- Home

- »

- Biotechnology

- »

-

Global 3D Printed Drugs Market Size & Share Report, 2030GVR Report cover

![3D Printed Drugs Market Size, Share & Trends Report]()

3D Printed Drugs Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Inkjet Printing, Zipdose Technology, Stereolithography), By Application (Orthopedic, Neurology), By End-use, Region, And Segment Forecasts

- Report ID: GVR-4-68039-951-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Printed Drugs Market Summary

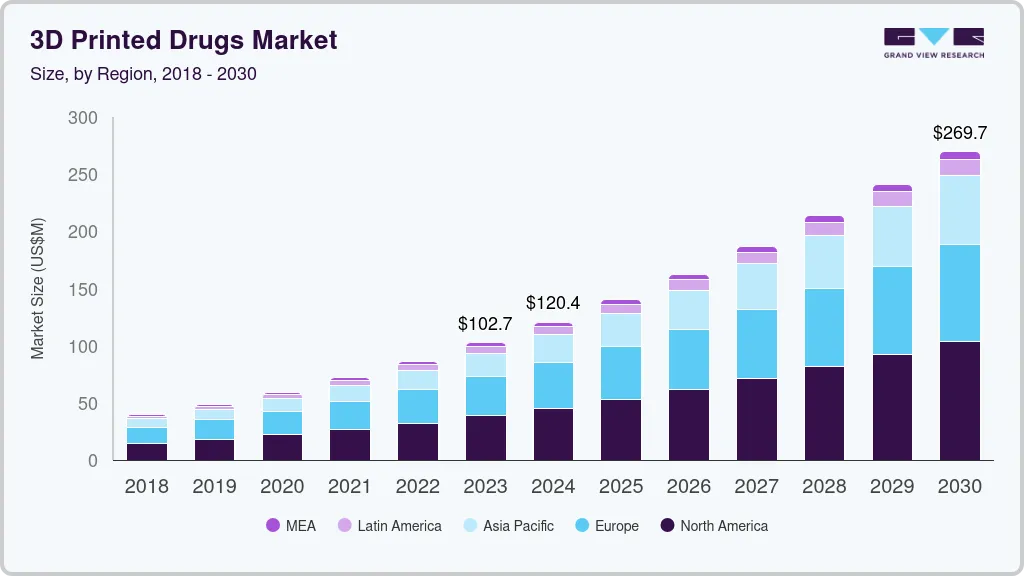

The global 3D printed drugs market size was valued at USD 102.7 million in 2023 and is projected to reach USD 269.7 million by 2030, growing at a CAGR of 14.8% from 2024 to 2030. 3D printed drugs are prescriptions that are created using the 3D printing process to give individuals safe and effective tailored medications.

Key Market Trends & Insights

- The North America dominated the regional market with a share of 37.23% in 2021.

- By technology, the zip dose segment held the highest share of the market in 2021.

- By application, The neurology segment dominated the market with a share of 49.84% in 2021.

- By end-use, the hospitals & clinics segment captured the highest revenue share of the market in 2021.

Market Size & Forecast

- 2023 Market Size: USD 102.7 Million

- 2030 Projected Market Size: USD 269.7 Million

- CAGR (2024-2030): 14.8%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market in 2021

These medications have a unitary porous architecture that disperses easily in the mouth, eliminating the need to swallow high-dose medications whole. It allows manufacturers to modify the size, look, form, and rate of distribution of a wide range of drugs with ease.The outbreak of COVID-19 led to an increase in the use of 3D printing. The operating players in the advanced manufacturing sector have introduced several 3D printers to aid in the production of drugs and other essential products. In addition, the drug shortage experienced during the COVID-19 pandemic has sparked the attention of pharmaceutical businesses in delivering medicines swiftly by taking advantage of 3D printing technology.

The market is booming as a result of the rising demand for customized drugs and the rapidly growing R&D activities that support 3D printing. This technology is bringing up promising opportunities for improving patient care by producing personalized medical therapies. Since the establishment of the U.S. Personalized Medicine Initiative in 2015, pharmaceutical research companies have also been researching the development of more tailored therapies to make medications safer and more effective. As a result, the demand for 3D-printed drugs is anticipated to grow in the coming years.

Several factors such as increasing incidence of chronic diseases, rising need for less expensive pharmaceuticals or tablets, and increasing applicability of 3D printing in the healthcare sectors are also contributing to the market growth. The 3D-printed pharmaceuticals are becoming more widely recognized as they are easy to ingest and soluble almost immediately. Moreover, they can be personalized to each patient's specific needs, supporting patients in a better way compared to batch-produced drugs. Therefore, the market for these drugs is predicted to rise during the projection period.

Increased investments by operating players for the production of advanced and effective 3D printed pharmaceuticals along with breakthroughs in 3D printing technology are likely to support market growth throughout the projected timeframe. For instance, in March 2022, CurfiyLabs and Natural Machines collaborated on the manufacturing of these medicine as per patients’ customized needs. This is expected to allow pharmacies and hospitals to receive medicines in a faster timeline.

Additionally, new players are entering the market with sophisticated technologies to meet the growing demand and capture untapped avenues of the market. For instance, FabRX uses its patented methods to provide tailored medications and drug-loaded medical devices. In addition, personalized dosage, polypills, chewy drugs, and fast-dissolving tablets are all available through the company's exclusive Print lets technology. Stereolithography is also being used to produce drug-loaded medical devices at the company.

Technology Insights

The zip dose segment held the highest share of the market in 2021. This drug technology is easy to use and beneficial to patients with dysphagia. Furthermore, an increasing requirement among geriatric & pediatric patients for rapid soluble drugs that disperse quickly in the mouth drives the market growth.

Inkjet printer technology, on the other hand, is anticipated to expand at the fastest rate during the projected period. As it generates 3D drugs at a steady rate and has technological superiorities over other techniques, it has a high adoption rate among patients. Inkjet printing is a method of depositing three-dimensional shapes in solid dosage forms by spraying various combinations of active pharmaceutical ingredients and excipients (inks) through a nozzle. Furthermore, increased epilepsy incidences continued technological advancements in 3D printing technology, and expanding awareness of this technology in emerging nations are primary market growth drivers.

Application Insights

The neurology segment dominated the market with a share of 49.84% in 2021. In August 2015, the U.S. FDA approved Aprecia Pharmaceutical’s SPRITAM (levetiracetam) tablets for the treatment of people with epilepsy. This is the only approved drug available on the market. This approval has gained the attention of pharmaceutical companies to invest in this segment thereby propelling the market growth.

The segment is also propelled by an increase in the prevalence of various neurological disorders such as Parkinson's disease. In an article published in April 2022, a team of scientists from Germany and the Netherlands used 3D printing technology for the manufacturing of Mini-Floating-Polypill as a therapy for Parkinson’s disease. Fused deposition modeling (FDM) was used for this study. Such research efforts are anticipated to supplement the segment growth.

On the other hand, orthopedic procedures are complex & tough, and new approaches are needed to overcome a slew of known issues and better patient outcomes. In addition, complications, particularly the high rate of infection, frequently result in extended patient suffering and functional loss. Thus, orthopedic drugs can be used to combat postoperative infections, hence, propelling the market growth.

End-use Insights

The hospitals & clinics segment captured the highest revenue share of the market in 2021. The widespread use of prescription pills to treat a variety of chronic diseases is moving the market for personalized pharmaceuticals forward. The segment is also being driven by the growing demand for pharmaceuticals and the cost-effective use of bio-drugs employing this technology.

Furthermore, in hospitals and clinics, these printers can be installed to enable the on-demand manufacturing of medications, specifically those with poor stability or that need to be stored in a cold chain. Additionally, it can considerably save expenses, waste, and environmental strain. These factors are anticipated to increase the adoption of 3D-printed drugs among hospitals and clinics.

Regional Insights

North America dominated the regional market with a share of 37.23% in 2021. This major share can be attributed to an increased incidence of chronic diseases, the presence of excellent domestic healthcare infrastructure, strong investment in R&D, and the expanding use of technological developments in the North America region.

The Asia Pacific is estimated to be the fastest-growing region due to significant developments by China and Japan in the technological integration of 3D printed drug methodologies. Moreover, the development of healthcare infrastructure, R&D, and clinical development frameworks of emerging economies such as India and Australia have poised the Asia Pacific market to witness lucrative opportunities and growth throughout the forecast period.

Key Companies & Market Share Insights

Key players in this market are implementing various strategies including partnerships through mergers and acquisitions, geographical expansion, and strategic collaborations to expand their market presence. For instance, in February 2020, CELLLINK extended its collaboration with AstraZeneca to provide bioinks and bioprinters for the latter company’s research developments. AstraZeneca is engaged in exploring new disease targets using these technologies. Some of the key players in the global 3D printed drugs market include:

-

Aprecia

-

Extend Biosciences

-

Bioduro

-

Affinity Therapeutics

-

Osmotica Pharmaceuticals

-

Aprecia Pharmaceuticals LLC

-

GlaxoSmithKline Plc

-

FabRx Ltd

-

Hewlett Packard Caribe

-

Merck

-

Cycle Pharmaceuticals

-

AstraZeneca

3D Printed Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 120.4 million

Revenue forecast in 2030

USD 269.7 million

Growth rate

CAGR of 14.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France, Italy, Spain, China; Japan; India, South Korea, Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Aprecia; Formac Pharmaceuticals; Extend Biosciences; Affinity Therapeutics; Osmotica Pharmaceuticals; GSK Group of Companies; FabRx Ltd.; Hewlett Packard Caribe; Merck & Co., Inc.; Cycle Pharmaceuticals; AstraZeneca.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the 3D-printed drugs based on technology, application, end-use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Inkjet Printing

-

Fused Deposition Modeling

-

Stereolithography

-

ZipDose Technology

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic

-

Neurology

-

Dental

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & clinics

-

Research Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global 3D printed drugs market size was estimated at USD 72.02 million in 2021 and is expected to reach USD 86.24 million in 2022.

b. The global 3D printed drugs market is expected to grow at a compound annual growth rate of 15.32% from 2022 to 2030 to reach USD 269.74 million by 2030.

b. North America dominated the 3D printed drugs market with a share of 37.23% in 2021. This is attributed to the availability of only U.S. approved 3D printed drug - SPRITAM in the U.S.

b. Some key players operating in the 3D printed drugs market include Aprecia Pharmaceuticals LLC, GlaxoSmithKline Plc, FabRx Ltd, Hewlett Packard Caribe, Merck KGaA, Cycle Pharmaceuticals, Tvasta, and AstraZeneca.

b. Some key factors that are driving the 3D printed drugs market growth include the rising usage of 3D printing in the medical industry, increasing adoption of personalized drugs, and high demand for instantaneous soluble tablets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.