Veterinary Imaging Instrument Industry Data Book - Veterinary X-Ray, Veterinary Ultrasound, Animal MRI and Animal/Veterinary CT Imaging Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Jan, 2023

- Report ID: sector-report-00124

- Format: Electronic (PDF)

- Number of Pages: 250

Database Overview

Grand View Research’s Veterinary Imaging Instrument industry data book is a collection of market sizing information & forecasts, regulatory data, competitive benchmarking analyses, macro-environmental analyses, and technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in 5 reports and one sector report overview:

Veterinary Imaging Instrument Industry Data Book Scope

|

Attribute |

Details |

|

Research Areas |

|

|

Details of Product |

|

|

Cumulative Country Coverage |

20+ Countries |

|

Cumulative Product Coverage |

25+ Level 1 & 2 Products |

|

Highlights of Datasets |

|

Veterinary Imaging Instrument Industry Data Book Coverage Snapshot

|

Markets Covered |

|||

|

Veterinary Imaging Instrument Industry USD 1.44 billion in 2021 5.7% CAGR (2022-2030) |

|||

|

Veterinary X-Ray Market Size USD 546.96 million in 2021 4.0% CAGR (2022-2030) |

Veterinary Ultrasound Market Size USD 326.71 million in 2021 6.8% CAGR (2022-2030) |

Veterinary MRI Market Size USD 198.80 million in 2021 7.3% CAGR (2022-2030) |

|

|

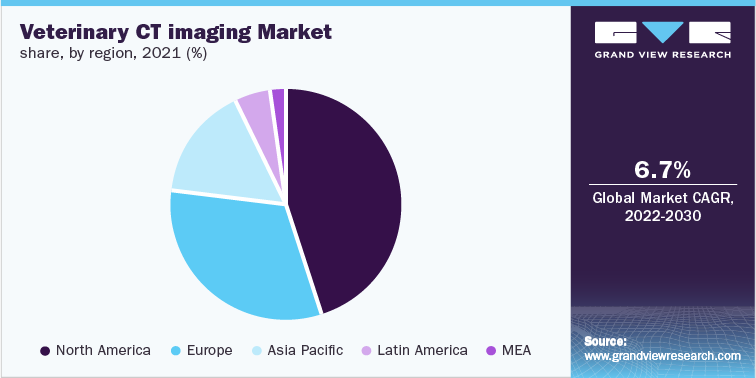

Veterinary CT Imaging Market Size USD 161.59 million in 2021 6.7% CAGR (2022-2030) |

Veterinary Video Endoscopy Imaging Market Size USD 201.13 million in 2021 5.9% CAGR (2022-2030) |

||

Veterinary Imaging Instrument Industry Outlook

The global market size for the veterinary imaging instrument was estimated at USD 1.44 Billion in 2021 and is anticipated to increase at a CAGR of 5.7% from 2022 to 2030. The market is expected to expand because of the rising pet expenditure, the number of veterinarians in developed countries, and product launches. For instance, the helical fan beam CT system has enabled quicker scanning for routine imaging of the sinuses and teeth in horses, according to the Journal of the American Veterinary Medical Association in 2020. As a result of this quality, the helical fan beam CT system has been accepted by professionals and is currently in use.

Moreover, the rising prevalence of cardiovascular disease, arthritis, lameness, and the occurrence of bone injuries in pet population is further anticipated to fuel market growth. North America held the lion’s share in the regional market. However, competition in the emerging market is increasing because nations owe to demand from consumers’ end and veterinary infrastructure development.

Key veterinary imaging equipment manufacturers are adopting strategies such as JV, M&A etc that would provide a wider consumer base and geographic footprint. For instance, Zomedica Corp. highlighted a successful acquisition of Assisi's LOOP and Calmer Canine product lines as well as assets of Revo2's imaging products in its Q3 2022 report. The combination of these two product lines would give veterinarians the chance to better care for the animals they treat while also benefiting their clinics financially, ultimately resulting in an increase in business revenue as user adoption of the products rises.

Veterinary X-Ray Market Analysis And Forecast

The global veterinary X-Ray market generated over USD 546.9 million in 2021 and is expected to grow at a CAGR of 4.0% over the forecast period. The market is driven by technological advancements in animal healthcare, which include effective assimilation of radiology information systems and teleradiology. Rising adoption in orthopedics and focus on innovation in animal health is anticipated to fuel demand.

An X-ray is a typical option for imaging to diagnose problems such as cough, trauma, fever, and troubled breathing among animals. Veterinarians use radiographs to examine pneumonia, cancer, heart problems, and other disease conditions. X-rays are the oldest but most frequently used imaging modality. Key players operating in this market are Sound; IDEXX Laboratories, Inc.; FUJIFILM Holdings America Corporation; and Carestream Health.

Veterinary Ultrasound Market Analysis And Forecast

The global veterinary ultrasound market was valued at USD 326.7 million in 2021 and is anticipated to witness growth at a rate of 6.8% over the forecast period. Ultrasonography is the second most used veterinary imaging diagnosis. It uses ultrasound waves of 1.5 MHz to 15 MHz frequency on the body parts and creates images based on the echo pattern received from tissues. Since ultrasound equipment is non-radiographic, it is cheaper than other imaging modalities, such as CT & MRI, and easily portable. Wide applicability, ease of usage and cost-effectiveness are key attributes expected to drive the growth of this market in the near future too.

Based on type, the market is segmented into 2-D ultrasound imaging, 3-D/4-D ultrasound imaging, and Doppler imaging. The 2-D ultrasound imaging segment accounted for the maximum revenue share of around 39% in 2021. The market growth is attributed to the widespread popularity of such devices in pregnancy detection as well as disease diagnosis. Furthermore, less cost as compared to other types of ultrasounds is also expected to boost the market growth.

Based on scanner type, the market is segmented into cart-based ultrasound scanners and handheld scanners. The cart-based ultrasound scanners segment accounted for the maximum revenue share of more than 50% in 2021. The market growth is attributed to their high adoption due to ease of use and extensive use in veterinary clinics, hospitals, and diagnostic centres

Based on application, the market is classified into orthopedics, cardiology, oncology, obstetrics & gynaecology, and others. The cardiology segment accounted for the maximum revenue share of around 25.0% in 2021. The increasing prevalence of cardiac disorders in animals is expected to contribute to market growth.

Based on end-use, the market is segmented into veterinary hospitals & clinics and others. The hospitals & clinics segment accounted for the highest revenue share of more than 55% in 2021. The availability of a wide range of diagnostic alternatives in hospitals and clinics is anticipated to contribute to market growth. Major players in the market such as Mindray Ltd., SOUND, and Canon, offer a wide range of affordable console/on-platform veterinary ultrasonography systems

Animal/Veterinary MRI Market Analysis And Forecast

The Veterinary MRI market was valued at USD 198.8 million in 2021 and is expected to reach over USD 300.0 million by 2030 at a CAGR of 7.3% from 2022 to 2030. Rising usage of this modality by veterinarians in whole-body imaging due to the associated benefits such as high contrast and detailed anatomical tomographic images is expected to provide a growth platform in the coming 5 years. Moreover, rising penetration in orthopaedics, neurologic, and oncologic therapeutic applications will further boost the growth of this market.

MRI in ophthalmology is highly investigated in canine fibrosarcoma and feline melanoma cases. It is now widely applied in clinical areas of nasal neoplasm, musculoskeletal diseases, shoulder diseases, elbow dysplasia, ligament injuries, and orbital & eye diseases. In addition, the application of MRI in large animal research is significantly growing. Since MRI does not use ionizing radiation, it is safe in general for pregnant animals majorly during the third or second trimester.

Animal/Veterinary CT Imaging Market Analysis And Forecast

The global super-resolution microscopes market was valued at USD 161.5 million in 2021 and is expected to grow at a CAGR of 6.7% over the forecast period. The rise in the companion animal population coupled with the growing adoption of pet insurance is anticipated to boost the market growth. Furthermore, an increasing number of veterinary practitioners and technological advancements in the sector are expected to fuel animal/veterinary CT imaging market growth.

CT has been widely explored since its first veterinary application for investigating the central nervous system in dogs and cats. In most cases, CT provides valuable images that are not precise in ultrasound or other radiography procedures. CT scans can be used in different species of animals to diagnose lesions, sinuses, jaw & dental arcade, retrobulbar region, skull, joints, and appendicular skeleton. Moreover, several bone diseases are investigated using CT scans as they can image bone curvature, angles, architecture, and thickness.

The North American region includes the U.S. and Canada, and it dominated the global market with the highest share of over 45.0% in 2021. This can be attributed to high healthcare costs and rise in the prevalence of obesity among the pet population. Furthermore, a surge in pet insurance claims is anticipated with the growing concern about pets among pet owners. For instance, it was estimated that in the U.S. pet adoption rate was around 2.48% in 2021 with about 4.0 million total pets.

Currently, the majority of North America’s market share is controlled by key companies and some emerging players. Strategic developments and initiatives by key players in the form of product launches, acquisitions, mergers, and partnerships are anticipated to boost competition and fuel market growth. For instance, in August 2020, IDEXX launched ImageVue DR30 Digital Imaging System to enhance its pet digital imaging portfolio.

Veterinary Endoscopy Imaging Market Analysis And Forecast

The global veterinary endoscopy imaging market size was valued at USD 201.13 million in 2021 and is expected to exhibit a CAGR of 5.9% during the forecast period to reach an estimated value of USD 1.79 billion by 2030.

The product type segment is divided into rigid, flexible, and other endoscopes. Rigid endoscopes dominated the market with a revenue share of over 40% in 2021. Easy product availability and usage in wider applications is a key growth facilitators for this market. As per the South Carolina Veterinary Specialists & Emergency Care, rigid endoscopes are typically used to examine the nasal passages, female urinary, reproductive tracts, exploratory evaluation and biopsy of the liver or pericardium and thoracic organs while flexible scopes are often used to study the stomach and intestines.

Asia Pacific is estimated to expand at the fastest at a CAGR of over 8% in the next few years. This is attributable to the growing pet population, awareness about animal diseases, and the presence of market players. Untapped opportunities and improving healthcare infrastructure are major factors expected to boost market growth during the forecast period.

The area of veterinary imaging is constantly evolving with new technologies that have a potential impact on the veterinary field. One such rapidly advancing technology is Artificial Intelligence (AI), especially incorporated into veterinary radiology and its respective software. For instance, an AI-based radiology software program called Vetology AI was launched by Vetology in 2019. It enables automated evaluation of various veterinary radiological parameters and directly uploads x-rays to servers securely. Implementing such AI-based strategies is a progressive step in veterinary practices. Certain radiology software with AI technology are already in the marketplace and gaining popularity due to advanced features & applications.

Technological advancements in veterinary diagnosis have created innovative solutions that can provide more veterinarians with access to greater volumes of relevant data. According to an article published in Innovative Veterinary Care in January 2021, with AI-based veterinary imaging software, vet professionals can access 200 times more data than without. In addition, such software can analyze mass information and concludes sensitive radiographs, MRI, CT, ultrasound, and other imaging interpretations rapidly. Therefore, technological innovations in veterinary radiology are contributing to market growth

Competitive Landscape

Key players operating in the veterinary imaging instrument market are IDEXX Laboratories, Inc.; Canon Medical Systems Corporation; FUJIFILM Holdings America Corporation, Samsung, Heska Corporation, and Butterfly Network, Inc. Some of the major private participants in the market are Carestream Health; Midmark Corporation; ESAOTE SPA, and SOUND. These players incorporate various strategic initiatives, such as partnerships, sales & marketing activities, mergers & acquisitions, service expansion, integrated offerings, and product launches, to strengthen their market presence.

These players are also involved in new product launches, acquisitions, and partnerships to gain a competitive edge over each other. For instance, in February 2022, Hallmarq Veterinary Imaging introduced a remote operations service. It is a subscription-based service that provides users quick remote access to MRI technologists who are certified to use a 1.5T Hallmarq Small Animal MRI scanner.