- Home

- »

- Sector Reports

- »

-

Paints and Coatings Industry Research Data Book, 2023-2030

![Paints and Coatings Industry Research Data Book, 2023-2030]()

Paints and Coatings Industry Data Book - Powder Coatings, Waterborne Coatings, Solvent-borne Coatings and High Solids/Radiation Curing Coatings Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030

- Published Date: Feb, 2023

- Report ID: sector-report-00149

- Format: Electronic (PDF)

- Number of Pages: 250

Database Overview

Grand View Research’s paints & coatings sector database is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Paints and Coatings Industry Data Book Scope

Attribute

Details

Areas of Research

- High Solids/Radiation Curing Coatings Market

- Powder Coatings Market

- Waterborne Coatings Market

- Solvent-borne Coatings Market

Number of Reports/Presentations Covered in the buddle

1 Sector Outlook Report + 4 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Product

4 Products Categories

Highlights of Datasets

- Production Data, by Country

- Trade Data, by Country

- Demand/Consumption Data, by Country

- High Solids/Radiation Curing Coatings

- Powder Coatings

- Waterborne Coatings

- Solvent-borne Coatings

- Statistic e-book

- Competitive Landscape

Paints and Coatings Industry Data Book Coverage Snapshot

Markets Covered

Paints and Coatings Industry

48.16 million tons in 2022

3.2% CAGR (2023-2030)

High Solids/Radiation Curing Coatings Market Size

5.07 million tons in 2022

3.1% CAGR (2023-2030)

Powder Coatings Market Size

8.52 million tons in 2022

3.9% CAGR (2023-2030)

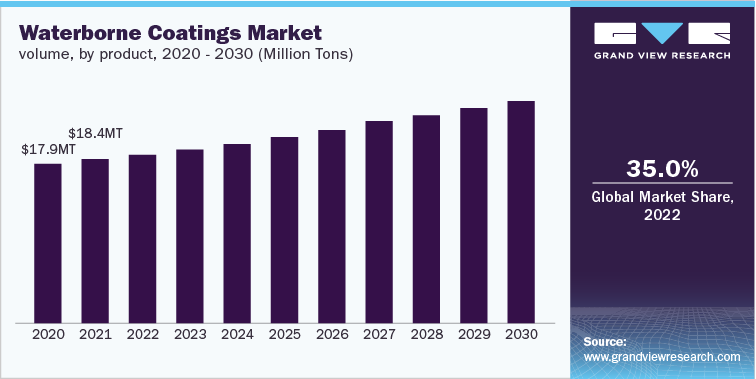

Waterborne Coatings Market Size

18.92 million tons in 2022

3.4% CAGR (2023-2030)

Solvent-borne Coatings Market Size

10.95 million tons in 2022

2.7% CAGR (2023-2030)

Paints & Coatings Industry Outlook

The economic value generated by the paints & coatings industry was estimated at approximately USD 161.44 billion in 2022. This economic output is an amalgamation of basic paints & coatings product categories namely, high solids/radiation curing, powder coatings, waterborne coatings, solvent-borne coatings and other specialty coatings.

Waterborne and powder-based coatings are gaining popularity among various end users owing to their properties such as low VOC content in comparison with solvent borne paints & coatings. Favorable governmental regulations regarding low VOC emission coatings, especially in North America and Europe, are anticipated to impact market growth positively over the foreseeable future. However, waterborne coatings are expensive as compared to other substitutes, including polyurethane and epoxy coatings. The high cost is due to high operational cost including raw material prices. The expensive waterborne coatings are limit the market expansion in developed economies.

Key players in the global paints and coatings market include PPG Industries, The Sherwin-Williams Company, Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., RPM International, Inc., Axalta Coating Systems, BASF Coatings, Kansai Paint Co., Ltd., and Jotun.

The above-mentioned figure depicts the U.S. construction spending from 2014 to 2022 in terms of USD billion. As depicted, construction spending in the country increased every year from 2014 to 2019, and this trend is expected to continue over the forecast period owing to the factors such as increasing infrastructural developments due to new import tariffs, changing trade deals, strong economy, proliferation of mega projects, focus on smart cities, and increasing household formation. Moreover, low-risk environment, stable economy, and robust financial sector of the U.S. are further anticipated to contribute to the growth of construction industry in the country, which, in turn, are expected to significantly drive the demand for paints and coatings over the forecast period.

Similarly, construction industry in India is anticipated to register a significant growth rate over the forecast period owing to the increasing infrastructure investments by the government and growing residential sector. Strong economic growth and rising government spending to develop infrastructure in the country are prominently fueling the growth of construction industry in India.

Private sector is emerging as a key player across various infrastructure sectors including roads, communication, power, and airports. The Indian government is offering a single-window clearance facility for speedy approvals of construction projects to boost the country’s infrastructure. In addition, government initiatives such as Housing for All, Make in India, and Smart Cities are likely to propel the growth of construction industry in the country in the coming years.

Central & South America and the Middle East & Africa are among the potential markets for construction industry. Rising GDP, increasing disposable income, growing importance of manufacturing & industrial sectors, and low cost of production are the factors attracting investors to these regions. In addition, rising efforts by various governments to develop the country’s infrastructure and housing sector are further anticipated to fuel the growth of construction industry, which, in turn, are anticipated to create the demand for paints and coatings over the forecast period.

The top ten automakers in the U.S. include Volkswagen Group, Daimler, Subaru, Hyundai KIA, Honda Motors, Nissan Motor Company & Mitsubishi, Fiat Chrysler Automobiles, Toyota Motor Corporation, Ford Motor Company, and General Motors, which have been structuring automotive industry.

The U.S. has witnessed a huge growth in automobile production in the recent past. For instance, in March 2017, automotive manufacturer, Ford, announced the production expansion of trucks and SUVs in three of its facilities located in Michigan, U.S. The overall cost of the expansion was approximately USD 1.2 billion. Capacity additions and expansion of plants by automotive companies in the U.S. are further expected to augment the demand for paint and coating products. In January 2018, Toyota Motors and Mazda Motors jointly announced the expansion of their production plant in Alabama, U.S. This expansion is anticipated to fuel the use of architectural paints and coatings.

Powder Coatings Market Analysis And Forecast

Powder coatings accounted for a share of over 19% in the industry in 2022. Powder-based coatings are more durable and eco-friendly as compared to their counterparts. Powder-based coatings have negligible VOC content due to the absence of solvents and, thus, they comply more efficiently and economically with the environmental protection regulations.

Powder-based coatings are widely used in agricultural equipment, automotive, machine components, mechanical parts & building facades, and electrical fixtures to prevent corrosion and provide a thicker coating. Increasing demand for low VOC or zero-emission coatings in the U.S., India, China, and in European countries is expected to propel the demand for powder-based paints & coatings over the forecast period.

Waterborne Coatings Market Analysis And Forecast

Waterborne coatings accounted for a share of nearly 35% in the industry in 2022. Water-based paints and coatings are widely used in confined and poorly ventilated spaces. These coatings dry at a faster rate as compared to solvent-based paints and coatings due to the rapid evaporation of water from the coating layer, which results in faster drying without surface skin formation.

Water-based paints and coatings are primarily used where solvent-based coatings are expected to react with the substrate. They are ideal primers as they possess excellent thermal and corrosion resistance. In addition, they are flame-resistant and have low toxicity owing to their low VOC content and low hazardous air pollutant emissions.

The use of water-based coatings is projected to increase due to stringent legislations regarding the solvents present in paints & coatings in the U.S. and other mature European countries. Several companies in the market are working toward the development of new fast-drying paints and coatings. Companies such as Alfa Laval and Hellenic Petroleum are using fast-drying water-based paints & coatings for heat exchangers, train wagons, piping, and tanks. This is expected to have a positive impact on the demand for water-based coatings over the forecast period.

Solvent-borne Coatings Market Analysis And Forecast

Solvent-borne coatings accounted for a share of nearly 23% in the industry in 2022. Aerospace paints & coatings are used to provide reliability, long-lasting lubrication for critical components in order to operate efficiently in high vacuum and extreme temperature. Solvent-based segment is projected to record a slower growth rate as compared to water-based segment over the forecast period owing to the stringent regulations concerning products with high VOC content. However, rising application of solvent-based coatings for industrial and architectural purposes, owing to their various properties such as lower drying times and better functionality in open & humid conditions, is expected to fuel the segment growth over the forecast period.

Solvent-based paints and coatings are primarily employed in offshore oil & gas applications in low heat and high humidity areas. They can be applied to large surface areas with high thickness as compared to water-based coatings. Furthermore, solvent-based paints and coatings are used to achieve decorative finishes over complex shapes and exhibit improved adhesion along with high water resistance.

These properties of solvent-based coatings make them suitable for external use in industries and offshore oil & gas applications. Growing popularity of paint anodization, particularly in the developing economies of the world, is expected to propel the demand for solvent-based paints and coatings over the forecast period. However, high cost coupled with high VOC content is likely to have a negative impact on the segment growth.

High Solids/Radiation Curing Coatings Market Analysis And Forecast

High solids/radiation curing coatings accounted for a share of nearly 11% in the industry in 2022. Rise in consumer awareness for sustainable products and increasingly strict environmental regulations regarding the reduction of VOC emissions are expected to boost the demand for high solids and radiation curing paints and coatings over the forecast period.

High solids and radiation curing coatings relatively constitute a small portion of the global market; however, the adoption of these coatings in various applications, such as marine, aerospace, paper & paperboard, and construction, is rising owing to their rapid curing and excellent physical properties. This is expected to drive the growth of the segment in the coming years. These coatings comprise 70% to 100% of solids, which cure when exposed to ultraviolet (UV) light. Further, as they majorly contain the solid system, they have very less or zero amount of volatile solvents to evaporate, which makes them eco-friendly. In addition, these coatings cure at a faster rate as compared to their counterparts, making them suitable for heat-sensitive substrates.

Competitive Insights

The global paints & coatings market is heading toward major consolidations to increase efficiency, support growth, and achieve more leverage with suppliers and customers. Market consolidation has become a long-term trend, particularly in the western market, with limited organic growth. For instance, the Americas market has been consolidating for decades, wherein key players are entering mergers & acquisitions to complement the strong organic growth and increase efficiencies through scale or improved processes.

Recent deals such as The Sherwin-Williams Company and The Valspar Corporation merger, Nippon Paint Holdings Co., Ltd. and Dunn-Edwards Corp. merger, and others reflect the ongoing trend of consolidation across paint & coating industry in the western market. However, the global market is still fragmented owing to the presence of several players operating across the globe.

Majority of the companies are anticipated to either mark their presence or develop their customer base in Asia Pacific, Central & South America, and the Middle East & Africa. This can be attributed to the high growth potential of various end-use industries including marine, automotive and vehicle refinish, electronics, aerospace, oil & gas, and mining in these regions. Furthermore, long-term customer relationships, vertical integration, and distribution partnerships help players strengthen their positions in the market.

Company

Plant

Capacity

Asian Paints

Asian Paints Limited, Asian Paints House

6A, Shantinagar, Santacruz (E),

Mumbai - 400 055, India.

Tel: 022 - 6218 1000

Paints: 250,000 KL

Berger Paints

Jejuri Plant, Maharashtra

Paints: 39,600 tons per annum

Kansai Nerolac

KANSAI NEROLAC Paints Limited Nerolac House, Near Shri Ram Mills, Ganpatrao Kadam Marg Area: Lower Parel West, City: Mumbai Pin: 400013

Tel: 1800 209 2092

Coatings: 547 million litres per annum

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified