- Home

- »

- Medical Devices

- »

-

Active Wheelchair Market Size, Share, Industry Report, 2030GVR Report cover

![Active Wheelchair Market Size, Share & Trends Report]()

Active Wheelchair Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Manual Wheelchair, Powered Wheelchair), By Indication (Alzheimer's Disease, Cerebral Palsy), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-132-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Active Wheelchair Market Size & Trends

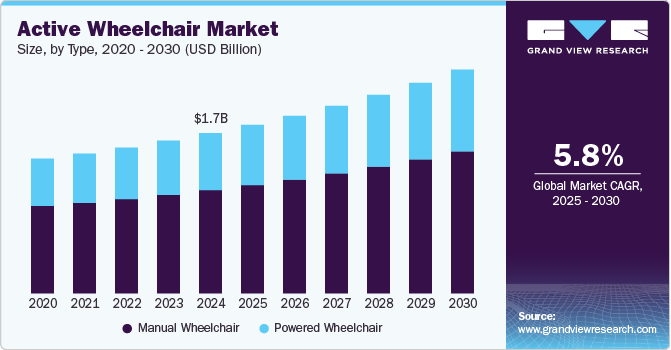

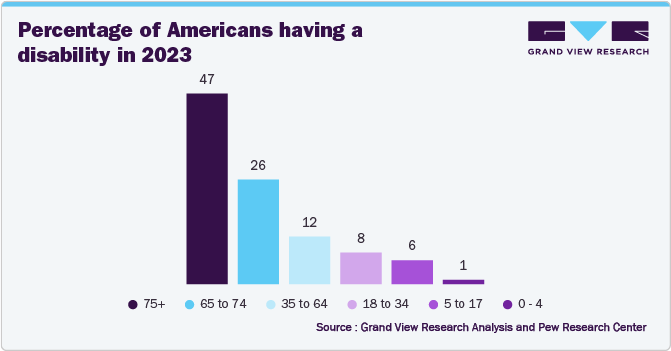

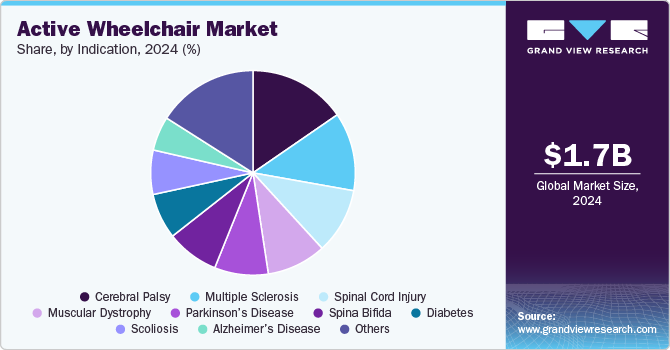

The global active wheelchair market size was estimated at USD 1.67 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. Active wheelchairs are versatile, lightweight mobility aids tailored for regular and active lifestyles. They are commonly used in sports and are highly steerable, customizable, and available in rigid and folding designs to meet individual preferences. The increasing number of disability cases is one of the major factors driving market growth. According to the WHO article published in March 2023, about 1.3 billion people across the globe live with significant disabilities, representing 16% of the total population. For these individuals, transportation challenges are far more severe, with disabled people facing difficulties that are 15 times greater than those encountered by individuals without disabilities.

This emphasizes the increased need for accessible, affordable mobility solutions like active wheelchairs. The substantial number of people affected by mobility limitations highlights a growing demand for advanced wheelchairs designed to improve accessibility, independence, and overall quality of life. As transportation remains a significant barrier, the active wheelchair industry is poised for growth, driven by the increasing need for enhanced mobility aids to support individuals with disabilities in their daily activities.

Growing road accident cases drive market growth. According to the World Health Organization (WHO) article published in December 2023, every year, around 1.19 million population are unfortunately lost due to road traffic accidents, while an additional 20 to 50 million individuals sustain non-fatal injuries. A significant portion of these survivors are left with long-term disabilities, underscoring the critical need for advanced mobility solutions. This growing prevalence of disability caused by road accidents has fueled demand for active wheelchairs, which offer enhanced functionality and independence for individuals with mobility challenges. Active wheelchairs are designed to support rehabilitation and improve the quality of life for those affected by these life-altering incidents, driving market growth.

The increasing use of mobility devices drives the growth of the market. According to the U.S. Department of Transportation, in February 2024, an estimated 5.5 million Americans rely on wheelchairs for mobility, with many facing significant challenges, particularly in air travel. The advancements in mobility solutions, as well as barriers such as inadequate accommodation and limited accessibility, continue to hinder travel experiences for wheelchair users. This ongoing issue emphasizes the need for innovative and reliable active wheelchairs that enhance mobility and address the growing demand for better accessibility, especially in public transportation like air travel.

Technological advancements are another factor driving market growth. For instance, in June 2024, Ottobock UK launched Juvo B7, a technologically advanced power wheelchair designed to deliver unparalleled comfort and control for individuals with complex mobility needs. This state-of-the-art wheelchair is engineered to provide all-day support, ensuring comfort and ease of movement. The Juvo B7 is available in two drive configurations, mid-wheel, and front-wheel drive, allowing greater versatility and customization to meet each user's unique positioning and mobility requirements. Whether for indoor or outdoor use, the Juvo B7 is designed to enhance the independence and quality of life for those with specific mobility challenges, making it an ideal choice for individuals who need a reliable and adaptable mobility solution.

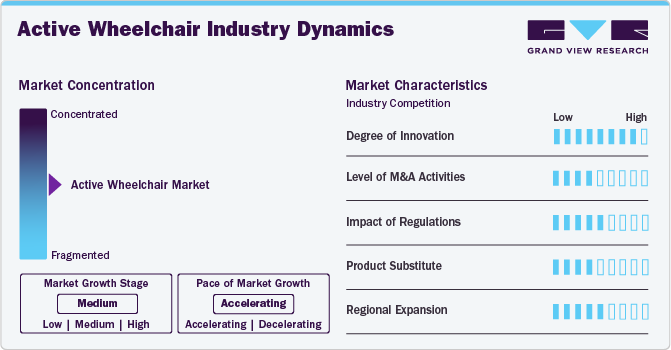

Market Concentration & Characteristics

The active wheelchair industry is experiencing high advancements by incorporating advanced materials and cutting-edge technologies. Innovations in lightweight and durable materials, such as carbon fiber and titanium, are enhancing the performance and portability of these wheelchairs. In addition, improved suspension systems and customizable seating options provide users with better comfort and maneuverability, particularly those with an active lifestyle. Integrating intelligent technologies, including joystick controls, app connectivity, and advanced battery systems, further improves the user experience, ensuring greater independence and convenience.

Several active wheelchair industry players, such as Sunrise Medical, Numotion, MEYRA GmbH, Permobil, and Invacare Corporation, are involved in merger and acquisition activities. Through M&A strategies, these key players employ critical approaches such as strategic collaborations, product launches, and geographical expansion to enhance their presence and address the increasing demand for active wheelchairs. For instance, In October 2023, Sunrise Medical, a leading provider of cutting-edge mobility solutions, revealed the acquisition of Ride Designs, a prominent company known for its premium custom seating systems designed specifically for wheelchair users.

Regulations are vital in the active wheelchair industry, as they guarantee product safety, performance, and quality. Although strict guidelines may result in longer approval timelines, they build consumer confidence and market reliability, advancing growth by upholding high standards for active mobility devices.

There are currently no direct substitutes. These mobility devices offer unparalleled features and benefits, such as enhanced maneuverability, customization, and support for an active lifestyle.

Leading companies in the active wheelchair industry are expanding their presence in emerging regions by collaborating with local distributors, establishing strategic alliances, and customizing their products to meet the unique healthcare needs of different populations. This approach enables them to better cater to regional demand while enhancing their competitive edge globally, driving increased market share and growth.

Type Insights

The manual wheelchair segment held the largest share of over 64.4% in 2024 due to the growing incidence of disability cases, rising initiatives by key companies, and technological advancements. A manual wheelchair is a mobility device that requires the user to propel it using their hands on the wheels or with assistance from someone else. It is typically lightweight, compact, and designed for easy maneuverability, offering users independence and flexibility for daily activities. For instance, in May 2024, Küschall introduced the all-new Champion SL manual wheelchair, featuring a host of innovative enhancements designed to elevate the user experience. The company describes Champion SL as "engineered for travel and built for performance," highlighting its focus on mobility and functionality. This new model combines advanced design elements to deliver superior comfort, ease of use, and adaptability for active wheelchair users, making it a perfect fit for those seeking convenience and high daily performance.

The powered wheelchair segment will show lucrative growth during the forecast period. Increasing incidence of disability cases and technological advancements drive market growth. A powered wheelchair is a mobility device equipped with an electric motor designed to assist individuals with limited mobility in moving independently and comfortably. For instance, in April 2023, Sunrise Medical launched the QUICKIE Q50 R Carbon, the lightest portable power wheelchair in the QUICKIE range, with a transportation weight of just 32 lbs. This innovative wheelchair is designed for easy transportation, storage, and maneuverability, offering an excellent solution for individuals who want to stay active and independent without the challenges of a heavy or bulky mobility device. Constructed with magnesium wheels, carbon fiber frame and motors, and breathable material, the Q50 R Carbon combines lightweight design with exceptional strength, supporting up to 300 lbs.

Indication Insights

The cerebral palsy (CP) segment held the largest share at 15.4% in 2024. Increasing cerebral palsy cases, rising government initiatives, and technologically advanced product launches drive segment growth. Cerebral palsy is a neurological disorder caused by abnormal brain development or damage, affecting movement, posture, and muscle coordination. According to the Birth Injury Justice Center article published in September 2024, cerebral palsy (CP), affecting approximately 1 to 4 per 1,000 live births in the U.S., is a leading condition driving the demand for specialized mobility solutions such as active wheelchairs. With most cases about 85-90% arising from birth-related factors, individuals with CP often face unique mobility challenges. Active wheelchairs, designed for agility, independence, and customization, empower individuals with CP to lead more active and fulfilling lives, addressing their specific needs and enhancing overall mobility.

The multiple sclerosis segment is expected to grow significantly during the forecast period due to several key factors. The increasing prevalence of numerous sclerosis diseases globally emphasizes the need for advanced solutions in healthcare settings to manage patient care effectively. Multiple sclerosis is a chronic condition characterized by inflammation and neurodegeneration within the central nervous system, making it one of the primary causes of neurological disability among young adults. According to the Elsevier B.V. article published in September 2024, estimated to have over 2.8 million cases worldwide, it significantly influences the demand in the active wheelchair industry. With incidence rates on the rise and a noticeable shift in MS prevalence toward older age groups, there is an increasing need for mobility solutions tailored to the unique challenges faced by individuals with this condition. Active wheelchairs, offering enhanced functionality and independence, provide critical support for those managing MS, enabling them to maintain mobility and improve their quality of life.

Regional Insights

North America active wheelchair market dominated with a share of 40.1% in 2024, owing to a rising incidence of disability, increasing demand for mobility solutions among the aging population, and increased government initiatives. According to the CDC, in July 2024, over one in four adults (28.7%) in the U.S. lived with some form of disability, with 12.2% experiencing mobility-related challenges such as difficulty walking or climbing stairs. This emphasizes the growing demand for innovative mobility solutions, such as active wheelchairs, which are crucial in addressing the challenges faced by individuals with mobility limitations. These wheelchairs are designed to promote greater independence, allowing users to navigate their environments quickly and confidently.

U.S. Active Wheelchair Market Trends

The U.S. active wheelchair market accounted for the largest share of North America's market in 2024. Increasing incidence of muscular dystrophy and increased government initiatives fuel market growth. According to the CDC article published in September 2024, about 1 in every 5,000 males aged 5-9 years, these progressive conditions increase mobility challenges over time. Active wheelchairs are essential for individuals with Duchenne and Becker muscular dystrophies, offering the functionality, adaptability, and independence needed to maintain mobility as their condition advances. This highlights the importance of advanced active wheelchair designs tailored to meet the needs of those with muscular dystrophy.

Europe Active Wheelchair Market Trends

The active wheelchair market in Europe held the second-largest revenue market share in 2024. Rising disability cases and increased government initiatives drive market growth. According to the Council of the EU and the European Council article published, in 2023, approximately 27% of the European Union population aged 16 and older was living with some form of disability, which equates to around 101 million people, or roughly one in four adults. This significant proportion of the population underscores the growing demand for mobility solutions, including active wheelchairs. As the need for enhanced mobility aids rises across Europe, active wheelchairs are becoming increasingly essential for individuals with disabilities, offering greater independence, mobility, and improved quality of life. This trend is expected to continue as the European market responds to the evolving needs of this large demographic.

Germany active wheelchair market is dominated by the highest revenue share, 24.2%, in 2024. Increasing accident and disability rates, ongoing advancements in technology, and improving healthcare infrastructure in the country. For instance, In February 2023, as per the article Statistisches Bundesamt, approximately 21,600 individuals were injured in road transport accidents, reflecting the ongoing challenges related to road safety in Germany. These figures underscore the continued need for mobility aids, as such accidents often result in injuries that require long-term mobility support. The demand for active wheelchairs is exceptionally high, as they play a crucial role in aiding recovery and improving the quality of life for those affected by road traffic-related injuries.

The active wheelchair market in the UK held the second-largest market share in 2024. Rising road accident injuries and increased government initiatives drive market growth. According to the brake article published in September 2024, In the UK, a total of 28,967 individuals were seriously injured in road traffic accidents in 2023, highlighting the significant impact of such incidents on public health and mobility. This considerable number of casualties emphasizes the ongoing need for effective mobility solutions, particularly for those requiring long-term movement assistance. As these accidents often lead to severe injuries, there is a growing demand for active wheelchairs, which provide vital support for recovery and help improve the independence and quality of life for those affected. This trend signals an increasing market potential for mobility aid in the UK.

France active wheelchair market is anticipated to witness a significant CAGR of 6.2% during the forecast period. Increased cases of disability and technological advancement drive the growth of the market. According to the lemonade article published in September 2024, in France, around 11 million individuals live with disabilities. This large demographic creates a growing demand for mobility solutions like active wheelchairs. The significant number of people requiring mobility assistance underscores the need for advanced and accessible mobility aids, driving expansion in the market. Addressing this large population's needs is crucial for improving their quality of life and independence, leading to increased market opportunities and innovation.

Asia Pacific Active Wheelchair Market Trends

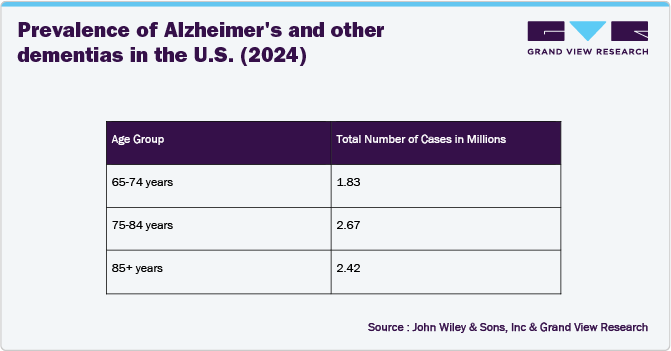

The Asia Pacific active wheelchair market in is expected to grow fastest during the forecast period. There are increasing disability cases, rising cases of Alzheimer’s disease, strategic initiatives by key players, and rising government initiatives. According to the Elsevier B.V. article published in November 2024, in the Asia Pacific region, the prevalence of Aβ-positive Alzheimer’s disease (AD) dementia varies significantly across different subregions. East Asia has the highest estimated number, with 6.6 million individuals affected, followed by South Asia with 3.9 million, high-income Asia Pacific regions with 2.5 million, and Southeast Asia with 2.4 million. This rising number of individuals living with Alzheimer’s disease highlights the growing need for mobility solutions, particularly as the disease progresses and impairs mobility. As more people in the Asia Pacific region face mobility challenges due to AD dementia, the demand for active wheelchairs is expected to increase, providing vital support for improving independence and enhancing the quality of life for affected individuals.

China active wheelchair market accounted for the second-largest share of the Asia Pacific region's market in2024. Rising number of disability cases, increasing geriatric population, technological advancements, and government initiatives. For instance, in December 2023, as per the Global Times article, the number of older people aged 60 and above has grown substantially and reached 280 million. Moreover, as per a Stanford University article published in March 2024, China faces a similar challenge, with 85 million individuals living with disabilities, which accounts for approximately 6.5 percent of its population.

The Japan active wheelchair market held the largest market share in the Asia Pacific region. Increasing disability cases and increased government initiatives drive market growth. According to the UJ Media Services article published in March 2024, in Japan, over 4 million people live with physical disabilities, with approximately 2 million relying on wheelchairs, making up about 1.57% of the population. Moreover, as per the Ministry of Health, 33.4% of individuals holding physical disability records are below 65, and 16.3% go outside daily. These figures underscore the growing need for advanced mobility solutions, such as active wheelchairs, to improve the quality of life for those facing mobility challenges. Access to effective mobility aids is crucial for supporting their independence and enabling participation in daily activities.

India active wheelchair market is experiencing significant growth. Increased road accident injuries and technological advancements drive the growth of the market. According to the Times of India article published in October 2024, road traffic accidents in India resulted in nearly 1.73 lakh fatalities and 4.63 lakh injuries, setting a record for road crash casualties in 2023. A significant portion of these deaths involved two-wheeler riders, particularly those not wearing helmets, who represented 44% of the fatalities. This alarming rise in road accidents emphasizes the need for mobility aid, as many individuals affected by such accidents may require long-term recovery support. The demand for active wheelchairs in India is expected to grow as these individuals seek solutions to regain independence and improve their quality of life after sustaining injuries in road crashes.

Latin America Active Wheelchair Market Trends

The active wheelchair market in Latin America is growing. Increasing disability cases and technologically advanced product launches. According to the NCBI article published in March 2024, in Latin America, approximately 85 million people, or 15% of the population, live with some form of disability. This sizable demographic highlights the growing demand for mobility solutions, including active wheelchairs, to support individuals in overcoming mobility challenges. As the need for advanced and accessible mobility aids increases, active wheelchairs play a crucial role in enhancing independence and improving the quality of life for those affected by disabilities across the region.

Brazil active wheelchair market is expanding due to several distinct growth drivers. The rising disability population drives the growth of the market. According to the Human Rights Watch article published in January 2024, Brazil has about 18 million individuals with disabilities, emphasizing a significant need for effective mobility solutions. This substantial population highlights the increasing demand for active wheelchairs, which offer enhanced mobility and independence for those with severe mobility challenges. As the number of people with disabilities continues to rise, the market for active wheelchairs in Brazil is expected to grow, driven by the need for advanced, supportive devices that improve daily living and overall quality of life for users.

Middle East & Africa Active Wheelchair Market Trends

The active wheelchair market in MEA is expected to grow lucratively due to the increasing number of disability cases and the increasing adoption of advanced medical technologies in the region. According to the HR Observer article published in December 2023, approximately 30 million people live with disabilities in the Middle East and Africa (MEA) region, highlighting a significant need for mobility solutions. This large population of individuals with mobility challenges underscores the growing demand for advanced mobility aids, including active wheelchairs.

South Africa active wheelchair market is growing at a CAGR of 3.7% over the forecast period. Rising disability cases and increased government initiatives drive the growth of the market. According to the Statistics South Africa article published in July 2024, with a population of approximately 62 million in 2022, around 3.3 million individuals are identified as having disabilities. This substantial number indicates a growing need for effective mobility solutions, particularly active wheelchairs. The increasing prevalence of disabilities, which impacts a significant segment of the population, underscores the importance of advanced mobility aids in enhancing independence and improving daily life for those affected. As the demand for active wheelchairs rises, driven by a larger and more diverse disabled population, the market is poised for growth, aiming to meet the needs of South Africans seeking better mobility and support.

Key Active Wheelchair Company Insights

Some key players operating in the active wheelchair industry include Sunrise Medical, Numotion, and MEYRA GmbH. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Drive Medical and Mountain Trike are emerging players in the active wheelchair industry.

Key Active Wheelchair Companies:

The following are the leading companies in the active wheelchair market. These companies collectively hold the largest market share and dictate industry trends.

- Sunrise Medical

- Numotion

- MEYRA GmbH

- Permobil

- Invacare Corporation

- Pride Mobility

- Ottobock

- Drive Medical

- Mountain Trike

- Motion Composites

Recent Developments

-

In June 2024, Platinum Equity announced its acquisition of German wheelchair manufacturer Sunrise Medical from Nordic Capital. This transaction marks a change in ownership for the well-known mobility solutions provider.

-

In June 2024, Drive DeVilbiss Healthcare (DDH) revealed the acquisition of the complete product range from Mobility Designed, Inc. This strategic move will expand DDH's collection of innovative medical equipment and incorporate advanced industrial design expertise into its operations.

-

In April 2024,Numotion, in collaboration with the United Spinal Association and United Airlines, launched an innovative tool to assist wheelchair users in selecting flights that accommodate their mobility devices. This new feature, accessible through the United Airlines app and website, enables customers to easily find flights compatible with the specific dimensions of their wheelchairs, streamlining the travel process for individuals with mobility challenges.

-

In February 2024,Permobil introduced QuickConfig for the full range of Corpus power wheelchairs in the U.S. and Canada. Originally launched in the summer of 2023, the feature was first offered for the F5 Corpus VS and M Corpus VS standing power wheelchairs.

Active Wheelchair Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.75 billion

Revenue forecast in 2030

USD 2.32 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Mexico; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sunrise Medical; Numotion; MEYRA GmbH; Permobil; Invacare Corporation; Pride Mobility; Ottobock; Drive Medical; Mountain Trike; Motion Composites

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Active Wheelchair Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. for this study, Grand View Research has segmented the global active wheelchair market report based on type, indication, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Wheelchair

-

Powered Wheelchair

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Cerebral Palsy

-

Multiple Sclerosis

-

Spinal Cord Injury

-

Muscular Dystrophy

-

Parkinson’s Disease

-

Spina Bifida

-

Diabetes

-

Scoliosis

-

Alzheimer’s Disease

-

Amyotrophic lateral sclerosis (ALS)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the active wheelchair market growth include the increasing geriatric and disabled population, increasing prevalence of chronic diseases, and technological advancement in the active wheelchairs industry.

b. The global active wheelchair market size was estimated at USD 1.67 billion in 2024 and is expected to reach USD 1.75 billion in 2025.

b. The global active wheelchair market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 2.32 billion by 2030.

b. North America dominated the active wheelchair market with a share of 40.1% in 2024. This is attributable to rising healthcare awareness coupled with increasing geriatric and disabled populations in the region.

b. Some key players operating in the active wheelchair market include Sunrise Medical, Numotion, MEYRA GmbH, Permobil, Invacare Corporation, Pride Mobility, Ottobock, Drive Medical, Mountain Trike, Motion Composites

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.