- Home

- »

- Plastics, Polymers & Resins

- »

-

Agricultural Films Market Size, Share, Industry Report, 2030GVR Report cover

![Agricultural Films Market Size, Share & Trends Report]()

Agricultural Films Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material (LDPE, LLDPE, HDPE, EVA/EBA, Reclaims), By Application (Green House, Mulching, Silage), By Region, And Segment Forecasts

- Report ID: 978-1-68038-144-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Films Market Summary

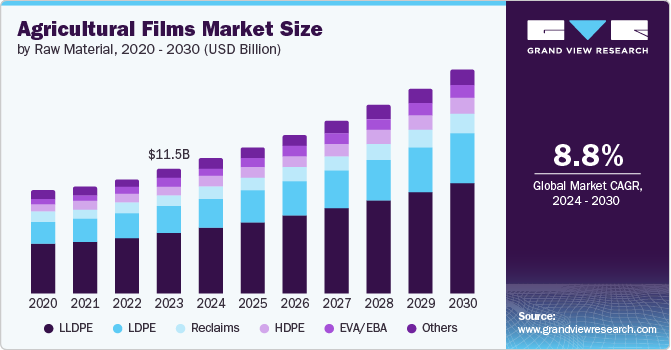

The global agricultural films market size was valued at USD 11.45 billion in 2023 and is projected to reach USD 20.59 billion by 2030, growing at a CAGR of 8.8% from 2024 to 2030. Agricultural output, demand for modern agricultural practices, and sustainable farming drives the agricultural films market in the forecast period.

Key Market Trends & Insights

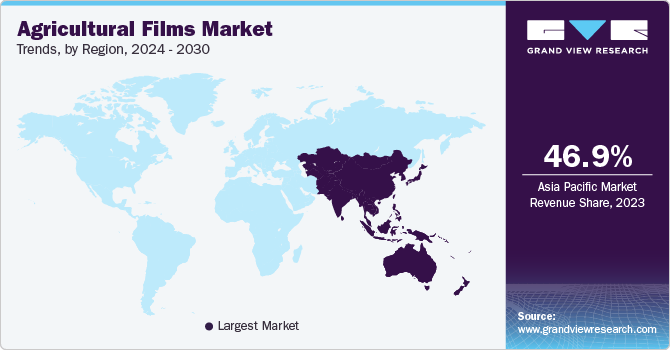

- The Asia Pacific dominated the global market with the revenue share of 46.9% in 2023.

- Based on raw material, LLDPE accounted for the largest market revenue share of 49.5% in 2023.

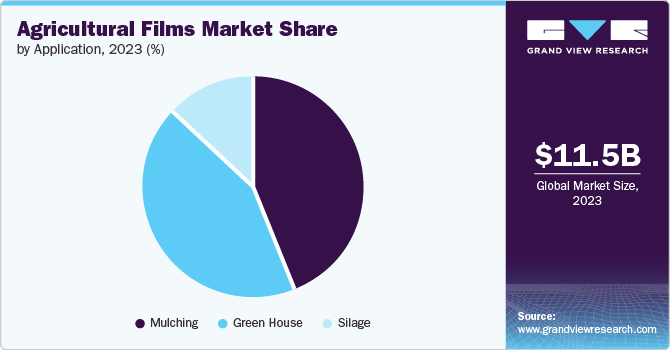

- Based on application, Mulching segment accounted for the largest market revenue share of 44.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.45 Billion

- 2030 Projected Market Size: USD 20.59 Billion

- CAGR (2024 to 2030): 8.8%

- Asia Pacific: Largest market in 2024

Agricultural film products are employed to safeguard crops in greenhouses and allow the plants to endure extreme climates. Agricultural films are utilized for different farming techniques to improve crop quality, adjust soil temperature, control weed growth, and boost crop yields. Other uses of these products include storing corn, silage, and hay. Thus, farmers require agricultural films for their cultivation needs. Agricultural films are proven solutions for soil protection, green house yields, and precision farming. The elastic films safeguard the plants in both indoor and outdoor environments. The durability and efficiency of agricultural films contribute to improving production. In extreme climates and regions with excess rainfall, it lessens the impact of hail.

The growing need for food has led to a rise in the use of plastic films in the agricultural sector. These films are used in low tunnels, irrigation systems, mulching, and silage. Agricultural films enhance crop yield with a better harvest and produce. Therefore, they are utilized in contemporary agriculture to supplement crop production. Other than the regular norm, film manufacturing industries focus on producing nano-greenhouse films for agricultural use at affordable prices. These films are ideal for remote regions as they do not run on electricity.

Raw Material Insights

LLDPE accounted for the largest market revenue share of 49.5% in 2023. LLDPE is extensively used in agriculture because it is readily accessible, inexpensive, has strong impact resistance, provides good electrical insulation, and exhibits outstanding chemical resistance. These films possess different characteristics such as high tensile strength, crack and UV ray resistance, moisture barrier, and adjustable temperature properties. These films are preferred over traditional films for their characteristics including better performance and reasonable costs.

LDPE is expected to register the fastest CAGR of 9.2% during the forecast period. These films are utilized in regions with severe weather conditions and limited access to water. LDPE films are used in low tunnels, greenhouses, mulching, silage, and irrigation tapes. Other features of LDPE films include enhanced light penetration, reduced reflection, and retaining heat for a green house.

Application Insights

Mulching segment accounted for the largest market revenue share of 44.3% in 2023. Mulching offers advantages such as suppressing weed growth, reducing water loss, controlling soil temperature, and supplementing crop health with ideal heat and water intake. Furthermore, mulching films reduce the need for pesticides and help in water conservation, promoting sustainable and eco-friendly farming methods. Farmers engaged in different types of farming value the economic and environmental advantages of mulching films, thus resulting in extensive use of mulching depending on soil conditions.

Green house is projected to grow at the fastest CAGR of 8.9% over the forecast period. Green house films are automated and suitable for external temperatures. The structures are often curved and are covered with PE films. The main factors fueling the growth of this segment include the inexpensive installation costs, enhanced soil protection, regulated climate conditions, management of pests and diseases, and the long lifespan of greenhouse films.

Regional Insights

North America agricultural films accounted for a global market share of 21.9% in 2023. The rising popularity of greenhouse farming, the need to save water resources, and the increasing interest in organic agriculture are propelling the growth of the agricultural film market. Furthermore, regional market growth is positively anticipated due to agricultural films featuring in biodegradability, UV resistance, and increased durability.

U.S. Agricultural Films Market Trends

The U.S. agricultural films market is expected to grow rapidly in coming years due to the population growth and the country is a major agricultural exporter. Shift in farming practices from traditional to modern techniques form the base of demand for mulching films in the U.S. Besides, as environmental concerns continue to dominate, biodegradable agricultural products will witness significant growth in the forecast period.

Asia Pacific Agricultural Films Market Trends

Asia Pacific agricultural films dominated the global market in 2023 due to the high population in countries such as China and India. There is a significant increase in the demand for food. Ideal weather conditions result in perennial farming activities and with the help of agricultural films, the quality levels in the soil can be controlled. Furthermore, the increasing use of greenhouse technology and focus on sustainability objectives drive market expansion with a leading position in the global market. It also extracts advantages from the growing use of advanced farming techniques, which boosts the need for agricultural films.

Agricultural films market in China dominated the market with a share of 33.4% in 2023 due to farmers adopt protective agrarian methods to improve the output and quality of crops. Protected cultivation covers nearly 3.3 million hectares of crop area in China.

Europe Agricultural Films Market Trends

Europe agricultural films market is anticipated to witness significant growth due to the rising use of modern farming practices and technologies, the desire for better crop yield and quality, and increased awareness of sustainable agriculture are fueling the demand for agricultural films. In addition, the anticipated growth of the agricultural film market in the area is expected to be driven by the increase in government support and efforts to promote sustainable farming practices and decrease carbon emissions.

The UK agricultural films market growth is anticipated higher in the coming years as agricultural films such as mulches and silage wraps maximize productivity on existing farmlands. The UK has a flourishing greenhouse industry driven by the desire for out-of-season produce and protection from unpredictable weather.

Key Agricultural Films Company Insights

Some key companies in the agricultural films market include RKW Group; Coveris; Rani Group; Groupe Barbier, and others. Organizations emphasize increasing customer base to gain a competitive edge in the industry. Therefore, key players are undertaking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Groupe Barbier is involved in recycling and manufacturing eco-friendly plastic products for the retail and agricultural sectors. The company focuses on advancing eco-friendly design, utilizing biomaterials, and managing the collection process of post-consumer films for recycling household, industrial, and agricultural films.

-

Polifilm is the leading manufacturer of extrusion films and protective films. It provides extrusion, technical, standard, off-the-shelf, and protective films. For technical films, the offerings include laminating, labeling, and protective films.

Key Agricultural Films Companies:

The following are the leading companies in the agricultural films market. These companies collectively hold the largest market share and dictate industry trends.

- RKW Group

- Coveris

- Rani Group

- Groupe Barbier

- Plastika Kritis

- Industrial Development Company Sal

- Polifilm

- Sigma Plastics Group

- ExxonMobil Corporation

- Geminor

- The Grupo Armando Alvarez

Recent Developments

-

In January 2024, RKW Group presented film and net solutions with non-wovens for the entire supply chain at Fruit Logistica expo in Berlin. The company showcased a wide range of products ranging from plant cultivation to packaging and transportation. RKW offers a variety of products for plant cultivation, including early harvesting films, non-woven crop covers, and greenhouse films.

-

In October 2023, Armando Alvarez Group and RedSea signed an exclusive collaboration agreement for creating and distributing new smart greenhouse covers. These new greenhouse covers use the advanced Iyris technology created by RedSea to control greenhouse temperature. The technology is integrated into the 100% recyclable covers made by the Armando Alvarez Group, conserving water and energy while enhancing harvest yield in hot regions.

Agricultural Films Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.41 billion

Revenue forecast in 2030

USD 20.59 billion

Growth rate

CAGR of 8.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Indonesia; Vietnam; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

RKW Group; Coveris; Rani Group; Groupe Barbier; Plastika Kritis; Industrial Development Company Sal; Polifilm; Sigma Plastics Group; ExxonMobil Corporation; Geminor; The Grupo Armando Alvarez

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Films Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural film market report based on raw material, application, and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

LDPE

-

LLDPE

-

HDPE

-

EVA/EBA

-

Reclaims

-

Others (PVC, EVOH, etc.)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Green house

-

Mulching

-

Silage

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.