- Home

- »

- Sector Reports

- »

-

Plastic Packaging Industry Overview Data Book, 2023-2030

![Plastic Packaging Industry Overview Data Book, 2023-2030]()

Plastic Packaging Industry Data Book - Food & Beverage, Personal & Household, Industrial and Pharmaceutical/ Healthcare Plastic Packaging Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Jul, 2023

- Report ID: sector-report-00183

- Format: Electronic (PDF)

- Number of Pages: 350

Database Overview

Grand View Research’s plastic packaging sector data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Plastic Packaging Industry Data Book Scope

Attributes

Details

Areas of Research

- Food & Beverage Plastic Packaging Market

- Personal & Household Plastic Packaging Market

- Industrial Plastic Packaging Market

- Pharmaceutical/ Healthcare Plastic Packaging Market

Number of Reports/Presentations in the Bundle

1 Sector Outlook Report + 4 Summary Presentations for Individual Areas of Research + 1 Statistic Book

Cumulative Coverage of Countries

50+ Countries

Cumulative of Products

10+Products

Highlights of Datasets

- Production Data, by Countries

- Import/Export Data, by Countries

- Demand/Consumption, by Countries

- Plastic Consumption Per Captia

- Competitive Analysis

- Food & Beverage Plastic Packaging, by Product

- Personal & Household Plastic Packaging Market, by Product

- Industrial Plastic Packaging Market, by Product

- Pharmaceutical/ Healthcare Plastic Packaging Market, by Product

Plastic Packaging Industry Data Book Coverage Snapshot

Markets Covered

Plastic Packaging Industry

USD 347.35 billion in 2022

Food & Beverage Plastic Packaging Market Size

USD 190,550.86 million in 2022

3.7% CAGR (2023-2030)

Personal & Household Plastic Packaging Market Size

USD 70,911.49 million in 2022

3.8% CAGR (2023-2030)

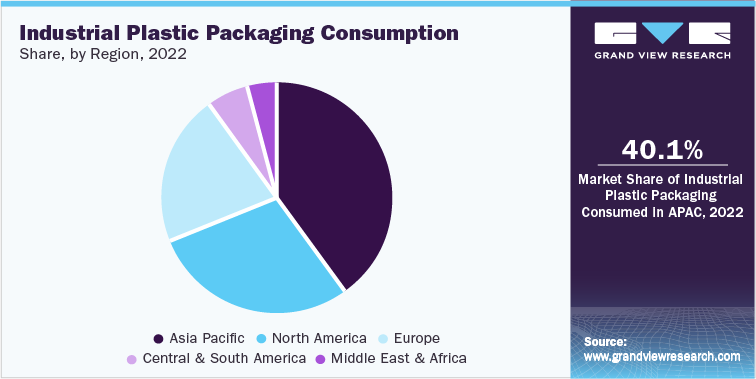

Industrial Plastic Packaging Market Size

USD 45,638.55 million in 2022

3.0% CAGR (2023-2030)

Pharmaceutical/ Healthcare Plastic Packaging Market Size

USD 40,249.05 million in 2022

4.1% CAGR (2023-2030)

Plastic Packaging Sector Outlook

The economic value generated by the plastic packaging industry was estimated at approximately USD 347.35 Billion in 2022. This economic output is an amalgamation of businesses that are involved in the raw material suppliers, manufacturers of plastic-based packaging products, distribution & supply, and application of plastic packaging.

Material types in the plastic packaging market include polyethylene terephthalate (PET), polyethylene (PE), polystyrene (PS), polypropylene (PP), polyvinyl chloride (PVC), and others. Polypropylene is widely gaining acceptance as a material in manufacturing plastic packaging products due to its flexibility and malleability, making it suitable to be extruded or molded into a variety of shapes and sizes for plastic packaging products for various end-use industries. In addition, PP can withstand repeated steam sterilization cycles, impermeability to water, greasy substances, and chemical & bio inertness making it suitable for pharmaceutical/healthcare packaging. Similarly, PET is gaining acceptance in the food & beverage market due to its properties such as transparency, flexibility, light weight, chemical resistance, and temperature resistance.

According to the Advisory Committee on Packaging (ACP), food waste has a higher environmental impact in the form of its carbon footprint compared to the same of packaging waste. Plastics play a major role in protecting food and preserving food value. There are many types of plastics available in the market which possess a variety of functional properties such as being food safe, transparent, heat, and chemical resistant which has driven their demand in food packaging. Furthermore, sustainable packaging awareness is seen to be growing due to which recyclable plastics are witnessing a strong demand and contribute to plastic consumption in the packaging sector.

The food & beverage segment emerged out to be the segment spearhead for the plastic packaging market during the forecast period of 2023 to 2030. This is majorly attributed to the wide range of packaging options available, the popularity of flexible packaging among consumers, and attractive printability on plastic packaging products. Personal & household care application for plastic packaging follows growth in demand for personal care products in recent years and is expected to grow further in the coming years driving its penetration mapping position. Industrial packaging application for plastics is a mature market, and hence will not experience high growth rates when compared to other applications.

The global plastic packaging market is expected to witness significant growth globally. This is attributed to the growth in population and urbanization which are increasing the volumes of trade between countries and hence driving the demand for plastic packaging. For instance, bulk transportation plastic packaging products such as IBC liners, container liners, and drums are used to export food & beverage, industrial fluids, and home care and personal care chemicals.

According to the World Bank, many countries in North America, Europe, Asia Pacific, the Middle East, and Central & South America have significant populations falling in the range of middle to high income. A rise in the millennial population shifts customer behaviors resulting in increased purchasing of more opulent convenience goods like ready-to-eat vegetables, fruits, and fresh meals. The rising income also encourages on-the-go consumption, thus driving the demand for convenient takeaway packaging and favoring the plastic packaging demand.

However, the growing environmental concerns regarding plastic packaging waste accumulation have driven various governments across different countries to introduce regulations related to plastic consumption in packaging. These regulations are aimed at reducing plastic consumption in packaging and moving towards sustainable materials. For instance, on 16 February 2023, the Taiwan government published the regulations related to packaging used in internet shopping which is expected to come into effect on July 1, 2023. These regulations apply to internet-based retailers and not to individual retailers on e-commerce platforms. Some of the restrictions mentioned in the regulation are, packaging materials should not contain polyvinyl chloride and the recycled materials blending ratio should be 25% and more for plastic packaging.

Also, on June 13, 2023, the Government of the Netherlands announced its intent to introduce new regulations governing plastic go packaging from July 2023 onwards. This new rule covers a variety of plastic go packaging such as containers, cups, plates, and disposable cutlery and applies to establishments offering takeaway food & drinks.

Food & Beverage Plastic Packaging Market Analysis And Forecast

Food and beverage is one of the largest markets with a significant impact on the global economy and is constantly growing at a significant rate owing to the rising population around the globe. Changing lifestyles, high rates of urbanization, and increased per capita income are driving the demand for packaged food and beverages, which, in turn, is driving the plastic packaging market.

The global food & beverage plastics packaging market is expected to witness growth on account of rising demand for packaged food & beverage demand in developed and developing economies, stringent regulations regarding the preservation of packaged food shelf life, and more convenient features offered by plastic packaging compared to other types of packaging. The convenience can be in the type of weight, price, heat-sealable, portability, and ease of use. Growing demand for packaged ready-to-eat meals, snacks, beverages, and other food products is substantially propelling the penetration of packaging in the food & beverage sector which can positively drive the demand for food & beverage plastic packaging.

Key players in the food & beverage plastic packaging market include Huhtamaki Oyj; Berry Global Inc.; Sealed Air Corporation; and Amcor Plc. Manufacturers of food & beverage plastic packaging aim to strengthen their market position by developing new product offerings and carrying out our research and development related to their packaging products. For instance, on March 9, 2023, Berry Global Inc. collaborated with Everbrand to package IS-FRITT brand products in post-consumer recycled plastic containers. Herein, Berrgy Global Inc. will supply its SuperLift brand containers with 50% PCR content consisting of polypropylene.

Personal & Household Plastic Packaging Market Analysis And Forecast

Rising consumption of cosmetics, along with increasing disposable income and demand for personal care products, is likely to drive the demand for plastic packaging in personal care & cosmetics applications. Moreover, various product innovations, such as Envers, an extensive range of cosmetic packaging from Lumson S.P.A., which utilizes airless technology on its polyethylene terephthalate glycol (PETG) bottles, increase the demand for added functionality.

Demand for cosmetics and personal care products from millennials is on the rise in major countries including the U.S., China, India, and other developing economies. The consumer base in these countries is expected to increase substantially over the forecast period leading to a higher demand for plastic packaging.

Polyethylene terephthalate is known for its durability, transparency, and resistance to moisture. These properties have made cosmetics product manufacturers consider PET for packaging. Glass and metals have been used considerably in cosmetics product manufacturing. However, the cost associated with these materials positions PET and other plastics at a lower level, thus bringing down the overall cost of the final product. Since the cosmetic products are high priced the rise in packaging cost can hamper the profit margins of the cosmetic product manufacturers.

Industrial Plastic Packaging Market Analysis And Forecast

The industrial packaging segment includes automotive, construction, energy, transportation, and chemical packaging applications. Various automotive parts such as sealing parts, dashboard assemblies, interior panels, interior door panels, bumpers, and air ducts use plastic packaging.

Plastic is a primary material for shippers, pallets, drums, crates, containers, and IBCs which are primarily used for the transportation of industrial, chemical, and petrochemical products. The growing e-commerce industry is expected to create demand for such pallets, shippers, and crates owing to additional warehousing requirements.

The petrochemical market is projected to grow due to the critical demand from end markets that consume petrochemicals. Petrochemicals are widely consumed in chemical, automotive, and other industrial sectors to produce lubricants, motor oil, adhesives, coatings, and paints. The demand for these products is driven by the growth of the automotive, construction, and manufacturing sectors. The growing population and urbanization across the globe are propelling these sectors’ growth which can increase the consumption of petrochemical-based products, thus fueling the demand for rigid bulk packaging.

Pharmaceutical/ Healthcare Plastic Packaging Market Analysis And Forecast

Packaging plays a crucial role in the safe storage of pharmaceutical products. The most common materials used for drug packaging include plastic and glass. The material selected for developing packaging for a specific drug depends on factors such as the degree of protection needed for the product, cost, method, compatibility with the sterilization process, and the degree to which the packaging material reacts with the packaged drug. Although some plastics are seen to react with pharmaceutical drugs, plastics such as PET and HDPE are used for producing pharmaceutical packaging since they do not leach harmful chemicals into pharmaceutical products.

In addition, pharmaceutical/healthcare plastics are specifically modified with additives to cater to the required functions such as impact resistance, durability, UV resistance, and moisture resistance. The cost of these plastics also falls low compared to borosilicate glass-based packaging which makes pharmaceutical packaging manufacturers consider plastics for packaging pharmaceutical drugs.

Plastic provides a high degree of flexibility and convenience in the bulk transportation of medicines and APIs using products like IBCs, containers, and drums. Higher packaging efficiency, easy handling, minimum contamination possibilities, and drug safety can be attributed to the higher popularity of plastics in pharmaceutical applications.

The growing packaging waste concerns have also gripped the pharmaceutical sector. Pharmaceutical drug manufacturers are exploring and have started developing sustainable pharmaceutical packaging. An example of this is blister packaging based made of mono-material. The combination of materials like PVC and aluminum used in conventional blister packaging makes it difficult to be recycled and often ends up in incineration centers. Hence the demand for pharmaceutical blister packaging made of polypropylene is increasing thereby also promoting a circular economy.

Competitive Insights

The plastic packaging market witnesses highly competitive rivalry with the presence of a number of global plastic packaging manufacturers such as Constantia Flexibles, Amcor plc, Berry Global Inc., Sonoco Product Company, DS Smith plc, Huhtamäki Oy, ALPLA, WINPAK LTD, and CCL Industries along with some other new and growing market players. The global plastic packaging market players face strong competition from other regional and national players as well as from each other since they have a well-established supply chain network, knowledge of suppliers across markets, and well-informed about the packaging compliances and regulations for various end-use sectors.

The market players compete based on product quality, production capacity, the technology used to produce packaging, and their geographical presence. Major players engage in investing in research and development, developing infrastructure, production facilities expansion, and mergers and acquisitions to vertically integrate their operations across the plastic packaging value chain. These initiatives help them expand their customer base, reduce production costs, develop state-of-the-art products and technologies, ensure competitiveness, and improve their revenue & operations profits.

-

In April 2023, Greif completely acquired Centurion Container LLC, a North American company engaged in manufacturing intermediate bulk containers and plastic drum reconditioning for USD 145.0 million. This acquisition is aimed at increasing Greif’s penetration in the North American region.

-

In January 2023, Amcor plc place its first commercial procurement order for Exxon Mobil Corporation’s certified-circular polymers. The company plans to use these polymers for producing plastic packaging targeting the Australia and New Zealand market. The initiative will help Amcor plc strengthen its market position as a company offering circular plastic-based packaging products.

-

In February 2022, Myers Industries, Inc. and Elkhart Industries jointly developed a new Tuff Stack Pro Heavyweight IBC exhibiting a design pressure rating of up to 428 kPa. The new IBC product has an inner cylindrical tank that is supported by a heavy-duty poly structural frame.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified