- Home

- »

- Advanced Interior Materials

- »

-

Aerostructure Materials Market Size & Share Report, 2030GVR Report cover

![Aerostructure Materials Market Size, Share & Trends Report]()

Aerostructure Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Composites, Alloys & Super Alloys), By End-use (Commercial, Unmanned Aerial Vehicles, Business & General Aviation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-425-6

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerostructure Materials Market Size & Trends

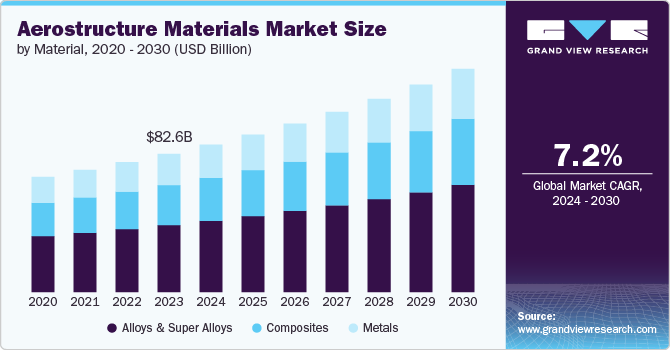

The global aerostructure materials market size was estimated at USD 82.63 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. This growth is attributed to the increasing preference for sustainable and efficient aerostructure to decrease the overall weight of an aircraft and reduce fuel consumption. Additionally, the growing number of regulations and standards to reduce carbon emissions is further increasing aircraft manufacturers' inclination toward eco-friendly aerostructure materials, thereby, fueling the market growth.

The market is also witnessing increased demand for aircraft globally, which is driving product growth. Growing demand for aircraft is based on rising passenger traffic, increased per capita income of consumers, and increasing trend of cargo transport. Additionally, increased defense budgets and modernization programs boost the demand for advanced military aircraft. Furthermore, technological advancement in terms of material and manufacturing processes, such as the use of composites and 3D printing is resulting in cost reduction and enhanced performance. Thereby, proving new opportunities to the market.

Advanced materials and manufacturing techniques for aerostructure materials production can be expensive. Moreover, compliance with stringent aviation safety and environmental regulations can further increase costs and complexity for manufacturers. These factors can limit the adoption of this product among small-scale manufacturers.

However, the development and adoption of electric and hybrid-electric aircraft are expected to attract new opportunities for innovative Aerostructure Materials. Increasing demand for maintenance, repair, and overhaul (MRO) services for existing fleets can drive growth in the aftermarket segment. In addition to this, increasing focus on sustainability and green aviation can drive demand for eco-friendly materials and designs in the sector.

Material Insights

Based on material, the alloys and super alloys segment dominated the market with a revenue share of 48.4% in 2023 and is further expected to grow at a significant rate over forecast period. Alloys and super alloys can withstand extremely high temperatures, making them suitable for engine and high-stress applications. Moreover, these materials can resist corrosion and oxidation, extending the life of the components and reducing maintenance requirements. This material is highly used in manufacturing engine components, landing gears, structural frames, and heat shields.

Demand for composites for aerostructure materials manufacturing is expected to grow at the fastest rate over the period of 2024 - 2030. Composites have a high strength-to-weight ratio which helps in reducing the overall weight of the aircraft and improving fuel efficiency. Additionally, composites possess superior strength and durability, which enhances the performance and lifespan of Aerostructure Materials. Furthermore, the material is used in manufacturing aerostructure materials which are subjected to regular stress and strain during flight operations owing to its excellent fatigue resistance.

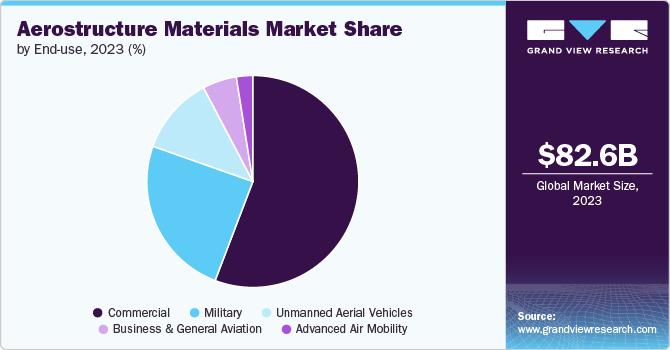

End Use Insights

On the basis of end use, the commercial segment accounted for the largest revenue share of 55.8% in 2023. Commercial end use of aerostructure materials includes passenger and cargo aircraft, business jets, regional aircraft, low-cost carriers, and emerging electric and hybrid-electric aircraft. Rising inclination toward improving fuel efficiency, reducing operational costs, enhancing overall performance, and safety of aircraft is driving segment growth. Additionally, the MRO sector provides significant aftermarket opportunities as airlines seek to maintain and upgrade their fleets.

Advanced air mobility is anticipated to grow at the fastest rate over the forecast period. Aerostructure Materials in this segment play a critical role in achieving the lightweight, high-strength, and aerodynamically efficient designs necessary for the unique operational requirements of advanced air mobility vehicles. Therefore, as the advanced air mobility industry progresses, the demand for advanced materials and manufacturing techniques in Aerostructure Materials will drive significant innovation areas for market players.

Regional Insights

North America aerostructure materials market dominated the global industry with a revenue share of 34.3% in 2023. North America, particularly the U.S., is home to some of the largest aerospace manufacturers in the world, such as Boeing and Lockheed Martin. These companies drive significant demand for Aerostructure Materials in the region. Additionally, ongoing investments in research and development lead to innovations in aerostructure materials and manufacturing processes, thereby enhancing market growth.

U.S. Aerostructure Materials Market Trends

The aerostructure materials market in the U.S. is expected to grow at a CAGR of 7.4% over the forecast period. The growing number of air travelers and cargo transport requirements bolster the demand for new commercial aircraft, thereby positively impacting the market growth in the country. In addition to this, high defense budgets and military modernization programs in the country increase demand for advanced military aircraft, fueling the Aerostructure Materials market.

Europe Aerostructure Materials Market Trends

The aerostructure materials market in Europe is expected to grow at a CAGR of 6.9% from 2024-2030. Europe has presence of major aerospace companies like Airbus, which significantly contribute to the demand for Aerostructure Materials in the region. Moreover, stringent environmental and fuel efficiency regulations establishing several countries of Europe drive the adoption of lightweight and efficient Aerostructure Materials.

Asia Pacific Aerostructure Materials Market Trends

The aerostructure materials market in Asia Pacific is expected to grow at the highest CAGR over the forecast period. This is due to the presence of emerging countries like China, India, and Japan. Rapid urbanization and economic development in these countries increased air travel, driving demand for new aircraft. This, in turn, results in market growth.

Key Aerostructure Materials Company Insights

Some of the key players operating in the market include AAR Corporation and AIRBUS.

-

AAR Corporation provides aviation services to commercial, defense, and governmental aircraft fleet operators, original equipment manufacturers, and independent service providers around the world. The company operates through two business segments, namely aviation services and expeditionary services. The aviation services segment provides aftermarket support and services, inventory management & distribution services, maintenance, repair & overhaul, and engineering services. This segment provides inventory and repair programs, warranty claim management, outsourcing programs, and sells & leases new, overhauled, and repaired engine and airframe parts.

-

AIRBUS was established in 1970 and is headquartered in Leiden, Netherlands. The group operates through three business segments, namely Airbus commercial aircraft, Airbus Helicopters, and Airbus defense & space. Airbus commercial aircraft business segment focuses on the development, manufacturing, marketing, and sale of commercial jet aircraft and aircraft components, as well as on aircraft conversion and related services. Its product line comprises A220, A320, A330, A330neo, A350 XWB, and double-deck A380 aircraft families.

Spirit Aerosystems, Inc. and Collins Aerospace are some of the emerging participants in the market.

-

Spirit Aerosystems, Inc. was founded in 2004 and is headquartered in Kansas, U.S. The company, incorporated in Delaware, is one of the major independent non-OEM commercial aerostructure designers and manufacturers in the world. It designs, engineers, and manufactures large, complex, and highly engineered commercial Aerostructure Materials such as fuselages, nacelles (including thrust reversers), struts/pylons, wing structures, and flight control surfaces. It operates through three business segments, namely fuselage systems, propulsion systems, and wing systems.

-

Collins Aerospace was established in 2018 and headquartered in the U.S. It is a leading aerostructure supplier of specialty structures and propulsion components with advanced technology for the defense and aerospace industry. The company offers aerostructure products for business jet, military, commercial, and submarine applications.

Key Aerostructure Materials Companies:

The following are the leading companies in the aerostructure materials market. These companies collectively hold the largest market share and dictate industry trends.

- AAR Corporation

- AIRBUS

- Spirit Aerosystems, Inc.

- Collins Aerospace

- Saab

- SAFRAN

- FACC AG

- ST Engineering

- Kaman Corporation

- GKN AEROSPACE

Recent Developments

-

In April 2022, Mahindra Aerostructure Materials Pvt. Ltd. signed a multi-year contract worth USD 100 million with Airbus Atlantic for the manufacturing and delivery of small assemblies and metallic components for Airbus commercial aircraft. The company is expected to provide approximately 2300 varieties of metallic components to the Airbus Atlantic in France.

Aerostructure Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 88.08 billion

Revenue forecast in 2030

USD 133.38 billion

Growth rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina

Key companies profiled

AAR Corporation, AIRBUS, Spirit Aerosystems, Inc., Collins Aerospace, Saab, SAFRAN, FACC AG, ST Engineering, Kaman Corporation, GKN AEROSPACE

Customization scope

Free report customization (equivalent up to 8 analysts orking days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerostructure Materials Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerostructure materials market report on the basis of material, end use, and region:

-

Aerostructure Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Composites

-

Alloys & Super Alloys

-

Metals

-

-

Aerostructure Materials End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Military

-

Unmanned Aerial Vehicles

-

Business & General Aviation

-

Advanced Air Mobility

-

-

Aerostructure Materials Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global aerostructure materials market size was estimated at USD 82.63 million in 2023 and is expected to reach USD 88.08 billion in 2024.

b. The global aerostructure materials market is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030 to reach USD 133.38 billion by 2030.

b. Alloys and super alloys accounted for the largest revenue share of over 48.4% in 2023. Alloys and super alloys can withstand extremely high temperatures, making them suitable for engine and high-stress applications. Moreover, these materials can resist corrosion and oxidation, extending the life of the components and reducing maintenance requirements. These factors are expected to fuel the demand for alloys and super alloys segment over the coming years.

b. Some key players operating in the Aerostructure Materials market include AAR Corporation, AIRBUS, Spirit Aerosystems, Inc., Collins Aerospace, Saab, SAFRAN, FACC AG, ST Engineering, Kaman Corporation, GKN AEROSPACE.

b. The key factors that are driving the market growth are the increasing preference of sustainable and efficient aerostructure to decrease the overall weight of an aircraft and reduce fuel consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.