- Home

- »

- Sector Reports

- »

-

Water Treatment Systems Industry Growth (Data Book 2030)

Database Overview

Grand View Research’s water treatment systems industry database is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

Water Treatment Systems Industry Data Book Scope

Attributes

Details

Areas of Research

- Point of Use Water Treatment Systems Market

- Point of Entry Water Treatment Systems Market

Number of Reports/Presentations in the Bundle

1 Sectoral Outlook Report + 3 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Application

10+ Products

Highlights of Datasets

- Demand ,by Countries

- Competitive Analysis

- Water Treatment Systems Market, by Technology

- Water Treatment Systems Market, by Application

- Water Treatment Systems Market, by Region

Water Treatment Systems Industry Data Book Coverage Snapshot

Market Covered

Water Treatment Systems Industry

USD 35,035.9 million in 2022

Point of Use Water Treatment Systems Market Size

USD 26,059.9 million in 2022

9.4% CAGR (2023-2030)

Point of Entry Water Treatment Systems Market Size

USD 8,976.0 million in 2022

5.2% CAGR (2023-2030)

Water Treatment Systems Sector Outlook

The economic value generated by the water treatment systems industry was estimated at approximately USD 35,035.9 million in 2022. This market incorporates a wide range of systems used for the improvement of the quality of the water which is used for drinking, cooking, washing, etc. The demand for water treatment systems is significantly driven by the growing concerns over the depletion of freshwater resources across the world and the rising concentration of chemical and other contaminants in the surface as well as groundwater sources.

Manufacturers are frequently engaged in mergers and acquisitions, partnerships, as well as new product launches to maintain and gain market share in the global water treatment systems industry. These technological advancements have led to improved filtration and disinfection performance of the water treatment systems along with the improvement of the water aesthetics such as color, odor, and taste. These companies have been realizing greater profit margins in the sale of their flagship products. Thus, these companies have been focusing more on building a stronger brand reputation rather than laying emphasis on product innovation.

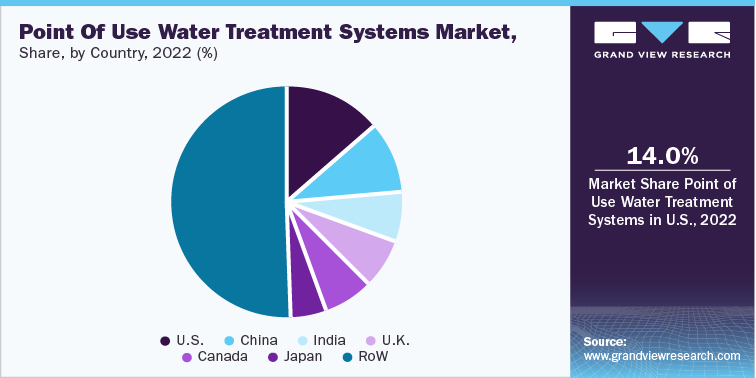

Table 1. Share of Major Water Treatment Systems Countries, by Installation

Total, 2022

Point of Use Water Treatment Systems, 2022

Point of Entry Water Treatment Systems, 2022

USD Million

35,035.9

USD Million

26,059.9

USD Million

8,976.0

U.S.

13%

U.S.

14%

U.S.

12%

China

9%

China

10%

China

9%

India

7%

India

7%

India

7%

UK

7%

UK

7%

UK

6%

Canada

6%

Canada

7%

Japan

5%

Japan

5%

Japan

5%

Italy

4%

Rest of the World

53%

Rest of the World

51%

Rest of the World

58%

The water treatment systems industry is also witnessing significant growth owing to the rising population and industrialization. Developing economies, particularly in the Asia Pacific, are experiencing rapid industrialization and urbanization, driving the demand for water treatment systems installed at residential, commercial, and industrial locations. With rising concern over health and well-being, institutional places, colleges, and schools are increasingly focusing on the installation of point-of-use and point-of-entry water treatment systems at the premises which is expected to propel the growth of the global water treatment systems market over the forecast period.

Point of Use Water Treatment Systems Market Analysis And Forecast

Point-of-use water treatment systems are cost-effective solutions for treating water for drinking purposes and other water usage. The market for point-of-use water treatment systems is driven by their rising popularity owing to their features, benefits, and performance pertaining to the removal of odor, chemicals, sediment, and dirt. The technologies used widely include water purification and water filtration systems. The rising popularity and increasing awareness of reverse osmosis water purification systems and water disinfection systems are likely to drive the growth of water treatment systems over the forecast period.

A point-of-use filtration system is put under a kitchen sink or is directly connected to a tap or faucet and is designed to be used at a particular spot in the house. The water is filtered once more after it has already been cleaned by the water supply department. These are essential devices that raise the water's quality so that it can be consumed both in household and business settings.

Point of Entry Water Treatment Systems Market Analysis And Forecast

Point-of-entry water treatment systems are installed at home, schools, colleges, hotels, and other commercial & industrial facilities where the water enters the premises. POE systems use a single technology or a combination of technologies to handle problems with the incoming water. Point-of-entry systems are substantially larger than point-of-use systems because they handle significantly higher flow rates and volumes. The installation of POE systems can help remove the lead nitrate or other lead-based compounds from water which may have entered from the pipe systems and plumbing fixtures and can be extremely harmful.

Growing industrialization, the commercial sector, and rising residential complexes across the world are likely to create increasing demand for point-of-entry water treatment systems over the forecast period. Moreover, owing to the increased water testing facilities, consumer health awareness, and rising accessibility to water treatment products, the market for point-of-entry water treatment systems is expected to grow over the forecast period. Furthermore, favorable regulations and government initiatives and schemes are likely to facilitate the installation of point-of-entry water treatment systems at various end-use locations, which in turn are expected to fuel the market growth.

Competitive Insights

Major players in the water treatment systems market include Pentair plc; 3M; A.O. Smith; EcoWater Systems; Panasonic Corporation; Amway; Kent RO Systems Ltd.; LG Electronics; BWT AG; Coway Co. Ltd.; DuPont; and Watts Water Technologies Inc. The manufacturers of water treatment systems adopt several strategies, including merger & acquisition, partnership & joint ventures, new product developments, distributor agreements, new online channels, and geographical expansions, to augment their market presence and cater to the ever-changing consumer requirements.

Strategies adopted by the companies usually include product portfolio expansion, collection network expansion, and geographic network expansion.

-

In July 2019, Pentair plc entered a legally binding agreement to buy Pelican Water Systems for USD 120 million in cash. This move helped the company to enhance its growth potential through its cutting-edge technologies and multi-channel strategy, which provided customers with more choices in terms of where, how, and when to purchase water treatment solutions.

-

In July 2022, AQUAPHOR opened its third factory in Estonia. This initiative aimed to ship annually its products to the global markets from its new plant’s production lines. The new line will enable the mass production of membrane water treatment and desalination systems.

-

In December 2021, DuPont developed a new water treatment facility to alleviate the nation's water shortage. DuPont built a heavy-duty vehicle-sized treatment plant that can accommodate four settlements totaling roughly 60,000 inhabitants.

-

In June 2022, PENTAIR completed the acquisition of Manitowoc Ice for USD 1.6 Billion. This move was taken by the company to expand its commercial water solutions platform and cater to the food service industry.

-

In August 2020, DuPont Water Solutions, a division of DuPont Safety & Construction, introduced DuPont FilmTecTM residential reverse osmosis (RO) components on Amazon in collaboration with Onsitego.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified