- Home

- »

- Medical Devices

- »

-

3D Medical Imaging Devices Market Size, Share Report 2030GVR Report cover

![3D Medical Imaging Devices Market Size, Share & Trends Report]()

3D Medical Imaging Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Device Type (Hardware, Software), By Application (Oncology, Cardiology), By End Use (Hospitals, Diagnostic Imaging Centers), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-782-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Medical Imaging Devices Market Trends

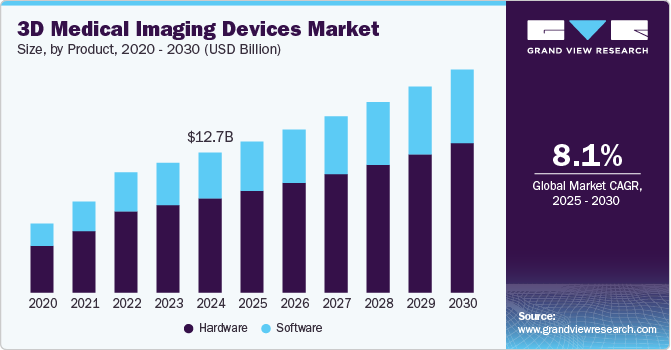

The global 3D medical imaging devices market size was estimated at USD 12.74 billion in 2024 and is expected to expand at a CAGR of 8.11% from 2025 to 2030. The rising prevalence of chronic disorders, an increasing preference for minimally invasive procedures, technological advancements and the growing aging population are the major factors contributing to the overall 3D medical imaging devices industry growth.

The growing prevalence of chronic disorders such as CVDs, Cancer, Neurological conditions and many others are further contributing to the 3D medical imaging devices industry growth. According to the data published by the International Agency for Research on Cancer, approximately 19,976,499 cancer cases were identified worldwide in 2022. These conditions frequently necessitate accurate and detailed imaging for early detection, diagnosis, and treatment planning. Medical 3D imaging technologies, including MRI and CT scans, provide healthcare professionals with three-dimensional views of anatomical structures and abnormalities, enhancing decision-making and improving patient care.

The evolution of 3D medical imaging has improved its efficiency, providing healthcare professionals with better tools for accurate diagnosis and treatment planning. These technologies allow for detailed visualization of anatomical structures, aiding in the detection and management of complex conditions. Furthermore, continuous advancements, such as improved imaging quality, integration of AI, and enhanced device capabilities, are further supporting the growth of the market. These innovations not only improve diagnostic accuracy but also streamline processes, making 3D imaging an increasingly essential part of modern healthcare.

The growing preference for minimally invasive procedures is further driving the adoption of 3D imaging technologies in surgical and interventional settings. These advanced imaging devices provide detailed and accurate visualization of complex anatomical structures, enabling surgeons and interventional radiologists to plan procedures more effectively. By using 3D images, they can navigate challenging areas with greater precision, ensuring that treatment is accurately targeted while minimizing damage to surrounding tissues. This approach not only enhances the safety and efficacy of procedures but also contributes to shorter recovery periods, reduced risks of complications, and improved overall patient outcomes. As the advantages of minimally invasive techniques become important to healthcare providers, the 3D medical imaging devices is expected to grow further.

Market Concentration & Characteristics

The 3D medical imaging devices industry is growing at a significant rate. This is because of the increasing need for advanced diagnostics. These devices allow healthcare professionals to view detailed, three-dimensional images of anatomical structures, offering greater clarity and precision. This detailed visualization is particularly useful in surgical planning, where accurate imaging helps doctors navigate complex areas of the body, reducing the risk of complications and improving patient outcomes. The ability to see structures in 3D enhances diagnostic accuracy, which is essential for detecting and treating a wide range of conditions. As the demand for more precise and effective diagnostic technologies rises, the adoption of 3D medical imaging devices continues to expand, making them an essential part of modern healthcare.

Companies in the 3D medical imaging devices industry are increasingly focusing on strategic product launches as a key approach to securing a significant share. By introducing innovative and advanced products, these companies aim to meet the growing demand for high-quality diagnostic tools that offer greater precision and efficiency. In November 2023, Boston Imaging, the U.S. division of Samsung's digital radiography and ultrasound business, announced the launch of the V6, a new ultrasound system offering advanced imaging capabilities in 2D, 3D, and color, specifically designed for Women's Health and Urology.

The 3D medical imaging devices industry is marked by a high degree of innovation, fueled by technological advancements and the increasing need for more precise and efficient diagnostic solutions. As healthcare demands increase, there is a continuous push to develop imaging systems that offer superior resolution, enhanced accuracy, and faster processing times.

Industry players in the 3D medical imaging devices industry are actively engaging in mergers and acquisitions (M&A) as part of their strategy to strengthen their position, expand their product portfolios, and enhance technological capabilities. In July 2024, GE HealthCare announced that it has reached an agreement to acquire the clinical artificial intelligence (AI) software business of Intelligent Ultrasound Group PLC for a total of approximately USD 51 million.

Regulations have a significant impact on 3D medical imaging devices, as they ensure these technologies are safe, effective, and of high quality. Regulatory organizations like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other national health authorities set strict standards for the development, testing, and approval of medical imaging devices.

Manufacturers are introducing new products in the industry as part of their efforts to remain competitive in an increasingly dynamic industry. For instance, in September 2024, PIUR IMAGING, a provider of tomographic 3D ultrasound technology, announced that its product, PIUR tUS Infinity, had received FDA approval. This approval is a major milestone, allowing the company’s advanced ultrasound technology to be introduced to the U.S. for the first time.

The geographical reach of the 3D medical imaging devices industry is steadily growing, driven by the increasing demand for advanced healthcare solutions, the expansion of healthcare infrastructure, and a greater awareness of the benefits of 3D imaging technologies. Adoption of these devices is notably rising in regions such as Asia Pacific, Latin America, and the Middle East, as these areas experience significant improvements in healthcare facilities and access to advanced diagnostic devices.

Device Type Insights

The hardware segment dominated the market in 2024. Hardware components are an essential part of any medical imaging device, serving as the foundation for technologies like MRI machines, CT scanners, and ultrasound devices. These essential components play a significant role in medical imaging, and healthcare institutions are making substantial investments in hardware to ensure optimal patient outcomes. As the use of 3D imaging increases, along with its various benefits, the segment is expected to experience further growth. The presence of major market players such as Koninklijke Philips N.V., Siemens Healthcare GmbH, GE Healthcare, and Shenzhen Mindray Bio-Medical Electronics Co., Ltd, all of which offer extensive portfolios of these devices, is a key factor driving segment growth.

The software is expected to grow at a fastest CAGR of 8.3% over the forecast period. Software plays an important role in improving the quality and functionality of images produced by hardware devices such as MRI, CT scanners, and ultrasound machines. These software solutions utilize advanced algorithms and image processing techniques to create detailed 3D reconstructions, enhance image contrast, and eliminate noise. As the demand for more accurate and detailed diagnostics continues to grow, healthcare providers are increasingly relying on these software tools to extract valuable insights from imaging data, driving the demand for advanced software solutions. The growth of this segment is supported by the presence of major industry players, such as GE Healthcare. For example, GE Healthcare's Innova 3D software generates 3D images from angiography, aiding in the visualization of complex vasculature. Similarly, Philips offers quantification software like QLAB for general imaging analysis. These factors are expected to contribute to the continued growth and strong market presence of the software segment over the forecast period.

Application Insights

The oncology segment dominated the 3D medical imaging devices market and accounted for the largest revenue share of 33% in 2024. This is driven by the rising incidence of cancer worldwide, which has led to an increasing demand for advanced diagnostic and treatment tools. 3D medical imaging devices, including CT, MRI, and PET-CT scanners, are essential in oncology as they provide detailed, accurate images of tumors and the surrounding tissues. These technologies are critical for cancer diagnosis, staging, treatment planning, and ongoing monitoring, making them a key component in the effective management of cancer patients.

The cardiology segment is projected to witness the fastest CAGR of 8.4% during the forecast period. Cardiac interventions, including catheter-based procedures, minimally invasive surgeries, and structural heart interventions, have become more complex. Cardiologists now require detailed 3D images of the heart and its vasculature to effectively plan and guide these procedures. Devices such as 3D echocardiography and cardiac CT/MRI offer the critical anatomical information needed, enhancing the precision and safety of these interventions. The rising incidence of cardiac conditions, such as heart attacks, cardiac arrest, and other cardiovascular diseases, is expected to drive the growing use of 3D imaging. For instance, the American Heart Association reports that over 356,000 cases of total cardiac arrest occur annually in the U.S.

End Use Insights

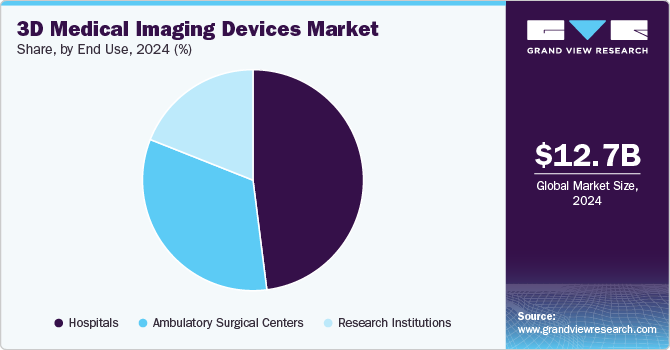

Hospital segment dominated the market by capturing a share of 48.3% in 2024. This is because it offers a wide range of diagnostic, therapeutic, and surgical services, which makes them the primary users of 3D medical imaging devices. These devices are essential for diagnosing and monitoring various medical conditions, from cancer and cardiovascular diseases to orthopedic and neurological disorders, allowing hospitals to offer a complete spectrum of healthcare services. Moreover, the hospitals segment is expected to witness growth due to several factors such as high adoption of image-guided therapy systems in hospitals, high volume of surgeries undertaken at hospitals, and hospitals being considered as primary health systems in several countries. Moreover, the installation of image-guided therapy systems at hospitals has demonstrated several positive results in terms of cost-effectiveness and optimization of clinical workflows. Furthermore, large hospitals usually have in-house medical imaging facilities, which is estimated to propel segment growth.

The diagnostic imaging centers segment is projected to witness the fastest CAGR of 8.4% during the forecast period. These centers provide faster appointments and shorter wait times for patients compared to hospitals. This quick access to diagnostic services is especially attractive for individuals needing non-emergency imaging, such as routine screenings, preventive check-ups, and follow-up studies. As healthcare trends increasingly focus on efficiency and convenience, diagnostic imaging centers are well-positioned to meet these needs. In many cases, these centers also serve as disease detection hubs, providing physicians with results that support further diagnosis and treatment. As awareness grows and technology continues to advance, the segment is expected to experience significant growth.

Regional Insights

North America 3D medical imaging devices market held the largest share of 35.8% in 2024. This is owing to the presence of major market players, the increasing prevalence of chronic conditions such as cancer, diabetes, cardiovascular diseases (CVDs), and the expanding geriatric population. Major players in the market contribute to the development of innovative 3D medical imaging technologies, enhancing diagnostic capabilities and improving patient outcomes.

U.S. 3D Medical Imaging Devices Market Trends

The U.S. 3D medical imaging devices market dominated the market in the North America region. This is attributed to the presence of key manufacturers that ensure the availability of advanced products and technologies in the country. In addition, these companies are continuously innovating and integrating various technologies to stay competitive. For instance, in June 2023, GE HealthCare announced the FDA approval and product launch of Sonic DL, a deep learning-based technology designed to significantly speed up image acquisition in Magnetic Resonance Imaging (MRI).

Europe 3D Medical Imaging Devices Market Trends

Europe 3D medical imaging devices market held a significant market share in 2024, this is owing to the presence of key market players and the strategic initiatives they are undertaking in the region, such as product introductions and technological innovations. For instance, in February 2024,PIUR IMAGING, a European provider of independent tomographic 3D ultrasound solutions, introduced the PIUR tUS Infinity 4 for Thyroid. This technology marks a major leap forward in tomographic 3D ultrasound imaging, establishing new industry benchmarks for speed, accuracy, and overall user experience.

UK 3D medical imaging devices market is experiencing significant growth, driven by the adoption of advanced technologies in this country. In April 2024, plans were unveiled to construct the UK's most powerful MRI scanner in Nottingham, aimed at addressing conditions like Alzheimer's disease.MRI creates 3D internal images of the body by utilizing strong magnetic fields and radio waves. According to the University of Nottingham, the new MRI machine will operate at temperatures as low as -270°C and be 1,000 times more powerful than the machines first developed in the 1970s. The advanced scanner is expected to be operational by late 2026 or early 2027.

The France 3D medical imaging devices market is expected to grow over the forecast period. The rising prevalence of chronic disorders in the country is becoming a significant healthcare concern. As a result, there is growing awareness among the population about available treatment and diagnostic options. This growing awareness is expected to drive the growth of the market.

Germany 3D medical imaging devices market is experiencing significant growth, driven by the increasing initiatives undertaken by major market players in this country. For instance, in October 2024, GE HealthCare has announced a collaboration with University Medicine Essen in Germany to create a new Theranostics Centre of Excellence. The centre will focus on integrating theranostics into clinical practice and advancing research into more personalized cancer care approaches. As part of the partnership, GE HealthCare will supply equipment for the university's new radiotracer development centre.

Asia Pacific 3D Medical Imaging Devices Market Trends

Asia Pacific 3D medical imaging devices market is expected to witness the fastest growth of CAGR 8.5% over the forecast period. This growth is primarily driven by the increasing prevalence of chronic disorders and the rising demand for advanced medical devices. In addition, growing awareness among the population about the benefits of these devices, coupled with improvements in healthcare infrastructure and better access to advanced technologies, is further accelerating the adoption of 3D medical imaging devices in the region.

Japan 3D medical imaging devices market is significantly driven by growing initiatives in the country. In September 2024, Clarius Mobile Health, a provider of high-definition handheld ultrasound systems, has entered into a new distribution agreement with Marubun Corporation, electronics trading company listed on the Tokyo Prime Market in Japan. Under this agreement, Marubun is authorized to sell Clarius wireless ultrasound scanners to hospitals and specialty clinics across Japan.

China 3D medical imaging devices market is expected to grow over the forecast period. This growth is primarily driven by the increasing prevalence of chronic diseases, rising healthcare spending, and advancements in medical technology. In addition, the expanding healthcare infrastructure, greater awareness of advanced diagnostic tools, and the growing demand for more precise and efficient imaging solutions are also contributing to the market's expansion.

Latin America 3D Medical Imaging Devices Market Trends

Latin America 3D medical imaging devices market is expected to grow owing to the rising demand for advanced diagnostic tools and increasing awareness among the population. As healthcare providers strive to deliver more accurate and timely diagnoses, there is a growing emphasis on utilizing advanced imaging technologies such as 3D medical imaging to improve patient outcomes. The increasing prevalence of chronic diseases, such as cancer, cardiovascular diseases, and diabetes, further fuels the need for advanced diagnostic devices.

Middle East & Africa 3D Medical Imaging Devices Market Trends

Middle East & Africa 3D medical imaging devices market is experiencing notable growth, driven by factors such as increasing healthcare investments, advancements in medical technology, and growing awareness about the benefits of 3D imaging. Rising rates of chronic diseases and an aging population are further fueling the demand for more accurate and efficient diagnostic tools. In addition, improvements in healthcare infrastructure, along with expanding access to advanced medical devices in both urban and rural areas, are contributing to the adoption of 3D medical imaging technologies. The region's focus on enhancing healthcare quality and expanding diagnostic capabilities is expected to continue driving the growth of the 3D medical imaging devices industry.

Key 3D Medical Imaging Devices Company Insights

Key players in the 3D medical imaging devices industry are adopting several strategic initiatives to mark their market presence and drive growth. These include significant investments in research and development aimed at innovating and enhancing product offerings, expanding their portfolios to include a broader range of imaging solutions, strategic collaborations, partnerships, and acquisitions to increase their reach, access new markets, and leverage complementary technologies. These efforts are helping to meet the evolving needs of healthcare providers, while simultaneously contributing to the continued expansion of the 3D medical imaging devices industry.

Key 3D Medical Imaging Devices Companies:

The following are the leading companies in the 3D medical imaging devices market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Healthineers

- Esaote SpA

- Koninklijke Philips N.V.

- GE Healthcare Ltd.

- Canon Medical Systems

- Hitachi Medical Systems

- Shimadzu Corporation

- DigiRad Corporation

- Del Medical Systems Inc

Recent Developments

-

In October 2024, GE HealthCare announced the launch of the Versana Premier, the newest addition to its Versana ultrasound family. This advanced system is designed to offer a combination of reliability, affordability, ease of use, and versatility, making it a valuable tool for a wide range of clinical applications.

-

In October 2024, GE HealthCare announced the establishment of a new AI Innovation Lab, aimed at accelerating early-stage AI innovations within the company. This initiative is part of GE HealthCare's broader AI and digital strategy, which focuses on integrating artificial intelligence into medical devices and developing AI applications that enhance decision-making throughout the care journey and various disease states.

-

In September 2024, Siemens Healthineers announced the FDA has granted premarket approval (PMA) for the Mammomat B.brilliant, a tomosynthesis or three-dimensional breast imaging technology. This approval includes new 3D image acquisition and reconstruction technology, further enhancing the system's capabilities. In addition to its previous clearance for full-field digital mammography (2D imaging), breast biopsy, and titanium contrast-enhanced mammography, the new features enable more advanced breast imaging.

3D Medical Imaging Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.75 billion

Revenue forecast in 2030

USD 20.31 billion

Growth rate

CAGR of 8.11% from 2025 to 2030

Actual period

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Siemens Healthineers; Esaote SpA; Koninklijke Philips N.V.; GE Healthcare Ltd.; Canon Medical Systems; Hitachi Medical Systems; Shimadzu Corporation; DigiRad Corporation; Del Medical Systems Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Medical Imaging Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global 3D medical imaging devices market report on the basis of device type, application, end use and region:

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

X-ray Devices

-

CT Devices

-

Ultrasound Systems

-

MRI Equipment

-

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiology

-

Orthopedic

-

Gynecology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global 3D medical imaging devices market size was estimated at USD 12.74 billion in 2024 and is expected to reach USD 13.75 billion in 2025.

b. The global 3D medical imaging devices market is expected to grow at a compound annual growth rate of 8.11% from 2025 to 2030 to reach USD 20.31 billion by 2030.

b. Hardware segment dominated the 3D medical imaging devices type market with a share of 67.4% in 2024. This is attributable to high demand for imaging devices globally.

b. Some key players operating in the 3D medical imaging devices market include GE Healthcare; Siemens Healthineers AG; Philips Healthcare; Canon Medical Systems Corporation; Mindray; FUJIFILM SonoSite, Inc.; Esaote; ContextVision; EOS imaging; Intelerad; Able Software Corp.; and Axial3D

b. Key factors that are driving the market growth include growing incidence of chronic disorders and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.