- Home

- »

- Biotechnology

- »

-

Agricultural Biotechnology Market Size, Industry Report, 2030GVR Report cover

![Agricultural Biotechnology Market Size, Share & Trends Report]()

Agricultural Biotechnology Market (2025 - 2030) Size, Share & Trends Analysis Report By Organism (Plants, Animals, Microbes), By Application (Vaccine, Flower Culturing, Biofuels), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-839-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agricultural Biotechnology Market Summary

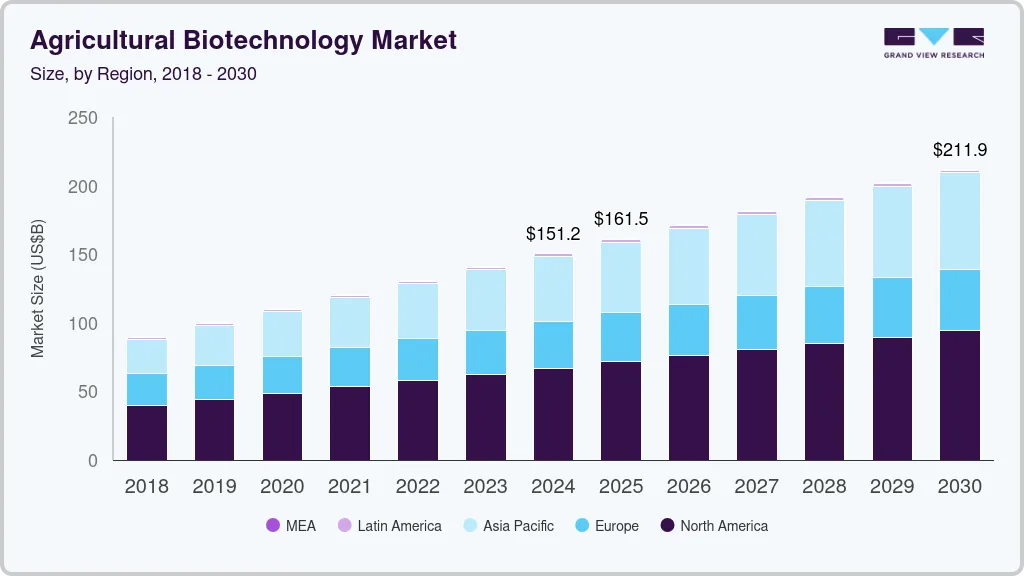

The global agricultural biotechnology market size was valued at USD 151.23 billion in 2024 and is projected to reach USD 212.57 billion by 2030, growing at a CAGR of 7.1% from 2025 to 2030. This growth is primarily driven by advances in gene editing technologies such as CRISPR-Cas9 enhance crop resilience to pests and environmental stressors, significantly improving yields.

Key Market Trends & Insights

- North America agricultural biotechnology market is expected to grow at a CAGR of 7.1% over the forecast period.

- The Asia Pacific agricultural biotechnology market dominated the global market and accounted for the largest revenue share of 31.5% in 2024.

- By organism, the plants segment led the market and accounted for the largest revenue share of 42.1% in 2024.

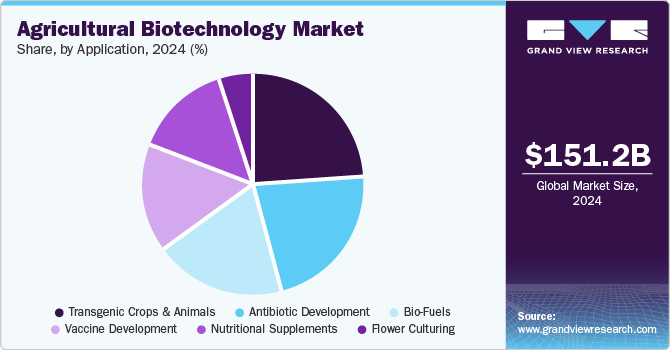

- By application, the transgenic crops and animals segment dominated the market with the highest revenue share of 24.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 151.23 Billion

- 2030 Projected Market Size: USD 212.57 Billion

- CAGR (2025-2030): 7.1%

- Asia Pacific: Largest market in 2024

In addition, the rising demand for sustainable farming practices and reduced chemical usage further fuels market growth. Furthermore, increasing consumer awareness regarding food safety and environmental sustainability also plays a crucial role in propelling the agricultural biotechnology sector forward.

Agricultural biotechnology, often referred to as aggrotech, encompasses a range of scientific techniques aimed at modifying living organisms such as plants, animals, and microorganisms to enhance agricultural productivity and sustainability. This field utilizes tools such as, molecular markers, tissue culture, and genetic engineering to develop crops with desirable traits such as improved yield, resistance to pests and diseases, and enhanced nutritional value.

The anticipated increase in the global adoption of genetically modified (GM) crops is expected to significantly influence market growth during the forecast period. Genetic modification enables the development of food and feed crops with superior traits, including enhanced nutritional content, higher yields, improved food-processing qualities, and resistance to pests and diseases. Many countries have swiftly embraced GM crops, particularly those engineered to be resistant to insects and tolerant of herbicides, marking a rapidly expanding segment within the agricultural sector.

In addition, the urgent need for increased agricultural output is driven by a rising global population and the subsequent demand for food. Biotechnology provides innovative solutions that improve crop quality and resilience, particularly in response to climate change challenges such as extreme weather and diminishing arable land. Furthermore, there is a growing consumer awareness of food safety and environmental sustainability, which is fostering demand for biotech crops that reduce reliance on chemical pesticides and fertilizers.

Organism Insights

The plants segment led the market and accounted for the largest revenue share of 42.1% in 2024. This growth can be attributed to the increasing demand for crops that exhibit enhanced traits such as improved yield, pest resistance, and nutritional value. In addition, as farmers face challenges such as climate change and soil degradation, biotechnology offers innovative solutions to develop resilient plant varieties. Furthermore, the rising consumer preference for sustainable and organic farming practices encourages the adoption of genetically modified crops that reduce chemical usage, propelling market expansion.

The animals segment is expected to grow at a CAGR of 7.7% over the forecast period, owing to the need for improved livestock productivity and health. In addition, biotechnological advancements facilitate the development of animal breeds with desirable traits, such as disease resistance and faster growth rates. This enhances food security and supports sustainable farming practices by optimizing resource use. Moreover, the growing focus on animal welfare and the demand for high-quality animal products drive investments in biotechnological innovations that improve breeding techniques and overall livestock management.

Application Insights

The transgenic crops and animals segment dominated the global agricultural biotechnology industry with the highest revenue share of 24.4% in 2024, driven by the increasing demand for enhanced agricultural productivity and sustainability. In addition, transgenic crops are designed to reveal traits such as pest resistance, herbicide tolerance, and improved nutritional content, which help farmers address challenges such as climate change and limited arable land. Furthermore, the rapid adoption of these crops worldwide reflects their effectiveness in boosting yields and reducing chemical inputs, making them essential for meeting global food demands.

The vaccine development is expected to grow at a CAGR of 8.1% from 2025 to 2030, owing to the need for innovative solutions to combat animal diseases and improve livestock health. Vaccines developed through biotechnological methods offer effective disease prevention while minimizing reliance on antibiotics. In addition, the growing focus on animal welfare and food safety drives investment in research aimed at producing safe, effective vaccines that can enhance livestock productivity. Furthermore, advancements in genetic engineering enable the development of vaccines that can be delivered through feed or water, simplifying administration and improving uptake among animal populations.

Regional Insights

The Asia Pacific agricultural biotechnology market dominated the global market and accounted for the largest revenue share of 31.5% in 2024. This growth can be attributed to the increasing demand for food security and sustainable agricultural practices. As the population continues to rise, there is a pressing need for innovative solutions that enhance crop productivity and resilience. Furthermore, the region faces significant challenges from climate change, prompting farmers to adopt biotechnology to develop climate-resilient crops. Moreover, government support for research and development initiatives further fosters an environment conducive to biotechnological advancements, promoting collaboration among stakeholders.

Japan Agricultural Biotechnology Market Trends

The agricultural biotechnology market in Japan led the Asia Pacific market and held the significant revenue share in 2024, driven by government initiatives aimed at modernizing agriculture and enhancing food security. The country's focus on developing genetically modified crops that are resistant to pests and diseases plays a crucial role in increasing agricultural productivity. In addition, rising consumer awareness regarding food safety and environmental sustainability drives demand for biotech solutions. Furthermore, the integration of advanced biotechnological techniques in crop production aligns with Japan’s goals of achieving sustainable agricultural practices while addressing challenges posed by climate change.

North America Agricultural Biotechnology Market Trends

North America agricultural biotechnology market is expected to grow at a CAGR of 7.1% over the forecast period, owing to the increasing acceptance of genetic engineering techniques among farmers. In addition, the region's emphasis on sustainability and food security encourages the adoption of biotechnological solutions that enhance crop yields while reducing reliance on chemical inputs. Furthermore, advancements in research and development contribute to the creation of innovative biotech products tailored to meet specific agricultural needs, further driving market expansion.

The agricultural biotechnology market in the U.S., dominated the North American market and accounted for the largest revenues share in 2024, propelled by strong consumer demand for genetically modified crops that offer improved traits such as pest resistance and drought tolerance. Furthermore, the country benefits from a well-established regulatory framework that supports biotech innovation and commercialization. Moreover, significant investments in research and development by both public and private sectors facilitate advancements in crop biotechnology, ensuring that U.S. agriculture remains competitive and sustainable in a rapidly changing global landscape.

Europe Agricultural Biotechnology Market Trends

The Europe agricultural biotechnology market is expected to witness substantial growth over the forecast period, primarily driven by a growing focus on sustainable farming practices and environmental conservation. In addition, the European Union's commitment to reducing pesticide use aligns with the development of biotech crops that require fewer chemical inputs. Furthermore, public awareness regarding food safety and nutrition drives interest in genetically modified organisms, fostering a more favorable environment for biotech innovations.

Key Agricultural Biotechnology Company Insights

Key companies in the global agricultural biotechnology industry include Bayer AG, Corteva, Syngenta, and others. These companies are implementing several strategies to enhance their competitive edge. These include significant investments in research and development to innovate and expand product portfolios. In addition, collaborations and partnerships with other firms and research institutions are also prevalent, enabling knowledge sharing and access to new technologies. Furthermore, companies are focusing on regulatory compliance to facilitate the approval of new biotech products, while actively engaging with stakeholders to promote the benefits of agricultural biotechnology for sustainable farming practices.

-

Bayer AG manufactures a wide range of products, including genetically modified seeds, crop protection chemicals, and biological solutions designed to enhance agricultural productivity and sustainability. Operating primarily in the crop protection and seed segments, Bayer leverages advanced research and development to create new hybrids and traits that meet the evolving needs of global agriculture.

-

Evogene specializes in developing advanced technologies to improve crop productivity and sustainability. The company focuses on manufacturing products that enhance plant traits through genetic engineering, including drought resistance and pest tolerance. Operating within the agricultural biotechnology segment, the company employs computational biology and machine learning to accelerate the discovery of new traits and develop innovative solutions for farmers, thereby addressing critical challenges in modern agriculture.

Key Agricultural Biotechnology Companies:

The following are the leading companies in the agricultural biotechnology market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Bayer AG

- ADAMA Agriculture Solution

- Corteva

- Syngenta

- Evogene

- DuPont

- Vilmorin

- Isagro SPA

- Benson Hil

Recent Developments

-

In February 2025, BASF is preparing to launch Prexio Active, a novel insecticide, after submitting registration dossiers in key Asia Pacific markets such as India. This marks a significant expansion of BASF's insecticide portfolio, providing sustainable solutions for rice farmers. Prexio Active targets all four rice hopper species and has no known cross-resistance to market standards. It offers effective, long-lasting control while being compatible with beneficial organisms. This insecticide active ingredient saves time and labor by only requiring one spray under normal pest pressure.

-

In August 2024, ADAMA Australia collaborated with Elemental Enzymes to introduce a novel bio-fungicide to the Australian market by 2026. This product, based on Elemental Enzymes’ patented peptide technology, was expected to target foliar diseases in winter crops and spring turf, offering a new mode of action against fungal diseases such as septoria in wheat. The bio-fungicide complements traditional chemical fungicides by stimulating the plant’s natural defenses, aiding in resistance management and improving crop health.

-

In February 2023, Bayer and Kimitec partnered to quicken the development and commercialization of biological crop protection and biostimulant solutions. This partnership aimed at creating integrated crop management systems, offering farmers sustainable solutions. By combining Kimitec's innovative agriculture biotechnology with Bayer's global reach, the collaboration expedited the development of biological products, meeting the growing demand for low-residue food production. The biologicals market is projected to reach nearly euro 25 billion by 2028.

Agricultural Biotechnology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 161.45 billion

Revenue forecast in 2030

USD 212.57 billion

Growth rate

CAGR of 7.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Organism, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Germany, UK, China, Japan, Brazil, and South Africa.

Key companies profiled

BASF SE; Bayer AG; ADAMA Agriculture Solution; Corteva; Syngenta; Evogene; DuPont; Vilmorin; Isagro SPA; Benson Hil.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agricultural Biotechnology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global agricultural biotechnology market report based on organism, application, and region:

-

Organism Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plants

-

Conventional Techniques

-

Established Genetic Modification

-

New Breeding Techniques

-

-

Animals

-

Conventional Techniques

-

Established Genetic Modification

-

New Breeding Techniques

-

-

Microbes

-

Conventional Techniques

-

Established Genetic Modification

-

New Breeding Techniques

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vaccine Development

-

Transgenic Crops & Animals

-

Antibiotic Development

-

Nutritional Supplements

-

Flower Culturing

-

Bio-Fuels

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

Japan

-

China

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.