- Home

- »

- Plastics, Polymers & Resins

- »

-

Adiponitrile Market Size And Share, Industry Report, 2030GVR Report cover

![Adiponitrile Market Size, Share & Trends Report]()

Adiponitrile Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Nylon Synthesis, HDI, Electrolyte Solution), By End Use (Automobile, Chemical Intermediate, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-870-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Adiponitrile Market Summary

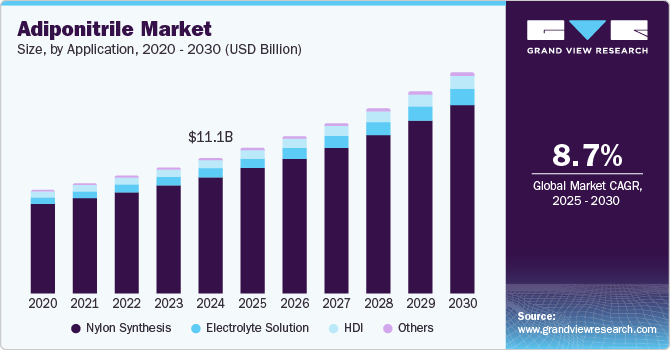

The global adiponitrile market size was estimated at USD 9.69 billion in 2022 and is projected to reach USD 18.18 billion by 2030, growing at a CAGR of 8.7% from 2023 to 2030. This growth can be attributed to its increasing application as feedstock in manufacturing HDI & nylon 6,6, used in different end-use industries, including automobiles, chemicals, and electronics.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2022.

- The adiponitrile market in China led the Asia Pacific market and held the largest revenue share in 2024

- Based on application, the nylon synthesis segment dominated the market, with the highest revenue share of 86.0% in 2024.

- Based on end use, the automotive segment dominated the market, with the highest revenue share of 43.1% in 2024.

Market Size & Forecast

- 2022 Market Size: USD 9.69 Billion

- 2030 Projected Market Size: USD 18.18 Billion

- CAGR (2023-2030): 8.7%

- Asia Pacific: Largest market in 2022

Furthermore, adiponitrile is a specific organic chemical that serves as an essential component in the production of nylon 6,6, a prominent synthetic polymer used in various applications such as textiles, automotive components, and engineering plastics.

The global increase in airbag production in the automobile industry, driven by regulations mandating airbag inclusion in different countries, is expected to boost the demand for nylon-66 further. This, in turn, will contribute to the growing need for adiponitrile, as it remains a fundamental precursor in producing this vital automotive material.

Adiponitrile is used in certain electrolyte solutions, primarily in electrochemical applications and batteries. It serves as a solvent or cosolvent in specific electrolyte formulations. For instance, adiponitrile can be incorporated into the electrolyte formulations of lithium-ion batteries as a cosolvent. It is often mixed with other solvents, such as ethylene carbonate (EC) and dimethyl carbonate (DMC), to improve the overall performance of batteries. Adiponitrile can enhance the thermal stability of electrolytes, reduce the risk of dendrite formation on lithium electrodes, and extend the lifecycle of batteries.

Producing adiponitrile often involves using hazardous chemicals that can generate harmful byproducts. Increasing environmental regulations and growing awareness about sustainability worldwide have led to stringent environmental compliance requirements. For instance, the adiponitrile manufacturing process often relies on the hydrocyanation of butadiene, which involves toxic hydrogen cyanide (HCN). Managing HCN safely can be environmentally challenging for manufacturers.

Furthermore, the advent of nylon substitutes such as polypropylene, bioresorbable polymers, para-aramid synthetic fibers, and polyvinylidene fluoride (PVDF) is anticipated to hamper the growth of the global nylon market owing to their low prices. This is expected to further affect the development of the product market.

Application Insights

Nylon synthesis applications dominated the market, with the highest revenue share of 86.0% in 2024. This can be attributable to its exceptional tensile strength and resistance to abrasion, making it suitable for a wide range of applications, from clothing and carpets to mechanical parts and industrial components. The synthesis of Nylon-6,6 commences with the hydrogenation of adiponitrile, yielding hexamethylenediamine, another essential component in the process. Hexamethylenediamine, derived from adiponitrile, combines with adipic acid to initiate a polycondensation reaction. This reaction leads to the formation of nylon-6,6, which is distinguished by its long-chain polymer structure and characterized by alternating amide linkages. This chain structure imparts the polymer with exceptional mechanical properties, such as high tensile strength and excellent resistance to wear and tear.

The electrolyte solution is expected to grow at a CAGR of 10.1% over the forecast period, owing to the increasing demand for lithium-ion batteries, particularly in electric vehicles, which enhances the need for high-performance electrolytes, where adiponitrile plays a crucial role. In addition, advancements in battery technology and the push for more efficient energy storage solutions further fuel this demand. Furthermore, the automotive industry's shift towards sustainability and reduced emissions also significantly contributes to the rising utilization of adiponitrile in electrolyte formulations.

End Use Insights

Automotive end use dominated the market, with the highest revenue share of 43.1% in 2024. This can be attributed to the increasing use of the product in the automotive industry for various applications. Its applications span from producing lightweight and fuel-efficient components to improving vehicle safety and comfort. Adiponitrile serves as a precursor in the creation of polyurethane foams used in automotive seating and insulation, providing comfort and reducing vehicle weight to enhance fuel efficiency. In addition, adiponitrile plays a significant role in producing fuel system components such as fuel tanks and lines. Moreover, adiponitrile is utilized in the production of airbag fabrics. Airbags are crucial safety components in vehicles, and their fabrics must possess high tensile strength, tear resistance, and flame retardancy.

The electrical and electronics segment is expected to grow at the fastest CAGR of 6.3% from 2025 to 2030, owing to the growing demand for high-performance electrical insulation materials and cables is a primary factor, as adiponitrile provides excellent insulation properties. Furthermore, advancements in electronic devices and infrastructure create a need for reliable materials, further boosting demand. Moreover, the ongoing trend towards miniaturization in electronics also necessitates efficient insulation solutions, contributing to the rapid growth of adiponitrile in this sector.

Regional Insights

Asia Pacific adiponitrile market dominated the global market with the highest revenue share of 40.3% in 2024. This can be attributed to ongoing industrialization, growing population, and expanding manufacturing base in Asia Pacific. The region is home to some of the largest manufacturing economies in the world, including China, Japan, South Korea, and India. The region's countries, including China, India, Japan, South Korea, Singapore, and Malaysia, are the largest manufacturers of electrical and electronic products in the world. Thus, the market for adiponitrile is expected to rise in the upcoming years owing to the growth of the electronics industry in this region.

China Adiponitrile Market Trends

The adiponitrile market in China led the Asia Pacific market and held the largest revenue share in 2024, driven by rapid industrial expansion and increasing demand for high-performance materials. In addition, the automotive sector is a major contributor, as the rising production of electric vehicles boosts the need for adiponitrile in manufacturing components such as tire cords and insulation materials. Furthermore, the establishment of local production facilities by international manufacturers is reducing costs and enhancing supply chain efficiency, further propelling market growth in the region.

North America Adiponitrile Market Trends

North America adiponitrile market is expected to grow at a CAGR of 9.1% over the forecast period, owing to the construction industry's expansion, particularly in non-residential projects such as hospitals and commercial buildings. In addition, legislative initiatives such as the Affordable Healthcare Act have stimulated the construction of healthcare facilities, increasing the need for architectural adiponitrile. Furthermore, the automotive industry's shift towards lightweight materials for enhanced fuel efficiency is driving demand for adiponitrile to produce durable components.

The adiponitrile market in the U.S. led the North American market with the highest revenue share in 2024, primarily driven by the construction sector, which remains a key driver for adiponitrile demand. The focus on developing healthcare infrastructure and educational institutions underpins significant growth opportunities. Furthermore, advancements in battery technology and electric vehicle production contribute to increased utilization of adiponitrile in various applications, reinforcing its importance in the automotive and construction sectors.

Europe Adiponitrile Market Trends

Europe adiponitrile market is expected to grow significantly over the forecast period, owing to the increasing applications across multiple sectors, including automotive, textiles, and electrical industries. In addition, the region's stringent regulations on vehicle safety and emissions are driving demand for advanced materials such as nylon 66, which relies on adiponitrile as a precursor. Furthermore, the shift towards electric vehicles and sustainable manufacturing practices fosters innovation and expands the market.

Key Adiponitrile Company Insights

The adiponitrile market is consolidated, with international & domestic players operating globally. Key players operating in this market include Ascend Performance Materials, BASF SE, Butachimie, and others. These companies have adopted the strategy of expansion to increase their production capacities and meet the surging demand for their products. In addition, companies also emphasize sustainability by developing eco-friendly production methods and exploring bio-based alternatives. Furthermore, strategic partnerships, mergers, and acquisitions are frequently employed to strengthen market presence and expand product portfolios.

Asahi Kasei Corp manufactures adiponitrile as a key intermediate for nylon 66, widely used in automotive and industrial applications. Operating within the chemical and materials segment, the company focuses on developing innovative solutions that cater to diverse customer needs, leveraging its in-house production capabilities to ensure quality and supply stability across various sectors.

BASF SE produces adiponitrile through various advanced methods, including catalytic processes, which serve as essential precursors for nylon 66 and other specialty chemicals. Operating in the chemicals segment, the company focuses on sustainable practices and technological innovations to enhance product efficiency and reduce environmental impact. Its extensive portfolio supports multiple industries, including automotive, textiles, and electronics, reflecting its commitment to meeting diverse market demands.

Key Adiponitrile Companies:

The following are the leading companies in the adiponitrile market. These companies collectively hold the largest market share and dictate industry trends.

- Asahi Kasei Corp

- Ascend Performance Materials

- BASF SE

- Butachimie

- Invista

- Kishida Chemical Co., Ltd

- Spectrum Chemical

- Tokyo Chemical Industry

- Vizag Chemical

Recent Developments

-

In December 2024, Ascend Performance Materials announced the successful production of bio-circular performance chemicals, including adiponitrile, acrylonitrile, hexamethylene diamine, and nylon 6,6 from used cooking oil. This innovative process reduces the carbon footprint of nylon 6,6 by 25% compared to traditional methods. Utilizing an ISCC Plus-certified mass-balance approach, the company ensures sustainable production without compromising quality.

-

In October 2024, INVISTA announced that it would continue producing hexamethylene diamine (HMD) at its facility in Orange, Texas. This strategic move supports the ongoing demand for HMD, a key intermediate in the production of nylon 6,6 derived from adiponitrile. The Orange facility plays a crucial role in INVISTA's supply chain for high-performance materials, ensuring a reliable source of HMD to meet the needs of various industries while enhancing the company's commitment to sustainability and innovation.

Adiponitrile Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.98 billion

Revenue forecast in 2030

USD 18.18 billion

Growth Rate

CAGR of 8.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, South Korea, India, Brazil, Argentina, South Africa, and Saudi Arabia

Key companies profiled

Asahi Kasei Corp; Ascend Performance Materials; BASF SE; Butachimie; Invista; Kishida Chemical Co., Ltd; Spectrum Chemical; Tokyo Chemical Industry; Vizag Chemical; Asahi Kasei Corp

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Adiponitrile Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global adiponitrile market report based on application, end use, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Nylon Synthesis

-

HDI

-

Electrolyte Solution

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Chemical Intermediate

-

Automotive

-

Electrical & Electronics

-

Textile

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.