- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Abaca Fiber Market Size And Share, Industry Report, 2030GVR Report cover

![Abaca Fiber Market Size, Share & Trends Report]()

Abaca Fiber Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pulp & Paper, Fiber Craft, Cordage, Textile), By Region (North America, Asia Pacific, Europe, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-517-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Abaca Fiber Market Summary

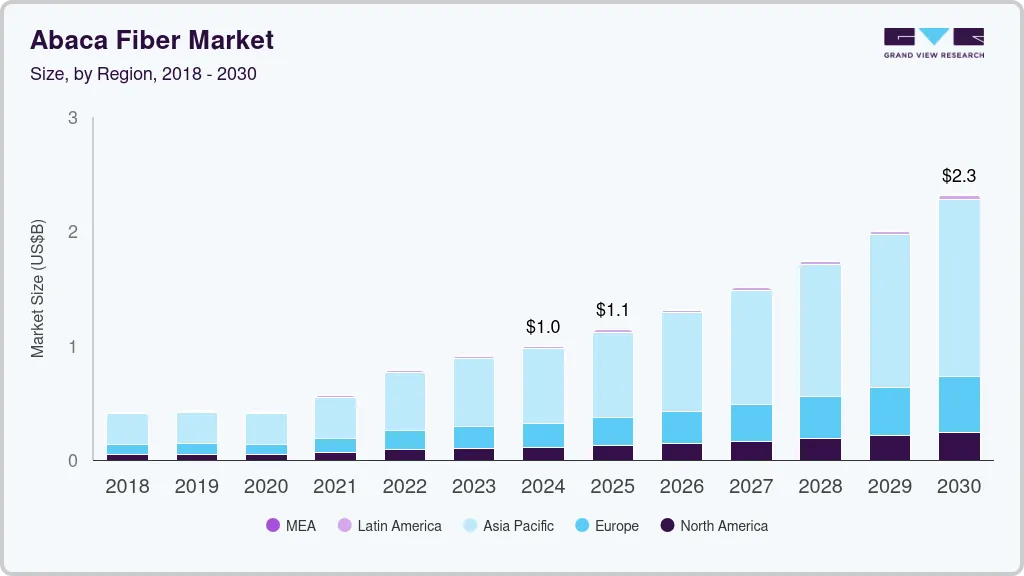

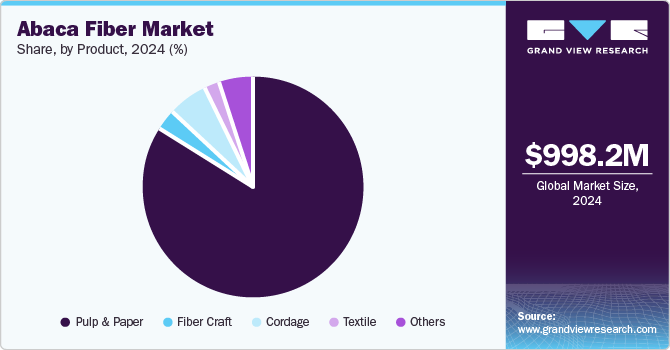

The global abaca fiber market size was estimated at USD 998.2 million in 2024 and is projected to reach USD 2,320.6 million by 2030, growing at a CAGR of 15.2% from 2025 to 2030. Rapidly rising usage of abaca fiber in the growing pulp and paper industry for applications such as cigarette filter papers, tea and coffee bags, and disposable medical and food papers is expected to drive the market.

Key Market Trends & Insights

- Asia Pacific abaca fiber market dominated the global market and accounted for the largest revenue share of about 65.2% in 2024.

- By product, the pulp and paper product segment led the market and accounted for the largest revenue share, more than 84.2% in 2024.

- Pulp & Paper is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 998.2 Million

- 2030 Projected Market Size: USD 2,320.6 Million

- CAGR (2025-2030): 15.2%

- Asia Pacific: Largest market in 2024

European and North American countries such as the UK, Germany, the U.S., Canada, and France are among the largest importers of abaca fibers for applications across various industries such as currency notes, tea/coffee bags, automotive, and textile. The lockdown regulations in these countries also led to transport restrictions, thus disrupting the market supply chain.

Over the past few years, there has been high demand for the product in the manufacture of clothing, curtains, paper making, screens, and furnishings owing to its properties such as superior high mechanical strength and long fiber length resistance to salt-water damage. This is expected to drive market growth. In addition, the market is also expected to grow on account of increasing product adoption across the globe.

The usage of abaca fibers is also rising in the automotive industry with the growing adoption of natural fibers in car manufacturing. These fibers are utilized in several applications in the automotive industry, such as filling products for bolsters, interior trip parts, and exterior semi-structure components as a substitute for glass fiber in reinforced plastic components.

The demand for abaca fibers has grown internationally over the past few years owing to its growing adoption within several industries, including paper, automotive, medical fabric, and handicraft. However, the market has witnessed low productivity, which has not been enough to fulfill the demand. For instance, the demand-supply gap was about 25,000 metric tons in 2019.

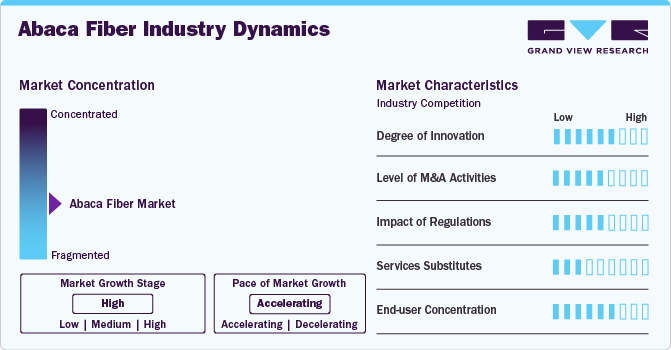

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market is fragmented, with numerous small and medium enterprises operating with a limited geographical reach. Thus, these players witness various challenges, such as a lack of investment from global players for strategic expansion. In addition, they exhibit an insufficient financial backup to conduct research and development activities for advancements in the material.

The market faces substitution threats from synthetic fibers like polypropylene and polyester, which are cheaper, widely available, and offer consistent quality for large-scale applications. Natural fibers such as jute, hemp, and sisal also compete due to similar properties and greater availability. These alternatives are preferred in cost-sensitive industries like packaging and construction, limiting market share. In addition, the restricted geographical production of abaca further hampers its competitiveness.

Product Insights

The pulp and paper product segment led the market and accounted for the largest revenue share, more than 84.2% in 2024. This is attributed to the rising demand for non-wood fibers as raw Materials for specialty paper applications. Specialty paper made using abaca fiber exhibits a superior strength-to-weight ratio, thus offering high functionality in manufacturing tea bags, currency, and security papers.

Active research and development activities are in progress to properly understand the pulping characteristics, pulp yield, and quality of abaca fibers. The outcomes of the studies can offer a good idea of the possibilities and potential uses of abaca fibers for pulp and paper production.

The textile product segment is also expected to witness a notable revenue-based CAGR of 11.7% over the forecast period on account of the rising demand for advanced biomaterials in fashion textiles. In addition, the latest trend in interior designing practices for both residential and commercial spaces is also expected to drive the demand for abaca fiber for textile manufacturing.

In the past few years, environmental concerns have compelled various industry leaders to focus on the development of ‘green’ products. In order to attain their sustainability goals, manufacturers have started employing biomaterials in their production technologies. Increasing demand for sustainable fibers having advanced properties is anticipated to offer expansion opportunities for abaca fibers in the textile industry.

Regional Insights

The abaca fiber market in North America is growing, focusing on sustainable and biodegradable materials in packaging, textiles, and industrial applications drives the demand for abaca fiber. With increasing environmental awareness, manufacturers are shifting toward natural fibers as alternatives to synthetic options. Moreover, the rise of eco-friendly products in industries like automotive and construction supports the demand for abaca fiber.

U.S. Abaca Fiber Market Trends

The abaca fiber market in the U.S. demand is propelled by its use in specialty papers, such as currency and tea bags, due to its durability and eco-friendly nature. The country's increasing regulations on single-use plastics and a shift to biodegradable materials in consumer goods have further boosted the adoption of abaca-based products. Furthermore, government initiatives promoting sustainability are encouraging industries to adopt natural fibers.

Asia Pacific Abaca Fiber Market Trends

Asia Pacific abaca fiber market dominated the global market and accounted for the largest revenue share of about 65.2% in 2024, owing to the growth in adoption of these fibers in several end-use industries, including healthcare, specialty paper, handicraft, automotive, and textile, due to their high mechanical strength, durability, long length, and sustainability.

The abaca fiber market in the Philippines is the largest manufacturer of abaca fibers in the world, with the Philippines accounting for more than 72.0% of the global market share in 2024. In addition, public investments in the Philippines and Japan to promote abaca cultivation practices and increase the fibers' production capacity are expected to positively influence market growth in the future.

Europe Abaca Fiber Market Trends

The abaca fiber market in Europe is expected to witness a notable revenue-based CAGR of 14.8% from 2025 to 2030, owing to the growing adoption of the fibers in several application industries, including food and beverages, automotive, and specialty papers, owing to their high mechanical strength, durability, flexibility, and long length.

In addition, favorable trade policies by European countries for importing abaca and other natural fibers are expected to benefit the growth of fiber markets. Key German automotive manufacturing companies are adopting abaca fibers for automotive parts such as headliners, rear cargo shelves, trunk components, and thermal insulation to reduce the overall vehicle weight and increase fuel efficiency.

Germany abaca market strongly emphasizes sustainability, and innovation in material science drives the demand for abaca fiber. The country is a leader in the automotive and paper industries, both of which are incorporating natural fibers to meet environmental standards. Abaca's strength and eco-friendliness make it an ideal material for Germany's advanced manufacturing sectors, including composites and filtration systems.

Central & South America Abaca Fiber Market Trends

The abaca fiber market in CSA is rising, and the rising agricultural and packaging industries are fostering the demand. The region's efforts to adopt sustainable practices in response to global environmental concerns have led to increased use of biodegradable materials. In addition, the fiber's ability to withstand harsh conditions makes it suitable for industrial applications in tropical climates prevalent in the region.

Middle East & Africa Abaca Fiber Market Trends

The abaca fiber market in the Middle East & Africa is increasing in demand due to the region's growing construction and packaging sectors. As countries in the region aim to diversify their economies and adopt eco-friendly materials, abaca fiber is becoming a preferred choice. Its durability and resistance to moisture make it ideal for use in ropes, bags, and industrial products in these arid climates.

Key Abaca Fiber Company Insights

Some key players operating in the market include Specialty Pulp Manufacturing, Inc (SPMI) and Ching Bee Trading Corporation.

-

Specialty Pulp Manufacturing, Inc. (SPMI) was established in 1949 and is headquartered in Quezon City, the Philippines. The company is primarily involved in the manufacturing of high-quality specialty pulps by using Manila hemp, otherwise known as abaca fiber. SPMI belongs to the Chinese Bee Group of Companies and has substantial trading experience in producing and manufacturing abaca fibers. It sells both food-grade and non-food-grade, bleached, and unbleached specialty pulps made from abaca, sisal, kenaf, and jute.

-

Ching Bee Trading Corporation was established in 1940 and is headquartered in Manila, the Philippines. The company has had a substantial market position from the beginning of its operation. It exports abaca, especially to the U.S., Japan, and European countries. The company has a strong market position both domestically and internationally. Ching Bee Trading Corporation ties up with other companies involved in manufacturing vegetable oils and desiccated coconuts.

M.A.P Enterprises and YZEN HANDICRAFT EXPORT TRADING are some emerging market participants.

-

M.A.P Enterprises, headquartered in Manila, Philippines, was established in 2008. It is primarily engaged in the production of abaca fibers, abaca gift envelopes, abaca flowers, and floral scrunched wraps. The company has strong trade networks, and its main marketing areas include Southeast Asia, Western Europe, Oceania, and South Asia.

-

YZEN HANDICRAFT EXPORT TRADING, headquartered in Central Visayas, Philippines, was established in 2008. It primarily manufactures sinamay, abaca fibers, raffia fibers, coco fibers, and coco coir. The company's products are chiefly used for applications such as hat making, flowers, gift wrapping, floral decorations, and Christmas decorations.

Key Abaca Fiber Companies:

The following are the leading companies in the abaca fiber market. These companies collectively hold the largest market share and dictate industry trends.

- M.A.P. Enterprises

- Yzen Handicraft Export Trading

- Specialty Pulp Manufacturing, Inc. (SPMI)

- Ching Bee Trading Corporation

- Peral Enterprises

- Sellinrail International Trading Company

- DGL Global Ventures LLC

- Terranova Papers

Abaca Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.15 billion

Revenue forecast in 2030

USD 2.32 billion

Growth rate

CAGR of 15.2% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Philippines

Key companies profiled

M.A.P. Enterprises; Yzen Handicraft Export Trading; Specialty Pulp Manufacturing, Inc. (SPMI); Ching Bee Trading Corporation; Peral Enterprises; Sellinrail International Trading Company; DGL Global Ventures LLC; Terranova Papers

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Abaca Fiber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global abaca fiber market report based on product and region.

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Pulp & paper

-

Fiber Craft

-

Cordage

-

Textile

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Philippines

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global abaca fiber market size was estimated at USD 998.2 million in 2024 and is expected to reach USD 1.15 billion in 2025.

b. The global abaca fiber market is expected to grow at a compound annual growth rate of 15.2% from 2025 to 2030 to reach USD 2.32 billion by 2030.

b. Based on product, polyethylene accounted for the largest revenue share of 84.2% in 2024. This is attributed to the high strength and low weight properties offered by the abaca fiber to specialty papers.

b. Some of the key players operating in the abaca fiber market include M.A.P. Enterprises, YZEN HANDICRAFT EXPORT TRADING, Specialty Pulp Manufacturing, Inc (SPMI), Ching Bee Trading Corporation, PERAL ENTERPRISES, SELLINRAIL INTERNATIONAL TRADING, COMPANY, DGL GLOBAL VENTURES LLC, TERRANOVAPAPERS.

b. The key factors that are driving the abaca fiber market include rising government emphasis on the usage of biodegradable material including fibers to replace hazardous synthetic materials, the rising application scope of abaca fiber across various end-use industries especially automotive and textile.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.