- Home

- »

- Next Generation Technologies

- »

-

5G Chipset Market Size, Share, Growth Analysis Report 2030GVR Report cover

![5G Chipset Market Size, Share & Trends Report]()

5G Chipset Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Operating Frequency, By Processing Node Type, By Deployment Type, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-534-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

5G Chipset Market Summary

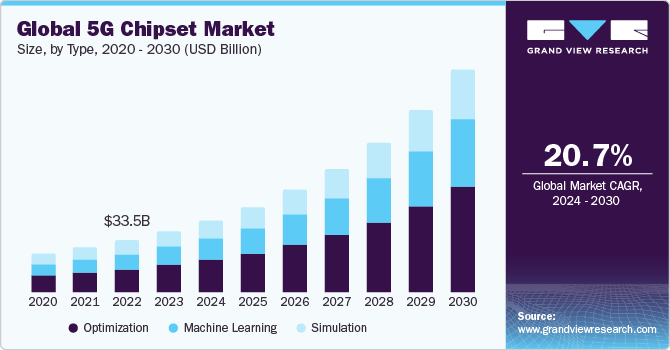

The global 5G chipset market size was estimated at USD 39.32 billion in 2023 and is projected to reach USD 143.69 billion by 2030, growing at a CAGR of 20.7% from 2024 to 2030. Increasing demand for broad network coverage and high-speed internet and high use of Machine-to-Machine (M2M) communication technology are some of the major growth driving factors.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for a 41.20% share in 2023.

- The 5G chipset market in Europe is expected to grow at a significant CAGR of 20.0% from 2024 to 2030.

- The 5G chipset market in MEA is anticipated to grow at a significant CAGR of 21.4% from 2024 to 2030.

- Based on type, the RFICs segment dominated the market in 2023 and accounted for a 45.09% share of the global revenue.

- In terms of vertical, the IT & telecom segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 39.32 Billion

- 2030 Projected Market Size: USD 143.69 Billion

- CAGR (2024-2030): 20.7%

- Asia Pacific: Largest market in 2023

In addition, the growing adoption of 5G networks in smart cities, automobiles, and the healthcare sector is also driving the demand for 5G chipsets. The surged use of connected cars, connected devices, smartphones, and tablets is further contributing to the market growth.The increasing penetration, adoption, and launch of 5G smartphones across the world is driving the demand for 5G chipsets. According to the GSMA’s The Mobile Economy 2023 report, 5G adoption is expected to increase owing to cheaper devices and new network deployments. By January 2023, there were around 229 commercial 5G networks across the globe, with more than 700 5G smartphone models launched, including more than 200 in 2022. Thus, with the growing number of 5G smartphone launches worldwide, the demand for 5G chipsets is expected to rise between 2024 and 2030.

Several 5G chipset solution providers are launching 5G chipsets for various applications, which in turn contributes to the market growth. For instance, in May 2023, Sequans Communications S.A., a prominent company in 4G/5G cellular IoT modules and chips, launched the 5G chipset platform, Taurus 5G NR. The chipset is specifically designed for 5G broadband IoT devices, offering cost-effective support for applications including enterprise and private networks, residential fixed wireless access, mobile computing, portable hotspots, smart cities, smart buildings, and high-end industrial IoT. Such initiatives are expected to bode well for the market growth.

The growing demand for 5G chipsets that support Vehicle to Everything (V2X) communications, offering highly reliable and low-latency solutions for connected vehicles, is boosting the market growth. In connected vehicle applications, 5G enables real-time communication between vehicles, pedestrians, infrastructure, and other road users, creating a cooperative, intelligent transport system (C-ITS) that reduces congestion, prevents accidents, and optimizes traffic flow. 5G also improves the autonomous capabilities of vehicles. With ultra-low latency, connected vehicles receive and process information faster, allowing them to make more efficient and faster decisions.

The high initial investment and deployment costs of 5G chipsets are expected to hinder the market's growth. The cost of 5G chipsets is a significant factor in the overall manufacturing of 5G-enabled devices such as smartphones. For instance, the higher prices of 5G chipsets increase the average selling price of premium smartphones that support 5G technology. However, an impending price war between key market companies is expected to lower the cost of 5G chipsets in the upcoming years.

Market Concentration & Characteristics

The industry's growth stage is high, and the pace of growth is accelerating. The 5G chipset industry can be characterized by a high degree of innovation, with continuous innovations in semiconductor manufacturing, beamforming, and mmWave technologies.

The 5G chipset industry is also characterized by a high level of new product launch activities by key companies. Companies are adopting this strategy to enhance their 5G chipset offerings in the global industry.

The regulatory trends play a substantial role in influencing the 5G chipset industry. For instance, the CHIPS and Science Act aims to promote investment in chip manufacturing facilities, alleviate supply chain challenges, and reintroduce skilled manufacturing employment opportunities to the U.S. Within this broader context, the development and production of 5G wireless chips play a significant role.

There are no direct substitutes available for 5G chipsets. 5G chipsets are designed to meet specific performance requirements, including low latency and high data rates. Meeting these requirements with alternative technologies while maintaining cost-effectiveness and energy efficiency can be difficult. Hence, the availability of product substitutes is low.

The 5G chipset industry has a high concentration of end users. Due to 5G technology, various industries, such as manufacturing, energy and utilities, media and entertainment, IT and telecom, transportation and logistics, and healthcare, are undergoing transformation. End users are increasingly adopting technologies such as autonomous vehicles, remote healthcare monitoring, and among others, which in turn is driving the demand for 5G chipsets.

Type Insights

The RFICs segment dominated the market in 2023 and accounted for a 45.09% share of the global revenue. The rising demand for RF transceivers ICs in smartphones is a major factor contributing to the segment growth. Additionally, the growth in mobile data traffic is driving the need for higher bandwidth and faster data rates which requires more advanced RF transceiver ICs capable of supporting a wider range of frequency bands and modulation schemes. At the same time, the increasing complexity of smartphones, which require more RF transceiver ICs to support multiple antennas for functions such as 4G/5G connectivity, Wi-Fi, Bluetooth, GPS, and NFC is a significant factor contributing to the segment growth.

The modems segment is projected to witness significant growth from 2024 to 2030. The integration of 5G modems into system-on-chip (SoC) designs is a major factor contributing to the segment growth. This integration not only reduces power consumption and increases performance but also simplifies the design process for device manufacturers. Moreover, the move towards more advanced modem designs that can support faster data rates and lower latency is also being driven by the demand for high-quality video streaming and low-latency applications such as gaming and virtual reality.

Operating Frequency Insights

The Sub-6 GHz segment dominated the market in 2023. Rising adoption of Sub-6 GHz technologies to provide widespread coverage in urban and rural areas, as these frequency bands offer greater range and penetration than the higher mmWave bands is a major factor contributing to the segment growth. 5G chipsets for Sub-6 GHz frequencies are designed to support the lower frequency bands used for 5G communications. These chipsets typically include a range of advanced features and technologies to optimize network performance and improve user experience. One key feature of 5G chipsets for Sub-6 GHz is support for Massive MIMO antenna systems, which enable the use of multiple antennas to improve network capacity and performance.

The 24-39 GHz segment is projected to witness significant growth from 2024 to 2030. The rising adoption of Millimeter-Wave (mmWave) technology, which utilizes frequencies in the range of 24-39 GHz band to provide ultra-high-speed 5G connections, is a major factor contributing to the segment growth. This technology enables data rates of several gigabits per second, which is critical for applications such as high-definition video streaming, augmented reality, and virtual reality. At the same time, the growing interest in integrating 5G modems and mmWave RF components into a single chip, which can help to reduce power consumption and simplify the design process for device manufacturers, is also a significant factor contributing to the segment growth.

Processing Node Type Insights

The 7 nm segment dominated the market in 2023. The rising adoption of 7 nm technology nodes in chip design, as it offers reduced power consumption, improved switching performance, and higher density, is a major factor contributing to the segment growth. Manufacturers across the globe early focus on producing 5G chipset components using a 7nm processor node. Major industry participants such as MediaTek Inc., Huawei Technologies Co. Ltd., Intel Corporation, and Qualcomm Incorporated are initially concentrating on creating 5G chipset components using a 7nm processing node. Moreover, the 7nm process also offers improved performance over larger process nodes, which is important for meeting the demanding requirements of 5G networks, such as high data rates, low latency, and reliable connectivity.

The 10 nm segment is projected to expand at the highest CAGR from 2024 to 2030 owing to the ability of the 10nm process to integrate more transistors onto a single chip, which allows for the development of more powerful and energy-efficient 5G chipsets. This is important for supporting advanced features such as Massive MIMO and beamforming, which require multiple transistors to be integrated into the chip. The 10nm process also enables the development of smaller and more compact chipsets, which is important for reducing device size and weight. Additionally, the 10nm process offers improved power efficiency over larger process nodes, which is critical for mobile devices that rely on battery power. This allows for longer battery life and improved device performance.

Deployment Type Insights

The smartphones segment dominated the market in 2023. Increasing consumer demand for faster and more reliable mobile connectivity is a major factor contributing to the segment growth. With the rise of mobile video streaming, online gaming, and other data-intensive applications, consumers are looking for smartphones that can deliver faster data speeds and lower latency. This has led to the development of 5G chipsets that are optimized for use in smartphones, offering advanced features such as support for multiple bands, higher data rates, and improved power efficiency.

The connected devices segment is expected to grow significantly from 2024 to 2030. The growing demand for high-speed and reliable connectivity in various IoT applications is a significant factor contributing to the segment's growth. Connected devices, such as smart home appliances, security systems, and industrial equipment, require low-latency, high-speed connections to function optimally. The deployment of 5G chipsets in these devices enables faster and more reliable data transfer, which can lead to more efficient and effective use of the devices. 5G networks can support significantly more connected devices than previous generations of wireless networks, which makes them well-suited for IoT applications that involve a large number of devices.

Vertical Insights

The IT & telecom segment dominated the market in 2023. Major manufacturer's considerable efforts in creating 5G chipset modules for telecom base stations, broadband gateway devices, and other communication equipment is a significant factor contributing to the segment growth. With the increasing usage of data-intensive applications, such as video streaming and cloud services, there is a growing need for faster and more reliable networks. The use of 5G chipsets in IT and Telecom infrastructure can help meet this demand by enabling faster and more efficient data transfer, which can enhance the overall performance of the infrastructure.

The manufacturing segment is expected to grow significantly from 2024 to 2030. Manufacturing industry leaders have recognized that digitalization is required to boost overall productivity. They are thereby automating their manufacturing processes through the use of different digitalization technologies. Using 5G chipsets in manufacturing can enable faster and more efficient machine-to-machine communication, which can lead to more efficient and effective use of the infrastructure. This trend also drives the development of new use cases and applications in the manufacturing sector, such as smart factories and industrial IoT applications that require real-time data transfer and analytics. Additionally, the use of 5G chipsets in manufacturing is driving the development of new automation and robotics solutions, which can increase productivity and efficiency on the factory floor.

Regional Insights

North America is expected to witness significant growth from 2024 to 2030. The deployment of 5G networks in North America is enabling the growth of emerging technologies such as autonomous vehicles, augmented reality, and virtual reality, which rely on low latency and high bandwidth.

U.S. 5G Chipset Market Trends

The 5G chipset market in the U.S. is expected to grow at a significant CAGR of 18.1% from 2024 to 2030. The U.S. is seeing significant investment in smart homes, smart industries, and smart cities. At the same time, customers in the U.S. are becoming more interested in high-graphics online gaming. Moreover, the country is also developing as an early adopter of self-driving automobiles and intelligent transportation infrastructure. All these advancements are projected to stimulate demand for 5G chipset components in the U.S.

The Canada 5G chipset market is expected to grow at a significant CAGR from 2024 to 2030. Factors such as the growing usage of cloud gaming and enhanced video usage in Canada are expected to drive the demand for 5G chipsets in the country.

Asia Pacific 5G Chipset Market Trends

Asia Pacific dominated the market and accounted for a 41.20% share in 2023. This is attributable to the rapid rise of high-speed connectivity and the increasing adoption of advanced technologies such as IoT, AI, and cloud computing. The use of 5G chipsets can help meet this demand by enabling faster and more reliable connectivity, which can support a wide range of applications and services. This trend is driving the development of new use cases and applications in areas such as smart cities, healthcare, education, and transportation. Additionally, the Asia Pacific region is home to several leading manufacturers of 5G chipsets, which is driving innovation and competition in the regional market.

The 5G chipset market in China is expected to grow at a significant CAGR of 21.9% from 2024 to 2030. The rapid adoption of 5G services by consumers, driven by the increasing availability of affordable 5G-enabled smartphones, is propelling the growth of the market.

India 5G Chipset Market is anticipated to grow at a significant CAGR from 2024 to 2030. The increasing adoption of 5G-enabled smartphones in India is a major factor driving the market’s growth. According to the India Cellular & Electronics Association’s estimates, the installed base of 5G handsets in India will reach approximately 500 million by December 2025, up from an estimated 150 million at the end of December 2023.

The 5G chipset market in Japan is expected to grow at a significant CAGR from 2024 to 2030. In Japan, major telecom operators have launched 5G networks in major cities, offering high-speed connectivity and enhanced user experiences. There is a strong focus on leveraging 5G to drive industrial transformation across sectors such as manufacturing, transportation, and healthcare.

Europe 5G Chipset Market Trends

The 5G chipset market in Europe is expected to grow at a significant CAGR of 20.0% from 2024 to 2030. Factors such as the rollout of 5G networks using low-band spectrum and the greater availability of 5G smartphones across European countries are boosting the market’s growth in the region.

The UK 5G chipset market is expected to grow at a significant CAGR from 2024 to 2030. Increasing government initiatives and investments to roll out standalone 5G networks across the country are expected to improve the market's growth.

The 5G chipset market in Germany is expected to grow at a significant CAGR from 2024 to 2030. Increasing demand for high-speed connectivity across rural and urban areas and the rising use of smartphones for various purposes, such as gaming, video streaming, and remote work, among others, is driving the demand for 5G chipsets in the country.

MEA 5G Chipset Market Trends

The 5G chipset market in MEA is anticipated to grow at a significant CAGR of 21.4% from 2024 to 2030. The MEA region is witnessing a surge in 5G adoption, propelled by the rapid expansion of existing networks and the introduction of new networks. In addition, the increase in smartphone connections is consistent across the region. Digital awareness and the availability of affordable devices are major factors in driving smartphone adoption in the region, which in turn drives the demand for 5G chipsets.

Kingdom of Saudi Arabia (KSA) 5G chipset market is expected to grow at a significant CAGR from 2024 to 2030. The rise of next-generation technologies like IoT, autonomous cars, smart cities, AR/VR, and industrial automation is pushing the development and adoption of 5G chipsets in the country to support these advanced applications.

Key 5G Chipset Company Insights

Some of the key companies operating in the market include MediaTek Inc.; Samsung Electronics Co., Ltd.; Infineon Technologies AG; Huawei Technologies, Inc.; and Qualcomm Technologies, Inc.

-

MediaTek Inc. is a global provider of fabless semiconductors. The company develops innovative systems-on-chip (SoC) for mobile devices, connectivity, home entertainment, and IoT products.

-

Infineon Technologies AG is a global semiconductor provider. The company designs, manufactures, develops, and markets application-specific integrated circuits. It provides microcontrollers, interfaces, sensors, and transistor products.

Unisoc Communications Inc.; Qorvo, Inc.; and Murata Manufacturing Co., Ltd. are some of the emerging companies in the 5G chipset market.

-

Qorvo, Inc. provides power and radio frequency (RF) technologies and solutions to infrastructure, mobile, the IoT, power management and defense/aerospace markets.

-

Unisoc Communications Inc. is a chip manufacturer. The company’s product portfolio includes baseband chips, radio frequency front-end chips, radio frequency chips, mobile communication central processing units, AI chipsets, and other computing, communication, and control chips, etc.

Key 5G Chipset Companies:

The following are the leading companies in the 5G chipset market. These companies collectively hold the largest market share and dictate industry trends.

- Huawei Technologies, Inc.

- MediaTek Inc.

- Intel Corporation

- Samsung Electronics Co., Ltd.

- Infineon Technologies AG

- Qualcomm Technologies, Inc.

- Unisoc Communications Inc.

- Qorvo, Inc.

- Murata Manufacturing Co., Ltd.

- MACOM

Recent Developments

-

In November 2023, MediaTek Inc. announced the power-efficient chipset, a Dimensity 8300 for premium 5G smartphones. Dimensity 8300 combines generative AI features, adaptive gaming technology, power-efficient solutions, and rapid connectivity to deliver top-tier experiences tailored for premium 5G smartphones.

-

In February 2023, Qualcomm Technologies, Inc., a semiconductor technology company, launched Snapdragon X75, its new 6th generation 5G radio frequency modem. The Snapdragon X75 5G modem's primary new feature is compatibility with 5G-Advanced (5G-A), a network protocol that will provide an advancement over standard 5G connection.

-

In May 2022, MediaTek Inc., a semiconductor company, unveiled its first mmWave 5G chipset, the Dimensity 1050 System-on-Chip (SoC), which would power the next generation of 5G devices with seamless connection, displays, gaming, and power efficiency. MediaTek Inc. also revealed two new chipsets, the Dimensity 930 and the Helio G99, to broaden its 5G and gaming chip families.

5G Chipset Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.45 billion

Revenue forecast in 2030

USD 143.69 billion

Growth rate

CAGR of 20.7% from 2024 to 2030

Historical data

2019 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, operating frequency, processing node type, deployment type, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Sweden; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Huawei Technologies Inc.; MediaTek Inc.; Intel Corporation; Samsung Electronics Co. Ltd.; Infineon Technologies AG; Qualcomm Technologies Inc.; Unisoc Communications Inc.; Qorvo Inc.; Murata Manufacturing Co. Ltd.; MACOM

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Chipset Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global 5G chipset market report based on type, operating frequency, processing node type, deployment type, vertical, and region:

-

Type Outlook (Revenue, USD Million, 2019 - 2030)

-

Modems

-

RFICs

-

RF Transceivers

-

RF FE

-

-

Others

-

-

Operating Frequency Outlook (Revenue, USD Million, 2019 - 2030)

-

Sub-6 GHz

-

24-39 GHz

-

Above 39 GHz

-

-

Processing Node Type Outlook (Revenue, USD Million, 2019 - 2030)

-

7 nm

-

10 nm

-

Others

-

-

Deployment Type Outlook (Revenue, USD Million, 2019 - 2030)

-

Telecom Base Station Equipment

-

Smartphones/Tablets

-

Single-mode

-

Standalone

-

Non-standalone

-

-

Multi-mode

-

-

Connected Vehicles

-

Single-mode

-

Standalone

-

Non-standalone

-

-

Multi-mode

-

-

Connected Devices

-

Single-mode

-

Standalone

-

Non-Standalone

-

-

Multi-mode

-

-

Broadband Access Gateway Devices

-

Single-mode

-

Standalone

-

Non-standalone

-

-

Multi-mode

-

-

Others

-

Single-mode

-

Standalone

-

Non-standalone

-

-

Multi-mode

-

-

-

Vertical Outlook (Revenue, USD Million, 2019 - 2030)

-

Manufacturing

-

Energy & Utilities

-

Media & Entertainment

-

IT & Telecom

-

Transportation & Logistics

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G chipset market size was estimated at USD 39.32 billion in 2023 and is expected to reach USD 46.45 billion by 2024.

b. The global 5G chipset market is expected to grow at a compound annual growth rate of 20.7% from 2024 to 2030 to reach USD 143.69 billion by 2030.

b. The sub-6GHz segment dominated the 5G chipset market with a share of more than 54.0% in 2023. This is attributed to the initial offerings of 5G chipset components supporting the sub-6GHz band by key market players for smartphones, connected cars, and laptops.

b. The 7nm segment dominated the market for 5G chipset with a share of 54.27% in 2023. This is attributed to the initial focus on developing 5G chipset components with a 7nm processing node by key players.

b. In terms of value, the IT and telecom vertical dominated the 5G chipset market with a share of over 36.0% in 2023. This is attributed to the significant investments being made by prominent players on developing 5G chipset modules for telecom base stations, broadband gateway devices, and other communication devices.

b. The smartphones segment dominated the 5G chipset market with a revenue share of nearly 50.8% in 2023. This is attributed to the growing demand for 5G-enabled smartphones for online gaming, watching Ultra High Definition (UHD) videos, and video calling applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.