Wound Dressing Industry Data Book - Abdominal Pads, Medical Adhesive Tapes and Super Absorbent Dressings, Medical Tapes & Bandages, Moist Wound Dressing, Surgical Dressing Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Jun, 2023

- Report ID: sector-report-00177

- Format: Electronic (PDF)

- Number of Pages: 300

Database Overview

Grand View Research’s wound dressing industry data book is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in 17 reports and one sector report overview:

Wound Dressing Industry Data Book Scope

|

Attribute |

Details |

|

Research Areas |

|

|

Number of Reports/Deliverables in the Bundle |

|

|

Cumulative Country Coverage |

50+ Countries |

|

Highlights of Datasets |

|

|

Total Number of Tables (Excel) in the bundle |

300+ |

|

Total Number of Figures in the bundle |

300+ |

Wound Dressing Industry Data Book Coverage Snapshot

|

Markets Covered |

|||

|

Wound Dressing Industry USD 61.0 billion in 2022 4.5% CAGR (2023-2030) |

|||

|

Abdominal Pads Market Size USD 967.9 million in 2022 6.1% CAGR (2023-2030) |

Medical Adhesive Tapes Market Size USD 750.9 million in 2022 5.3% CAGR (2023-2030) |

Film Dressing Market Size USD 1.51 billion in 2022 4.6% CAGR (2023-2030) |

Hydrogel Dressing Market Size USD 883.9 million in 2022 4.3% CAGR (2023-2030) |

|

Collagen Dressing Market Size USD 691.8 million in 2022 3.8% CAGR (2023-2030) |

Super Absorbent Dressing Market Size USD 99.9 million in 2022 4.7% CAGR (2023-2030) |

Alginate Dressing Market Size USD 902.7 million in 2022 4.1% CAGR (2023-2030) |

Foam Dressing Market Size USD 1.13 billion in 2022 4.3% CAGR (2023-2030) |

|

Hydrocolloid Dressing Market Size USD 1.38 billion in 2022 5.0% CAGR (2023-2030) |

Silver Wound Dressing Market Size USD 951.0 million in 2022 5.6% CAGR (2023-2030) |

Wound Dressing Market Size USD 13.6 billion in 2022 4.1% CAGR (2023-2030) |

Advanced Wound Dressing Market Size USD 7.44 billion in 2022 4.5% CAGR (2023-2030) |

|

Surgical Dressing Market Size USD 4.80 billion in 2022 5.6% CAGR (2023-2030) |

Medical Gauze and Tapes Market Size USD 6.01 billion in 2022 5.6% CAGR (2023-2030) |

Medical Tapes and Bandages Market Size USD 9.35 billion in 2022 3.4% CAGR (2023-2030) |

Moist Wound Dressing Market Size USD 4.25 billion in 2022 5.5% CAGR (2023-2030) |

|

Traditional Wound Management Market Size USD 6.21 billion in 2022 3.7% CAGR (2023-2030) |

|||

Wound Dressing Industry Outlook

The global wound dressing market size was valued at USD 61.0 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030. Increasing incidence of chronic diseases such as diabetes, cancer, and other autoimmune diseases is anticipated to increase the incidence rate of chronic and acute wounds across the globe. Factors such as antimicrobial resistance, unhealthy & sedentary lifestyles, and tobacco & alcohol consumption are contributing to the rising prevalence of non-communicable diseases. Furthermore, technological advancements are projected to have a significant impact on wound dressing industry in the coming years. The quality of life of patients suffering from chronic wounds improves as technology advances and becomes more affordable. For instance, in December 2022, MediWound Ltd. obtained the U.S. Food and Drug Administration (FDA) approval for its NexoBrid. This product is intended for the removal of eschar in adults with deep partial-thickness and/or full-thickness thermal burns.

Wound dressings have progressed from simple bandages that cover the wound to advanced ones that release pharmaceutically active chemicals to speed up healing and reduce pain and inflammation. Thus , we have included all the markets related to wound dressing industry which include abdominal pads, medical adhesive tapes, film dressing, hydrogel dressing, collagen dressing, super absorbent dressing, alginate dressing, foam dressing, hydrocolloid dressing, silver wound dressing, wound dressing, advanced wound dressing, surgical dressing, medical gauze and tapes, medical tapes and bandages, moist wound dressing, and traditional wound management. Wound care is critical for accelerating healing and reducing the risk of infection. A wound might be acute or chronic, and depending on the wound situation, each of the products listed above has its own set of advantages.

Wound Dressing Market Key company categorization

|

|

Operating Strategies |

Competitive Edge |

Weaknesses |

||

|

Mature Players |

|

|

|

|

|

|

Emerging Players |

|

|

|

|

|

Abdominal Pads Market Analysis And Forecast

The global abdominal pads market size was valued at USD 967.9 million in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. The abdominal pad is used as a secondary dressing over a primary dressing such as alginate or hydro fiber and it is made up of highly absorbent material to absorb excess fluid. The market for abdominal pads is anticipated to be majorly driven by the rising cases of burn injuries and the surge in the prevalence of chronic wounds. Moreover, the rise in the number of surgical procedures is further expected to fuel market growth.

Abdominal Pads Market Key Segments

|

Sterile |

Non-sterile |

|

|

Burns continue to be one of the most prevalent types of injuries, making up a significant number of trauma cases for hospital emergencies globally, marking a decline in their frequency. Burns also continue to cause high mortality rates and morbidity. According to an article titled, “The Global Macroeconomic Burden of Burn Injuries” published in PRS Journal in October 2021, over nine million people suffer from thermal injuries annually across the world. Among those injured, 90% of mortality occurs in low- and middle-income countries (LMICs). Nearly half of these fatalities take place in the South-East Asian regions with the majority occurring in low and middle-income nations. In India, seven million individuals experience burn injuries annually, resulting in 1.4 lakh fatalities and 2.4 lakh disabled people. Thus, the rising prevalence of burn injuries is fueling the abdominal pads market growth.

An increasing number of surgeries is also one of the major factors driving the abdominal pads market growth. The number of surgeries is increasing due to the rising prevalence of chronic conditions. Abdominal pads, thus, are increasingly being used for most surgical wounds, post cancer surgery, and are relatively large and deep, releasing exudates that require regular management. These pads help manage large wounds, thereby significantly reducing the risk of infection.

Medical Adhesive Tapes Market Analysis And Forecast

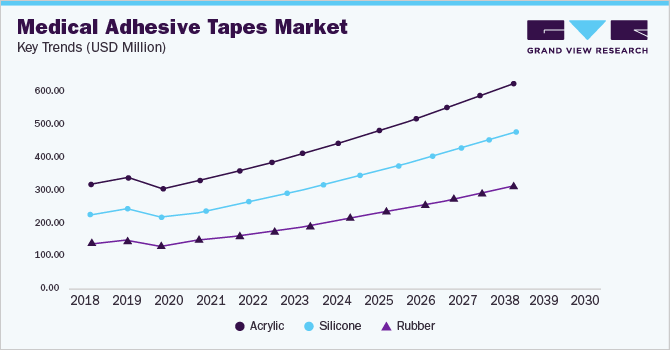

The global medical adhesive tapes market size was valued at USD 750.9 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. The rising prevalence of chronic disorders, such as diabetic ulcers, venous leg ulcers, and traumatic wounds, is one of the key factors leading to an increase in the usage of medical adhesive tapes. For instance, according to WHO figures, every year, roughly 1.2 million people die due to vehicle crashes, whereas 20 to 50 million people incur non-fatal injuries.

Medical Adhesive Tapes Market Key Segments

|

Acrylic |

Silicone |

Rubber |

|

|

|

The demand for medical adhesive tapes significantly reduced as a result of the COVID-19 pandemic. Medical adhesive tapes are an essential component of healthcare, but due to an increase in COVID-19 cases, there has been a decline in market demand. Hospitals and clinics were under more pressure to reprofile their patients and give COVID-19 patients priority care as the rate of hospitalization rose. However, players in this industry changed their approaches by deciding to pursue R&D throughout the pandemic and creating cutting-edge technologies to assist in the fight against the virus.

Based on type, the medical adhesive tapes industry is segmented into acrylic, silicone, and rubber. The acrylic segment dominated the market in 2022. Dominance can be accredited to the advantages it provides. For instance, acrylic medical adhesive tape provides a strong initial tack, has low skin sensitivity, and does not leave residue on the skin after its removal. Moreover, these tapes are resistant to humidity and heat, are latex-free, and can be laminated to surfaces that include foams and film dressings. The tape does not break down during the dressing of the wound.

Super Absorbent Dressings Market Analysis And Forecast

The global super absorbent dressings market size was valued at USD 99.92 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.7% from 2022 to 2030. The demand for super-absorbent dressings is expected to increase due to an increase in the number of chronic diseases across the globe. For instance, according to the Government of Canada, 44% of Canadian adults have at least one of the ten most common chronic conditions. According to a similar source, 11% of Canadians suffer from diabetes, whereas 8% have cancer. Furthermore, a rise in the geriatric population is one of the major driving factors in the market. For instance, according to the Canadian Institute for Health Information, in 2017, the geriatric population comprised 6.2 million, which was expected to reach 10.4 million by 2037. Therefore, an increase in the number of chronic diseases, along with the growth of the geriatric population, is anticipated to propel the market growth during the forecast period.

Super Absorbent Dressings Market Key Segments

|

Adherent |

Non-Adherent |

|

|

Super absorbent dressings are designed to minimize the adherence to wounds and manage exudate. These dressings can be used over surgical incisions, burns, lacerations, exudating wounds, or grafts. Thus, an increase in the number of surgical procedures is expected to propel the market growth during the forecast period. For instance, according to OMICS Group Conference, about 51.4 million surgical procedures are carried out in UAE, whereas this number increases to 234 million worldwide. Hence, due to the aforementioned factors, the market is anticipated to grow over the forecast period.

Based on product, the non-adherent super absorbent dressings segment dominated the market in 2022. These super absorbent dressings are used for heavily draining wounds. The non-adherent super-absorbent dressings lock fluid away from the skin and help in quick wound healing. These being non-stick dressings, they don’t stick over the wounds and require tape or wrap to secure the pad over wounds. Highly exuding wounds such as wounds related to accidents, chronic wounds such as venous leg ulcers, and pressure ulcers may propel the segment growth.

Competitive Insights

The wound dressing market is highly fragmented and has many large and small market players. Competitive rivalry and the degree of competition are expected to be high, which may increase further, as current market players are intensifying their strategies to take hold of the majority of the collagen dressing market. To have a competitive edge over competitors, many market players are entering into various strategic initiatives such as product launches, mergers and acquisitions, and geographic expansion.

Some of the recent major strategies by major players include:

-

In July 2022, Smith+Nephew announced the launch of the WOUND COMPASS Clinical Support App to help reduce variation in wound care practice. The app will provide digital support to health care professionals who aid wound assessment, helping decision-making & reduce practice variation.

-

In May 2022, 3M launched an extended-wear medical adhesive tape. This tape is intended to be used over the skin for up to 21 days.

-

In November 2021, Paul Hartmann AG invested USD 44.46 million in the Heidenheim region. This was done to develop a new production line and modernize the existing facilities and infrastructure.

-

In June 2021, MiMedx received regulatory approval from the Japanese Ministry of Health, Labour and Welfare to commercialize their product EPIFIX in Japan.

-

In January 2020, Convatec announced the release of ConvaMax. ConvaMax superabsorber wound dressing is used for the management of highly exuding wounds, including leg ulcers, pressure ulcers, diabetic foot ulcers, and dehisced surgical wounds. This was expected to help the company gain significant market share.

-

In October 2019, 3M expanded its wound care offerings, by completing the acquisition of Acelity, Inc.