- Home

- »

- Sector Reports

- »

-

Returnable Packaging Industry Analysis, Data Book, 2030

Database Overview

Grand View Research’s returnable packaging sector database is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Returnable Packaging Industry Data Book Scope

Attribute

Details

Areas of Research

- Food & Beverage Returnable Packaging Market

- Automotive Returnable Packaging Market

- Consumer Durables Returnable Packaging Market

- Healthcare Returnable Packaging Market

Number of Reports/Presentation in the Bundle

1 Sector Outlook Report + 4 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+ countries

Cumulative of Products

10+ Products

Highlights of Datasets

- Production Data, by Countries

- Import/Export Data, by Countries

- Demand/Consumption, by Countries

- Competitive Analysis

- Food & Beverage Returnable Packaging, by Product

- Food & Beverage Returnable Packaging, by Material

- Automotive Returnable Packaging, by Product

- Automotive Returnable Packaging, by Material

- Consumer Durables Returnable Packaging, by Product

- Consumer Durables Returnable Packaging, by Material

- Healthcare Returnable Packaging, by Product

- Healthcare Returnable Packaging, by Material

Returnable Packaging Industry Data Book Coverage Snapshot

Markets Covered

Returnable Packaging Industry

USD 88.41 billion in 2022

6.1% CAGR (2023-2030)

Food & Beverage Returnable Packaging Market Size

USD 37.67 billion in 2022

5.9% CAGR (2023-2030)

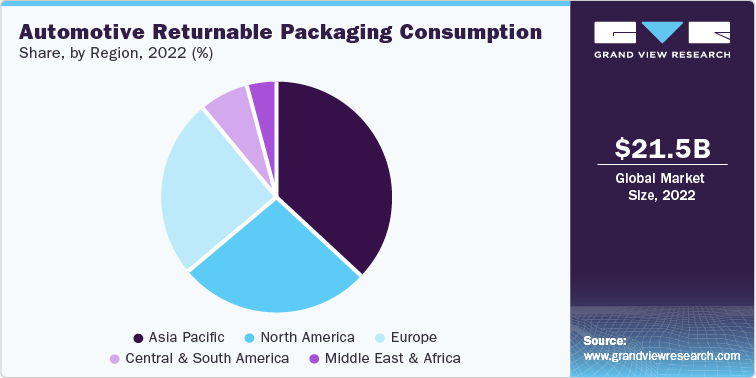

Automotive Returnable Packaging Market Size

USD 21.50 billion in 2022

5.5% CAGR (2023-2030)

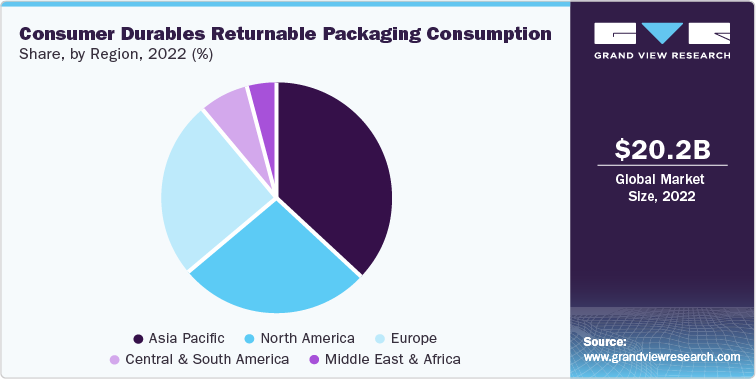

Consumer Durables Returnable Packaging Market Size

USD 20.16 billion in 2022

6.7% CAGR (2023-2030)

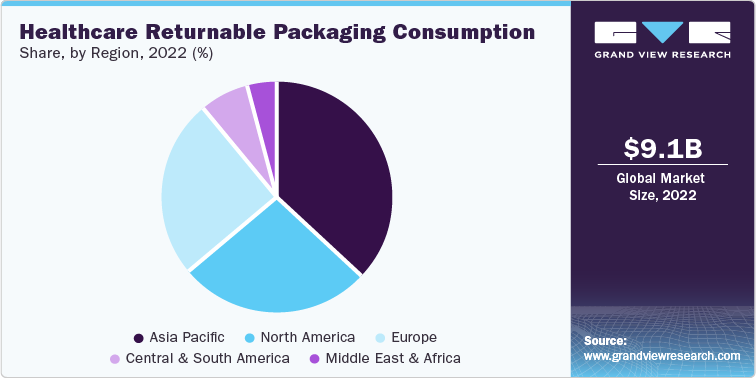

Healthcare Returnable Packaging Market Size

USD 9.07 billion in 2022

6.9% CAGR (2023-2030)

Returnable Packaging Sector Outlook

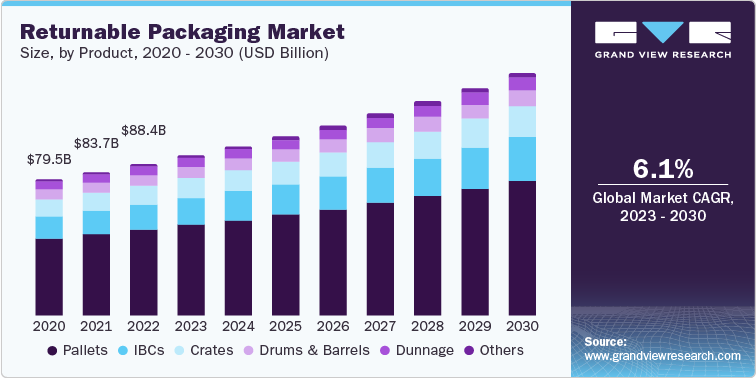

The economic value generated by the returnable packaging industry was estimated at approximately USD 88.41 billion in 2022. This economic output is an amalgamation of businesses that are involved in the raw material suppliers, manufacturers of returnable packaging products, distribution & supply, and application of returnable packaging.

Based on product, the market is categorized into pallets, crates, immediate bulk containers (IBCs), drums & barrels, dunnage, and others. Pallets dominated the returnable packaging market in 2022 with the highest revenue share and are expected to maintain the dominance by 2030. Materials like wood, plastics, steel, and aluminum are commonly used for manufacturing the pallets. High load handling capacity and higher handling & storage efficiencies are driving the demand for pallets in the global market.

In addition, the IBCs segment is expected to grow at a rapid CAGR of 7.2% during the forecast period. Growing pharmaceutical and chemical sectors in developing and emerging markets like Brazil, India, and China are expected to drive the global demand for IBCs. The penetration of IBCs in the beverage industry is rapidly increasing coupled with the growing demand for sustainable and cost-effective packaging solutions from these industries for international trade is expected to drive the demand for IBCs.

Based on material, the returnable packaging market is segmented into plastic, metal, and wood. The plastic segment accounted for the largest share of over 63.0% in 2022. Packaging solutions produced from plastic films such as high-density polypropylene (HDPE) and polypropylene (PE) are easily cleanable and are resistant to corrosion, harsh climate, and solvents. They are extremely capable of handling shocks during transport and are easy to handle with a forklift and other material-handling equipment. Plastic packaging solutions resist chemicals and can handle all weather conditions making them perfect for the pharmaceutical, chemical, food, and beverage industry which is expected to fuel the market growth for this segment.

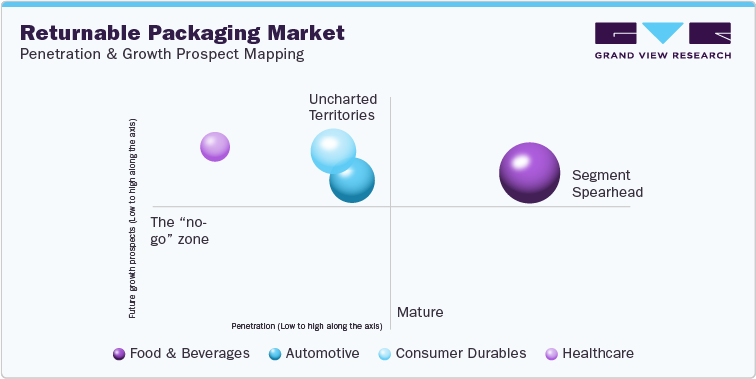

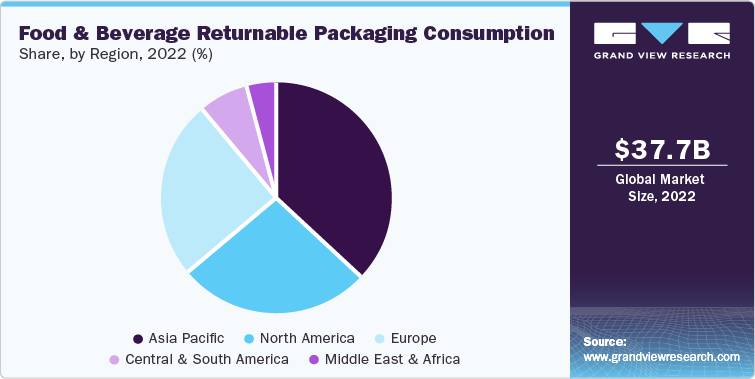

The food & beverage segment recorded the highest market share in 2022 due to innovative products like intermediate bulk containers such as rigid intermediate bulk containers and flexible intermediate bulk containers, flexitanks gaining popularity in the bulk transport of food & beverages owing to low cost, high efficiency, and high storage capacity.

For the past decade, crates, trays, and pallets made of wood and plastic have been an integral part of the food & beverage sector, simplifying the storage and transport of the products.

Various products like pallets, crates, flexi tank systems, and containers facilitate storage and transport using advanced technologies like IoT, RFID, and others. Innovative products like intermediate bulk containers such as rigid intermediate bulk containers and flexible intermediate bulk containers, flexitanks are gaining popularity in the bulk transport of food and beverages owing to low cost, high efficiency, and high storage capacity.

The global returnable packaging market, by value, was estimated at USD 88.41 billion in 2022, which is expected to reach USD 141.4 billion by 2030, growing at a CAGR of 6.1% from 2023 to 2030. This is due to the growing demand for sturdy and durable material handling solutions. Returnable packaging eliminates packaging waste going into landfills and thus is highly sustainable. Increasing adoption of sustainable packaging solutions by end-users to improve their brand reputation, coupled with rising regulatory pressure regarding the use of plastic packaging, is expected to fuel market growth.

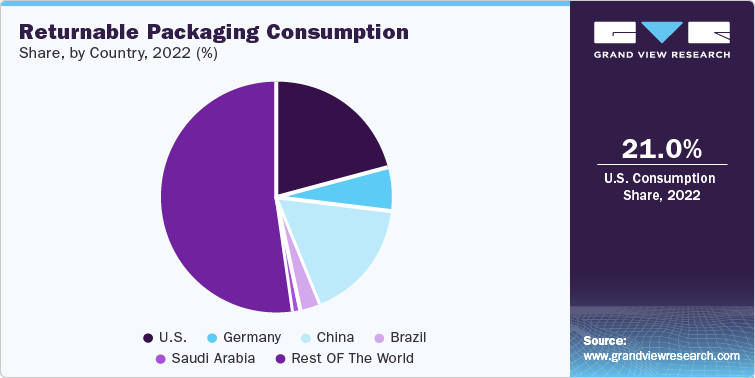

Furthermore, North America is among the prominent regions for the returnable packaging market due to large-sized pharmaceuticals, food & beverages, and automotive companies in the U.S., Mexico, and Canada. In July 2020, the North America Free Trade Agreement (NAFTA) substituted the United States-Mexico-Canada Agreement (USMCA). NAFTA was aimed at boosting the trade between North American countries. Thus, such an optimistic political scenario or trade relations are likely to favor the market growth in the region.

In 2022, plastic dominated the material segment in North America, and the segment is likely to witness robust growth from 2023 to 2030. The sturdy nature, low cost, and low weight of plastic-based reusable packaging containers are mainly attributed to the segment’s highest share in 2022. In addition, plastic-based containers are contamination-free and can be cleaned easily, unlike wooden containers which are highly preferred over wood-based containers by the food & beverage and pharmaceutical industries.

Food & Beverage Returnable Packaging Market Analysis And Forecast

Food and beverage dominated the returnable packaging market in 2022 and is expected to maintain the lead in 2030. For the past decade, crates, trays, and pallets made of wood and plastics have been an integral part of the food & beverage sector, simplifying the storage and transport of the products.

This is due to the strong presence of key bakery, and processed meat and beverage companies such as Associated British Foods plc, Warburtons, and Nestlé in the region. The companies are continuously involved in new product developments and production aiming to meet consumer demands. Increasing production activities by such companies are expected to drive the demand for returnable packaging solutions which will affect the market positively.

Key players in the food & beverage returnable packaging market include Huhtamaki Oyj; Berry Global Inc.; Sealed Air Corporation; and Amcor Plc. Manufacturers of food & beverage returnable packaging aim to strengthen their market position by developing new product offerings and carrying out our research and development related to their packaging products. For instance, in September 2022, CHEP and Cabka collaborated to supply reusable containers out of recycled plastics. These containers are customized to CHEP’s performance requirements and are set to maximize the use of recycled materials facilitating a fully circular approach.

Automotive Returnable Packaging Market Analysis And Forecast

Returnable packaging has been an integral part of the automotive supply chain over the past decade. Packaging products like pallet crates, containers, and dunnage are primarily used to store and transport automobiles and assembly parts, body panels, and other parts. The production of automobiles around the world has been increasing since the past decade with an increasing population and higher income levels. Increasing automotive output is also expected to fuel the auto ancillary industry.

Developing countries like India, Brazil, and China have established a strong supply chain for automobiles and have significant export levels. Automotive assembly lines need bulk packaging solutions like pallets, crates, bins, and containers produced from metal and plastics. The development of electric vehicles to increase sustainability and environmental protection is also expected to increase the demand for returnable packaging solutions from the automotive industry.

The COVID-19 pandemic adversely affected the production and sales in the automotive industry in 2020. Lockdown implemented in major automobile hubs like China, India, the U.S., Germany, and Brazil has reduced the industry output significantly. Growing fears for the second wave of the infection from COVID-19 affected the demand for returnable packaging products.

Consumer Durables Returnable Packaging Market Analysis And Forecast

Consumer durable includes packaging solutions for televisions, washing machines, refrigerators, air conditioners, cellphones, laptops, and others. Kitchen appliances like microwave ovens, mixers, grinders, and juicers also require packaging solutions for transport. Consumer durables commonly use corrugated boxes, containers, dunnage, and other products for packaging. Demand for sustainable and environmentally friendly packaging solutions for these products is increasing owing to changing consumer preferences and government regulation. Increasing the global population coupled with a high rate of urbanization and rising income levels is expected to fuel the demand for innovative packaging solutions for consumer durables such as returnable packaging products.

Healthcare Returnable Packaging Market Analysis And Forecast

Healthcare is the fastest-growing end-use of the returnable packaging market owing to remarkable growth in demand for pharmaceutical and healthcare products. Medical OEMs and equipment manufacturers use the returnable packaging solution for the transportation of various equipment like ventilators, oxygenators, heart rate monitors, and others. Transportation of sensitive and fragile equipment requires reliable, strong packaging solutions capable of absorbing shocks and withstand harsh transportation conditions. The COVID-19 pandemic also increased the demand for healthcare equipment like ventilators and contributed to the demand for returnable packaging solutions in 2020.

The pharmaceutical industry requires packing products like pallets, containers, FIBCs, drums, and barrels for the transportation of chemicals, medicines, drugs, and vaccines in bulk quantities. The increasing number of old population in countries like Japan, Germany, Italy, Portugal, and other European countries is expected to increase the demand for pharmaceutical products and healthcare equipment which is expected to drive demand for the returnable packaging from the healthcare end-use industry. The development of the COVID-19 vaccine contributed to the additional demand for these packaging solutions for the safe transport, storage, and distribution of vaccine vials.

Competitive Insights

The returnable packaging market is highly competitive with the presence of both global and regional companies. Companies operating in the market offer a wide range of products that are available in a variety of shapes, sizes, and colors. Moreover, they offer custom packaging products to suit customer-specific requirements.

The market has also witnessed several new product launches and mergers and acquisitions over the last few years. The industry players are adopting several strategies including collaborations, mergers & acquisitions, joint ventures, and partnership agreements to increase the customer base and individual market share.

-

In April 2023, Brambles announced the completion of the merger between CHEP, a returnable packaging manufacturer, and LOSCAM, a pooling and returnable packaging solutions provider for supply chains. This merger will help Brambles to meet the increasing demand for returnable packaging solutions with an effective supply chain.

-

In September 2020, Orbis Corporation introduced a new New Odyssey Pallet to its rackable plastics family of pallets. The new pallet is designed for use in heavy-duty racking applications to its suite of plastic pallet product offerings. The said pallet has a robust solution that helps in heavy loads and offers stability with unique design features, including molded-in frictional elements and optional steel reinforcements.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified