- Home

- »

- Sector Reports

- »

-

Water & Wastewater Treatment Equipment Industry Data Book, 2030

![Water & Wastewater Treatment Equipment Industry Data Book, 2030]()

Water & Wastewater Treatment Equipment Industry Data Book - Primary, Secondary and Tertiary Water & Wastewater Treatment Equipment Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Aug, 2023

- Report ID: sector-report-00221

- Format: Electronic (PDF)

- Number of Pages: 250

Database Overview

Grand View Research’s water & wastewater treatment equipment industry database is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

Water & Wastewater Treatment Equipment Industry Data Book Scope

Attribute

Details

Areas of Research

- Primary Water & Wastewater Treatment Equipment Market

- Secondary Water & Wastewater Treatment Equipment Market

- Tertiary Water & Wastewater Treatment Equipment Market

Number of Reports/Presentations in the buddle

1 Sector Outlook Report + 3 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Products

10+ Products

Highlights of Datasets

- Demand by Countries

- Competitive Landscape

- Water & Wastewater Treatment Equipment Market, by Application

- Water & Wastewater Treatment Equipment Market, by Region

Water & Wastewater Treatment Equipment Industry Data Book Coverage Snapshot

Markets Covered

Water & Wastewater Treatment Equipment Industry

USD 63.4 billion in 2022

Primary Water & Wastewater Treatment Equipment Market Size

USD 12.3 billion in 2022

3.9% CAGR (2023-2030)

Secondary Water & Wastewater Treatment Equipment Market Size

USD 23.3 billion in 2022

4.3% CAGR (2023-2030)

Tertiary Water & Wastewater Treatment Equipment Market Size

USD 27.9 billion in 2022

4.8% CAGR (2023-2030)

Water & Wastewater Treatment Equipment Sector Outlook

The economic value generated by the water & wastewater treatment equipment industry was estimated at approximately USD 63.4 billion in 2022. The demand for clean water is significantly increasing across the world owing to increasing agriculture and industrial activities. The clean water reservoirs are depleting fast due to the increasing water withdrawals from groundwater and surface water along with rising global warming. This is expected to increase the demand for water & wastewater treatment equipment over the forecast period. Furthermore, improving economic conditions, rising population, growing footprint of industrial players, and the introduction of stringent regulation about wastewater treatment worldwide are projected to impact global water & wastewater treatment equipment growth over the forecast period.

Major players such as Xylem Inc., Pentair plc, and DuPont are aiming at the economies of scope as water and wastewater treatment equipment is widely used in municipal and industrial sectors for water treatment. Therefore, new product development and extensive marketing activities hold significant importance in gaining a competitive edge in the market.

Share of Major Water & Wastewater Treatment Equipment Countries by Process

Total, 2022

Primary Water & Wastewater Treatment Equipment, 2022

Secondary Water & Wastewater Treatment Equipment, 2022

Tertiary Water & Wastewater Treatment Equipment, 2022

USD Billion

63.4

USD Billion

12.3

USD Billion

23.3

USD Billion

27.9

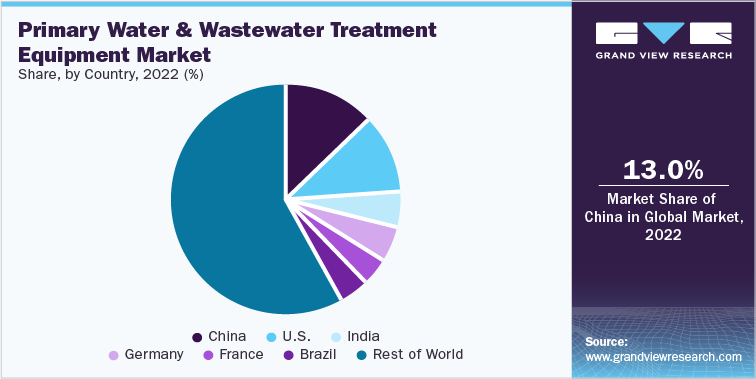

China

13%

China

13%

China

13%

China

12%

U.S.

11%

U.S.

11%

U.S.

11%

U.S.

11%

India

5%

India

5%

India

5%

India

5%

Germany

5%

Germany

5%

Germany

5%

Germany

5%

France

4%

France

4%

France

4%

France

4%

Brazil

4%

Brazil

4%

Brazil

4%

Brazil

4%

Rest of the World

59%

Rest of the World

58%

Rest of the World

59%

Rest of the World

59%

The water & wastewater treatment equipment sector is also witnessing significant growth owing to the rising population and industrialization. Developing economies, particularly in the Asia Pacific, are experiencing rapid industrialization and urbanization, driving the demand for water & wastewater treatment equipment. According to the UN World Water Development Report, approximately 6 billion people will face a clean water shortage by 2050. This is due to the rapid increase in world population and economic growth, which has resulted in increased demand for clean water. Moreover, reduced water resources and increased water pollution also contribute to the demand for water & wastewater treatment equipment.

Primary Water & Wastewater Treatment Equipment Market Analysis & Forecast

The use of primary treatment equipment such as screens or grit chambers is expected to grow across the world. It has promising opportunities in developing countries where awareness about sewage treatment is beginning to grow. Moreover, key companies in the market are also trying to develop systems to increase primary treatment capacities where there is limited or less space or cost considerations to install more advanced treatment equipment. Such developments in the market are expected to prompt the growth in the demand for primary water & wastewater treatment equipment over the forecast period.

Primary water & wastewater treatment includes equipment such as a primary clarifier, sludge removal, grit removal, and pre-treatment equipment, among others. Various countries have enacted stringent wastewater discharge laws for the municipal and industrial sectors, which is projected to support the primary water and wastewater treatment equipment market growth. The United States Environmental Protection Agency (EPA), the Central Pollution Control Board (CPCB), and the European Environment Agency (EEA) all play critical roles in avoiding water pollution and enhancing water quality.

Secondary Water & Wastewater Treatment Equipment Market Analysis & Forecast

Secondary water & wastewater treatment comprises biological treatment, which leads to the removal of the soluble organic substance and chemicals using bio-towers, trickling filters, rotating biological contactors, and activated sludge systems. Some of the secondary treatment methods include a secondary clarifier which is employed to settle out and separate the biological material or floc. The growing investments in sanitary sewage systems in developing economies are expected to drive the demand for activated sludge and sludge treatment equipment driving the growth of the secondary water & wastewater treatment equipment market.

Technological advancements, increasing awareness about health consciousness, rising demand for clean water, and introduction of stringent regulation will likely contribute to the growth of secondary water & wastewater treatment equipment over the forecast period. According to the Migration Data Portal, the share of the global population living in urban areas by 2030 is expected to be 60%, increasing from 55% when compared to 2018. This indicates that the urban infrastructure, mainly the sewage systems, will be under pressure, requiring advanced technology in the form of sludge treatment.

Tertiary Water & Wastewater Treatment Equipment Market Analysis & Forecast

The growing importance of disinfection equipment as the final treatment stage before the water is reused, recycled, or discharged into the environment is likely to boost the growth of the tertiary water & wastewater treatment equipment over the forecast period. The residual inorganic compounds and pollutants, bacteria, viruses, and parasites are eliminated during this procedure, making the water suitable for reuse. Furthermore, rising demands for reduced global water footprints and optimally treated water quality outputs have increased the number of MBR installations, particularly in North America and Europe. These aforementioned factors are likely to further propel the demand for the tertiary water & wastewater treatment equipment market in the coming years.

Photocatalytic degradation methods have been extensively used in recent years to eliminate organic contaminants in wastewater and effluents. As a developing destruction technique, advanced oxidation processes (AOPs) have been developed, resulting in the complete mineralization of most organic pollutants. Moreover, the rising R&D expenditure by the manufacturers to develop high-performance, efficient, and cost-effective is likely to increase product innovations and heighten product launches, thereby supporting the tertiary water & wastewater treatment equipment market growth over the forecast period.

Competitive Insights

Major players in the water & wastewater treatment equipment market include Evoqua Water Technologies LLC; Pentair plc; Ecolab Inc.; DuPont; Xylem, Inc.; Calgon Carbon Corporation; Toshiba Corporation; Veolia Group; Aquatech International LLC; Ecologix Environmental Systems, LLC; Evonik Industries AG; Lenntech B.V.; and Parkson Corporation. The manufacturers of water & wastewater treatment equipment adopt several strategies, including merger & acquisition, new product developments, partnership & joint ventures, distributor agreements, and geographical expansions, to enhance their market presence and cater to the ever-changing consumer requirements.

Strategies adopted by the companies usually include product portfolio expansion, network expansion, and geographic network expansion.

-

In January 2023, Xylem, Inc. announced the plan to acquire Evoqua. Evoqua engaged in the business of water treatment solutions for various end-use industries such as food and beverage, power generation, life sciences, and microelectronics. With this initiative, the company will expand its presence in Europe and North America.

-

In March 2021, DuPont launched a new biofouling-preventing technology for Reverse Osmosis installations. The pre-treatment technology helps to increase plant uptime and also decreases operational costs.

-

In June 2022, Xylem, Inc. expanded its regional headquarters in Singapore through the launch of a multi-disciplinary center for water, wastewater, and energy technologies. This center is expected to focus on developing technologies in water distribution and water & wastewater treatment.

-

In October 2020, Koch Membrane Systems announced to continue its partnership with ADM, an agricultural origination and processing company. KSS is expected to develop capabilities to address water conservation in industrial operations.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified