- Home

- »

- Plastics, Polymers & Resins

- »

-

Adhesives And Sealants Market Size, Industry Report, 2033GVR Report cover

![Adhesives And Sealants Market Size, Share & Trends Report]()

Adhesives And Sealants Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Water Based, Solvent Based, Hot Melt, Reactive & Others), By Product (Acrylic, PVA), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-081-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Adhesives And Sealants Market Summary

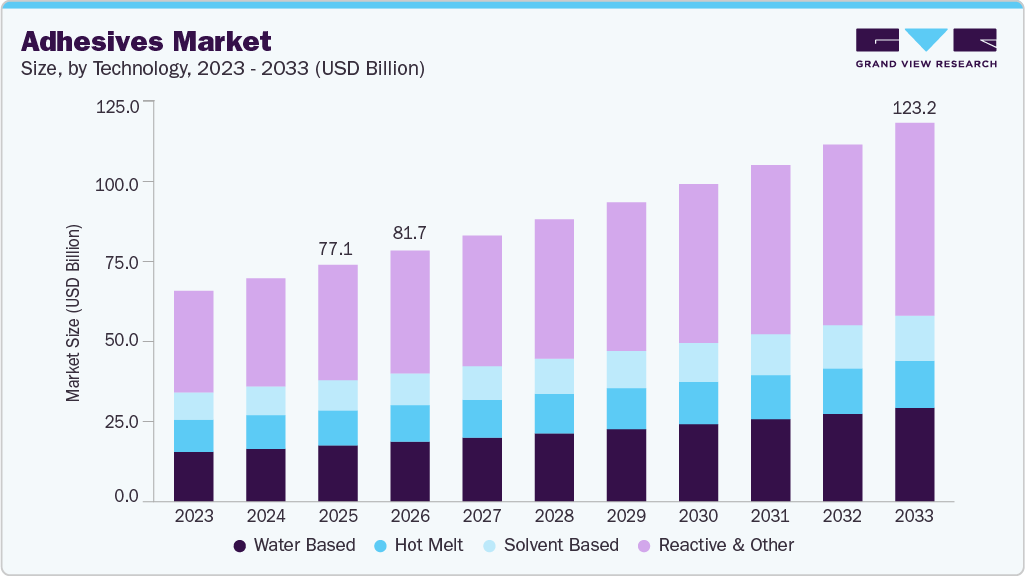

The global adhesives and sealants market size was estimated at USD 77.08 billion in 2025 and is projected to reach USD 123.20 billion by 2033, growing at a CAGR of 6.0% from 2026 to 2033. The industry is supported by technological advancements and rising performance requirements across end-use industries.

Key Market Trends & Insights

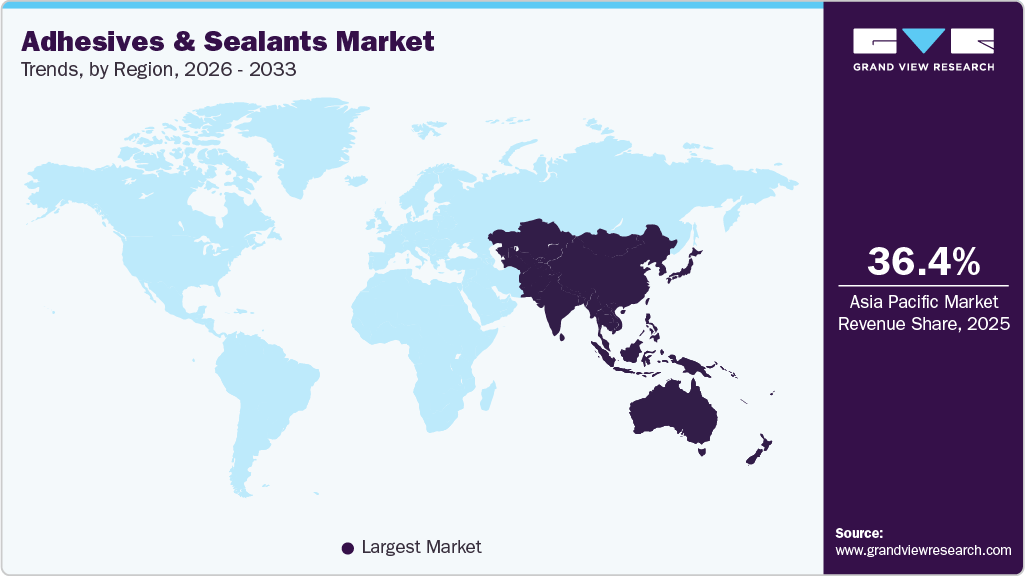

- Asia Pacific dominated the adhesives and sealants market with the largest revenue share of 36.4% in 2025.

- The global adhesives and sealants market is projected to grow at a CAGR of 6.0% from 2026 to 2033.

- By technology, the water-based adhesives and sealants segment is expected to witness the fastest growth rate of 6.6% from 2026 to 2033.

- By product, acrylic adhesives dominated the market with a revenue share of 36.9% in 2025.

- By application, the furniture & woodworking-based adhesives segment is expected to witness the fastest growth of 7.4% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 77.08 Billion

- 2033 Projected Market Size: USD 123.20 Billion

- CAGR (2026-2033): 6.0%

- Asia Pacific: Largest market in 2025

Increasing demand for automotive adhesives and sealants and silicone adhesives and sealants reflects a broader shift toward advanced bonding solutions that offer enhanced flexibility, vibration resistance, and durability. In addition, the high-temperature adhesives and sealants market is gaining traction as manufacturers seek materials capable of maintaining bond integrity under extreme thermal and mechanical conditions.In the construction and transportation sectors, infrastructure modernization and next-generation mobility platforms are accelerating the use of specialized adhesive systems. Aerospace adhesives and sealants market growth is supported by the need for lightweight, high-strength bonding solutions in aircraft structures, while the aviation adhesives and sealants market benefits from increasing aircraft maintenance, repair, and overhaul activities. These applications demand materials with superior chemical resistance, fatigue performance, and long service life, reinforcing the role of advanced adhesive technologies in critical structural assemblies.

From a materials and end-use perspective, sustainability and healthcare innovation are creating new growth avenues. The bio-based adhesives and sealants market is expanding as industries adopt low-VOC and renewable formulations to meet regulatory and environmental goals. Simultaneously, rising demand for minimally invasive procedures and advanced medical devices is driving the medical adhesives and sealants market, including strong growth in the surgical sealants and adhesives market and the dental adhesives and sealants market, where precision bonding, biocompatibility, and reliability are essential.

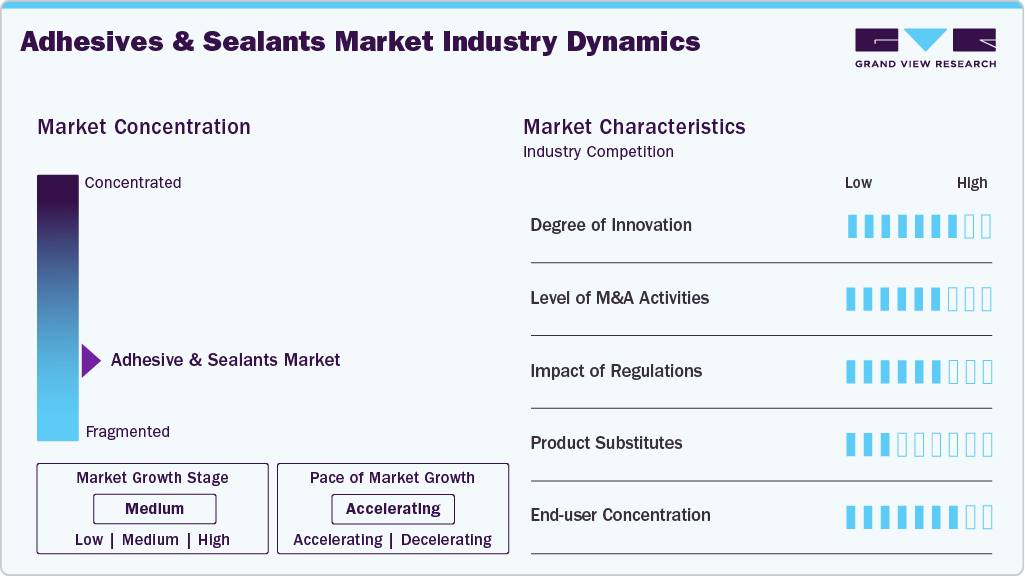

Market Concentration & Characteristics

The industry remains highly fragmented and competitive, characterized by the presence of numerous small and medium-sized players alongside established manufacturers. Companies operating across segments such as automotive adhesives and sealants, silicone adhesives and sealants, and high-temperature adhesives and sealants are actively pursuing growth through product launches, strategic collaborations, and technology upgrades to strengthen their market positioning.

In addition, market participants are expanding production capacities and pursuing regional acquisitions to enhance geographic reach and portfolio depth across applications including medical adhesives and sealants and aerospace and aviation adhesives and sealants. Strategic acquisitions remain a key growth lever; for instance, H.B. Fuller’s acquisition of Beardow Adams supports its expansion in the European market, reflecting the broader trend of consolidation to capture regional demand and improve competitive advantage.

Adhesives Technology Insights

The water-based segment dominated the adhesives & sealants market, accounting for the largest revenue share of 23.8% in 2025. Water-based adhesive technology is highly versatile and delivers reliable bonding across a wide range of applications, including automotive adhesives and sealants and select medical adhesives and sealants. Formulated using water, polymers, and functional additives, these adhesives are suitable for both porous and non-porous substrates and are typically applied in liquid form, becoming effective as the water evaporates or is absorbed. Available in both natural and synthetic variants, water-based adhesives are widely adopted due to their adaptability, low-VOC profile, and environmental compatibility.

The solvent-based adhesives segment is expected to grow at the fastest CAGR of 5.2% from 2026 to 2033, driven by strong demand across packaging, medical, and tape applications. These formulations are increasingly used within automotive adhesives and sealants and medical adhesives and sealants due to their superior resistance to moisture, heat, and chemicals, along with strong adhesion to both porous and non-porous substrates. Upon solvent evaporation, they form a durable bonding layer, supporting their widespread adoption across automotive components, food packaging, household products, and graphic materials.

Adhesives Product Insights

The acrylic segment dominated the market and accounted for the largest revenue share of 36.9% in 2025. The expansion of this market segment is largely due to the versatility of acrylic adhesives, which can effectively bond a wide range of materials such as metals, plastics, glass, ceramics, and wood. They also offer strong resistance to moisture, harsh temperatures, chemicals, and UV exposure, making them well-suited for use in both indoor and outdoor environments.

The EVA segment is expected to grow with a CAGR of 6.5% from 2026 to 2033, due to its versatility, fast setting time, and capability to bond a wide variety of polar and non-polar substrates without the use of water or solvents. Their formulations can be customized to meet specific industrial requirements, offering features such as flexibility, high strength, low-temperature performance, and resistance to various conditions. Commonly utilized in industries like packaging, paper, woodworking, automotive, and mattress production, EVA adhesives are preferred for their durability, ease of use, and cost-efficiency across a broad temperature range. Their strong bonding capabilities and adaptability make them highly valuable in fast-paced manufacturing and assembly operations.

Adhesives Application Insights

The paper & packaging-based adhesives application dominated the market, accounting for the largest revenue share of 29.4% in 2025, supported by the growing reliance on adhesives for strength, durability, and process efficiency across the packaging value chain. These formulations are critical in corrugated board and box manufacturing, where they ensure secure layer bonding, structural integrity, and resistance to moisture and temperature variations. Increasing demand for high-performance and sustainable packaging is also encouraging the adoption of bio-based adhesives and sealants that align with regulatory and environmental requirements.

The furniture & woodworking segment is expected to register the fastest CAGR of 7.4% from 2026 to 2033, driven by rising demand for durable, aesthetically refined, and eco-friendly furniture products. Adhesives are widely used in edge banding, lamination, cabinet assembly, and solid wood bonding, enabling complex designs and faster production cycles. Advanced solutions such as hot-melt EVA, PUR, and water-based systems-along with high-temperature adhesives and sealants are increasingly preferred for their heat resistance, rapid curing, and low-VOC performance.

Sealants Product Insights

The silicone sealants dominated the market and accounted for the largest revenue share of 33.2% in 2025, driven by regulatory support promoting the use of these products across various industries. For instance, the implementation of TAFE (Tractors and Farm Equipment Limited) regulations, which require reducing the overall weight of vehicles to help control pollution, has led to a rise in the use of silicone sealants in automotive applications.

The acrylic sealants segment is expected to grow at the fastest CAGR of 6.3% during the forecast period, driven by their versatility, ease of application, and environmental compatibility, making them ideal for various construction and interior applications. As a water-based, paintable, and low-VOC solution, acrylic sealants are increasingly preferred for sealing gaps in trim, molding, cabinetry, windows, and doors, particularly in indoor environments requiring clean air standards. Their strong adhesion, flexibility, quick curing, and ease of cleanup make them cost-effective and user-friendly for professionals and DIY users. The rising demand for sustainable and safe building materials further accelerates their adoption in residential, commercial, and general construction sectors.

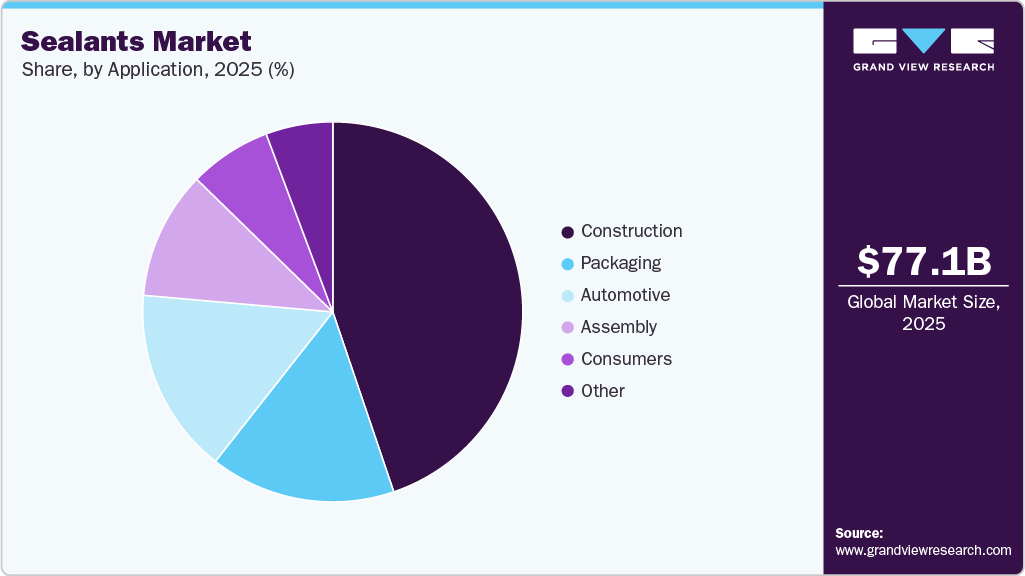

Sealants Application Insights

The construction sealants-based application dominated the market, accounting for 44.8% of total revenue in 2025, driven by extensive use in concrete joints, expansion gaps, crack sealing, and prefabricated structures. Silicone adhesives and sealants and high-temperature adhesives and sealants are widely used to seal metals, concrete, wood, and composite materials, forming durable and impermeable barriers against water, air, dust, UV radiation, and humidity. These solutions are essential for ensuring long-term structural integrity and weather resistance in windows, doors, sandwich panels, partitions, and precast concrete systems.

The packaging segment is expected to grow at the fastest CAGR of 6.4% from 2026 to 2033, as sealants play an increasingly critical role in protecting products from moisture, oxygen, and temperature fluctuations. Advanced sealing solutions are gaining traction across automotive adhesives and sealants and industrial packaging applications, supporting extended shelf life, improved handling safety, and chemical stability during storage and transport. The adoption of high-performance barrier packaging also reduces reliance on modified-atmosphere storage, aligning with cost-efficiency and sustainability objectives across multiple end-use industries.

Regional Insights

Asia Pacific adhesives & sealants market accounted for a 36.4% revenue share in 2025, driven by strong demand in building, construction, and automotive sectors across India, Indonesia, and Sri Lanka. Government initiatives such as India’s Smart Cities Mission and PMAY, along with Indonesia’s RPJMN, are boosting residential and commercial projects, increasing the use of silicone adhesives and sealants and high-temperature adhesives and sealants for tiling, insulation, and waterproofing. Rising middle-class income and growth in manufacturing and automotive production, supported by initiatives like “Make in India,” are further fueling market expansion in the region.

China held over 52.9% revenue share of the Asia Pacific Adhesives & Sealants market. China adhesives & sealants market is growing steadily, led by rising automotive production and adoption of fuel-efficient and electric vehicles. Manufacturers are shifting from mechanical fasteners to automotive adhesives and sealants and structural adhesives to reduce vehicle weight, enhance safety, and improve vibration resistance. Companies like Tesla, BYD, and NIO increasingly use adhesives in body-in-white construction and battery assemblies, while the expanding automotive aftermarket is driving demand for sealants in windshield installation, body repair, and engine components. Major global players, including Henkel, 3M, and Sika, are scaling operations to capture this growing demand.

Europe Adhesives And Sealants Market Trends

The adhesives & sealants market in Europe is driven by rising construction activities, automotive production, and technological advancements. Renovation of aging buildings over 90% constructed before 1990 and 40% before 1960 offers significant opportunities for silicone adhesives and sealants and high-temperature adhesives and sealants in structural bonding, insulation, flooring, and waterproofing applications. The region’s robust construction sector and increasing demand for durable, reliable bonding solutions continue to support market expansion across both residential and commercial projects.

North America Adhesives And Sealants Market Trends

The adhesives & sealants market in North America has experienced steady growth, supported by rising building and construction activities and infrastructure projects. In the automotive sector, the shift toward lightweight materials and enhanced vehicle performance is driving demand for automotive adhesives and sealants and high-temperature adhesives and sealants as alternatives to mechanical fasteners and welding. These solutions offer strong bonding, reduce vehicle weight, improve fuel efficiency, and enhance overall durability, reinforcing their adoption across both commercial and passenger vehicle manufacturing.

Middle East & Africa Adhesives And Sealants Market Trends

The adhesives & sealants market in the Middle East & Africa is expected to grow steadily, driven by expanding oil & gas operations and rising investments in the construction sector. Government initiatives to boost the automotive industry including tax incentives, economic zones, and infrastructure development are further supporting market growth. Countries like Morocco are attracting major global automotive players, leveraging strategic locations and favorable policies, which is increasing demand for automotive adhesives and sealants and high-temperature adhesives and sealants in vehicle manufacturing and industrial applications.

Latin America Adhesives And Sealants Market Trends

The adhesives & sealants market in Latin America is projected to emerge as a high-growth region during the forecast period, fueled by new construction and infrastructure projects in countries like Brazil and Argentina. Expansion in key sectors such as automotive, construction, and packaging is driving demand for automotive adhesives and sealants and silicone adhesives and sealants. Industrial development and rising manufacturing activities are further supporting the adoption of advanced bonding solutions across residential, commercial, and industrial applications.

Key Adhesives And Sealants Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the adhesives & sealants market include Henkel AG, Dow, Kuraray Co., and Ashland Inc., among others.

-

Henkel AG is a multinational company that operates in various industries including adhesives, sealants, surface treatments, and other industrial chemicals. The company is known for its well-known brands such as Loctite, Bonderite, Teroson, Technomelt, Aquence, and Schwarzkopf. The company holds leading positions in both industrial and consumer businesses, offering a diverse portfolio that includes hair care products, laundry detergents, fabric softeners, adhesives, sealants and functional coatings.

-

Dow, Inc. specializes in material science. The company’s product portfolio includes plastics, performance materials, coatings, silicones, and industrial intermediates. It offers a wide range of products and solutions in packaging, infrastructure, mobility, and consumer care segments. Dow’s products are used in various sectors such as homes and personal care, durable goods, adhesives and sealants, coatings and food & specialty packaging.

Key Adhesives And Sealants Companies:

The following are the leading companies in the adhesives and sealants market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Ashland Inc.

- Avery Denison Corporation

- H B Fuller

- Henkel AG

- Sika AG

- Pidilite Industries

- Huntsman

- Wacker Chemie AG

- RPM International Inc.

- Dow

- Kuraray Co., Ltd.

Recent Developments

-

In July 2025, Sonoco committed a $30 million investment to expand its production capacity in the adhesives and sealants market. This strategic move aims to strengthen supply capabilities, meet rising demand across key end-use industries, and enhance the company’s position in high-growth segments such as packaging, automotive, and industrial applications.

-

In May 2024, H.B. Fuller, the world’s largest pure play adhesives company, announced the acquisition of ND Industries Inc., a U.S.-based leader in specialty adhesives and fastener locking and sealing solutions. This strategic move enhances H.B. Fuller’s product portfolio, especially in high-growth, high-margin segments like automotive, electronics, and aerospace, and adds ND’s Vibra-Tite brand to its range of epoxy, cyanoacrylate, UV-curable, and anaerobic technologies. The acquisition also includes ND’s network of pre-applied coating centers and custom equipment capabilities, which will now operate under H.B. Fuller’s Engineering Adhesives unit.

Adhesives And Sealants Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 81.69 billion

Revenue forecast in 2033

USD 123.20 billion

Growth rate

CAGR of 6.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Turkey, Switzerland; China; India; Japan; South Korea; Brazil; Argentina; Colombia; GCC.

Key companies profiled

3M Company; Ashland Inc.; Avery Denison Corporation; H B Fuller; Henkel AG; Sika AG; Pidilite Industries; Huntsman; Wacker Chemie AG; RPM International Inc.; Dow; Kuraray Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Adhesives And Sealants Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global adhesives & sealants market report based on product, application, technology, and region

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Water Based

-

Solvent Based

-

Hot Melt

-

Reactive & Others

-

-

Adhesives Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Acrylic

-

PVA

-

Polyurethane

-

Styrenic block

-

Epoxy

-

EVA

-

Other Products

-

-

Adhesives Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Paper & Packaging

-

Consumer & DIY

-

Building & Construction

-

Furniture & Woodworking

-

Footwear & Leather

-

Automotive & Transportation

-

Medical

-

Other Applications

-

-

Sealants Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Silicones

-

Polyurethanes

-

Acrylic

-

Polyvinyl Acetate

-

Other Products

-

-

Sealants Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Construction

-

Automotive

-

Packaging

-

Assembly

-

Consumers

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Turkey

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global adhesives and sealants market size was estimated at USD 77.08 billion in 2025 and is expected to reach USD 81.69 billion in 2026.

b. The adhesives & sealants market is expected to grow at a compound annual growth rate of 6.0% from 2026 to 2033 to reach USD 123.20 billion by 2033.

b. Asia Pacific adhesives & sealants market accounted for a 36.4% revenue share in 2025, driven by strong demand in building, construction, and automotive sectors across India, Indonesia, and Sri Lanka. Government initiatives such as India’s Smart Cities Mission and PMAY, along with Indonesia’s RPJMN, are boosting residential and commercial projects, increasing the use of silicone adhesives and sealants and high-temperature adhesives and sealants for tiling, insulation, and waterproofing.

b. Some of the key players operating in the Adhesives & Sealants Market include 3M Company; Ashland Inc.; Avery Denison Corporation; H B Fuller; Henkel AG; Sika AG; Pidilite Industries; Huntsman; Wacker Chemie AG; RPM International Inc.; Dow; Kuraray Co., Ltd.

b. The industry is supported by technological advancements and rising performance requirements across end-use industries. Increasing demand for automotive adhesives and sealants and silicone adhesives and sealants reflects a broader shift toward advanced bonding solutions that offer enhanced flexibility, vibration resistance, and durability. In addition, the high-temperature adhesives and sealants market is gaining traction as manufacturers seek materials capable of maintaining bond integrity under extreme thermal and mechanical conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.