- Home

- »

- Advanced Interior Materials

- »

-

Aerospace Composites Market Size, Industry Report, 2033GVR Report cover

![Aerospace Composites Market Size, Share & Trends Report]()

Aerospace Composites Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Carbon Fiber, Glass Fiber), By Application (Commercial Aircraft, Business & General Aviation, Military Aircraft), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-847-4

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace Composites Market Summary

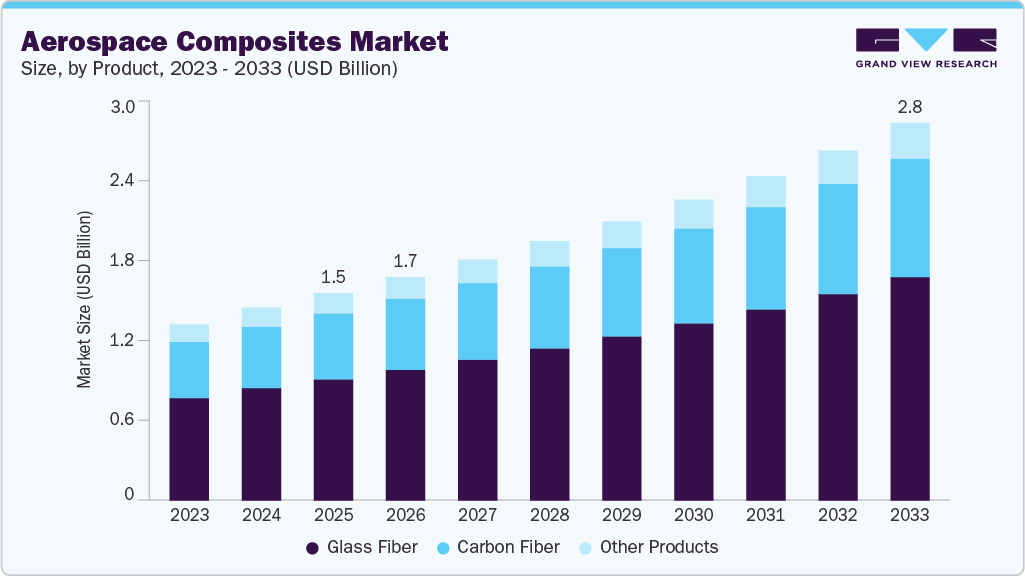

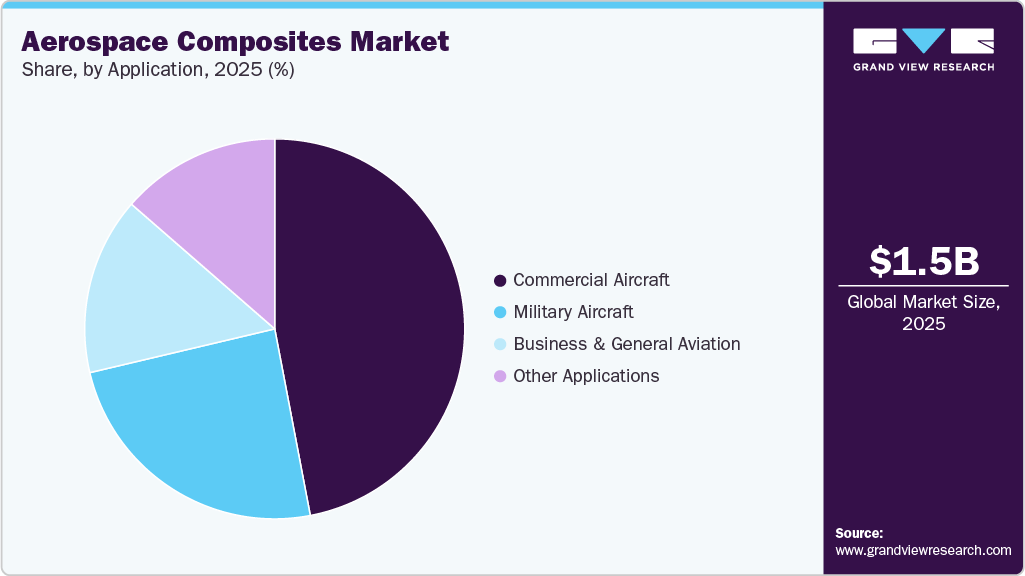

The global aerospace composites market size was estimated at USD 1.54 billion in 2025 and is projected to reach USD 2.81 billion by 2033, expected to grow at a CAGR of 7.9% from 2026 to 2033. The demand for aerospace composites is increasing due to the aviation industry’s strong focus on lightweight materials that improve fuel efficiency and reduce carbon emissions.

Key Market Trends & Insights

- North America dominated the aerospace composites market with the largest revenue share of 53.7% in 2025.

- The aerospace composites market in the U.S. is driven by commercial aviation, defense, and space sectors

- By product, the glass fiber segment is expected to grow at the fastest CAGR of 8.0% over the forecast period.

- By application, the business & general aviation segment is expected to grow at the fastest CAGR of 8.0% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 1.54 Billion

- 2033 Projected Market Size: USD 2.81 Billion

- CAGR (2026-2033): 7.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest Market

Aircraft manufacturers are increasingly replacing traditional metals with composites to achieve weight reduction without compromising structural integrity. The growing production of commercial aircraft, driven by rising air passenger traffic globally, is further fueling demand. Defense modernization programs are also driving the adoption of advanced composite materials in military aircraft and UAVs. In addition, the rise in space exploration missions and satellite launches is boosting the use of high-performance aerospace composites. Airlines’ emphasis on lowering operating costs is encouraging OEMs to adopt composite-intensive aircraft platforms. Key drivers of the aerospace composites market include stringent fuel efficiency regulations and emission norms imposed by aviation authorities. Composites offer superior strength-to-weight ratios, corrosion resistance, and fatigue performance compared to metals. Increasing use of carbon fiber reinforced polymers (CFRP) in fuselage, wings, and interior components is a major growth driver. Technological advancements in resin systems and manufacturing processes such as automated fiber placement are accelerating adoption. Rising defense budgets across major economies are increasing procurement of advanced aircraft platforms. Growth in the aftermarket and MRO sector is also supporting demand for composite repair materials.

The aerospace composites market is witnessing strong innovation in thermoplastic composites due to their recyclability and faster processing times. Development of next-generation carbon fibers with improved strength and toughness is gaining traction. Automation and digital manufacturing technologies are transforming composite fabrication efficiency. Hybrid composites combining carbon, glass, and ceramic fibers are emerging for specialized applications. There is increasing focus on sustainable composite materials and recycling technologies. Advanced resin systems with enhanced fire, smoke, and toxicity resistance are being adopted. These trends are reshaping material selection and aircraft design strategies.

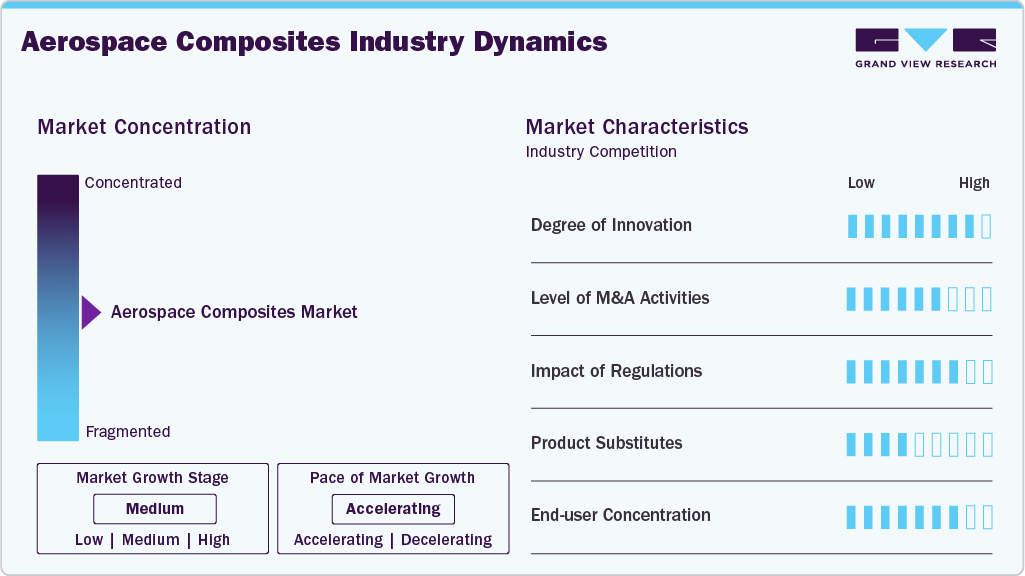

Market Concentration & Characteristics

The aerospace composites market is moderately consolidated, with a few global players dominating high-performance material supply. Major manufacturers have strong long-term contracts with aircraft OEMs and Tier 1 suppliers. High entry barriers exist due to stringent certification requirements and capital-intensive manufacturing processes. Established players benefit from strong R&D capabilities and vertically integrated operations. Smaller players typically operate in niche applications or regional markets. Strategic partnerships and joint ventures are common to expand technological capabilities.

The threat of substitutes in the aerospace composites market is relatively low. Traditional materials such as aluminum and titanium alloys still compete in specific structural applications but lack comparable weight advantages. Advanced aluminum-lithium alloys pose limited competition but cannot fully replace composites in next-generation aircraft. High switching costs and certification challenges discourage rapid substitution. The performance benefits of composites in terms of fuel efficiency and durability reduce substitution risks. However, cost considerations may slow adoption in some programs.

Product Insights

The glass fiber segment held the largest revenue share of 58.6% in 2025, due to its cost-effectiveness and wide applicability across structural and interior components. Glass fiber composites offer good strength, corrosion resistance, and impact performance at a significantly lower cost compared to carbon fiber. These materials are extensively used in radomes, fairings, interiors, and secondary structures, especially in commercial and regional aircraft. High production volumes and established manufacturing processes further support dominance. The segment benefits from ease of processing and repair, making it attractive for OEMs and MRO providers. Consistent demand from high-volume aircraft programs continues to sustain revenue leadership.

The carbon fiber segment is expected to grow at a significant CAGR of 7.7% over the forecast period, due to rising adoption in primary aircraft structures aimed at weight reduction and fuel efficiency. Carbon fiber reinforced polymers provide superior stiffness-to-weight and strength-to-weight ratios compared to traditional materials. Increasing use in fuselage sections, wings, empennage, and load-bearing components is driving growth. Advancements in automated fiber placement and resin technologies are reducing manufacturing costs and cycle times. Growing emphasis on next-generation and sustainable aircraft platforms further supports adoption. Defense and space applications are also contributing to accelerated growth of this segment.

Application Insights

The commercial aircraft segment held the largest revenue share of 47.0% in 2025, owing to the large global fleet size and continuous aircraft production by major OEMs. Rising air passenger traffic has driven increased orders for both narrow-body and wide-body aircraft, which incorporate high volumes of composite materials. Airlines’ focus on fuel efficiency and reduced operating costs has accelerated the adoption of composite-intensive aircraft designs. High utilization rates lead to sustained demand for both OEM and aftermarket composite components. Expansion of low-cost carriers in emerging economies further supports volume growth.

The business & general aviation segment is expected to grow at the fastest CAGR of 8.0% over the forecast period, driven by rising demand for lightweight, high-performance aircraft. Increasing adoption of advanced composites enhances speed, range, and fuel efficiency in business jets and general aviation aircraft. Growth in private aviation, charter services, and corporate travel is supporting aircraft deliveries. Manufacturers are increasingly using carbon and hybrid composites to improve cabin comfort and aerodynamic efficiency. Technological advancements are enabling customized composite structures for smaller aircraft platforms.

Regional Insights

North America aerospace composites marketdominated the global aerospace composites market and accounted for the largest revenue share of 53.7% in 2025, due to the presence of major aircraft OEMs and composite manufacturers. Strong defense spending and continuous aircraft fleet modernization drive demand. The region leads in R&D and adoption of advanced composite technologies. High penetration of composite-intensive aircraft platforms supports market maturity. Growth in space and defense applications remains strong. Regulatory focus on emission reduction reinforces composite adoption.

U.S. Aerospace Composites Market Trends

The aerospace composites market in the U.S. is driven by commercial aviation, defense, and space sectors. Strong government funding for aerospace R&D accelerates innovation. The presence of leading OEMs ensures stable long-term demand. Increased use of composites in next-generation aircraft platforms is a key trend. Growth in unmanned systems further boosts demand. The U.S. remains a technology leader in aerospace composites.

Asia Pacific Aerospace Composites Market Trends

The Asia Pacific is growing significantly, driven by the rapid expansion of commercial aviation and increasing defense procurement. Rising aircraft production and increasing passenger traffic are key contributors. The region benefits from cost-competitive manufacturing and expanding aerospace supply chains. Strong government support for domestic aerospace programs further drives demand. Investments in space programs are also increasing composite consumption. Growing MRO activities support aftermarket demand. Overall, Asia Pacific remains a high-growth region.

Aerospace composites market in China is driven by indigenous aircraft development programs and rising defense investments. The government is prioritizing domestic production of advanced aerospace materials. Increasing commercial aircraft manufacturing capacity is supporting composite demand. Investments in carbon fiber and resin production are strengthening the local supply chain. Space exploration initiatives are further boosting demand. Long-term strategic planning supports sustained market growth.

Europe Aerospace Composites Market Trends

Europe’s market is supported by strong aircraft manufacturing and sustainability-focused regulations. OEMs are increasingly adopting lightweight composites to meet emission targets. Investments in next-generation aircraft programs are driving material innovation. Collaborative R&D initiatives across countries strengthen the composite ecosystem. Defense and space applications also contribute to demand. Europe remains a key market for advanced composites.

Aerospace composites market in Germany plays a crucial role in aerospace composites due to its strong engineering base. The country focuses on high-performance structural components and advanced manufacturing technologies. Investments in automation and lightweight materials support market growth. Germany’s participation in European aircraft programs drives steady demand. Research institutions contribute to material innovation. The market benefits from a robust industrial supply chain.

Latin America Aerospace Composites Market Trends

Latin America’s aerospace composites market is growing steadily with regional aircraft manufacturing and MRO activities. Brazil remains a key contributor due to its strong aerospace manufacturing base. Increasing defense modernization programs support demand. The region benefits from expanding aviation infrastructure. Composite adoption is rising in both commercial and defense aircraft. Growth remains moderate but stable.

Middle East & Africa Aerospace Composites Market Trends

The Middle East & Africa market is driven by expanding commercial airline fleets and rising defense procurement. Investments in aviation hubs and MRO facilities support composite usage. Countries are modernizing military aircraft fleets, increasing demand for advanced materials. Growing interest in UAVs also supports market growth. Import dependency remains high, but demand continues to rise. The region shows long-term growth potential.

Key Aerospace Composites Company Insights

Some of the key players operating in the market include Kineco, Spirit AeroSystems

-

Kineco is an India-based manufacturer specializing in advanced composite structures and interiors for aerospace and defense applications. The company supplies lightweight composite components to global aircraft OEMs and Tier-1 suppliers, with capabilities spanning design, tooling, and fabrication.

-

Spirit AeroSystems is a leading aerostructures manufacturer producing large-scale composite and metallic structures for commercial and defense aircraft. The company has strong expertise in composite fuselage sections, wings, nacelles, and flight control structures for major global OEMs.

Solvay and SGL Carbon are some of the emerging market participants in the aerospace composites market.

-

Solvay is a major supplier of aerospace-grade composite materials, including high-performance thermoset and thermoplastic resins, prepregs, and adhesive systems. Its advanced materials are widely used in primary and secondary aircraft structures across commercial, defense, and space platforms.

-

SGL Carbon specializes in carbon-based materials and advanced composites for aerospace applications. The company supplies carbon fibers, composite materials, and lightweight structural solutions used in aircraft, space systems, and high-performance aviation components.

Key Aerospace Composites Companies:

The following key companies have been profiled for this study on the aerospace composites market.

- Teijin Ltd.

- Mitsubishi Chemical

- Solvay

- Spirit AeroSystems

- Toray Industries, Inc.

- GKN Aerospace

- SGL Carbon

- Hexcel Corporation

- Kineco

- Tata Advanced Systems (TASL)

Recent Developments

-

In October 2025, Teijin Carbon and A&P Technology launched the high-performance IMS65 PAEK Bimax braided fabric, a new advanced composite material designed for fast, scalable manufacturing and improved performance in aerospace and other high-performance sectors.

-

In December 2025, Mitsubishi Chemical announced to strengthen carbon fiber manufacturing capacity in Japan and the United States, targeting high-end applications, including aerospace, effectively expanding production to meet rising demand.

Aerospace Composites Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.65 billion

Revenue forecast in 2033

USD 2.81 billion

Growth rate

CAGR of 7.9% from 2026 to 2033

Base year for estimation

2025

Actual estimates/Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Russia; China; Japan; India; South Korea; Brazil

Key companies profiled

Teijin Ltd.; Mitsubishi Chemical; Solvay; Spirit AeroSystems; Toray Industries, Inc.; GKN Aerospace; SGL Carbon; Hexcel Corporation; Kineco; Tata Advanced Systems (TASL)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

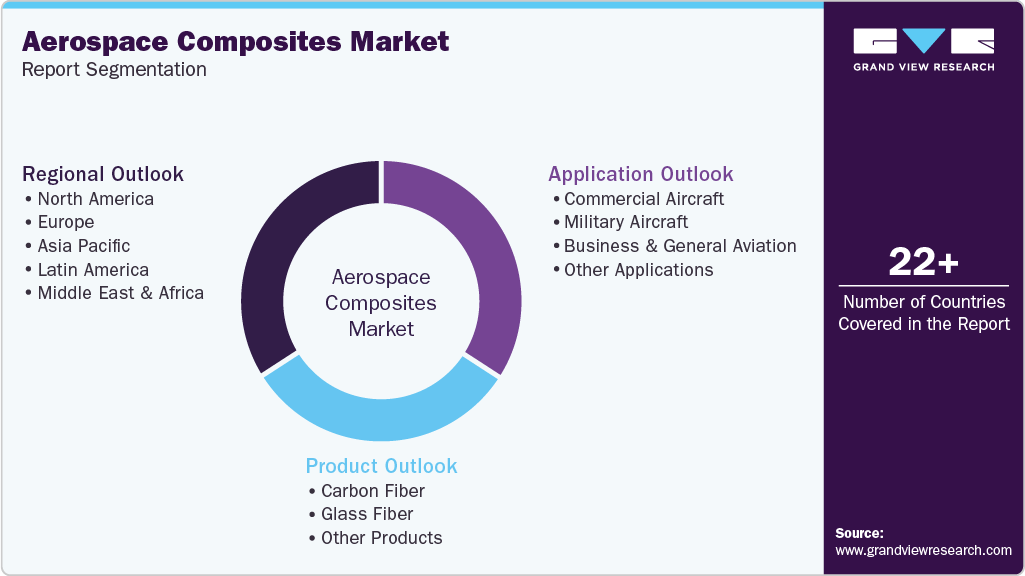

Global Aerospace Composites Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the aerospace composites market based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2026 - 2033)

-

Carbon Fiber

-

Glass Fiber

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2026 - 2033)

-

Commercial Aircraft

-

Military Aircraft

-

Business & General Aviation

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2026 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global aerospace composites market size was estimated at USD 1.54 billion in 2025 and is expected to reach USD 1.65 billion in 2026.

b. The global aerospace composites market is expected to grow at a compound annual growth rate of 7.9% from 2026 to 2033 to reach USD 2.81 billion by 2033.

b. The glass fiber segment held the highest revenue market share of 58.6% in 2025, primarily due to its cost efficiency and versatility across a wide range of end-use industries.

b. Some of the key players operating in the aerospace composites market include Teijin Ltd., Mitsubishi Chemical, Solvay, Spirit AeroSystems, Toray Industries, Inc., GKN Aerospace, SGL Carbon, Hexcel Corporation, and Kineco, Tata Advanced Systems (TASL)

b. Key factors driving the aerospace composites market include rising demand for lightweight and fuel-efficient aircraft, stringent emission regulations, increasing commercial aircraft production, and growing adoption of advanced materials in defense and space applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.