- Home

- »

- Next Generation Technologies

- »

-

AI Agents In Financial Services Market, Industry Report 2033GVR Report cover

![AI Agents In Financial Services Market Size, Share & Trends Report]()

AI Agents In Financial Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Risk Management Agents, Compliance and Regulatory Agents, Fraud Detection Agents, Customer Service Agents), By Institutional Type, By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-542-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

AI Agents In Financial Services Market Summary

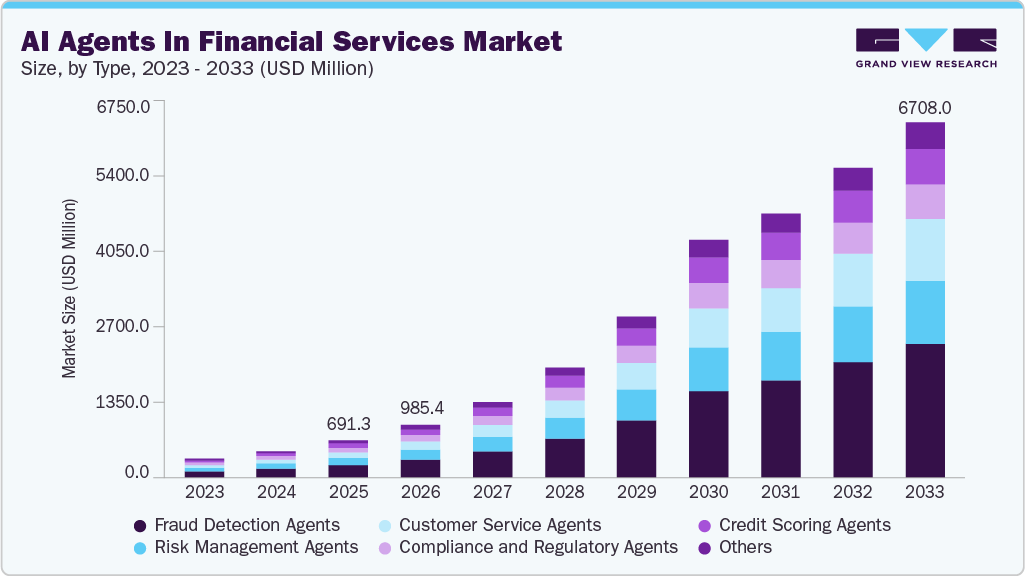

The global AI agents in financial services market size was estimated at USD 691.3 million in 2025 and is projected to reach USD 6,708.0 million by 2033, growing at a CAGR of 31.5% from 2026 to 2033. AI agents are rapidly transforming financial services by automating complicated processes, improving decision-making, and serving personalized customer experiences.

Key Market Trends & Insights

- North America AI agents in financial services market held the largest global revenue share of 37.8% in 2025.

- The U.S. AI agents in financial services industry led North America with the largest revenue share in 2025.

- By type, the fraud detection agents segment led the market with the largest revenue share of 33.8% in 2025.

- By institutional type, the traditional banks segment accounted for the largest revenue share of 45.5% in 2025.

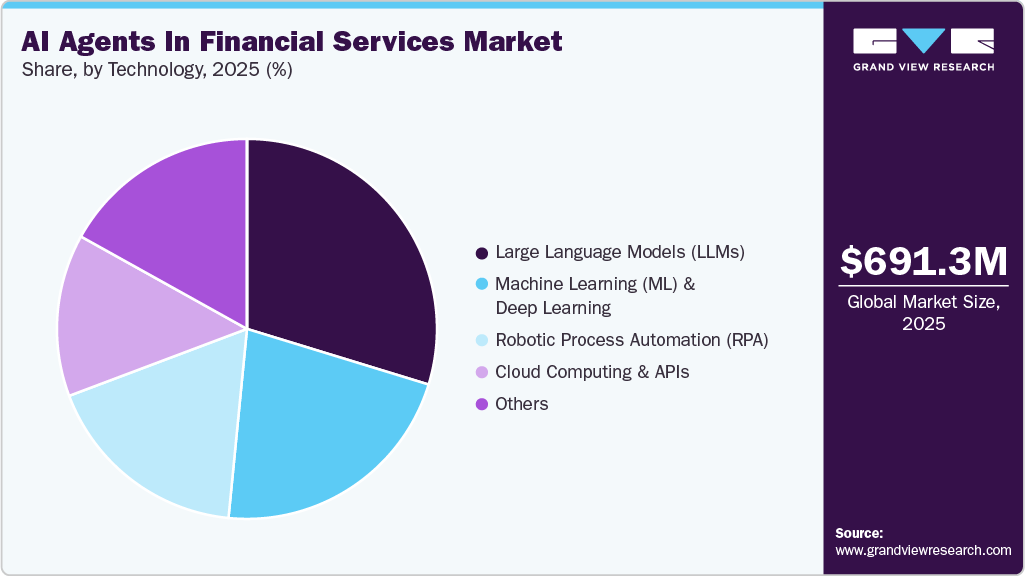

- By technology, the Large Language Models (LLMs) segment is expected to grow at the fastest CAGR of 34.2% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 691.3 Million

- 2033 Projected Market Size: USD 6,708.0 Million

- CAGR (2026-2033): 31.5%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

These intelligent systems manage tasks ranging from customer onboarding and 24/7 support to fraud detection and real-time investment management, making tasks more efficient and secure. AI-driven automation and digitalization are increasingly shaping financial services, and several companies are actively implementing these solutions. AI agents help streamline core banking and insurance operations, reducing manual workloads. Natural language interfaces enable easier interaction with financial data. Real-time insights and predictive analytics improve decision-making speed and accuracy. Integration of AI into existing platforms supports scalable digital transformation across the. For instance, in June 2025, SAP Fioneer, a German financial technology company, launched its AI Agent to transform core banking and insurance operations. This solution automates processes, provides real‑time insights, and allows users to interact with financial data using natural language, all integrated with SAP’s financial services platforms.AI-driven automation and intelligent decision support are transforming financial services. AI agents help streamline accounting, reporting, and workflow processes, reducing manual effort. Natural language interfaces make accessing and analyzing financial data easier for users. Real-time insights from AI agents improve accuracy and speed in decision-making. Automation also helps minimize errors and enhances operational efficiency. Many companies are actively implementing these AI solutions to improve financial operations. These developments are driving growth in the AI-powered financial tools market. For instance, in November 2025, Sage Group plc, a UK-based financial technology company, announced the Finance Intelligence Agent, a new AI agent within its Sage Intacct suite that autonomously delivers insights, automates accounting workflows, and routes natural language queries to the right financial data sources, reducing manual reporting work.

Integration of generative AI with enterprise systems accelerates the adoption of AI agents across financial services by enabling deeper automation and intelligence. Access to core banking, ERP, and CRM platforms allows AI agents to operate on real-time, high-quality enterprise data. This capability enhances decision-making across credit assessment, fraud detection, and risk management. Automated report generation, compliance documents, and insights reduce manual workloads and operational costs. Personalized financial guidance and customer interactions improve user experience and retention. Seamless system integration supports end-to-end workflow orchestration across front-, middle-, and back-office functions. Faster data processing enables institutions to respond quickly to market and regulatory changes. Improved scalability encourages financial firms to deploy AI agents across multiple business units.

Type Insights

The fraud detection agents segment led the AI agents in financial services industry, accounting for a revenue share of 33.8% in 2025. AI fraud detection agents are rapidly transforming financial services by enhancing the ability to identify and prevent increasingly complex forms of fraud. Financial institutions are heavily investing in AI-driven solutions that leverage machine learning, behavioral analytics, and real-time data monitoring to quickly detect anomalies and suspicious patterns. For instance, in April 2025, Juniper Payments announced an embedded AI-driven fraud prevention engine in its Payments hub, enabling real-time fraud detection at payment origin to support instant payments for banks and credit unions, reducing false positives and enhancing risk scoring across payment types.

The customer service agents segment is expected to experience significant growth over the forecast period as AI agent and technology innovations evolve. AI-powered customer service agents are transforming financial services by streamlining operations and enhancing customer interactions. Financial institutions increasingly deploy AI to handle routine inquiries, detect fraud, and provide personalized financial advice, freeing human agents for more complex tasks. For instance, in May 2024, RetailBank Corp implemented an AI-integrated customer service platform featuring chatbots and voice assistants. This reduced average response times by over 70% and cut the number of calls requiring human agents by 50%, allowing human staff to focus on complex issues and significantly improving customer satisfaction.

Institutional Type Insights

The traditional banks segment accounted for the largest revenue share of the AI agents in financial services market in 2025. Traditional banks are gradually implementing AI agents across institutional functions to improve financial services. They influence AI to improve customer interactions through chatbots and virtual assistants, automate back-office processes, and enhance fraud detection and risk management. AI-driven predictive analytics help in better decision-making, personalized product offerings, and dynamic credit scoring. Banks are also partnering with AI technology suppliers to accelerate innovation and address talent gaps. This integration leads to increased operational efficiency, reduced costs, and enhanced customer satisfaction, positioning banks to stay competitive in a rapidly evolving digital landscape.

The FinTech companies segment is expected to grow significantly over the forecast period. FinTech companies deploying institutional AI agents in financial services are seeing significant growth, driven by the rapid adoption of AI technologies for fraud detection, risk management, customer service automation, and algorithmic trading. Moreover, the market is driven by the need for real-time insights, enhanced compliance, and improved operational efficiency. AI-powered chatbots, virtual assistants, and advanced analytics are reshaping how financial institutions operate, leading to faster decision-making and better customer experiences.

Technology Insights

The Large Language Models (LLMs) segment accounted for the largest revenue share of the AI agents in financial services industry in 2025. Machine Learning and Optimization enhance decision-making and operational efficiency across various industries. These technologies leverage vast amounts of data to identify patterns, make predictions, and optimize processes, resulting in more informed and effective business strategies. In March 2025, Uptiq launched the AI Workbench Developer Edition, a platform that empowers developers to create AI Agents for financial services using low-code/no-code tools and supports over 16 Large Language Models (LLMs). The platform enables the design, fine-tuning, and deployment of custom AI agents for workflows like lending, credit underwriting, and customer service automation, with enterprise-grade security.

The Robotic Process Automation (RPA) segment is projected to grow significantly over the forecast period. Robotic Process Automation (RPA) is laying the foundation for AI agents in financial services by automating repetitive, rule-based processes such as data movement, document processing, and compliance checks, thus freeing up human talent for higher-value work. As financial institutions integrate RPA with AI, these agents evolve from simple task automation to intelligent decision-making, content generation, and customer interaction, driving operational efficiency and rapid innovation.

Regional Insights

North America dominated the AI agents in financial services market, accounting for 37.8% of the revenue share in 2025. AI agents are rapidly transforming financial services in North America, driven by early adoption, strong investment, and a robust tech ecosystem. They are widely used to automate customer service, fraud detection, risk management, and personalized financial advice, thereby enhancing both efficiency and the customer experience. Major initiatives are, for instance, in March 2025, Oracle Financial Services introduced AI agents in its Investigation Hub Cloud Service to automate and accelerate financial crime investigations, reducing manual work and improving decision consistency for financial institutions globally.

U.S. AI Agents In Financial Services Market Trends

The adoption of AI agents in U.S. financial services is accelerating rapidly, with major banks and fintech firms integrating them across functions such as customer support, fraud monitoring, and compliance. Institutions are leveraging AI agents to streamline operations, reduce response times, and deliver personalized financial advice. The growing availability of enterprise-grade AI tools and cloud infrastructure is enabling faster, more cost-effective deployments. This trend shows a broader shift toward intelligent automation as a strategic priority in the U.S. financial sector.

Europe AI Agents In Financial Services Market Trends

AI agents are seeing significant momentum in Europe’s financial services sector, particularly in banking and insurance, where firms are deploying them to improve customer service, risk analysis, and compliance workflows. A growing number of European institutions are prioritizing AI integration to meet rising expectations for digital efficiency and personalization. Despite regulatory complexities and workforce readiness concerns, investment in AI-powered solutions continues to rise. This reflects a clear shift toward embedding intelligent automation at the core of financial operations across the region.

Asia Pacific AI Agents In Financial Services Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. AI agents are rapidly transforming financial services across the Asia Pacific region, with institutions in markets like China, India, and Japan leading in deployment. These agents are being widely used to enhance customer engagement, automate back-office functions, and strengthen fraud detection systems. Financial firms are increasingly viewing AI as a strategic tool to improve efficiency and meet rising digital expectations. A strong push for innovation and government-backed digital finance initiatives across the region supports this shift.

Key AI Agents In Financial Services Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Amazon Web Services, Inc., empowers financial services companies with advanced AI agents and cloud technologies to transform customer experiences, streamline operations, and enhance decision-making. By leveraging AWS AI solutions such as Amazon Bedrock and Amazon Q, financial institutions can automate processes like fraud detection, customer onboarding, and personalized client interactions, while improving data analytics and regulatory compliance. These AI-driven tools help uncover hidden financial patterns, mitigate risks, and deliver tailored services, enabling organizations to stay agile and competitive in a rapidly evolving industry.

-

FICO is a key player in analytics and decision management, renowned for pioneering the use of AI agents, predictive analytics, and mathematical algorithms to transform financial services. Its flagship FICO Score is the industry standard for assessing consumer credit risk, used by 90% of top US lenders to drive lending decisions, manage risk, and fight fraud. FICO’s AI-powered solutions help financial institutions optimize operations, ensure regulatory compliance, and deliver more profitable customer relationships. Leveraging big data, open-source standards, and cloud computing, FICO empowers businesses to make billions of precise, agile decisions every year across the financial sector.

Key AI Agents In Financial Services Companies:

The following key companies have been profiled for this study on the AI agents in financial services market

- Accenture

- Amazon Web Services, Inc.

- FICO

- Microsoft

- NVIDIA

- Salesforce

- SAP

- Oracle

- Temenos

- Upstart

- WorkFusion

- Zest AI

Recent Developments

-

In March 2025, Oracle Financial Services launched new agentic AI capabilities within its Investigation Hub Cloud Service to help financial institutions tackle financial crime more effectively. These AI agents automate investigative processes, uncover complex fraud patterns, and generate generative AI-driven narratives, significantly reducing manual work and enabling investigators to focus on high-priority leads. The enhanced solution is now available globally, empowering organizations of all sizes to conduct financial investigations more predictably, thoroughly, and efficiently.

-

In March 2025, Auquan announced the launch of its industry-first risk agent, an AI agent purpose-built for risk monitoring and detection in financial services. Unlike traditional tools, Auquan’s risk agent autonomously executes the entire risk monitoring and reporting workflow, providing early warning detection of emerging risks across investment and credit portfolios. The risk agent draws on over two million data sources across more than 65 languages, delivering unparalleled risk visibility and situational awareness for global institutions.

-

In March 2025, Accenture expanded its AI refinery platform with the launch of a no-code AI agent builder and over 50 industry-specific AI agent solutions, aiming for 100 by year-end. These new solutions, built on NVIDIA AI Enterprise, empower business users to rapidly create and customize advanced reasoning AI agents across sectors such as financial services, insurance, and telecommunications. Early adopters such as ESPN, HPE, Noli, and the United Nations are already leveraging these innovations to enhance efficiency and engagement. The expansion accelerates the adoption of agentic AI, enabling organizations to quickly scale networks of intelligent agents and reinvent core business processes for greater agility and value creation.

AI Agents In Financial Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 985.4 million

Revenue forecast in 2033

USD 6,708.0 million

Growth rate

CAGR of 31.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, institutional type, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Accenture; Amazon Web Services, Inc.; FICO; Microsoft; NVIDIA; Salesforce; SAP; Oracle; Temenos; Upstart; WorkFusion; Zest AI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

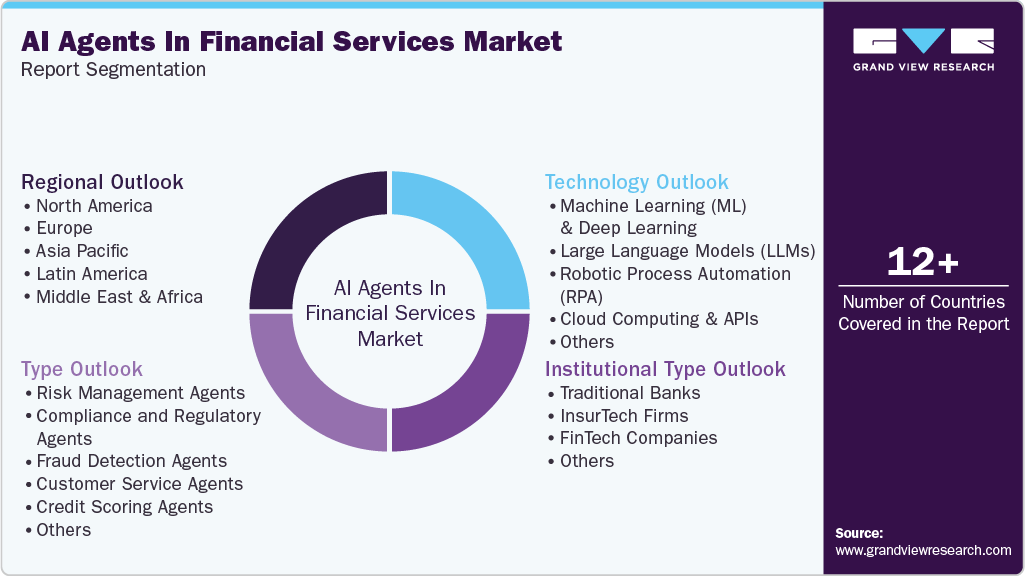

Global AI Agents In Financial Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI agents in financial Services market report based on type, institution type, technology, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Risk Management Agents

-

Compliance and Regulatory Agents

-

Fraud Detection Agents

-

Customer Service Agents

-

Credit Scoring Agents

-

Others

-

-

Institutional Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Traditional Banks

-

InsurTech Firms

-

FinTech Companies

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning (ML) & Deep Learning

-

Large Language Models (LLMs)

-

Robotic Process Automation (RPA)

-

Cloud Computing & APIs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI agents in financial services market size was estimated at USD 691.3 million in 2025 and is expected to reach USD 985.4 million in 2026.

b. The global AI agents in financial services market is expected to grow at a compound annual growth rate of 31.5% from 2026 to 2033 to reach USD 6,708.0 million by 2033.

b. Some key players operating in the AI agents in financial services market include Accenture; Amazon Web Services (AWS); FICO; Microsoft; NVIDIA; Salesforce; SAP; Oracle; Temenos; Upstart; WorkFusion; Zest AI

b. North America dominated the AI agents in financial services market with a share of 37.8% in 2025. AI agents are rapidly transforming financial services in North America, driven by early adoption, strong investment, and a robust tech ecosystem.

b. Key factors that are driving the market growth include technological innovations and changing consumer expectations. Customers now demand seamless, personalized digital capabilities, and AI agents are central to meeting these expectations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.