Plastic Processing Machinery Industry Data Book - Plastic Injection Molding Machine, Plastic Extrusion Machinery, Plastic Blow Molding Machine Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Jul, 2023

- Report ID: sector-report-00188

- Format: Electronic (PDF)

- Number of Pages: 350

Database Overview

Grand View Research’s plastic processing machinery industry data book is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

Plastic Processing Machinery Industry Data Book Scope

|

Attributes |

Details |

|

Areas of Research |

|

|

Number of Reports/Presentations in the Bundle |

1 Sector Outlook Report + 5 Summary Presentations for Individual Areas of Research + 1 Statistic eBook |

|

Cumulative Coverage of Countries |

50+ Countries |

|

Cumulative Coverage of Products |

10+ Products |

|

Highlights of Datasets |

|

Plastic Processing Machinery Industry Data Book Coverage Snapshot

|

Markets Covered |

||

|

Plastic Processing Machinery Industry USD 21.13 billions in 2022 |

||

|

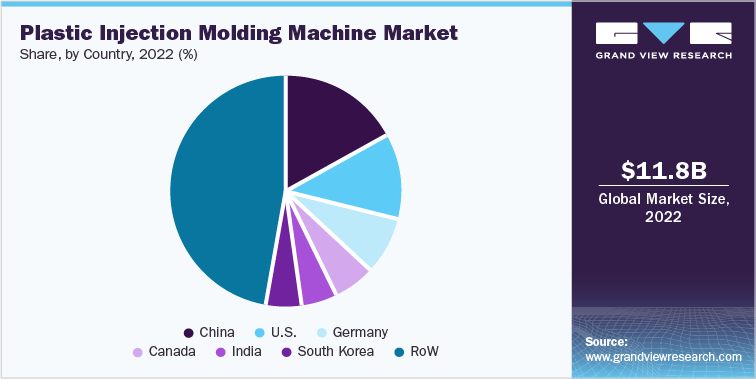

Plastic Injection Molding Machine Market Size USD 11.75 billions in 2022 4.8% CAGR (2023-2030) |

Plastic Extrusion Machinery Market Size USD 6.41 billions in 2022 4.4% CAGR (2023-2030) |

Plastic Blow Molding Machine Market Size USD 2.97 billions in 2022 3.9% CAGR (2023-2030) |

Plastic Processing Machinery Sector Outlook

The economic value generated by the plastic processing machinery industry was estimated at approximately USD 21.13 billion in 2022. This market incorporates a wide range of equipment used in the manufacturing and processing plastic products, including injection molding machines, blow molding machines, extrusion machines, and more. The demand for plastic products across various industries, such as packaging, automotive, electronics, and construction, has been a key driver for the expansion of this market.

Manufacturers are incorporating automation, robotics, and artificial intelligence into their machines to enhance efficiency, productivity, and precision in the production process. These technological advancements have led to improved cycle times, reduced waste, and increased flexibility, allowing manufacturers to meet the ever-changing demands of the industry. Additionally, there is a growing focus on sustainability within the plastic processing machinery market. With increasing concerns about plastic waste and its impact on the environment, there is a greater emphasis on developing machinery that promotes recycling, reusability, and the use of biodegradable materials.

Share of Major Plastic Processing Machinery Countries, by Product

|

Total, 2022 |

Plastic Injection Molding Machine, 2022 |

Plastic Extrusion Machinery, 2022 |

Plastic Blow Molding Machine, 2022 |

||||

|

USD Billion |

21.13 |

USD Billion |

11.75 |

USD Billion |

6.41 |

USD Billion |

2.97 |

|

China |

17% |

China |

17% |

China |

17% |

China |

18% |

|

U.S. |

13% |

U.S. |

12% |

U.S. |

13% |

U.S. |

13% |

|

Germany |

8% |

Germany |

8% |

Japan |

7% |

Germany |

8% |

|

Canada |

5% |

Canada |

6% |

Germany |

6% |

Canada |

6% |

|

Japan |

5% |

India |

5% |

India |

6% |

India |

5% |

|

Canada |

5% |

South Korea |

5% |

UK |

4% |

Japan |

4% |

|

Rest of the World |

47% |

Rest of the World |

47% |

Rest of the World |

47% |

Rest of the World |

48% |

The plastic processing machinery market is also witnessing significant regional growth. Developing economies, particularly in the Asia Pacific, are experiencing rapid industrialization and urbanization, driving the demand for plastic products and, consequently, the need for plastic processing machinery. Additionally, emerging markets are attracting investments from global players, leading to the establishment of manufacturing facilities and the adoption of advanced machinery in these regions.

Plastic Injection Molding Machine Market Analysis And Forecast

Plastic injection molding machines are used to produce numerous products in numerous industries including packaging, medical, electronics, firearms, aerospace, construction, and consumer goods. it is among the most essential processes for mass production. Technological breakthroughs in injection molding machines, including their ability to shape different raw materials into desired shapes, have led to the replacement of traditional molding machines with new injection molding machines. As a result, the global demand for automated and energy-efficient injection molding machines is continuously increasing. This, in turn, fuels the growth of the injection molding machine market.

The packaging industry occupies one of the significant chunks in the plastic injection molding material market. Injection molding has several applications in the packaging industry. It is used to make thin wall containers, dairy juice & water packaging, beverage caps & closure, and specialty closures among others. The market is projected to witness growth opportunities in emerging economies of Asia Pacific and Central & South America, with rising investments in the automotive, packaging, and electronics industries owing to economic development in India, China, Brazil, and Argentina.

Plastic Extrusion Machinery Market Analysis And Forecast

Plastic extrusion is a manufacturing process involving melting plastic materials and shaping them into a continuous profile through a die. This technology has wide-ranging applications in various industries, including packaging, construction, automotive, and electronics. Moreover, the low cost per part, flexibility in operation, high production volume, and compounding ability are the other factors responsible for the growing demand for extrusion machinery.

The market for plastic extrusion machinery has been driven by several factors. Firstly, the increasing demand for plastic products, particularly in developing economies of Asia Pacific and Central & South America, has fueled the need for efficient and high-capacity extrusion machinery. Additionally, advancements in technology have led to the development of more sophisticated and automated extrusion equipment, improving productivity and reducing production costs. Furthermore, the expansion of end-use industries such as packaging and construction has provided significant opportunities for the plastic extrusion machinery market. The packaging industry, in particular, has witnessed a surge in demand for extruded plastic products like films, sheets, and containers due to their lightweight, durability, and cost-effectiveness.

Plastic Blow Molding Machine Market Analysis And Forecast

The demand for blow molding machines has been fueled by the increasing use of plastic containers, bottles, and other hollow plastic products in various industries, including packaging, automotive, consumer goods, and construction. These machines are essential for the efficient and cost-effective production of high-quality plastic products on a large scale. Manufacturers are investing in advanced blow molding machines that offer improved automation, energy efficiency, and versatility in terms of mold capabilities and production speed. The market is witnessing the development of new technologies and innovations that enhance the efficiency and capabilities of blow molding machines, leading to higher productivity and reduced production costs.

The growing focus on sustainability and environmental consciousness has also influenced the plastic blow molding machine market. Many manufacturers are investing in machines that enable the use of recycled materials or employ eco-friendly production techniques. Geographically, the market for plastic blow molding machines is widespread, with significant growth observed in regions such as Asia Pacific, North America, and Europe. The expanding consumer base, rapid industrialization, and increasing investments in various end-use industries contribute to the market’s growth in these regions.

Competitive Insights

Major players in the plastic processing machinery market include Arburg GmbH + Co KG., KraussMaffei, Haitian International, Milacron, Nissei Plastic Industrial Co., Ltd. ENGEL AUSTRIA GmbH., Chen Hsong Holdings Limited, UBE Machinery Corporation, Ltd., and Husky Injection Molding Systems Ltd. The manufacturers of plastic processing machinery adopt several strategies, including acquisitions, mergers, joint ventures, new product developments, and geographical expansions, to enhance their market penetration and cater to the changing technological requirements of various end-users such as automotive, consumer goods, packaging, and electronics, among others.

Strategies adopted by the companies usually include product portfolio expansion, collection network expansion, and geographic network expansion.

-

In April 2023, Haitan International announced the expansion of new production and logistic network facility, with a total area of 250,00 square meters at its site in Ruma, Serbia. This plant will be operational in the first quarter of 2025.

-

In February 2023, ARBURG GmbH + Co KG launched Two hybrid ALLROUNDER 470 H machines. Compared to a hydraulic machine, the new ALLROUNDER 470 H boasts an energy footprint that is up to 50% better and can save up to 12,000 kg of CO2 per year.

-

In September 2022, KraussMaffei completed the construction of the new plant Laatzen near Hanover. The new plant will use for the production of recycling equipment and extrusion systems for the rubber and plastics processing sector

-

In April 2021, the company launched a multi-purpose co-extruder uniEX single screw extruder series. These extruders can now be used for board and sheet extrusion. This new series of extruders come in a compact design, has a wide processing window, and has high quantities with mild melt treatment. They are available in three sizes, 35, 45, and 60 mm, and have output rates ranging from 50 kilograms per hour to 500 kilograms per hour, depending on the material

-

In July 2021, NISSEI PLASTIC INDUSTRIAL CO., LTD. merged its U.S.-based sales subsidiary NISSEI AMERICA, INC., and its production subsidiary, NISSEI PLASTIC MACHINERY AMERICA INC. to enhance its global production and sales structures

-

In April 2021, AMUT S.P.A launched a single calendar extruder to manufacture waterproofing membranes. The outline of the extruder allows manufacturing in one single step a co-extruded 3-layer membrane, resulting in diversified membrane production and minimized costs