- Home

- »

- Alcohol & Tobacco

- »

-

Agave Spirits Market Size, Share And Growth Report, 2030GVR Report cover

![Agave Spirits Market Size, Share & Trends Report]()

Agave Spirits Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Tequila, Mezcal, By Point of Sale (Off Premise, On Premise), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-480-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agave Spirits Market Summary

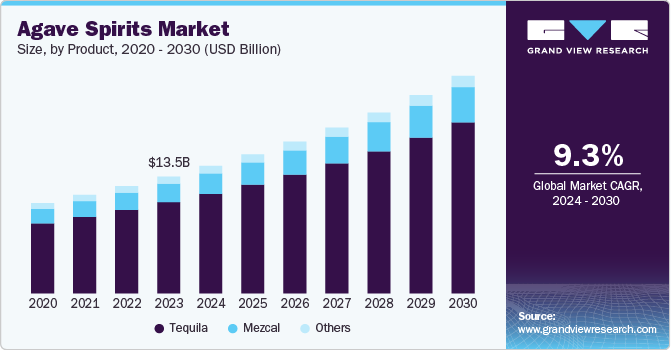

The global agave spirits market was estimated at USD 13.5 billion in 2023 and is expected to grow at a CAGR of 9.3% from 2024 to 2030. Growing demand for premium and ultra-premium spirits is a key driver for market growth.

Key Market Trends & Insights

- North America agave spirits market held the largest revenue of USD 5.5 billion in 2023.

- By product, the tequila was the largest consumed agave spirit, with revenue exceeding USD 10 billion in 2023.

- By point of sale, the off-premise sale of agave spirits generated USD 10 billion in market revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 13.5 Billion

- 2030 Projected Market Size: USD 25.12 Billion

- CAGR (2024-2030): 9.3%

- North America: Largest market in 2023

Consumers increasingly seek high-quality products that emphasize unique characteristics and traditional production methods. This trend has led to a surge in demand for artisanal spirits, which often come from single estates and use organic cultivation practices.

The increasing health consciousness among consumers is also seen as a key driver for agave spirits market growth. Tequila is perceived as a healthier option compared to other spirits due to its lower sugar and calorie content, particularly when consumed without a mixer. This is in line with changing consumer preferences toward healthier drinking habits. In addition, the increasing preference towards sipping spirits instead of shots, a significant shift in consumer habits and market trends, is further expected to promote market growth.

The cocktail culture has significantly boosted the popularity of agave spirits. Bartenders are creatively incorporating tequila and mezcal into diverse cocktail offerings, making these spirits more accessible and appealing to a broader audience. Classic cocktails like margaritas and innovative drinks have contributed to increased consumer interest. Agave spirits are gaining traction beyond traditional markets in North America, with growing popularity in regions like Europe and Asia. This expansion is fueled by increasing consumer interest in Mexican culture and cuisine, further driving demand for tequila and mezcal.

In spite of the growing demand for agave spirits, a few factors could negatively impact the market in the near future. The tequila industry is subject to stringent regulations regarding production, labeling, and geographical indications. Compliance with these regulations can be costly and time-consuming, particularly for smaller or new producers needing more resources to navigate complex legal requirements.

Tequila production relies heavily on blue agave, which has a long maturation period. Fluctuations in agave crop yields can lead to shortages and price volatility, impacting production costs and profitability. Additionally, recent disruptions in global supply chains due to events like the COVID-19 pandemic have further complicated sourcing and distribution efforts.

Product Insights

Tequila was the largest consumed agave spirit, with revenue exceeding USD 10 billion in 2023, and is expected to grow at a CAGR of 9.5% over the forecast period. Tequila remains the spirit of choice among all agave spirits and the demand is expected to rise over the forecast period. There is a significant trend towards premium and ultra-premium tequila. Consumers increasingly seek high-quality options, with brands offering unique flavors and artisanal production methods. This has led to a surge in demand for aged tequilas like reposado and añejo, which are seen as more sophisticated choices.

The rise of ready-to-drink (RTD) premixed tequila cocktails is appealing to younger consumers looking for convenience. These products are often available in various flavors and formats, making them attractive for social gatherings and parties. In addition, the emergence of celebrity-owned tequila brands has significantly raised awareness and interest in the category. High-profile endorsements have attracted new consumers who may be less familiar with traditional tequila offerings.

Tequila sales have significantly improved in countries such as China, Australia, Japan, and India, which are traditionally smaller markets. This area is projected to exhibit the highest compound annual growth rate (CAGR) in the coming years, driven by increasing consumer interest in agave spirits, particularly among millennials.

Mezcal was the second most popular agave spirit and has gained traction in recent years. There is a growing focus on high-quality, artisanal mezcal products. Consumers are increasingly seeking authentic experiences and unique flavor profiles, which mezcal offers through its diverse varieties of agave and traditional production methods. The increased focus on low-calorie spirits has further boosted the mezcal market. Many consumers prefer mezcal due to its lower sugar content compared to other spirits. This trend is driving the demand for organic and naturally sourced beverages.

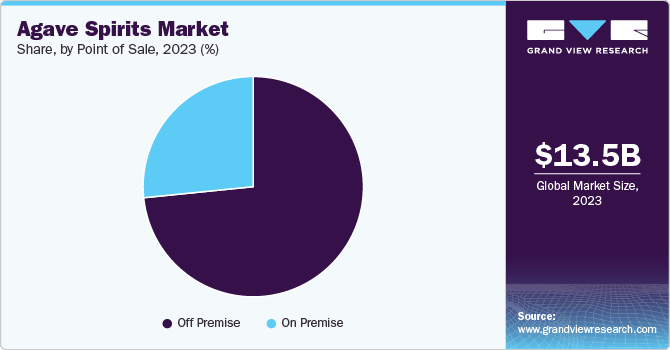

Point of Sale Insights

The off-premise sale of agave spirits generated USD 10 billion in market revenue in 2023 and is expected to grow at a CAGR of 9.1% from 2024 to 2030. Off-premise sales refers to the sale of spirits through supermarkets and convenience stores. The segment is expected to be the most promising, particularly as this provides consumers with a broader variety to choose from. In addition, product prices are generally lower off-premises than at bars and restaurants.

As consumers become more educated about different tequila types-such as Blanco, reposado, and añejo, they are more likely to seek these products in off-premises channels where they can explore a wider selection than what may be available on-premise. In addition, the COVID-19 pandemic significantly altered purchasing habits, with many consumers opting for at-home consumption of alcoholic beverages. This trend has increased sales through off-premises channels, such as liquor stores and online retailers, as consumers seek convenience and safety in their shopping experiences.

The rise of online shopping for alcohol has made it easier for consumers to purchase tequila from the comfort of their homes. Many retailers now offer delivery services, enhancing accessibility and convenience, which is particularly appealing to those looking to stock up on premium spirits. In addition, there is a growing consumer preference for premium and artisanal spirits, including tequila. As consumers become more selective and willing to invest in higher-quality products, this trend supports the off-premises market where premium tequilas can be readily purchased.

Regional Insights

North America agave spirits market held the largest revenue of USD 5.5 billion in 2023 and is expected to grow at a CAGR of 8.2% over the forecast period. The demand for agave spirits in the U.S. will remain a key driver for market growth. Sales of agave spirits, particularly tequila and mezcal, are experiencing significant growth in North America driven by consumer demand, innovative production methods, and a strong cocktail culture.

U.S. Agave Spirit Market Trends

The agave spirits market in the U.S. was estimated at USD 4.8 billion in 2023 and is expected to grow at a CAGR of over 8% over the forecast period. Sales of agave-based spirits, particularly tequila and mezcal, are experiencing significant growth in the U.S. market, with projections showing that they will soon surpass vodka in on-premise sales. The rise in cocktail culture has been pivotal in driving agave spirit sales. Signature cocktails such as Margaritas and innovative creations like the Agave Old Fashioned have popularized these spirits in bars and restaurants.

The increased demand has resulted in an increased supply of agave spirit products. Retailers are responding to consumer demand by planning to allocate more shelf space to agave-based spirits, with 64% of retailers indicating they will prioritize these products over others. Innovative production techniques are emerging, including the cultivation of agave outside Mexico, allowing for unique flavor profiles and expanding the market beyond Mexico.

Mexico agave spirits market is the world’s largest producer of agave spirits, particularly due to the country's abundance of blue agave plants. Tequila and mezcal are an integral part of the country's culture, and as such, the consumption of these products is expected to remain robust in the coming years. There is rising demand for alternate agave spirits such as bacanora and raicilla in Mexico as they can be customized in terms of flavor to offer a better drinking experience.

In recent years, the agave spirits market in Canada has also witnessed high demand for agave spirits, particularly due to the growing cocktail culture. Tequila's versatility as a cocktail base is enhancing its popularity. Nearly 30% of consumers now cite it as their favorite spirit for cocktails, reflecting a significant increase in interest over recent years. Classic cocktails like Margaritas remain popular, but there is also a growing appetite for innovative and signature cocktails that incorporate tequila.

Europe Agave Spirits Market Trends

Germany agave spirits market is the largest agave spirit consumer in Europe and is expected to grow at a CAGR of over 10% from 2024 to 2030. There is a notable preference for Blanco and Reposado tequilas among German consumers. Blanco tequila, known for its fresh and vibrant flavors, is particularly popular for cocktails. This trend aligns with the broader global shift towards premium and ultra-premium spirits, with consumers increasingly seeking high-quality options. There is growing popularity for Mexican cuisine in Germany, which is also a key driver for market growth. Tequila is often viewed as a complementary spirit that enhances the dining experience with these foods.

Asia Pacific Agave Spirits Market Trends

The agave spirits demand in Asia Pacific is expected to grow at a CAGR of 11% over the forecast period, primarily due to the growing demand in China, India, and Japan. China is the largest tequila market in Asia and is expected to remain the market leader in the coming years. Young urban consumers, particularly those aged 21 to 35, are increasingly open to trying new spirits, contributing to tequila's popularity as an exotic alternative to traditional Chinese spirits like baijiu. The influence of Western drinking culture and social media trends has led to an increased interest in cocktails featuring tequila, further driving its popularity. In addition, the market is also witnessing an influx of Mexican distillers expanding their operations in China, capitalizing on the growing demand for premium tequila.

The Indian agave spirit market is rapidly evolving, driven by increased sales, changing consumer perceptions, and a vibrant cocktail culture. As more brands enter the space and consumer interest grows, tequila is poised to become a staple in the Indian beverage landscape. Demand for tequila is expanding beyond major metropolitan areas to tier-2 cities, indicating widespread acceptance across diverse regions of India. This is also reflected in the fact that as of 2020, India had less than a dozen agave brands, and the number today stands at over 40. The country is expected to remain vital to the agave spirit ecosystem.

Key Agave Spirits Company Insights

The market is structured around several key components that define its dynamics, growth potential, and competitive landscape. The major manufacturers of agave spirit are based in Mexico, and the market is moderately consolidated. The market has a few large players controlling a significant portion of the market share. This consolidation allows for economies of scale but also creates competitive pressure for smaller brands.

Key Agave Spirits Companies:

The following are the leading companies in the agave spirit market. These companies collectively hold the largest market share and dictate industry trends.

- Jose Cuervo

- Don Julio

- Patrón

- Casamigos

- 1800 Tequila

- Gran Centenario

- Hornitos

- Espolón

- El Jimador

- Olmeca

- Del Maguey

- Mezcal Vago

- Amores

- Sasma BV

- Suntory Holdings Limited

Recent Developments

-

In May 2023, Campari Group, the Italy-based beverage company, launched Mayenda, a new luxury tequila brand featuring Mayenda Tequila Blanco. This innovative product has labels crafted from 100% reclaimed agave byproducts. Mayenda Tequila Blanco is now available at select retailers in both Mexico and the United States.

-

In July 2023, Beam Suntory officially entered the mezcal market with a strategic distribution partnership with Mezcal Amarás. The agreement allows Beam Suntory to import and distribute Mezcal Amarás in several U.S. states. The partnership aims to enhance Beam Suntory's presence in the fast-growing agave-based spirits segment.

Agave Spirits Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.72 billion

Revenue forecast in 2030

USD 25.12 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, point of sale, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Jose Cuervo; Don Julio; Patrón; Casamigos; 1800 Tequila; Gran Centenario; Hornitos; Espolón; El Jimador; Olmeca (including Olmeca Altos); Del Maguey; Mezcal Vago; Amores; Sasma BV; Suntory Holdings Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Agave Spirits Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global agave spirits market report on the basis of product, packaging, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tequila

-

Mezcal

-

Others (Raicilla, Bacanora, etc)

-

-

Point of Sale Outlook (Revenue, USD Billion, 2018 - 2030)

-

On Premise

-

Off-Premise

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.