- Home

- »

- Organic Chemicals

- »

-

Acetaldehyde Market Size And Share, Industry Report, 2030GVR Report cover

![Acetaldehyde Market Size, Share & Trends Report]()

Acetaldehyde Market (2025 - 2030) Size, Share & Trends Analysis Report By Process (Oxidation Of Ethylene, Oxidation Of Ethanol, Dehydrogenation Of Ethanol), By Application (Food & Beverage, Chemicals), By Region And Segment Forecasts

- Report ID: GVR-4-68040-146-3

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Acetaldehyde Market Summary

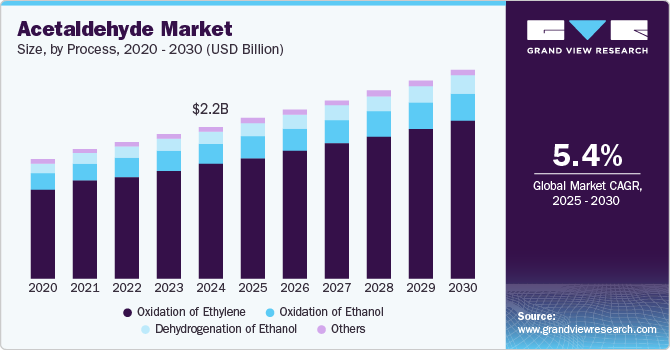

The global acetaldehyde market size was estimated at USD 2.23 billion in 2024 and is projected to reach USD 3.05 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. Acetaldehyde is widely used as an intermediate in the production of flavoring agents, preservatives, and food additives.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for 60.0% of global revenue in 2024.

- By process, oxidation of ethylene segment accounted for 75.48% of the revenue share in 2024.

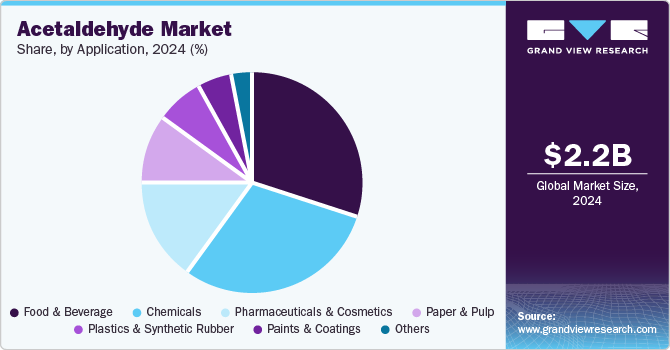

- By application, food & Beverage segment accounted for 32.0% of the revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.23 Billion

- 2030 Projected Market Size: USD 3.05 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

The increasing global consumption of processed and packaged food products has driven the demand for acetaldehyde in the food and beverage sector. Its role in enhancing flavors and maintaining food quality makes it an essential component for food manufacturers, particularly as consumer preferences shift towards convenient and ready-to-eat products.

The chemical industry is a major consumer of acetaldehyde, utilizing it as a key intermediate in producing chemicals such as acetic acid, pentaerythritol, and peracetic acid. These chemicals are critical in manufacturing adhesives, paints, synthetic resins, and coatings. The growing demand for these downstream products, driven by robust construction, automotive, and industrial activities, has significantly bolstered the global acetaldehyde market. Acetaldehyde plays a crucial role in the agriculture sector as a precursor for manufacturing pesticides, herbicides, and fungicides. With increasing global concerns about food security and rising agricultural activities to meet the needs of a growing population, the demand for acetaldehyde in agrochemical production has risen. In addition, its use in plant growth regulators and soil fumigants further enhances its importance in modern farming practices.

The pharmaceutical industry relies on acetaldehyde for synthesizing various drugs and active pharmaceutical ingredients (APIs). Its role in producing sedatives, vitamins, and anti-infective drugs contributes to its demand in the healthcare sector. The expanding global pharmaceutical market, fueled by aging populations and rising healthcare spending, has created steady growth opportunities for acetaldehyde producers. The development of bio-based acetaldehyde derived from renewable resources is gaining traction as industries seek sustainable and environmentally friendly alternatives. Bio-based acetaldehyde offers reduced carbon emissions and aligns with stringent environmental regulations.

Process Insights

Oxidation of Ethylene segment accounted for 75.48% of the revenue share in 2024. The oxidation of ethylene is one of the most widely adopted processes for acetaldehyde production due to its cost-effectiveness and high efficiency. This process allows manufacturers to produce acetaldehyde at competitive costs, leveraging ethylene—a readily available raw material in global markets. The simplicity of the process and its relatively lower energy requirements compared to other methods contribute to its popularity among acetaldehyde producers.

Oxidation of Ethanol segment is expected to grow significantly at CAGR of 5.2% over the forecast period. Ethanol, derived from both petrochemical and bio-based sources, is abundantly available across global markets. The growing production of bioethanol, driven by the need for renewable and sustainable energy sources, has ensured a consistent supply for acetaldehyde production. This abundant supply enhances the feasibility of using ethanol oxidation as a preferred method, particularly in regions with strong bioethanol industries, such as North America and Brazil.

Application Insights

Food & Beverage segment accounted for 32.0% of the revenue share in 2024. Acetaldehyde is widely utilized in the food and beverage industry as a key ingredient in the production of flavoring agents and preservatives. It plays a vital role in enhancing the aroma and taste of various food products and beverages, including fruit juices, dairy products, and confectionery. As consumer preferences lean toward diverse and exotic flavors, the demand for acetaldehyde in formulating new and unique flavor profiles has risen. Its application in preserving the freshness and shelf life of packaged food products further drives its demand, particularly in regions with high consumption of processed and convenience foods.

Pharmaceuticals & cosmetics segment is expected to grow significantly at CAGR of 5.8% over the forecast period. Acetaldehyde serves as a critical intermediate in the synthesis of various active pharmaceutical ingredients (APIs) and essential drugs. It is used in producing sedatives, vitamins (such as vitamin B5), and other therapeutic agents. The growing global pharmaceutical industry, driven by rising healthcare needs, increasing prevalence of chronic diseases, and aging populations, has led to a surge in demand for acetaldehyde-based APIs. In addition, the expanding production of anti-infective drugs and formulations involving acetaldehyde further strengthens its role in the pharmaceutical sector.

Regional Insights

North America acetaldehyde market is expected to grow significantly at CAGR of 5.6% over the forecast period. Environmental concerns and stringent regulations in North America have prompted the development and adoption of bio-based acetaldehyde derived from renewable resources. This eco-friendly alternative reduces the environmental footprint and aligns with the region’s sustainability goals. The shift toward bio-based products is gaining traction across industries, from chemicals to food processing, providing new growth opportunities for acetaldehyde producers in the region.

U.S. Acetaldehyde Market Trends

The U.S. demand for acetaldehyde is supported by its use in producing synthetic fibers, such as polyester, which are widely employed in textiles and industrial applications. The increasing adoption of polyester-based products, driven by the rising demand for durable and cost-effective fabrics, has indirectly bolstered acetaldehyde consumption. Its use in textile dyeing processes further enhances its relevance in the market.

Asia Pacific Acetaldehyde Market Trends

Asia Pacific dominated the market and accounted for 60.0% of global revenue in 2024. The robust industrial and manufacturing landscape in Asia Pacific has made it a key consumer of acetaldehyde for various chemical applications. Countries such as China, Japan, and South Korea are leading producers of acetic acid, pentaerythritol, and other derivatives that utilize acetaldehyde as a critical intermediate. The rising construction and automotive industries in the region, which rely on paints, adhesives, and coatings, have further fueled demand for acetaldehyde.

The agricultural sector in China continues to grow, driven by the country's focus on enhancing food production to support its large population. Acetaldehyde is extensively used in the production of agrochemicals, including pesticides, herbicides, and fungicides. With an emphasis on improving crop yields and combating agricultural pests, the demand for acetaldehyde-based agrochemical intermediates has risen. Government initiatives promoting advanced farming techniques further amplify the market growth.

CSA Acetaldehyde Market Trends

The food and beverage sector in CSA is rapidly growing, supported by an increasing population, urbanization, and rising disposable incomes. Acetaldehyde is widely used in producing flavoring agents and food additives, making it a crucial ingredient for food processing industries. The shift towards packaged and processed foods in the region has further amplified the demand for acetaldehyde in this segment.

Europe Acetaldehyde Market Trends

The pharmaceutical industry in Europe is one of the largest in the world, with acetaldehyde playing a key role in the synthesis of various drugs and active pharmaceutical ingredients (APIs). Acetaldehyde is used in the production of vitamins, sedatives, and other therapeutic compounds. With Europe experiencing an aging population and increasing healthcare needs, the demand for acetaldehyde in pharmaceutical applications is growing, further stimulating the regional market.

Key Acetaldehyde Company Insights

Some of the key players operating in the market includeCelanese Corporation, Eastman Chemical Company, Others

-

Celanese Corporation is a global technology and specialty materials company headquartered in Irving, Texas. It is a leading producer of acetaldehyde, primarily used as an intermediate in the production of various chemicals and materials. Celanese’s product offerings include acetaldehyde and its derivatives such as acetic acid, ethyl acetate, and acetic anhydride. The company operates across multiple industries, including automotive, electronics, consumer goods, and industrial applications.

-

Eastman Chemical Company is a global operator in the specialty chemicals and materials sector. Eastman serves a wide range of industries including automotive, healthcare, agriculture, packaging, and consumer goods. The company is a prominent player in the production of acetaldehyde and its derivatives, offering a variety of products such as acetaldehyde, acetic acid, and other key intermediates used in chemical synthesis. Eastman’s acetaldehyde-based products are integral to the production of resins, coatings, solvents, and plasticizers, as well as essential chemicals for the food and beverage, pharmaceutical, and agricultural sectors.

Key Acetaldehyde Companies:

The following are the leading companies in the acetaldehyde market. These companies collectively hold the largest market share and dictate industry trends.

- Celanese Corporation

- Eastman Chemical Company

- Sumitomo Chemical Co., Ltd

- Sekab

- Lonza

- LCY Chemical

- Jubilant Life Sciences

- Ashok Alco-chem

Acetaldehyde Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.35 billion

Revenue forecast in 2030

USD 3.05 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; Netherlands; China; India; Japan; South Korea; Brazil; Chile; Argentina; Saudi Arabia; South Africa

Segments covered

Process, application, region

Key companies profiled

Celanese Corporation; Eastman Chemical Company; Sumitomo Chemical Co., Ltd; Sekab, Lonza; LCY Chemical; Jubilant Life Sciences; Ashok Alco-chem

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acetaldehyde Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global acetaldehyde market on the basis of process, application and region:

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oxidation of Ethylene

-

Oxidation of Ethanol

-

Dehydrogenation of Ethanol

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Chemicals

-

Pharmaceuticals & Cosmetics

-

Paper & Pulp

-

Plastics & Synthetic Rubber

-

Paints & Coatings

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Chile

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global acetaldehyde market size was estimated at USD 2.23 billion in 2024 and is expected to reach USD 2.35 billion in 2025.

b. The global acetaldehyde market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 3.05 billion by 2030

b. Asia Pacific dominated the market and accounted for 60.0% of global revenue in 2024. The robust industrial and manufacturing landscape in Asia Pacific has made it a key consumer of acetaldehyde for various chemical applications.

b. Some key players operating in the acetaldehyde market include Celanese Corporation, Eastman Chemical Company, Sumitomo Chemical Co., Ltd, Sekab, Lonza, LCY, Chemical, Jubilant Life Sciences, and Ashok Alco-chem

b. Key factors that are driving the market growth include its wide usage in the production of several downstream chemicals such as acetic acid, ethyl acetate, acetic anhydride, 1,3-butadiene, and chloral.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.