- Home

- »

- Sector Reports

- »

-

Positive Displacement Pump Industry Trends Data Book, 2030

Database Overview

Grand View Research’s positive displacement pump sector database is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

Positive Displacement Pumps Industry Data Book Scope

Attribute

Details

Areas of Research

- Rotary Pump Market

- Reciprocating Pump Market

Number of Reports/Presentations in the Bundle

1 Sector Outlook Report + 3 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+ countries

Cumulative Coverage of Products

10+ Products

Highlights of Datasets

- Demand/Consumption, by Counties

- Competitive Analysis

- Positive Displacement Pumps, by type

- Positive Displacement Pumps, by end-use

- Positive Displacement Pumps, by region

Positive Displacement Pumps Industry Data Book Coverage Snapshot

Markets Covered

Positive Displacement Pumps Industry

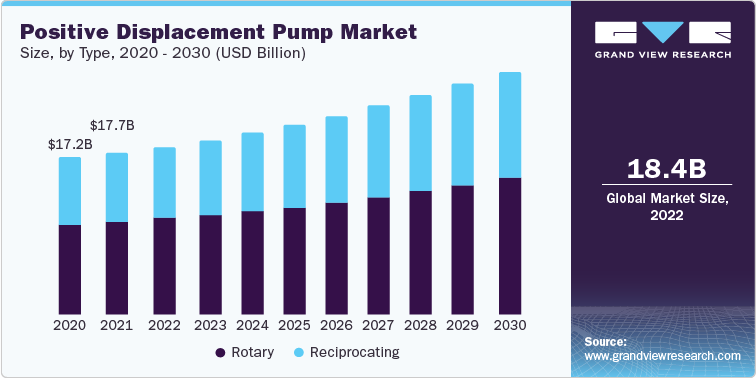

USD 18.35 billion in 2022

Rotary Pump Market Size

USD 10.42 billion in 2022

4.5% CAGR (2023-2030)

Reciprocating Pump Market Size

USD 7.93 billion in 2022

5.0% CAGR (2023-2030)

Positive Displacement Pump Sector Outlook

The economic value generated by the positive displacement pump industry was estimated at approximately USD 18.35 billion in 2022. The demand from various industries such as oil & gas, chemicals, pharmaceuticals, and water treatment is driving this market’s growth. Positive displacement pumps, known for their precision and ability to handle a wide range of fluids, were increasingly adopted for critical applications where accuracy and reliability were paramount. Technological advancements, including the integration of smart and energy-efficient features, were enhancing the overall outlook of the sector. However, the specific outlook can be influenced by economic conditions, technological developments, and industry trends, so it is advisable to check more recent sources for the latest information.

Positive displacement pumps transfer the fluid mechanically by repeatedly enclosing a fixed volume with the help of seals or valves. The pump’s action is cyclic, which is driven by screws, lobes, diaphragms, vanes, or gears. These are preferred in the oil & gas industry mainly because of the limitations of the centrifugal pumps. Positive displacement pumps work at lower speeds which makes them less prone to damages caused by high viscosity oils and slurries. These are used when applications require accurate dosing. The industry is further segmented into reciprocating and rotary pumps.

Share of Major Positive Displacement Pump Countries by Type

Total, 2022

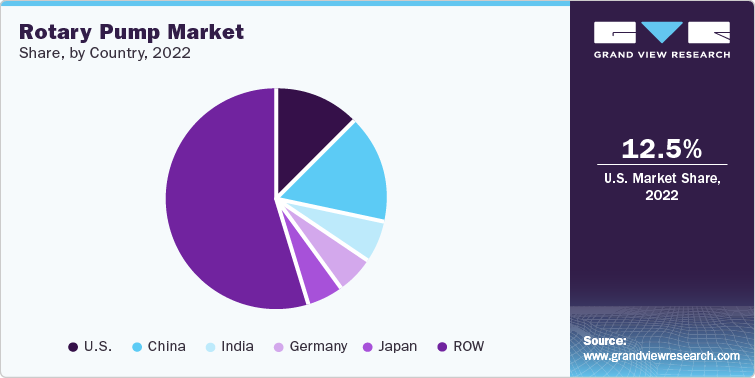

Rotary, 2022

Reciprocating, 2022

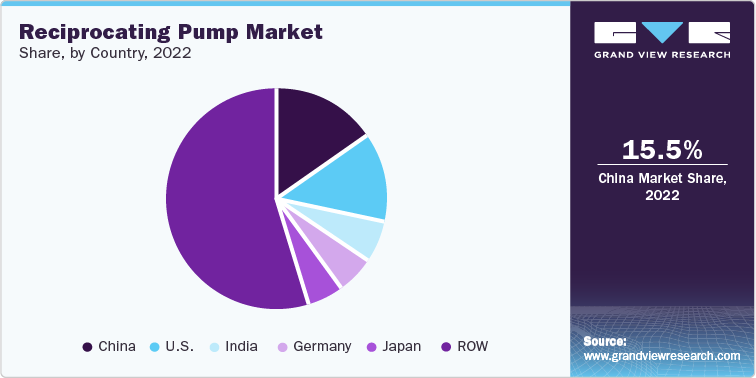

USD Billion

18.35

USD Billion

10.42

USD Billion

7.93

U.S.

12.7%

U.S.

12.5%

U.S.

15.5%

China

15.8%

China

16.0%

China

13.0%

India

6.0%

India

6.0%

India

6.0%

Germany

5.6%

Germany

5.7%

Germany

5.4%

Japan

5.2%

Japan

5.1%

Japan

5.3%

Rest of the World

54.7%

Rest of the World

54.7%

Rest of the World

54.8%

Source: Grand View Research

The rise of Industrial IoT is poised to transform the manufacturing environment by developing a digitally connected ecosystem. End-users across multiple industry verticals are eager to invest in IoT technologies that enable them to make their assets smarter and more intuitive in the current context, with increased demand to control operating expenditure and improve production efficiency. This trend is influencing the positive displacement pumps industry, where several leading and niche manufacturers are actively investigating IoT-based solutions to integrate intelligence into their product offerings.

The integration of IoT in positive displacement pumps has revolutionized the industrial landscape by enhancing efficiency, predictive maintenance, and overall performance. IoT-enabled pumps gather real-time data, allowing for continuous monitoring of the key parameters such as pressure, temperature, and flow rates. This data is then analyzed to predict potential issues, enabling proactive maintenance to prevent downtime. Additionally, IoT facilitates remote monitoring and control, optimizing operations and reducing the need for on-site interventions. The connectivity and data-driven insights provided by IoT, empower businesses to make informed decisions, improve energy efficiency, and extend the lifespan of positive displacement pumps, thereby positively impacting the market through increased reliability and cost-effectiveness.

The innovations in positive displacement pump technology have increased pump dependability, improved process operations, and offered long-term declines in routine operating procedures. These developments have also improved performance and dependability while using less energy. These advanced positive displacement pumps are used in various end-use industries such as agriculture, power, industrial wastewater, and chemicals, thereby augmenting their demand.

Rotary Pump Market Analysis And Forecast

Rotary pumps are a type of positive displacement pump that move a fixed volume of fluid with each revolution. These self-priming pumps give nearly constant supplied capacity regardless of pressure. These offer distinct advantages in various applications due to their unique design and operational characteristics. Known for their continuous and smooth fluid transfer, these pumps excel in handling viscous liquids, making them essential in industries such as oil & gas, petrochemicals, and food processing.

The positive displacement nature of rotary pumps ensures consistent flow rates, enabling precise control in various processes. Their ability to handle a wide range of viscosities, from thin liquids to highly viscous substances, enhances their versatility. Moreover, rotary pumps often require minimal maintenance, contributing to cost-effectiveness and operational efficiency. These rotary pumps play a pivotal role in ensuring reliable and efficient fluid transfer across diverse industrial sectors.

Rotary pumps find a wide range of applications worldwide, with their maximum usage often seen in industrial settings. These pumps are commonly employed in various sectors, including manufacturing, oil & gas, and wastewater treatment. China, in particular, has a significant demand for rotary pumps due to its vast industrial infrastructure. These pumps play a crucial role in transporting fluids and viscous materials efficiently, making them indispensable in maintaining and operating industrial processes.

Reciprocating Pump Market Analysis And Forecast

Reciprocating pumps are characterized by their versatility and widespread use across multiple industries. These pumps operate through back-and-forth linear motion, making them suitable for applications where precise control and high pressure are required. Key insights into this market include a strong presence in the oil & gas sector for tasks like well stimulation and transfer of crude oil.

The chemical industry also relies on reciprocating pumps for accurate dosing of chemicals. The pharmaceutical and food processing industries also utilize them for their precision in handling sensitive materials. As sustainability gains importance, reciprocating pumps are increasingly used in carbon capture and sequestration systems, reflecting a growing emphasis on eco-friendly practices. Overall, the reciprocating pump market continues to evolve to meet the diverse needs of these industries.

Reciprocating pumps offer several advantages, including their ability to provide high-pressure output, precise control of flow rates, and efficient handling of viscous or abrasive fluids. These pumps are commonly used in applications that demand accuracy and reliability, such as the oil and gas industry for well stimulation and crude oil transfer. They are also vital in chemical manufacturing for precise dosing of chemicals, and their ability to handle a wide range of fluids makes them ideal for applications in pharmaceuticals and food processing. Moreover, reciprocating pumps are increasingly employed in carbon capture and sequestration systems, contributing to environmental sustainability efforts.

Competitive Insights

Major market players include Ingersoll Rand SPX Flow; Alfa Laval; Viking Pump, Inc.; Grundfos; Schlumberger Limited; KSB Group; and Sulzer Ltd. Positive displacement pump manufacturers adopt strategies such as mergers & acquisitions, partnerships & joint ventures, new product developments, distributor agreements, new online channels, and geographical expansions, to gain greater market presence and cater to the ever-changing consumer requirements.

Strategies adopted by industry players usually include product portfolio expansions, collection network expansions, and geographic network expansions:

-

In August 2023, Edwards Vacuum introduced the E2S series, a rotary vane vacuum pump designed for applications in industry and research, offering shorter cycle times, higher throughput, and user-friendly operation. The E2S series includes three pump sizes: E2S 45, E2S 65, and E2S 85. This rotary vane pump is well-suited for vacuum drying, degassing, heat treatment, vacuum furnaces, leak testing in automotive manufacturing, coating applications, and various research and analytical applications.

-

In April 2023, Packo unveiled the ZLC rotary lobe pump, certified as 3A compliant, targeting the pharmaceutical, biotech, and cosmetic industries. The ZLC pump is ideal for a wide range of applications, from cosmetic and personal hygiene products to medical and pharmaceutical substances, ensuring the highest safety and hygiene standards.

-

In March 2023, KSB Limited acquired proprietary technology from Bharat Pumps and Compressors Ltd., granting exclusive ownership and rights to the technology of BP&CL's product line. This strategic move enables KSB Limited to leverage its strengths and market potential, expanding its product offerings in new pump systems as well as aftermarkets.

-

In November 2022, Pfeiffer Vacuum launched the SmartVane rotary vane pump for mass spectrometry applications, such as ICP-MS and LC/MS, across environmental, food, pharmaceutical, and clinical analytics sectors. The SmartVane is engineered to prevent oil leaks and contamination, offering longer maintenance intervals due to its integrated motor design.

-

In November 2022, Vogelsang GmbH & Co KG introduced the HiCone progressive cavity pump for biogas plants, supporting high pumping capacities of up to 290 m3/h.

-

In September 2022, Ingersoll Rand finalized the acquisition of Pedro Gil Construcciones Mecánicas S, a Spanish manufacturer of pumps, positive displacement blowers, and vacuum systems. This addition bolstered Ingersoll Rand's presence in the Industrial Technologies and Services segment.

-

In August 2022, Ingersoll Rand acquired Hydro Prokav, a company with an annual revenue of approximately USD 6 million, predominantly from aftermarket parts. This strategic acquisition expanded Ingersoll Rand's footprint in progressive cavity pumps and complemented the Seepex acquisition, facilitating further market penetration in India and Southeast Asia. Hydro Prokav became a part of Ingersoll-Rand's Precision and Science Technologies segment.

-

In May 2022, NETZSCH expanded its positive displacement pump offerings with the PERIPRO Peristaltic Pump, known for its ability to deliver substantial flow rates at a wide pressure range. These pumps are characterized by extended operational life, ease of use, and energy savings of up to 30% compared to other hose pumps, attributed to their innovative design.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified