted for a market share of around 27% in 2023. The implementation of the Single European Sky initiative aimed at enhancing the efficiency of air navigation services across Europe drives the market growth.

The UK air traffic management market is projected to grow at a considerable CAGR from 2024 to 2030. The rise in commercial and cargo air traffic, coupled with initiatives to modernize air traffic management systems, including the use of AI and automation, drives market growth.

The air traffic management market in Germany is expected to grow at a significant CAGR from 2024 to 2030. Germany's focus on technological advancements in air traffic management solutions, such as digital tower operations and advanced surveillance systems, alongside stringent air safety regulations, boosts market development.

Middle East and Africa Air Traffic Management Market Trends

The air traffic management market in the Middle East and Africa is anticipated to grow at a significant CAGR of 9.8% from 2024 to 2030. The surge in air passenger traffic and the need for modernized air traffic management systems to enhance safety and efficiency are key drivers for the market growth in the region.

TheSaudi Arabia air traffic management market is anticipated to grow at a considerable CAGR during the forecast period. Saudi Arabia's ambitious aviation sector expansion plans and the adoption of innovative air traffic management solutions to support the growing number of pilgrimages contribute significantly to the market's growth.

Key Air Traffic Management Company Insights

Some of the key players operating in the market are RTX Corporation, Inc., L3Harris Technologies, Inc., and Airbus SE

-

RTX Corporation, Inc. is a major player in defense, aerospace, and technology, known globally for its innovative products and solutions. The company offers a wide range of services, including high-tech radar systems, electronics, and cybersecurity. RTX is also focused on making a positive impact on global security and leading the way in space technology and communication advancements

-

L3Harris Technologies, Inc. is a leading technology company specializing in defense and commercial technologies across air, land, sea, space, and cyber domains. Known for its strong innovation in communications and electronic systems, L3Harris aims to make military and civilian operations more efficient and safer. With a commitment to excellence and sustainability, the company plays a crucial role in global security, space exploration, and air traffic management

Frequentis AG, Leidos Holdings, Inc. are some of the emerging market participants in the global market.

-

Stereolabs Frequentis AG is a global player in communication and information solutions, focusing on making air and ground transportation safer and more efficient. The company specializes in advanced technology for air traffic management and public safety communication systems

-

Leidos Holdings, Inc. is a technology company delivering a wide range of services and solutions in defense, intelligence, civil, and health markets. Their focus is on solving complex challenges in national security, engineering, and health, using technology and expertise to make the world safer, healthier, and more efficient

Key Air Traffic Management Companies:

The following are the leading companies in the air traffic management market. These companies collectively hold the largest market share and dictate industry trends.

- Thales S.A.

- RTX Corporation

- Indra Sistemas, S.A.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Frequentis AG

- Leidos Holdings, Inc.

- Honeywell International Inc.

- Airbus SE

- Saab AB

Recent Developments

-

In January 2024, EasyJet Airline Company Limited became the first airline to partner with the Iris program. This program is led by the European Space Agency (ESA) and Viasat, a global communications company. Together, they are using the latest satellite technology to improve how air traffic is managed

-

In October 2023, Airport officials from Biju Patnak International Airport in Bhubaneswar, Odisha, announced the installation of a new air traffic management automation system in the recently developed air traffic control center. This technological upgrade has enhanced the operational efficiency of flight operations at the airport

-

In July 2023, Skykraft Pvt Ltd has achieved a milestone by successfully conducting the initial trial of space-based VHF voice communications. This attempt is a significant step in their project to develop satellites aimed at offering space-based communication and monitoring services for aviation. The successful trial contributes to the advancement of operational space-based aviation VHF services, aligning with the preparations for the World Radio Congress 2023

-

In July 2023, Honeywell International Inc. in Phoenix revealed that its research and development branch in Europe joined several projects under the SESAR 3 Joint Undertaking partnership and the Digital European Sky program. These projects focused on developing innovative solutions to elevate automation across different airspaces. The goal was to enhance operational efficiency and sustainability by introducing new or improved operational methodologies

Air Traffic Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.38 billion

Revenue forecast in 2030

USD 15.42 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, airport size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Thales S.A.; RTX Corporation; Indra Sistemas, S.A.; L3Harris Technologies, Inc.; Leonardo S.p.A.; Frequentis AG; Leidos Holdings, Inc.; Honeywell International Inc.; Airbus SE; Saab AB

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Traffic Management Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global air traffic management market report based on technology, component, airport size, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Communication Systems

-

Navigation

-

Surveillance

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software & Solutions

-

-

Airport Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Airport

-

Medium Airport

-

Large Airport

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global air traffic management market size was estimated at USD 8.64 billion in 2023 and is expected to reach USD 9.38 billion in 2024.

b. The global air traffic management market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 15.42 billion by 2030.

b. The North America region accounted for the largest share of 33.2% in the air traffic management market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the air traffic management market include Thales S.A.; RTX Corporation; Indra Sistemas, S.A.; L3Harris Technologies, Inc.; Leonardo S.p.A.; Frequentis AG; Leidos Holdings, Inc.; Honeywell International Inc.; Airbus SE; Saab AB.

b. Key factors that are driving the air traffic management market growth include the integration of advanced technologies, such as Artificial Intelligence (AI) and Machine Learning (ML), into air traffic management systems to improve efficiency and safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.