- Home

- »

- Advanced Interior Materials

- »

-

Air Conditioning Systems Market Size, Industry Report, 2033GVR Report cover

![Air Conditioning Systems Market Size, Share & Trends Report]()

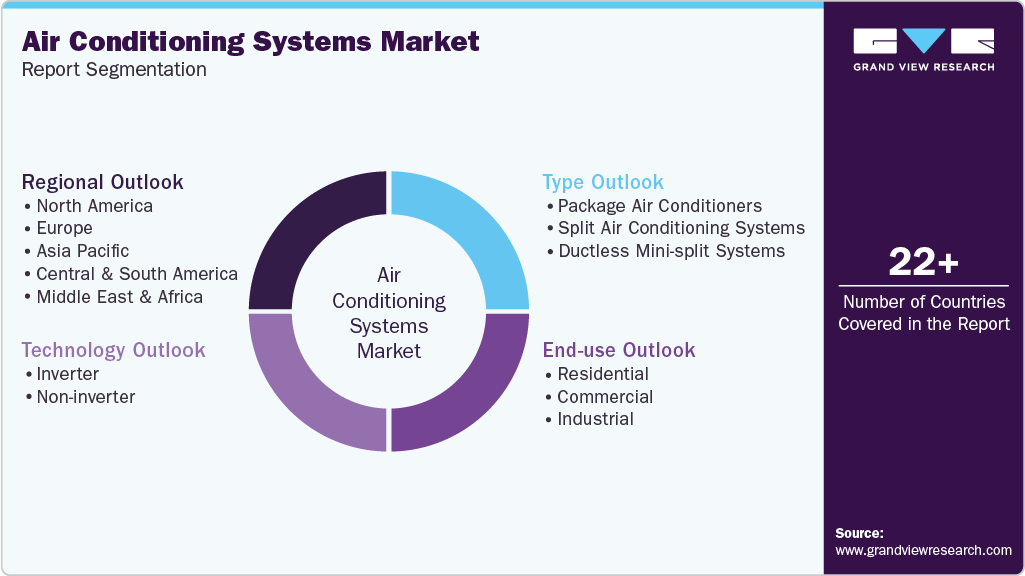

Air Conditioning Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Package Air Conditioners, Split Air Conditioning Systems, Ductless Mini-split Systems), By Technology (Inverter, Non-inverter), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-528-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Conditioning Systems Market Summary

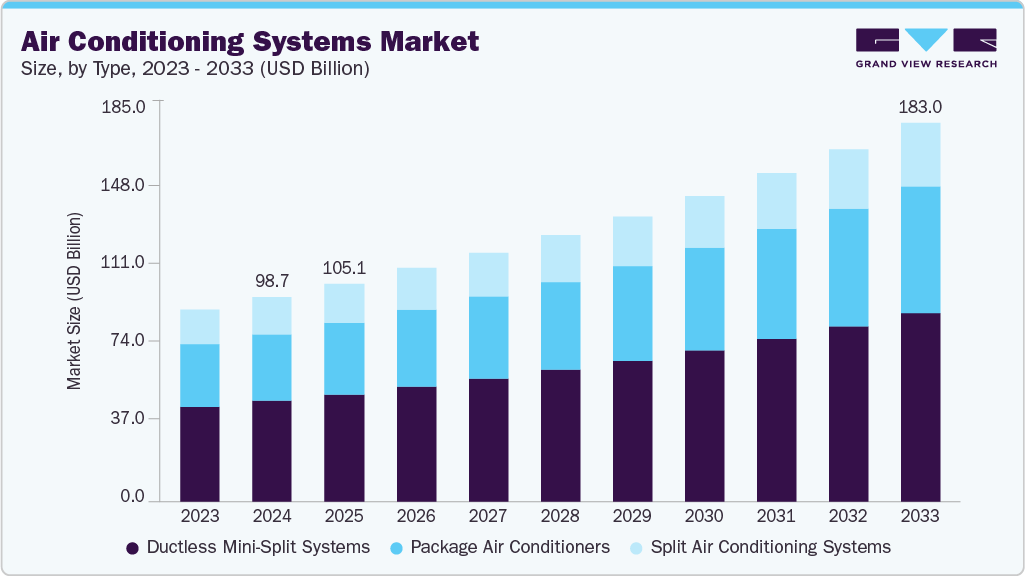

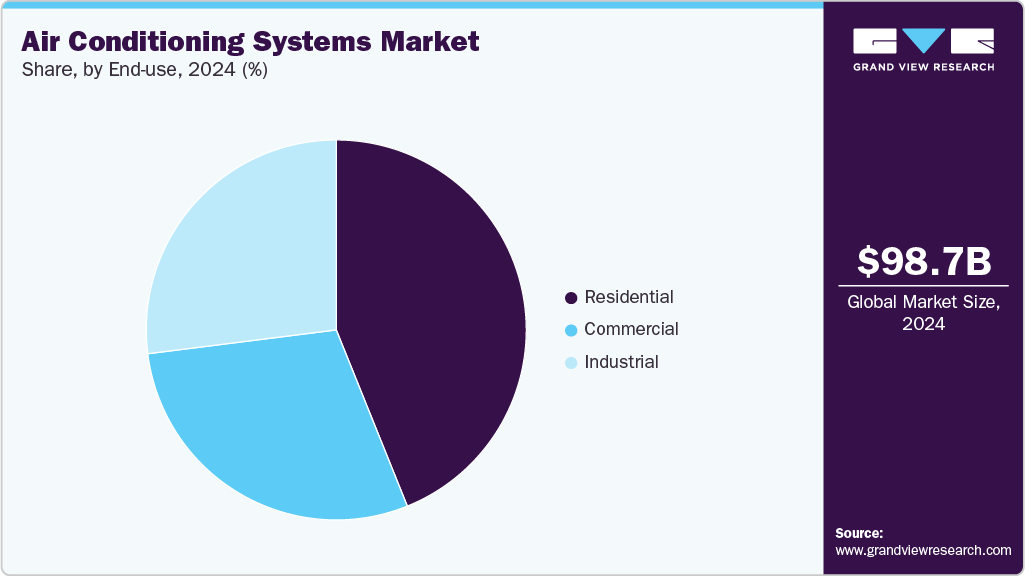

The global air conditioning system market size was estimated at USD 98.74 billion in 2024 and is projected to reach USD 182.97 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. This growth is primarily driven by rapid urbanization and the rising adoption of smart infrastructure in both residential and commercial sectors.

Key Market Trends & Insights

- Asia Pacific dominated the air conditioning systems market with the largest revenue share of 57.4% in 2024.

- The air conditioning systems market in the India is expected to grow at a substantial CAGR of 9.5% from 2025 to 2033.

- By type, the package air conditioners segment is expected to grow at a considerable CAGR of 7.4% from 2025 to 2033.

- By technology, inverter segment is expected to grow at a considerable CAGR of 8.4% from 2025 to 2033.

- By end use, the residential segment is expected to grow at a considerable CAGR of 8.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 98.74 Billion

- 2033 Projected Market Size: USD 182.97 Billion

- CAGR (2025-2033): 7.2%

- Asia Pacific: Largest market in 2024

The increasing demand for energy-efficient and environmentally friendly cooling solutions is accelerating the shift toward inverter-based and solar-powered air conditioning systems. In addition, stringent government regulations aimed at reducing carbon emissions are encouraging the use of low-global warming potential (GWP) refrigerants, pushing manufacturers to innovate and adopt sustainable technologies.

Technological advancements like AI-enabled climate control, IoT integration, and remote monitoring are reshaping the air conditioning industry. Consumers are increasingly opting for smart ACs that offer convenience, automation, and energy optimization. The expansion of construction activities, particularly in emerging economies, is also fueling market growth. Moreover, improving living standards and higher disposable incomes are encouraging spending on advanced air conditioning systems.

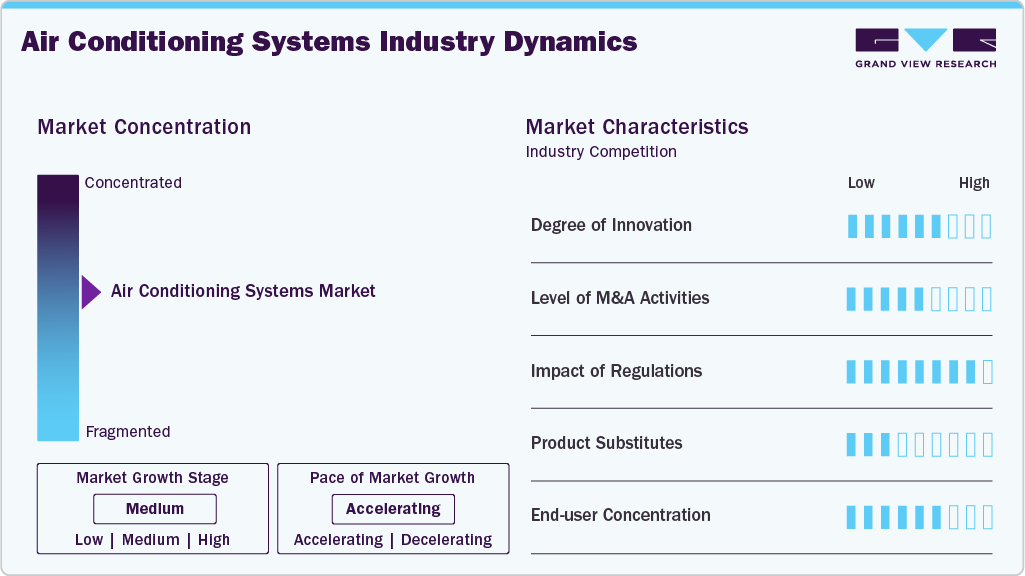

Market Concentration & Characteristics

The global air conditioning systems market is moderately concentrated, with a few major players holding significant market shares. Companies like Daikin, Carrier, LG, and Mitsubishi Electric dominate due to their strong brand presence, extensive product portfolios, and global distribution networks. However, regional manufacturers and new entrants are gaining ground, especially in emerging markets. This blend of dominance and local competition gives the market a balanced structure between concentration and fragmentation.

The air conditioning industry shows a high degree of innovation, with companies focusing on energy efficiency, smart connectivity, and eco-friendly technologies. Advancements like AI-based climate control, IoT integration, and inverter systems are reshaping product development. Manufacturers are also investing in R&D to reduce environmental impact through sustainable refrigerants. Innovation is key to meeting evolving consumer preferences and regulatory demands.

The industry has witnessed moderate to high merger and acquisition activity, aimed at expanding market reach, technological capabilities, and product diversification. Leading players acquire regional firms to strengthen their presence in emerging markets. M&A also allows for quicker adoption of advanced technologies and cost synergies. This trend is expected to continue as companies seek competitive advantages.

Regulations play a significant role in shaping the air conditioning industry, particularly concerning energy consumption and refrigerant use. Governments globally are enforcing stricter efficiency standards and phasing out high-GWP refrigerants. Compliance with these policies pushes companies toward greener, compliant technologies. Regulatory frameworks thus drive both innovation and product differentiation in the market.

Drivers, Opportunities & Restraints

The air conditioning systems market is driven by rising global temperatures and growing urbanization, leading to increased demand for indoor cooling. Technological advancements in energy-efficient and smart ACs are also fueling market growth. Expanding commercial infrastructure and residential construction further support demand. Additionally, rising disposable incomes are boosting consumer spending on premium air solutions.

The growing focus on sustainable cooling solutions presents significant opportunities for manufacturers. Emerging markets in Asia, Africa, and Latin America offer untapped potential due to rising urban development. Integration of IoT, AI, and solar power into AC systems can attract tech-savvy consumers. Government incentives for energy-efficient appliances also create room for product innovation and adoption.

High initial costs of advanced air conditioning systems can limit adoption, particularly in low-income regions. Energy consumption and environmental concerns related to refrigerants pose challenges for the industry. Strict regulatory standards can increase production costs and limit market entry for smaller players. Additionally, supply chain disruptions and raw material price fluctuations may hinder growth.

Type Insights

Ductless mini-split systems dominated the market and accounted for 49.4% of revenue share in 2024, due to their flexibility, energy efficiency, and ease of installation. They are ideal for homes and small commercial spaces without existing ductwork, offering zoned cooling. Growing demand for retrofitting solutions in urban areas further drives adoption. Inverter technology and smart features make them attractive to energy-conscious consumers.

Package air conditioners segment is expected to grow at a fastest CAGR of 7.4% from 2025 to 2033 in terms of revenue, driven by their suitability for large commercial and institutional buildings. These systems offer high-capacity cooling in a compact, pre-assembled unit, simplifying installation and maintenance. Increased construction of malls, offices, and healthcare facilities boosts demand. Their ability to handle large spaces efficiently makes them a preferred choice for centralized cooling.

Technology Insights

The inverter air conditioners segment held the largest revenue share of 68.6% in the market in 2024, owing to their energy efficiency, variable speed operation, and better temperature control. They consume less power by adjusting the compressor speed based on room temperature, reducing electricity bills. Rising environmental concerns and stricter energy regulations are pushing consumers toward inverter models. Additionally, manufacturers are expanding their inverter product lines to meet demand across residential and commercial sectors.

The non-inverter segment is expected to grow at a moderate CAGR of 4.0% from 2025 to 2033 in terms of revenue, mainly in price-sensitive markets where affordability is a key factor. These systems operate at fixed speeds, leading to higher energy consumption but lower upfront costs. Demand persists in regions with lower usage duration or limited access to advanced technologies. However, their market share is gradually declining due to rising awareness of long-term energy savings.

End-use Insights

The residential sector dominated the air conditioning market and accounted for a 43.9% share in 2024, due to rising urbanization, growing middle-class income, and increasing demand for home comfort. Consumers are opting for energy-efficient and smart ACs tailored for household use. Government incentives on energy-rated appliances further boost residential adoption. Additionally, changing climate conditions are driving year-round cooling needs in homes.

The commercial segment is expected to grow at a significant CAGR of 6.4% from 2025 to 2033 in terms of revenue, driven by expanding office spaces, retail outlets, hospitals, and hospitality infrastructure. Demand for centralized and VRF systems is rising to meet large-scale cooling requirements efficiently. Businesses are investing in advanced HVAC systems for better energy management and indoor air quality. Green building initiatives and regulatory standards are also encouraging commercial AC adoption.

Regional Insights

The North America air condition systems market is growing at a significant CAGR of 3.9% of the global market in 2024, driven by rising demand for energy-efficient and smart HVAC systems. Aging infrastructure and the need for system upgrades in residential and commercial spaces are key contributors. Consumers are increasingly adopting inverters and eco-friendly technologies. Government regulations supporting sustainable cooling solutions further support market expansion.

U.S. Air Conditioning Systems Market Trends

The U.S. dominates the North American air conditioning industry due to widespread residential and commercial adoption. High temperature variations across regions drive consistent demand for both cooling and heating systems. Consumers are shifting toward smart and energy-efficient AC units, supported by favorable government policies. The presence of leading manufacturers and strong distribution networks further boosts market leadership.

Canada air conditioning market is growing steadily, driven by rising temperatures and increasing residential installations. As climate change leads to warmer summers, demand for ACs in previously cooler regions is rising. Energy efficiency and eco-friendly features are major purchasing factors for Canadian consumers. Government incentives and green building standards are also encouraging the adoption of modern HVAC systems.

Europe Air Conditioning Systems Market Trends

Europe air conditioning systems market is witnessing gradual growth in the market, fueled by rising temperatures and increased awareness of indoor air quality. Demand is particularly strong in Southern and Central Europe, where heatwaves are becoming more frequent. The push for green buildings and strict EU energy standards is influencing product adoption. Retrofitting of older buildings also supports the growing need for modern AC systems.

Germany air conditioning systems market is growing due to increasing temperatures and the need for improved indoor comfort in both homes and workplaces. Demand is rising in commercial buildings, especially in offices and data centers. Energy efficiency and compliance with EU environmental standards are key factors influencing consumer choice. Government support for green technologies is also encouraging the adoption of advanced HVAC systems.

The UK air condition systems market is witnessing steady growth in air conditioning demand, driven by more frequent heatwaves and rising awareness of indoor air quality. Residential adoption is increasing, particularly in urban areas and modern housing developments. Energy-efficient and smart AC systems are gaining popularity amid growing environmental concerns. The shift toward sustainable construction practices further supports market expansion.

Asia Pacific Air Conditioning Systems Market Trends

Asia Pacific air conditioning systems market dominated the global market and accounted for a 57.4% share in 2024, due to rapid urbanization, population growth, and infrastructure development. Countries such as China, India, and Japan are major contributors, with increasing demand in both residential and commercial sectors. Rising incomes and climate conditions further fuel AC adoption. The presence of major manufacturers and government energy-efficiency programs also drives market leadership.

China air conditioning market is growing rapidly due to rising urbanization, increasing disposable incomes, and expanding residential construction. Government initiatives promoting energy-efficient appliances are pushing consumers toward inverter and eco-friendly ACs. The commercial sector, including offices and retail spaces, is also contributing to demand. Local manufacturers are investing heavily in R&D and expanding smart AC offerings to cater to tech-savvy consumers.

India is experiencing strong growth in the AC market driven by rising temperatures, a growing middle class, and increasing urban housing. Demand is particularly high in Tier I and Tier II cities, with a shift toward inverter and energy-saving models. Government programs like the BEE star labeling system are encouraging the adoption of efficient cooling systems. Domestic and global brands are expanding their presence through local manufacturing and competitive pricing.

Middle East & Africa Air Conditioning Systems Market Trends

The Middle East and Africa air conditioning systems market is experiencing significant growth in AC demand, driven by extreme heat and rapid infrastructure development. Urbanization and large-scale projects in countries like the UAE and Saudi Arabia are major contributors. Consumers prioritize powerful and durable systems suited for harsh climates. Increasing focus on energy conservation is also influencing product selection in this region.

The Saudi Arabia air conditioning market is growing steadily due to its extreme climate and year-round cooling requirements. Large-scale infrastructure projects under Vision 2030, including smart cities and tourism hubs, are boosting HVAC demand. There is a rising preference for energy-efficient systems to reduce power consumption in both residential and commercial sectors. Government regulations promoting sustainable construction and energy conservation are further supporting market growth.

Latin America Air Conditioning Systems Market Trends

The Latin America air conditioning market is growing due to expanding urban areas and higher temperatures across the region. Countries such as Brazil and Argentina are witnessing rising demand for affordable and energy-efficient units. Improvements in construction and rising middle-class income support market penetration. However, economic instability and cost concerns still pose challenges in some areas.

Brazil air conditioning market is growing due to rising temperatures, increased urbanization, and expanding middle-class income. Residential demand is climbing, especially in major cities where heat waves are becoming more frequent. Energy-efficient and affordable AC models are gaining popularity among consumers. Government programs promoting sustainable energy use are also encouraging the adoption of modern HVAC systems.

Key Air Conditioning Systems Company Insights

Some key players operating in the market include DAIKIN INDUSTRIES, Ltd., Carrier., and Haier Group.

-

Daikin specializes in advanced air conditioning systems, with a strong focus on inverter and energy-saving technologies. The company leads in environmentally responsible solutions, particularly through its early adoption of R-32 refrigerants. It heavily invests in R&D to develop smart and AI-enabled HVAC products. Daikin has a robust manufacturing and distribution presence across Asia, Europe, and North America. Its product strategy emphasizes performance, low environmental impact, and regulatory compliance.

-

Carrier is known for its high efficiency HVAC systems tailored for both residential and large-scale commercial applications. The company emphasizes sustainable technologies, offering solutions with low-GWP refrigerants and energy optimization features. Its portfolio includes smart AC systems integrated with building automation platforms. Carrier is active in acquisitions to strengthen its digital and green HVAC offerings. The company leverages data-driven innovation to improve lifecycle performance and reduce carbon footprints.

Key Air Conditioning Systems Companies:

The following are the leading companies in the air conditioning systems market. These companies collectively hold the largest market share and dictate industry trends.

- DAIKIN INDUSTRIES, Ltd.

- Carrier.

- Haier Group

- Johnson Controls - Hitachi Air Conditioning Company

- Lennox International Inc.

- LG Electronics.

- Midea.

- Mitsubishi Electric India Pvt. Ltd.

- Panasonic Corporation

- Samsung Electronics Co. Ltd.

- ALFA LAVAL

- Electrolux

- Trane Technologies plc

- Whirlpool

- Voltas, Inc.

Recent Developments

-

In August 2025, Bosch completed a USD 8 billion acquisition of Johnson Controls' residential and light commercial HVAC business, including full ownership of the Hitachi joint venture. The deal adds North American ducted systems and strengthens Bosch's global HVAC footprint. With this move, Bosch’s Home Comfort division nearly doubles in size. It significantly boosts the company’s presence in the U.S. and Asia.

-

In January 2025, Panasonic introduced its OASYS Residential Central AC System in the U.S., combining mini-split AC, ventilators, and transfer fans. It reduces energy use by over 50% and ensures quiet, uniform airflow for well-insulated homes. The system helps prevent condensation and mold in hidden spaces.

-

In February 2025, Haier launched its Kinouchi Limited Edition ACs in India, featuring unique color options like Black, Morning Mist, and Moonstone Grey. These models offer rapid cooling in 10 seconds, even at 60°C, with AI-based Supersonic Cooling. They include self-cleaning, HEXA Inverter, and Turbo Mode for long-range airflow.

Air Conditioning Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 105.08 billion

Revenue forecast in 2033

USD 182.97 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion, volume in thousand units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Turkey China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

DAIKIN INDUSTRIES, Ltd.; Carrier.; Haier Group; Johnson Controls - Hitachi Air Conditioning Company; Lennox International Inc.; LG Electronics.; Midea.; Mitsubishi Electric India Pvt. Ltd.; Panasonic Corporation; Samsung Electronics Co. Ltd.; ALFA LAVAL; Electrolux; Trane Technologies plc; Whirlpool; Voltas, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Conditioning Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global air conditioning systems market report based on type, technology, end-use, and region.

-

Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Package Air Conditioners

-

Split Air Conditioning Systems

-

Ductless Mini-split Systems

-

-

End-use Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Inverter

-

Non-inverter

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

Türkiye

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global air conditioning system’s market size was estimated at USD 98.74 billion in 2024 and is expected to be USD 105.08 billion in 2025.

b. The global air conditioning systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 182.97 billion by 2033.

b. Inverter air conditioners segment held the largest share in the market and accounted for a share of 68.6% in 2024 owing to their energy efficiency, variable speed operation, and better temperature control. They consume less power by adjusting compressor speed based on room temperature, reducing electricity bills. Rising environmental concerns and stricter energy regulations are pushing consumers toward inverter models.

b. Some of the key players operating in the global air conditioning systems market include DAIKIN INDUSTRIES, Ltd.; Carrier.; Haier Group; Johnson Controls - Hitachi Air Conditioning Company; Lennox International Inc.; LG Electronics.; Midea.; Mitsubishi Electric India Pvt. Ltd.; Panasonic Corporation; Samsung Electronics Co. Ltd.; ALFA LAVAL; Electrolux; Trane Technologies plc; Whirlpool; Voltas, Inc.

b. The global air conditioning systems market is driven by rising temperatures, urbanization, and growing demand for indoor comfort. Technological advancements in energy-efficient and smart ACs are boosting consumer adoption. Additionally, government incentives and green building initiatives are supporting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.