- Home

- »

- Biotechnology

- »

-

Adult Stem Cells Market Size, Share & Growth Report, 2030GVR Report cover

![Adult Stem Cells Market Size, Share & Trends Report]()

Adult Stem Cells Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Autologous Adult Stem Cells, Allogeneic Adult Stem Cells), By Product & Services (Product, Services), By Indication, By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-338-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Adult Stem Cells Market Size & Trends

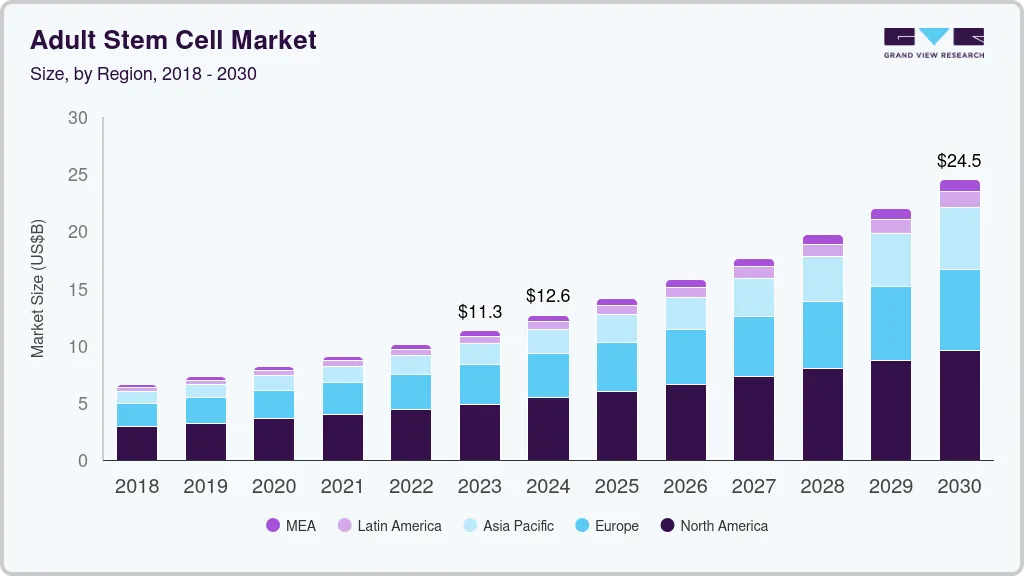

The global adult stem cells market size was valued at USD 13.79 billion in 2024 and is projected to reach USD 26.1 billion by 2030, grow at a CAGR of 11.2% from 2025 to 2030, driven by several key factors. These cells, found in various tissues and organs, hold immense potential for regenerative medicine and therapeutic applications. As research continues to uncover their capabilities, the market is poised for significant expansion in the coming years.Research and development (R&D) efforts in adult stem cell therapies have intensified, propelled by advances in biotechnology and molecular biology.

Scientists are exploring new sources of adult stem cells, optimizing culture techniques, and refining methods for differentiation into specialized cell types. For instance, Boston Children's Hospital has achieved significant milestones in adult stem cell research, including the isolation of lung stem cells from both normal lungs and those affected by lung cancer. These innovations are expanding the scope of potential applications in treating a wide range of diseases and injuries, from cardiovascular disorders to neurological conditions.

One of the most important drivers of the market is the increasing investment in research and development. Pharmaceutical companies, biotechnology firms, and academic institutions are allocating significant resources to explore the therapeutic potential of adult stem cells across various medical applications. For instance, the Department of Biotechnology (DBT) in India is actively supporting initiatives in many areas of stem cell research from 2019 to 2022. These initiatives include fundamental biological insights, translational research projects, and genetics conversion technologies for power and clinical applications. During this period, DBT committed USD 8.80 million to these projects. These investments support preclinical studies, clinical trials, and the development of scalable manufacturing processes.

Advanced technologies such as CRISPR-Cas9 gene editing and induced pluripotent stem cells (iPSCs) are enhancing researchers' ability to manipulate and utilize stem cells effectively. As R&D efforts yield promising results and regulatory frameworks evolve, the market is poised to expand, offering innovative solutions for treating complex diseases and improving patient outcomes globally.

In addition, the increasing prevalence of chronic diseases represents a significant driver of market growth. Conditions such as diabetes, cardiovascular diseases, and neurodegenerative disorders are rising due to aging populations and lifestyle factors. As per the February 2024 report released by the CDC, roughly 129 million individuals in the U.S. are impacted by at least one significant chronic illness. Adult stem cells offer potential therapies that can address the underlying causes of these diseases, providing regenerative solutions that traditional treatments often cannot match. As healthcare systems seek more effective and personalized approaches to managing chronic conditions, the demand for adult stem cell therapies is expected to grow, fueling further research, development, and adoption in clinical settings.

Furthermore, regulatory agencies worldwide are establishing guidelines to ensure the safety, efficacy, and ethical use of adult stem cell therapies. Streamlined approval processes and clearer regulatory pathways encourage investment in commercialization and market expansion, facilitating patient access to advanced treatment options.

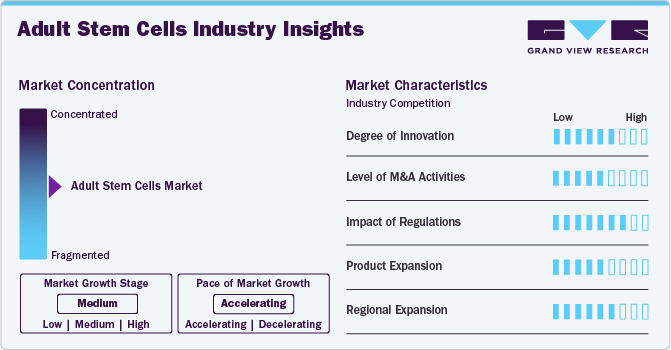

Market Concentration & Characteristics

The adult stem cells market growth stage is high, and the pace is accelerating. The adult stem cells industry is characterized by a high degree of innovation owing to the increasing number of pipelines and clinical studies and increasing applications of adult stem cells. Several clinical trials are being conducted to test the efficacy and safety of adult stem cells in diseases such as graft versus host disease, cerebral palsy, systemic lupus erythematous, type1 diabetes, and rheumatoid arthritis.

The market is also characterized by the moderate level of merger and acquisition activities undertaken by several industry players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market.

The development and application of adult stem cells are subject to stringent regulations to ensure safety, efficacy, and ethical considerations. Ethical considerations also play a significant role in regulating adult stem cells technologies. Many countries have bioethical committees or advisory boards assessing the ethical implications on stem cells.

The industry has seen significant growth in recent years, driven by the increasing demand for adult stem cell technology due to the growing research & development activities. Moreover, companies are entering into research and development deals, leveraging their adult stem cell technologies against various therapeutic targets. Furthermore, product expansion will experience an increase owing to the potential application in the treatment of various diseases, including cancer.

The regional expansion in the adult stem cells industry is at a moderate level. Companies focus on regional expansion to increase the reach of their products and capture the untapped markets. Furthermore, it enables companies to expand their manufacturing facilities and capacity, boosting market growth.

Type Insights

The allogeneic adult stem cells segment held the largest share of 55.9% in 2023, driven by innovation and contributions from leading market players. Companies are developing advanced therapies and expanding their product portfolios to address a variety of medical conditions. For instance, in September 2022, Bristol Myers Squibb and Century Therapeutics established a strategic alliance to develop therapies using allogeneic cells derived from induced pluripotent stem cells (iPSCs). This partnership combines Century's advanced iPSC-derived allogeneic cell therapy technology with Bristol Myers Squibb's extensive expertise in oncology drug development and cell therapy. Innovations such as enhanced cell engineering techniques and scalable manufacturing processes are propelling the segment forward. Key players are investing heavily in research and development, fostering collaborations, and obtaining regulatory approvals, all of which contribute to the dynamic expansion of the allogeneic market.

The autologous adult stem cells segment is projected to grow at the fastest CAGR over the forecast period, driven by an increase in clinical trials and research efforts. This personalized approach, using a patient's own stem cells, minimizes rejection risks and enhances treatment efficacy. Numerous ongoing clinical trials are exploring autologous therapies for conditions like cardiovascular diseases, neurological disorders, and orthopedic injuries. Significant investments in research and development are accelerating the advancement of innovative therapies, further propelling market expansion and offering promising solutions for various medical conditions.

Product & Services Insights

The products segment dominated the market with a share of 79.9% in 2023 due to several key factors. Within the product segment, the cells and cell lines segment has emerged as a significant revenue generator, driving the market's growth. Numerous market participants are actively pursuing untapped opportunities in this domain by undertaking strategies such as new product development and business expansion. For instance, In January 2024, Cellcolabs AB, a spin-off company from the prestigious Karolinska Institute, specializing in the production of both research-grade and Good Manufacturing Practice (GMP) mesenchymal stem cells (MSCs), has entered into a strategic partnership with REPROCELL Inc., a pioneering Japanese company focused on induced pluripotent stem cells (iPSCs). This collaborative venture aims to globally distribute high-quality MSCs and MSC-derived products manufactured by Cellcolabs for research and clinical purposes. The agreement also encompasses an exclusive distribution right for Japan, further strengthening the partnership's reach and impact in the adult stem cell industry.

The services segment is experiencing robust growth, driven by increasing demand for stem cell banking, processing, and storage services. This expansion is fueled by heightened awareness of stem cell therapies and their potential benefits. Service providers are investing in advanced technologies and robust infrastructure to ensure high-quality, reliable services. Additionally, collaborations with healthcare institutions and ongoing research are enhancing the capabilities and scope of services offered, contributing to the overall growth of the market.

Indication Insights

The bone and cartilage repair segment held the largest share of 29.9% in 2023,driven by advancements in regenerative medicine. Innovations in stem cell therapies are providing new, effective treatment options for conditions such as osteoarthritis, fractures, and cartilage injuries. Adult stem cells, particularly mesenchymal stem cells (MSCs), are being increasingly utilized due to their ability to differentiate into bone and cartilage tissues, promoting natural healing and regeneration. For instance, a review published in the Journal of Translational Medicine in 2022 discussed the modification of MSCs for cartilage-targeted therapy, emphasizing the importance of direct homing of MSCs for the efficacy of MSC-based cartilage repair. The study further highlighted the potential of MSCs for targeted repair of damaged cartilage and restoration of joint function, offering an effective solution for tissue regeneration & repair. Ongoing research and clinical trials are enhancing understanding and application of these therapies, leading to improved patient outcomes and expanding the market for bone and cartilage repair solutions.

The inflammatory and immunological diseases segment is expected to grow at the fastest CAGR during the forecast period, due to the increasing recognition of stem cell therapies' potential in treating autoimmune disorders and inflammatory conditions. Adult stem cells, particularly mesenchymal stem cells (MSCs), have shown promise in modulating immune responses and reducing inflammation. Clinical trials and research studies are exploring their efficacy in conditions such as rheumatoid arthritis, multiple sclerosis, and inflammatory bowel disease. Advances in understanding immune system interactions and refining cell therapy techniques are driving market expansion, offering new avenues for managing chronic inflammatory and immunological diseases effectively.

Application Insights

The disease modeling segment held the largest share of 29.3% in 2023,propelled by advancements in technology and increasing research activities. Adult stem cells, particularly induced pluripotent stem cells (iPSCs), are valuable tools for modeling various diseases in laboratory settings. They allow researchers to study disease mechanisms, screen potential drug candidates, and develop personalized medicine approaches. The application of iPSCs in disease modeling is expanding across a wide range of conditions, including genetic disorders, neurodegenerative diseases, and cardiovascular disorders. This growth is enhancing our understanding of disease pathophysiology and accelerating the development of targeted therapies.

The tissue engineering segment is expected to grow at a significant rate over the forecast period, driven by substantial investments in regenerative medicine and advanced biotechnology. Adult stem cells, particularly mesenchymal stem cells (MSCs), play a crucial role in tissue regeneration and repair. Innovations in biomaterials, 3D bioprinting, and scaffold technologies are enhancing the efficacy of stem cell-based tissue engineering therapies. These advancements enable the creation of functional tissues for applications in orthopedics, cardiovascular repair, and wound healing. With increasing research and development funding and collaborations between academic institutions and industry players, the tissue engineering market continues to expand, offering transformative solutions for complex medical challenges.

End Use Insights

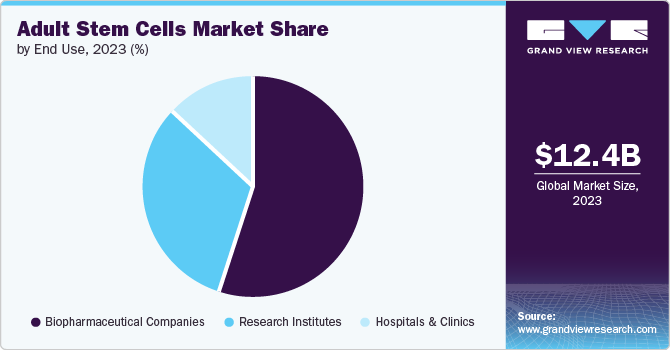

The biopharmaceutical companies segment held the largest share of 55.4% in 2023 and growing at a fastest CAGR of 11.5%, driving innovation and commercialization of stem cell-based therapies. These companies are investing heavily in research and development to harness the therapeutic potential of adult stem cells across various medical applications. They collaborate with academic institutions and clinical research organizations to advance clinical trials and regulatory approvals. In August 2021, for instance, Gilead Sciences subsidiary Kite announced the acquisition of Appia Bio Inc., a biotechnology company. The partnership aims to jointly explore and develop new hematopoietic stem cell (HSC)-derived therapies specifically targeting hematopoietic cancers (haematological malignancies). This collaboration combines the expertise of both companies for cell delivery in improving the treatment of cancer patients. Biopharmaceutical firms also focus on scaling up manufacturing capabilities and ensuring the safety and efficacy of stem cell products, thereby contributing significantly to the growth and evolution of the market.

The research Institutes segment is expanding as institutions focus on pioneering advancements in stem cell research. These institutes drive innovation through fundamental research, clinical trials, and collaborations with biotechnology firms and healthcare providers. They play a critical role in advancing knowledge of stem cell biology, therapeutic applications, and translational research efforts. With increased funding and interdisciplinary collaborations, research institutes are shaping the future of regenerative medicine and contributing to the growth and development of the market.

Regional Insights

North America dominated the overall global market andaccounted for the 43.3% revenue share in 2023. fueled by increasing research and development activities focused on regenerative medicine solutions. Pharmaceutical companies, academic institutions, and biotechnology firms in the region are heavily investing in exploring the therapeutic potential of adult stem cells. These efforts aim to develop innovative treatments for conditions like cardiovascular diseases, neurodegenerative disorders, and orthopedic injuries. For instance, the California Institute for Regenerative Medicine (CIRM) Board authorized funding for initiatives related to its Clinical and Translation programs totaling about USD 89 million in April 2023. Advances in technologies such as CRISPR-Cas9 and induced pluripotent stem cells (iPSCs) are enhancing capabilities and driving the commercialization of promising therapies across diverse medical fields.

U.S. Adult Stem Cells Market Trends

The U.S. market held a significant share of North America market in 2023, largely driven by the expanding field of stem cell therapy. Increasing numbers of clinical trials across various therapeutic areas, including oncology, orthopedics, and autoimmune diseases, are demonstrating the efficacy and safety of adult stem cell treatments. Concurrently, substantial investments from both private sectors and government initiatives are accelerating research and development efforts. For instance, UC San Diego achieved a major milestone in increasing research opportunities in the field when it secured a USD 8 million grant in November 2022 to progress its stem cell treatment clinical trials. These factors collectively contribute to the market's expansion, paving the way for advanced regenerative medicine solutions in the U.S.

Europe Adult Stem Cells Market Trends

The Europe market is experiencing significant growth by substantial funding and investments in research and development. For instance, in January 2024, CellVoyant secured USD 8.11 million in seed funding aimed at accelerating the advancement of innovative stem cell therapies. European governments and private entities are actively supporting stem cell research, aiming to develop innovative regenerative medicine therapies. This financial backing facilitates numerous clinical trials and accelerates the commercialization of new treatments. Collaborative efforts among academic institutions, biotech companies, and healthcare providers are driving advancements in the field, positioning Europe as a key player in the global market.

The adult stem cells market in the UK is experiencing robust growth, driven by advancements in medical research and the increasing emphasis on personalized medicine. The UK's strong healthcare infrastructure, combined with its world-class research institutions and biotechnology sector, provides a fertile ground for the development and application of cutting-edge adult stem cells.

The adult stem cells market in Germany is expected to grow over the forecast period due to the growing incidence and prevalence of genetic disorders,favorable government policies supporting research activities and the introduction of new drugs and therapies by key players.

The adult stem cells market in France is expected to grow over the forecast period. France is focusing on increasing the number of stem cell clinical trials. Researchers are studying intravenous injection of autologous stem cells therapy for treating ischemic stroke.

Asia Pacific Adult Stem Cells Market Trends

The Asia Pacific marketis experiencing the fastest growth,driven by significant research and development efforts in adult stem cell technology. Countries like Japan, South Korea, and China are at the forefront, investing heavily in advanced technologies and innovative therapies. These nations are focusing on developing cutting-edge treatments for various diseases, including cardiovascular, neurological, and autoimmune disorders. For instance,in March 2024, researchers from the Indian Institute of Science (IISc) made notable discoveries regarding the process of gene expression as adult cells are reprogrammed into induced pluripotent stem cells (iPSCs). Enhanced government support, coupled with collaboration between academic institutions and biotech firms, is accelerating the pace of advancements. This dynamic environment is fostering breakthroughs in stem cell applications, positioning the Asia Pacific region as a major hub for adult stem cell therapy development.

The China adult stem cells market is witnessing rapid growth, underpinned by the country's robust healthcare reforms, burgeoning biotechnology sector, and significant government investments in biomedical research and innovation. China's focus on advancing precision medicine and developing innovative therapies for cancer and other chronic diseases drives substantial demand for cutting-edge adult stem cell technologies.

The Japan adult stem cells market is expected to grow over the forecast period. This is attributed to the technological advancements pertaining to stem cell research and well-defined regulatory policies for research on adult stem cells.

The adult stem cells market in India is anticipated to grow at a rapid rate over the forecast period. The large and diverse population, India faces a significant burden of chronic diseases, such as cancer and cardiovascular disorders, driving the need for advanced diagnostic and therapeutic solutions.

Middle East and Africa Adult stem cells market Trends

The market in Middle East and Africais poised to grow in the near future, as increasing applications of biotechnology in healthcare are contributing to its expansion.

The adult stem cells market in Saudi Arabia is expected to grow over the forecast period due to increasing investments in healthcare innovation and research. The country’s focus on advancing biotechnology, coupled with the rising awareness of personalized medicine, is driving the expansion of the market in Saudi Arabia.

The adult stem cells market in Kuwait is anticipated to witness growth over the forecast period owing to the escalating investment in scientific research and development by both governmental and private entities. This investment is propelling advancements in adult stem cells technologies, consequently presenting opportunities for developing novel and enhanced cell isolation tools and techniques.

Key Adult Stem Cells Company Insights

The market players operating in the market are adopting product approvals to increase the reach of their products in the market and improve their availability in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Adult Stem Cells Companies:

The following are the leading companies in the adult stem cells market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc

- STEMCELL Technologies

- Osiris Therapeutics

- Vericel Corporation

- ZenBio, Inc.

- Stempeutics Research

- Fate Therapeutics, Inc.

- BrainStorm Cell Therapeutics Inc.

- Celgene Corporation

- Stemedica Cell Technologies, Inc.

Recent Developments

-

In April 2024, Gamida Cell Ltd. announced that the FDA in the U.S. approved Gamida Cell's allogeneic cell therapy, Omisirge, for use in adult and pediatric patients 12 years of age and older who have hematologic malignancies and are scheduled to receive umbilical cord blood transplantation following myeloablative conditioning. The purpose of this permission is to shorten the time it takes for neutrophils to recover and to become infected.

-

In February 2024, TrophiCell, a spin-out company from the University of Liverpool, demonstrates innovative approaches to utilizing adult mesenchymal stem cells (MSCs) for medicinal applications.

-

In May 2023, EPROCELL announced plans to launch Contract Development and Manufacturing Organization (CDMO) services for producing Advanced Therapy Medicinal Product & Servicess (ATMPs) derived from mesenchymal stem cells (MSCs). This initiative is supported by a partnership with Histocell.

Adult Stem Cells Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.38 billion

Revenue forecast in 2030

USD 26.1 billion

Growth Rate

CAGR of 11.2% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product & services, indication, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, Australia, Thailand, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc; STEMCELL Technologies; Osiris Therapeutics; Vericel Corporation; ZenBio, Inc.; Stempeutics Research; Fate Therapeutics, Inc.; BrainStorm Cell Therapeutics Inc.; Celgene Corporation; Stemedica Cell Technologies, Inc

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Adult Stem Cells Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global adult stem cells market report based on type, product & services, indication, application, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Autologous Adult Stem Cells

-

Allogeneic Adult Stem Cells

-

-

Product & Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Product

-

Kits, Media, & Reagents

-

Cells & cell lines

-

Hematopoietic

-

Mesenchymal

-

Neural

-

Epithelial/Skin

-

Others

-

-

Services

-

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bone and Cartilage Repair

-

Cardiovascular Diseases

-

Inflammatory and Immunological Diseases

-

Liver diseases

-

Cancer

-

GvHD

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Therapeutics

-

Disease Modeling

-

Drug Development & Discovery

-

Toxicology Studies

-

Biobanking

-

Tissue Engineering

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biopharmaceutical Companies

-

Research Institutes

-

Hospitals & Clinics

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global adult stem cells market size was estimated at USD 12.35 billion in 2023 and is expected to reach USD 13.8 billion in 2024.

b. The global adult stem cells market is expected to grow at a compound annual growth rate of 11.20% from 2024 to 2030 to reach USD 26.1 billion by 2030.

b. North America adult stem cell market dominated the overall global market and accounted for the 43.3% revenue share in 2023. fueled by increasing research and development activities focused on regenerative medicine solutions. Pharmaceutical companies, academic institutions, and biotechnology firms in the region are heavily investing in exploring the therapeutic potential of adult stem cells.

b. Some key players operating in the adult stem cells market include Thermo Fisher Scientific, Inc; STEMCELL Technologies; Osiris Therapeutics; Vericel Corporation; ZenBio, Inc.; Stempeutics Research; Fate Therapeutics, Inc.; BrainStorm Cell Therapeutics Inc.; Celgene Corporation; Stemedica Cell Technologies, Inc.

b. The increasing prevalence of chronic diseases represents a significant driver of market growth. Conditions such as diabetes, cardiovascular diseases, and neurodegenerative disorders are rising due to aging populations and lifestyle factors. As healthcare systems seek more effective and personalized approaches to managing chronic conditions, the demand for adult stem cell therapies is expected to grow, fueling further research, development, and adoption in clinical settings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.