- Home

- »

- Next Generation Technologies

- »

-

Active Network Management Market Size Report, 2030GVR Report cover

![Active Network Management Market Size, Share & Trends Report]()

Active Network Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Solution & Service), By Enterprise Size (SMEs, Large Enterprise), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-353-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Active Network Management Market Trends

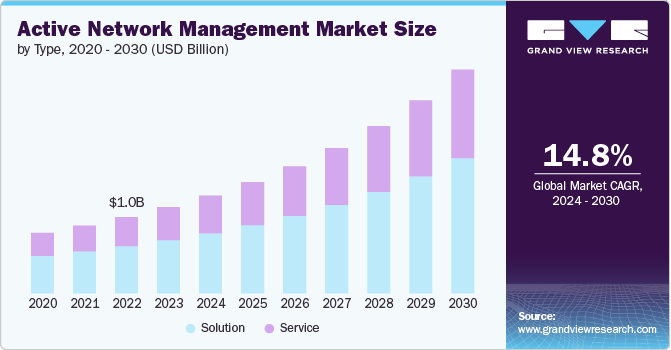

The global active network management market size was estimated at USD 1.14 billion in 2023 and is expected to grow at a CAGR of 14.8% from 2024 to 2030. The market growth is attributed to the increasing complexity of modern networks and the growing demand for highly efficient and reliable network operations. With the rise of cloud services, IoT devices, and edge computing, effective network management is crucial for seamless connectivity and performance. As a result, organizations across several industries are increasingly investing in advanced active network management solutions for proactively monitoring, analyzing, and optimizing their networks.

Active network management plays a pivotal role in the effective management of smart grids, serving as a connective framework that links various components integral to the operation of a smart grid. This includes renewable energy generation sources, energy storage devices, and smaller-scale energy generators. By doing so, it establishes a highly intelligent energy infrastructure capable of autonomous control over these diverse components within the energy network. This intricate system not only streamlines operations but also provides essential information necessary for ensuring that all elements within the smart grid are meticulously governed in the most efficient and optimal manner possible.

Another factor fueling the growth of the market is the increasing focus on sustainability and energy efficiency. As energy costs continue to rise, businesses are actively seeking ways to reduce their carbon footprint and energy consumption. Active network management solutions help organizations optimize their energy usage by intelligently managing power distribution and reducing energy wastage. By minimizing energy costs and enhancing sustainability, these solutions have garnered the attention of environmentally conscious businesses, contributing to the market's growth. Thus, the market is thriving as it meets the evolving needs of organizations looking to maintain efficient, resilient, and eco-friendly network infrastructures in a digital-first world.

Moreover, the growing adoption of 5G technology is creating new opportunities for the active network management market. The rollout of 5G networks brings unprecedented speeds and low latency, but it also introduces greater complexity in network management. 5G networks require more dynamic and flexible management solutions to handle the increased data traffic and diverse array of connected devices. Active network management systems are evolving to meet these challenges. Type tools for managing network slicing, orchestrating virtualized network functions, and ensuring quality of service across various 5G use cases. As 5G continues to expand globally, the demand for sophisticated active network management solutions is expected to surge, further propelling market growth in the coming years.

Despite its potential for significant growth, the market encounters several challenges. A major hurdle is the substantial initial investment needed for advanced network management solutions, which can deter small and medium-sized enterprises with limited budgets. Furthermore, integrating these systems with existing legacy infrastructure presents technical challenges and may necessitate extensive staff training or hiring specialized personnel. Additionally, there are concerns about data security and privacy, as active network management systems frequently handle sensitive information, making them potential targets for cyberattacks.

Type Insights

The solution segment held the largest market share of 61.6% in 2023. Based on the type, the market is segmented into solution and service. The segmental growth can be attributed to the rising demand for effective power distribution management systems and load-balancing modules in power grids. Furthermore, multiple European nations, such as the UK, Germany, the Netherlands, and Belgium, are in the process of implementing intelligent energy distribution systems to enhance power allocation efficiency. Active network management software solutions encompass a range of management suites and platforms, which encompass advanced metering infrastructure (AMI), distribution automation, geographic information systems, outage management, and telecommunications network management.

The service segment is expected to grow rapidly during the forecast period. The increasing complexity of network infrastructures, coupled with a prevalent skill gap in organizations, is driving demand for professional services, managed services, and consulting. In addition, cloud adoption is creating opportunities for migration and integration services, while customization needs are fueling tailored solutions across industries. Continuous innovation in network technologies necessitates regular updates, creating a consistent demand for maintenance services.

Enterprise Size Insights

The large enterprises segment held the largest market share in 2023. Based on the enterprise size, the market is segmented into small & medium enterprises and large enterprises. The growth of the large enterprises segment can be attributed to the growing adoption of advanced active network management systems owing to the increasing need for enhanced operational efficiency, improved network performance, and robust security measures in large-scale operations. Furthermore, a shift towards cloud-based and hybrid network architectures is being witnessed among large enterprises, necessitating more advanced network management capabilities.

The small & medium enterprises (SMEs) segment is anticipated to be the fastest-growing segment throughout the projection period. The growth can be attributed to the growing number of SMEs worldwide. Additionally, government initiatives in many countries are actively promoting entrepreneurship and SME growth, contributing to an increase in the number of SMEs. As SMEs grow and their network needs become more complex, they are increasingly turning to active network management solutions to ensure reliability, security, and scalability. Moreover, as digital transformation initiatives become increasingly critical for businesses of all sizes, SMEs are recognizing the importance of efficient network management.

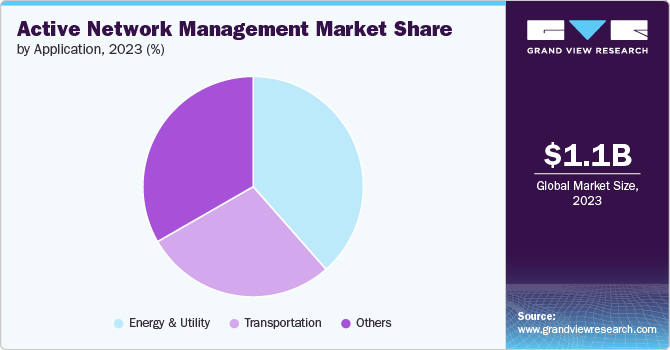

Application Insights

The energy & utility segment dominated the market in 2023 and is predicted to grow significantly during the forecast period. The integration of renewable energy sources, such as solar and wind power, has prompted energy and utility companies to embrace active network management solutions to manage the influx of intermittent energy efficiently. Moreover, the advent of smart grids, featuring advanced metering infrastructure, distribution automation, and real-time monitoring, has further accentuated the demand for active network management. These systems empower utilities to monitor and control energy distribution with precision, mitigate losses, and enhance grid reliability.

The transportation segment is expected to grow substantially during the forecast period. This segment encompasses a wide range of applications, from intelligent traffic management systems to connected vehicle networks and smart public transportation solutions. One of the primary drivers of growth in this segment is the rapid development of smart city initiatives worldwide. As urban areas seek to improve mobility and reduce congestion, they are increasingly turning to active network management solutions to optimize traffic flow, manage public transportation systems, and enhance overall transportation efficiency.

Regional Insights

The active network management market of North America dominated the global market in 2023. The segmental growth can be attributed to the region's increasing focus on renewable energy integration, smart grid development, and grid modernization initiatives has accelerated the adoption of active network management solutions. Furthermore, the growing demand for electric vehicles has also played a role in driving market’s growth, with active network management being essential for managing EV charging infrastructure. Regulatory compliance and the increasing reliance on data centers in the region have contributed to the ongoing expansion of the active network management market.

U.S. Active Network Management Market Trends

The U.S. active network management market is experiencing significant growth, driven by the rapid adoption of smart grid technologies and the increasing emphasis on grid resilience. A major trend is the modernization of aging infrastructure to handle the growing demand for electricity and improve reliability.

Europe Active Network Management Market Trends

Theactive network management market of Europe is characterized by its strong commitment to sustainability and renewable energy integration. The European Union's stringent environmental regulations and ambitious carbon reduction targets are driving the adoption of advanced network management solutions.

Asia Pacific Active Network Management Market Trends

Asia Pacific active network management market is marked by its dynamic and diverse landscape, driven by rapid urbanization and industrialization. A key trend in this region is the substantial investment in smart city initiatives, where advanced network management plays a crucial role in ensuring efficient energy distribution and management.

Key Active Network Management Company Insights

Key players operating in the market include Abb Ltd.; Chemtrols Industries Pvt. Ltd.; Cisco Systems Inc.; General Electric Company; IBM Corporation; Landis+Gyr AG; Oracle Corporation; Schneider Electric S.E.; Siemens Ag; And Itron, Inc.; among others. The key market players are focusing on various strategic initiatives, including partnerships & collaborations, new product development, and geographic expansion to gain a competitive advantage over their rivals.

Key Active Network Management Companies:

The following are the leading companies in the active network management market. These companies collectively hold the largest market share and dictate industry trends.

- Abb Ltd.

- Chemtrols Industries Pvt. Ltd.

- Cisco Systems Inc.

- General Electric Company

- IBM Corporation

- Landis+Gyr AG

- Oracle Corporation

- Schneider Electric S.E.

- Siemens Ag

- Itron, Inc.

Recent Developments

-

In February 2023, Siemens AG announced a strategic partnership with EnergyHub to develop an advanced Distributed Energy Resources (DER) management system. This collaboration aims to integrate Siemens' software solutions with EnergyHub's grid capabilities, enhancing network planning, operation, and maintenance for utilities. By leveraging Siemens' expertise in network management and EnergyHub's technological strengths, the partnership aims to offer a comprehensive DER management solution. This initiative supports utilities in achieving net-zero emissions by maximizing the use of distributed energy resources as cost-effective alternatives to traditional infrastructure investments.

Active Network Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.29 billion

Revenue forecast in 2030

USD 2.96 billion

Growth rate

CAGR of 14.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, enterprise size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Abb Ltd.; Chemtrols Industries Pvt. Ltd.; Cisco Systems Inc.; General Electric Company; IBM Corporation; Landis+Gyr AG; Oracle Corporation; Schneider Electric S.E.; Siemens Ag; Itron, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Active Network Management Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global active network management market based on type, enterprise size, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Service

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global active network management market size was estimated at USD 1.14 billion in 2023 and is expected to reach USD 1.29 billion in 2024.

b. The global active network management market is expected to grow at a compound annual growth rate of 14.8% from 2024 to 2030 to reach USD 2.96 billion by 2030.

b. North America dominated the active network management market with a share of 32.62% in 2023. The regional market growth can be attributed to the region's increasing focus on renewable energy integration, smart grid development, and grid modernization initiatives has accelerated the adoption of active network management solutions.

b. Some key players operating in the active network management market include ABB Ltd.; Chemtrols Industries Pvt. Ltd.; Cisco Systems Inc.; General Electric Company; IBM Corporation; Landis+Gyr AG; Oracle Corporation; Schneider Electric S.E.; Siemens Ag; Itron, Inc.

b. Key factors that are driving the market growth include an increase in the need for efficient power management solutions and a surge in demand for smart energy planning in smart city projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.